Written by: Aiying Research

We live in an era where information can instantaneously traverse the globe. An email or a video call can connect the two ends of the Earth in milliseconds. However, a seemingly more fundamental need—the flow of value—appears to be trapped in a completely different set of physical laws. Why does initiating an international remittance feel more like a time-consuming international package delivery rather than an instant email? This sharp contradiction reveals a long-standing dilemma deep within the global financial infrastructure.

Traditional views often attribute this to "technological backwardness," but that is not the whole truth. The core of the problem lies in architectural fragmentation. The global payment system we rely on today, with its backbone—the SWIFT network—is essentially an "information flow" network rather than a "funds flow" network. It transmits payment instructions rather than the value itself. The actual settlement of funds relies on a vast, complex, and multilayered correspondent banking network. Each transaction may need to traverse multiple banking intermediaries across several countries, each with its own operating hours, compliance processes, technical standards, and fee structures.

This architecture leads to a phenomenon we call "temporal-spatial folding": during the transfer of value, time is unnecessarily elongated, space is repeatedly fragmented, and costs accumulate at each transfer point. Data from the World Bank consistently shows that the average cost of global personal remittances has long hovered above 6%, far exceeding the 3% target set by the United Nations Sustainable Development Goals. The Financial Stability Board (FSB) has acknowledged in its annual progress reports to the G20 that progress in reducing costs and improving speed has been slow, with stagnation in some areas. This is not just an issue of economic efficiency; it directly impacts the vitality of global trade, the survival of small and medium-sized enterprises, and the millions of families that rely on remittances for their livelihoods.

The essence of the "temporal-spatial folding" dilemma is the separation of information networks and value networks. While information spreads at the speed of light, value remains constrained by a "physical world" composed of time zones, holidays, and lengthy compliance chains.

It is within this seemingly unsolvable dilemma that an imaginative solution is quietly emerging and rapidly expanding its influence. It does not aim to completely overturn the entire financial system overnight but rather represents a pragmatic and intelligent "leveraging of strengths." It harnesses the core advantages of emerging technologies to precisely address the most painful aspects of the traditional system. This article will reveal the internal mechanisms of this model through the professional research and compliance perspective of "Aiying Paymentresearch" in the field of payment finance (PayFi), and propose a brand new analytical framework—"Value Relay" model—to help you gain a deeper understanding of the ongoing payment revolution, its opportunities, challenges, and future outcomes.

Core Concept: "Value Relay"—A Payment Race Across New and Old Continents

To accurately describe this emerging hybrid payment model, we need a metaphor that is both vivid and capable of revealing its operational essence. The industry has previously proposed a "sandwich" model, but we believe this metaphor is too static and fails to capture its dynamic, efficient, and segmented collaborative core characteristics. Therefore, Aiying proposes a more original and fitting analytical framework: "Value Relay" model.

Imagine a payment race spanning two continents. The goal of this race is to securely, quickly, and cost-effectively deliver a value from Paris, France, to São Paulo, Brazil. The traditional racing method (correspondent banking model) resembles an obstacle course, where participants must climb over multiple high walls (different banks), cross multiple time zones (waiting for business hours), and complete multiple procedures (compliance checks), resulting in a lengthy process with significant energy (funds) consumption.

In contrast, the "Value Relay" model is a meticulously designed relay race. In this race, "value" is the crucial relay baton, and the track cleverly spans two worlds: the traditional fiat currency "continent" and the emerging blockchain "highway."

1. Breaking Down the Relay Race into Three Legs

This value relay race is clearly divided into three segments, completed by three specialized "runners":

First Leg (Start): Local Fiat Network (Local Fiat Leg).

At the sound of the starting gun, a business in Paris needs to complete the start on the most familiar and efficient "track" in its country. This runner utilizes local instant payment systems (such as SEPA Instant) to quickly and cost-effectively transfer fiat currency (euros) to the first "relay runner"—a compliant entry service provider (On-Ramp Provider). This process typically takes place within seconds or minutes, with almost no delay. At this moment, the baton transitions from traditional fiat form to prepare for digital form.

Second Leg (Core Sprint): Blockchain Network (Blockchain Leg).

This is the longest, most critical, and revolutionary international segment of the entire race. The first relay runner instantly converts the baton (euros) into a value-stable digital asset—a stablecoin (such as USDC or EURCV). Next, the second "runner"—a high-performance blockchain network (such as Solana, Tron, or Ethereum Layer 2 network)—takes over this digitized baton. This runner possesses extraordinary capabilities: it sprints in the digital world at nearly the speed of light, operating 24/7, ignoring borders, time zones, and banking hours. In just a few seconds to minutes, it delivers the value to the designated receiving point in Brazil, with almost no value loss (extremely low on-chain transaction fees). This is the most direct disruption to the "temporal-spatial folding" of traditional payments.

Third Leg (Finish Line): Destination Fiat Network (Destination Fiat Leg).

When the digitized baton arrives in Brazil, it is immediately handed over to the third "relay runner"—a compliant and well-liquidated exit service provider (Off-Ramp Provider) in the local area. This runner quickly converts the stablecoin back into local fiat currency (Brazilian real) on Brazil's "local track" (such as Brazil's Pix instant payment system) and accurately delivers it to the final recipient's bank account. As the recipient receives a notification of the funds on their phone, this international value relay race concludes perfectly.

2. Essence of the Model: Segment Optimization and Temporal-Spatial Compression

The essence of the "Value Relay" model lies in "Segment Optimization." It does not attempt to completely rebuild the entire payment arena (which is neither realistic nor necessary in the short term) but rather intelligently identifies the slowest, most expensive, and least transparent link in the traditional model—the international settlement segment—and replaces it with the most efficient solution available today: blockchain transmission.

In this way, it achieves extreme compression of the two core costs of "time" and "space" in the traditional payment system.

Time Compression:

It compresses the settlement cycle that originally required several working days down to minutes. This is not just an increase in speed; it is a significant release of the time value of funds.

Space Compression:

It compresses the originally complex path that needed to traverse multiple intermediaries and jurisdictions into a single point-to-point, seamless digital value transfer, greatly simplifying the process and enhancing transparency.

3. Clear Positioning: A Pragmatic "Hybrid" Transition Phase

Aiying must emphasize that the "Value Relay" model is not the ultimate solution for global payments. It is more like a "hybrid" transition phase connecting the past and the future. It cleverly leverages the immense liquidity and user base at both ends of the existing fiat currency system (which is key to its rapid implementation) while using the blockchain system as its efficient, low-cost "core engine."

Just as hybrid cars play a crucial role in the transition from the internal combustion engine era to the pure electric era, the "Value Relay" model serves as an equally important, pragmatic, and efficient bridge in the evolution of the traditional payment system toward a fully tokenized "unified ledger" era. Understanding this is crucial for accurately assessing its current value, potential risks, and future evolutionary paths.

In-Depth Deconstruction: The Engine, Benefits, and New Friction Points of Value Relay

The "Value Relay" model elegantly reshapes our imagination of cross-border payments. However, to truly understand its potential and limitations, we must delve into its internals, disassemble its engine like engineers, quantify its benefits like accountants, and examine the new friction points it introduces like risk officers. This chapter will be the core of the entire text, and we will conduct the most detailed analysis from these three dimensions.

Section One: Engine Room Exploration—How Does the Relay Race Operate Precisely?

A successful relay race depends not only on the speed of each runner but also on the smooth and precise baton handoff. The "engine room" of the value relay model is similarly composed of several key components working in precise collaboration.

1. On-Ramp: The Digital Starting Point of Value and the First Compliance Barrier

The entry service provider (On-Ramp Provider) is the gateway for value to enter the blockchain world from the fiat currency world. Its role goes far beyond that of a simple "currency exchanger." A mature entry service provider actually plays a dual role:

Liquidity Provider:

It must efficiently receive local fiat currency (such as through SEPA, FedNow, Faster Payments, etc.) and convert it into stablecoins at competitive prices. This requires the service provider to have a deep reserve of liquidity in both fiat and digital assets.

Compliance Gatekeeper:

This is a more critical aspect. The entry service provider is the first line of defense against money laundering (AML) and counter-terrorism financing (CFT). It must conduct strict "Know Your Customer" (KYC) or "Know Your Business" (KYB) checks on the payment initiator. As emphasized in TRM Labs' risk mitigation blueprint, regulators clearly require that any activities involving crypto assets must comply with strict AML/CFT controls. This means that before value enters the blockchain "highway," its source's legitimacy has already been preliminarily confirmed.

The efficiency and cost of the entry ramp directly determine the "starting speed" and initial cost of the entire value relay experience.

2. Blockchain Transmission: The Choice of Core Sprint Track

Once the value is tokenized into stablecoins, it begins its core sprint on the blockchain. Stablecoins, as digital assets anchored to fiat currencies, solve the price volatility problem of cryptocurrencies, making them ideal mediums for payment and settlement. Currently, the issuance and trading of stablecoins are mainly concentrated on several mainstream public chains, and choosing different "tracks" can lead to vastly different experiences:

Ethereum:

As the birthplace of smart contracts and DeFi, Ethereum boasts the largest ecosystem and the highest level of security. However, its mainnet (Layer 1) has high and volatile transaction fees (Gas Fees) and relatively slow processing speeds, making it unsuitable for small, high-frequency payments. Consequently, an increasing number of stablecoin transactions are migrating to its Layer 2 scaling solutions (such as Arbitrum and Optimism), which offer lower fees and faster speeds.

Tron:

Known for its low transaction fees and high throughput, the Tron network supports a massive volume of stablecoin (especially USDT) transactions. According to analysis from Damex.io, its transaction fees typically range from $3 to $6, making it popular in remittance and B2B payment scenarios in many developing markets.

Solana:

Renowned for its extremely high transaction speed (TPS) and very low fees (usually below $0.01). A McKinsey report indicates that stablecoins issued on Solana can be transacted in just one or two seconds, becoming irreversible after 30 seconds (McKinsey, 2025), making it a strong competitor for payment applications with high performance requirements.

The rise of stablecoins is astonishing. McKinsey's report estimates that by the end of the first quarter of 2025, the average daily real on-chain payment transaction volume of stablecoins will reach $20 billion to $30 billion (McKinsey, 2025). Particularly in the B2B payment sector, its growth is even more rapid. Data from the Artemis report shows that the monthly B2B stablecoin payment volume of leading payment companies increased from $770 million to $3 billion last year. This fully demonstrates that blockchain, as the core track for value transfer, has had its performance and efficiency initially validated by the market.

3. Off-Ramp: Liquidity and the "Last Mile" Challenge

The exit service provider (Off-Ramp Provider) is responsible for the "last mile" of the value relay race. Its task is to securely and swiftly convert the arriving stablecoins into local fiat currency and pay the final recipient. Similar to entry service providers, it also plays a dual role as a liquidity provider and compliance executor.

However, the exit ramp is recognized as one of the biggest bottlenecks in the current value relay model. The challenges mainly lie in:

Liquidity Depth:

In the markets for mainstream currencies like the US dollar and euro, it is relatively easy to find exit service providers with sufficient liquidity. However, in many emerging markets and developing economies (EMDEs), the trading pairs between local fiat currencies and stablecoins may have thin liquidity. This means that there could be significant slippage (price impact) during conversion, eroding cost advantages.

Compliance and Banking Relationships:

A reliable exit service provider must have compliant operational qualifications and solid banking partnerships locally to ensure smooth access to local payment systems (such as Brazil's Pix and India's UPI). Establishing such a network requires significant investment and time.

Cost and Competition:

The service fees of the exit ramp are a significant component of the total cost. In a market with insufficient competition, a few service providers may charge high fees, greatly diminishing the overall cost advantage of the value relay model.

Therefore, the coverage and efficiency of a value relay network largely depend on the establishment of a strong, compliant, and cost-effective exit ramp network globally.

Section Two: Quantifying Real Benefits—What is the "Compressed" Value?

"Faster, cheaper, and more transparent" are the most intuitive labels for the value relay model. However, for businesses and financial institutions, these labels conceal deeper, quantifiable commercial value.

1. Time Value: The Leap from "In-Transit Funds" to "Working Capital Efficiency"

The traditional cross-border payment settlement cycle often takes 3-5 working days, meaning that businesses have a large amount of funds in an "in-transit" state for extended periods. These funds cannot be used for production investment or generate interest income, representing sunk working capital. The value relay model compresses the settlement time from "days" to "minutes," with its core value being a significant increase in the efficiency of working capital.

Let’s look at two specific application scenarios:

Treasury Management:

Multinational companies need to allocate funds between subsidiaries around the world. Under traditional methods, finance teams must plan funds several days in advance to cope with settlement delays. This not only increases operational complexity but may also incur additional costs due to the need for short-term borrowing to fill liquidity gaps. Companies also need to manage complex derivatives to hedge against exchange rate risks faced by in-transit funds. However, with the value relay model, funds can be allocated in real-time as needed, greatly reducing the demand for short-term liquidity and exposure to exchange rate risks, simplifying the operations of the treasury department.

B2B Trade Finance:

In international trade, payment delays directly affect the operation of the supply chain. For example, exporters may not receive payment for goods for several days or even weeks after shipment. Early exploration cases of blockchain in trade finance, such as the transaction between Ornua (an Irish dairy company) and a Seychelles trading company, have demonstrated remarkable efficiency improvements. Through a blockchain platform, the credit letter process that originally took 7-10 days was shortened to less than 4 hours (Deutsche Bank, flow). Similarly, Marubeni Corporation in Japan reduced the delivery time of trade documents from several days to 2 hours in its trade with Australia. This increase in efficiency means that exporters can recover funds faster, improve cash flow, and reduce reliance on expensive trade financing.

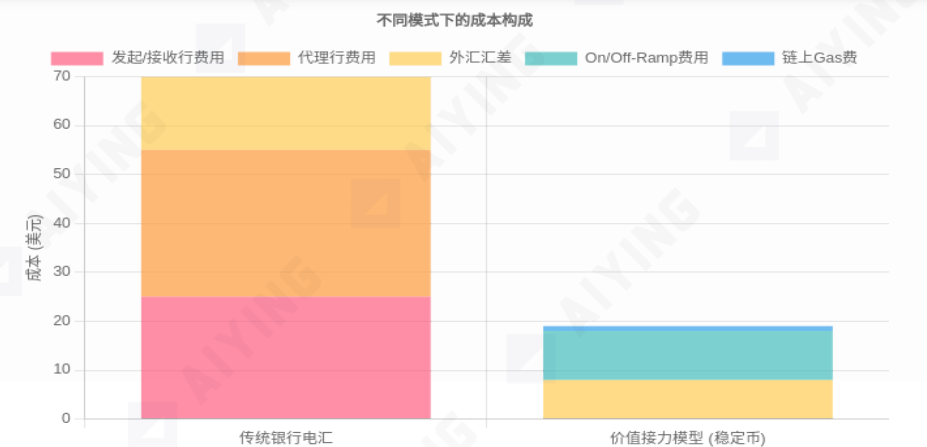

2. Cost Structure Optimization: A Dialectical View of "Low-Cost" Advantages

The cost advantage of the value relay model is one of its most attractive features, but it needs to be viewed dialectically. Simply claiming that "blockchain transaction fees are low" is one-sided and even misleading. The true total cost structure is:

Total Cost = Entry Ramp Fees + On-Chain Gas Fees + Exit Ramp Fees + Exchange Rate Spread between Fiat and Stablecoins at Both Ends

Compared to traditional wire transfers, its advantages lie in:

Elimination of Correspondent Bank Fees:

In traditional wire transfers, each intermediary bank charges a fee, which constitutes a significant portion of the cost. The value relay model completely eliminates this cost through point-to-point blockchain transmission.

Extremely Low Transmission Costs:

On efficient public chains, the Gas fee for a transaction can be as low as a few cents, regardless of the transaction amount. This stands in stark contrast to traditional wire transfers, which charge high fees based on a percentage or per transaction.

However, the magnitude of its cost advantage highly depends on the efficiency and level of competition of the two "ramps." According to research by Coinbase, the total cost of remittances using stablecoins is approximately between 0.5% and 3.0%, which still shows a significant advantage compared to traditional channels (averaging over 6%, with bank wire transfers reaching over 10%). But this range also illustrates the substantial impact of ramp costs. Jack Zhang, CEO of payment giant Airwallex, has made a notable criticism, arguing that in many cases, due to the high costs of fiat currency exchanges at both ends, users do not experience significant cost savings or efficiency improvements from stablecoin payments.

Therefore, Aiying believes that the cost advantage of the value relay model is real, but it is a dynamic variable that depends on the specific payment corridors, transaction scales, and the competitive landscape of ramp service providers.

Figure 2: Comparison of Cross-Border Payment Cost Structure (Sending $1000) Data Source: Estimated Model Based on World Bank, Coinbase, BCG Reports

3. Transparency and Traceability: From "Payment Black Box" to "Glass Pipeline"

One major flaw of the traditional correspondent banking system is its "black box" operation. Once the payer initiates a payment, it is often impossible to track the funds' whereabouts, current status, and detailed deductions in real-time. This uncertainty poses significant challenges for corporate financial reconciliation and individual users.

The value relay model provides unprecedented transparency through its blockchain core. Every transaction on the chain is:

Publicly Verifiable:

Anyone can query the occurrence time, amount, sender, and receiver addresses of a transaction through a blockchain explorer.

Immutable:

Once a transaction is written to a block and confirmed by the network, it cannot be altered or deleted, providing a high level of record integrity.

End-to-End Traceable:

The flow path of funds is clearly visible, from one address to another, making it easy to understand.

This "glass pipeline" transparency is revolutionary for certain specific scenarios. For example, in international aid or charitable donations, it can ensure that funds reach the beneficiaries point-to-point, eliminating corruption and misappropriation in intermediary links. In supply chain finance, buyers, sellers, logistics companies, and financial institutions can track the status of goods and the payment process on a shared, trusted ledger, achieving automation of "payment on delivery" (Safeheron).

Section Three: New Friction Points—Invisible Barriers on the Relay Track

Although the value relay model addresses many old friction points, it is not without flaws. As a hybrid system connecting two different worlds, it also gives rise to a series of new, unique friction points and risks. Ignoring these barriers will prevent a comprehensive assessment of the model's feasibility.

1. Liquidity Silos: Congestion on the Ramps

The smooth operation of the entire model is based on a core assumption: that there is sufficient and immediate liquidity where needed. However, the reality is that liquidity is unevenly distributed globally.

Mainstream Currency Corridors:

Between major currency pairs like the US dollar, euro, and pound, there are numerous active exchanges and market makers, with deep liquidity and unobstructed ramps.

Emerging Market Currency Corridors:

When transactions involve some emerging market currencies (such as currencies from parts of Africa, Latin America, and Southeast Asia), the situation is quite different. Local compliant exit service providers may be scarce, and their reserves of stablecoins and local fiat currencies are limited, restricting the volume of transactions they can handle. This leads to narrow, congested, and expensive exit ramps in these regions, creating new "liquidity silos." Users may find that while on-chain transfers are fast, converting stablecoins to local fiat currency may require waiting or incur high exchange fees, significantly undermining the model's advantages.

As noted in the report by the Boston Consulting Group (BCG), although stablecoin transfers are nearly real-time on-chain, the exit ramp remains a challenge due to the limited availability of local liquidity providers and the scarcity of infrastructure to integrate stablecoin payments into existing payment ecosystems.

2. Technical and Operational Risks: Unfamiliar Track Rules

For businesses accustomed to traditional financial operations, adopting the value relay model means entering a completely new technological and operational domain, which brings new risks:

Operational Complexity:

Businesses need to learn how to manage digital asset wallets, securely store private keys, interact with crypto-native service providers, and handle accounting and tax issues between fiat and crypto assets. This increases the learning costs and operational burdens for finance and IT departments.

Technical Security Risks:

The blockchain world is filled with technical risks that are uncommon in traditional finance. For example, smart contracts may have undiscovered vulnerabilities that could lead to fund theft; "cross-chain bridges" used for transferring assets are hotspots for hacker attacks; exchanges or wallet service providers may be hacked.

Asset Stability Risks:

The cornerstone of the model is the stability of "stablecoins." Although mainstream fiat-collateralized stablecoins (like USDC and USDT) have relatively transparent reserve proofs, the market still harbors doubts about the quality and liquidity of reserve assets. More importantly, there have been catastrophic de-pegging and collapse events involving algorithmic stablecoins (like Terra/LUNA) in the past (ScienceDirect, 2022), ringing alarm bells for all users: not all stablecoins are created equal, and their inherent protocol design and risk management mechanisms are crucial.

3. Centralization Risks of "Pseudo-Decentralization"

A core narrative of the value relay model is "decentralization"—bypassing traditional banking intermediaries. However, this is largely a "pseudo-decentralization." Users are merely shifting their trust from traditional banks to a series of new centralized entities.

Stablecoin Issuers:

The safety of users' funds directly depends on the reserve management capabilities and business integrity of private companies like Tether (issuer of USDT) or Circle (issuer of USDC). These issuers themselves constitute significant centralized nodes.

Exchanges and Ramp Service Providers:

Most transactions rely on centralized cryptocurrency exchanges (like Coinbase and Binance) or specialized payment companies (like BVNK and Triple-A) as entry and exit points. The security, solvency, compliance levels, and potential single points of failure of these platforms become new centralized risks that users must consider.

The Bank for International Settlements (BIS) has also expressed similar concerns in its report, noting that although the original intention of crypto assets was decentralization, a new ecosystem dominated by custodial wallets and centralized exchanges has evolved in reality (BIS Annual Report 2025). Therefore, users have not completely escaped intermediaries; they have merely changed the type of intermediary.

Key Takeaways: The "value relay" model demonstrates significant advantages in time value, cost structure, and transparency through segment optimization, especially in releasing corporate working capital. However, its benefits are not universal and are highly dependent on the liquidity of payment corridors. At the same time, it introduces new operational complexities, technical security risks, and reliance on new centralized intermediaries. A comprehensive assessment must weigh the benefits it brings against the new friction points that arise.

The Compliance Corset: Navigating Regulatory Fog in a Hybrid Model

If technology and liquidity are the "hardware" of the value relay model, then compliance is the "operating system" on which it relies. For institutions like Aiying, we understand that any financial innovation, no matter how disruptive its technology, must ultimately don the "corset" of compliance to ensure stability and longevity. The value relay model spans both new and old financial worlds, making the regulatory environment it faces exceptionally complex, akin to navigating through fog.

1. Regulatory "Fault Lines": The Collision of Laws in Two Worlds

The greatest compliance challenge of the value relay model stems from its inherent regulatory "fault line." It acts like a bridge, one end rooted in the solid ground of traditional finance, while the other extends toward the emerging continent of virtual assets.

At the Fiat End (Entry/Exit Ramps):

Activities here are subject to mature and stringent financial regulations. Service providers typically need to hold payment institution (PI), electronic money institution (EMI), or banking licenses and strictly comply with local KYC/AML regulations, consumer protection laws, and data privacy laws. Regulatory agencies have clear expectations and enforcement experience in this area.

At the Blockchain End (Core Transmission):

Activities here are governed by rapidly evolving but not yet fully unified regulatory frameworks for virtual asset service providers (VASP) around the world. The core of these frameworks is the recommendations of the Financial Action Task Force (FATF), but the specific implementation paths and rigor vary greatly from country to country.

This regulatory fault line means that a complete payment transaction may need to adhere to two entirely different regulatory logics and reporting requirements at different stages. This brings significant compliance complexity and uncertainty to the payment companies, financial institutions, and businesses involved. The use of two different payment tracks (traditional banks and blockchain) inherently introduces regulatory risks and issues of standardization.

2. The Core Challenge of AML/CFT: How to Maintain the Integrity of the Review Chain?

Anti-money laundering and counter-terrorism financing (AML/CFT) are the cornerstones of all financial activities. In the value relay model, maintaining the integrity of the AML review chain is a core challenge.

The issue lies in the transfer of funds from a strictly regulated bank account to a pseudonymous on-chain address, and then back to another bank account. This process presents a potential "regulatory vacuum": how to ensure that clean funds exiting Bank A do not interact with illegal activities (such as dark web transactions or sanctioned addresses) on-chain before being "cleaned" and entering Bank B?

To address this issue, the FATF proposed Recommendation 16, known as the "Travel Rule." This rule requires VASPs to transmit the identity information of both parties involved in a virtual asset transfer, similar to bank wire transfers. However, implementing the travel rule in the value relay model faces significant challenges:

Technical Implementation Difficulty:

There is no native protocol on public blockchains to transmit these personal identity details. VASPs need to adopt additional, standardized solutions to exchange this data.

Interaction with Unhosted Wallets:

When transactions involve user-controlled unhosted wallets, the situation becomes even more complex. Without a centralized VASP to collect and relay information, this facilitates the flow of illegal funds.

Therefore, exit ramp service providers face immense compliance pressure when receiving stablecoins from the chain. They must have the capability to assess the "cleanliness" of these funds on-chain; otherwise, they risk becoming the last link in the money laundering chain, facing hefty fines and reputational damage.

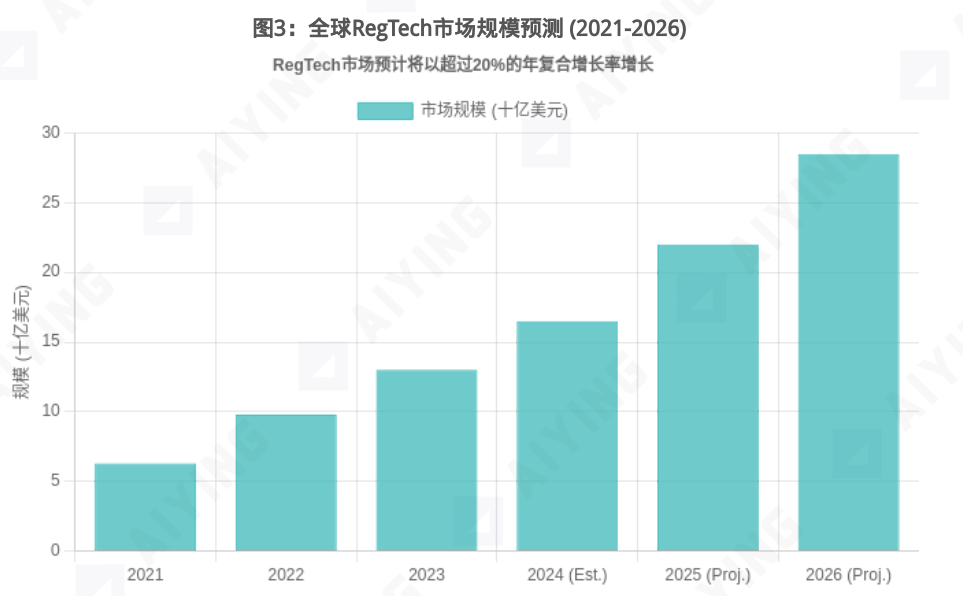

3. RegTech: The Compass to Navigate the Fog

In the face of such a complex regulatory environment, traditional, manual compliance methods are becoming inadequate. Fortunately, technology, while presenting challenges, also offers solutions. Regulatory technology (RegTech) is becoming an essential "compass" for navigating this fog.

The global RegTech market is thriving, expected to exceed $22 billion by mid-2025 (Silent Eight, 2024). In the value relay model, the application of RegTech is primarily reflected in the following areas:

On-Chain Analysis Tools:

This is a key technology for bridging the regulatory fault line. Companies like Chainalysis, TRM Labs, and Elliptic provide powerful on-chain monitoring and analysis tools. These tools enable exit ramp service providers to conduct real-time "background checks" on stablecoins received, allowing for risk-based decision-making and effective AML risk management.

Real-Time Transaction Monitoring:

Tracking the flow path of funds on the blockchain.

Risk Scoring:

Assessing the risk of each on-chain address to identify any associations with illegal activities (such as hacking, dark web markets, or sanctioned entities).

Source of Funds Tracing:

When suspicious funds appear, tracing their source and tracking their destination.

Automated and Intelligent Compliance:

At the entry and exit ramps, AI-driven KYC/KYB solutions are replacing traditional manual reviews. These solutions can utilize machine learning and big data analytics to complete customer identity verification and risk assessment more quickly and accurately, with ongoing monitoring, significantly improving compliance efficiency.

Compliance as Code:

This is a more cutting-edge concept. In the future, basic compliance rules (such as transaction limits and prohibitions on transfers to sanctioned addresses) can be directly encoded into payment processes using smart contract features. This means that a non-compliant transaction will be automatically blocked by the system before it occurs, shifting from "passive detection" to "proactive prevention."

Data Source: Based on Industry ARC, Markets and Markets Reports

The Global Regulatory "Puzzle": Finding Compliance Paths in Fragmentation

Participants in the value relay model must also face a fragmented global regulatory environment. Countries have varying attitudes toward stablecoins and digital assets, legislative processes, and regulatory focuses, creating a complex "regulatory puzzle."

European Union:

The landmark "Markets in Crypto-Assets Regulation" (MiCA) has been introduced. MiCA provides a clear legal framework for the issuance and operation of stablecoins (referred to in the regulation as "asset-referenced tokens" and "e-money tokens"), requiring issuers to obtain authorization, maintain sufficient reserves, and meet strict governance and disclosure requirements. This offers a relatively clear compliance path for value relay service providers operating in Europe.

United States:

The regulatory framework is still being formed, presenting a complex situation of multi-agency (SEC, CFTC, Treasury) joint regulation. Recent legislative proposals, such as the "Financial Innovation and Technology for the 21st Century Act" (FIT21) and the "Genius Act," aimed at establishing a federal regulatory framework for payment stablecoins, indicate that the U.S. is moving towards clearer regulatory directions.

Asia:

Financial centers like Singapore, Hong Kong, and Japan have also introduced their own virtual asset regulatory frameworks, striving to balance innovation encouragement with risk control.

For a global payment network, this means it cannot adopt a "one-size-fits-all" compliance strategy. It must possess the ability to flexibly stitch together a complete compliance path for different payment corridors and customer types within the global "regulatory puzzle." This is not only a test for legal teams but also a comprehensive challenge to the entire company's technological architecture, product design, and risk management capabilities.

Final Outlook: From "Value Relay" to Seamless "Unified Ledger"

After deeply analyzing the internal workings, real benefits, emerging risks, and compliance challenges of the "value relay" model, we can take a more comprehensive perspective to examine its historical position in the evolution of finance and envision a more integrated and intelligent future.

1. Limitations of the Relay Race: Efficiency Ceiling and Value "Jumping"

We must recognize that while the "value relay" model appears to be a brilliant innovation at present, it is essentially a clever "patch" rather than the ultimate form. Its success also exposes its fundamental limitations.

The fundamental limitation lies in the fact that value still needs to "jump" between two disconnected worlds: on-chain and off-chain. Each time value is "on-ramped" from fiat to stablecoin and each time it is "off-ramped" from stablecoin to fiat represents a potential friction. The fiat "ramps" at both ends constitute the ceiling for the model's efficiency, cost, and imagination.

Efficiency Ceiling:

No matter how fast on-chain transfers are (in seconds), the total duration of the entire process is still limited by the speed of the fiat clearing systems at both ends (although instant payment systems have greatly improved this).

Cost Ceiling:

On-chain gas fees may be negligible, but the service fees and exchange costs at both ramps cannot be eliminated and may become high in a non-competitive market.

Imagination Ceiling:

As long as value needs to be converted between different forms, the composability of financial innovation will be limited. True end-to-end financial automation and intelligence are difficult to fully realize in a system that requires "transfers."

Therefore, no matter how fast the value relay race runs, it ultimately remains a segmented competition. One cannot help but ask: Is it possible that future payments will no longer require baton exchanges but will instead flow seamlessly from start to finish on a single track?

2. Future Vision—Unified Ledger

Global leading financial research institutions, such as the Bank for International Settlements (BIS), have painted a picture of this future. The core concept of this vision is called "Unified Ledger" (BIS Annual Report 2025).

In a future financial infrastructure based on a unified ledger, payments will no longer require the cumbersome jumps of "on-chain" and "off-chain." Because almost all forms of value will be natively tokenized on the same programmable platform.

Imagine:

Tokenized Bank Deposits:

Your deposits in the bank will no longer just be a number in the bank's database but a token that can flow and be programmed directly on the unified ledger.

Tokenized Securities:

Financial assets like stocks and bonds will also exist in token form, allowing for "delivery versus payment" (DvP) to be atomically and risk-free completed in an instant.

Tokenized Real-World Assets (RWA):

Real estate, artworks, carbon credits, etc., can all be tokenized, gaining unprecedented liquidity.

Digital Currency as the Core Settlement Tool:

On this ledger, the final settlement of all tokenized assets will be completed through a stable and reliable digital currency. This could be a Wholesale Central Bank Digital Currency (Wholesale CBDC) issued by a central bank or a tokenized deposit or payment stablecoin issued by commercial banks under strict regulation.

On this unified ledger, a payment from Paris to São Paulo will no longer be a "relay race." It will be a single, seamless atomic operation: the payer's tokenized euro deposit will be directly converted into the payee's tokenized real deposit through a smart contract, completing the entire process within seconds without any intermediary conversion. This is the true end-to-end digital value transfer.

3. Path to Realization—Open Finance and Interoperability

Transitioning from today's "value relay" model to the future "unified ledger" is not an overnight process. It requires the establishment of a new set of global "rules of the game" and "technical language." Two concepts are crucial in this regard: Open Finance and Interoperability.

Open Finance:

If open banking allows third parties to access bank account data with user authorization, then open finance extends this concept to a broader financial field, including investments, insurance, pensions, etc. Its core is the absolute ownership and control of users over their own data. In the evolution towards a unified ledger, the principles and frameworks of open finance lay the governance foundation for the secure and compliant sharing of data and functions between different institutions and systems (IMF, New Open Finance Guidelines).

Interoperability:

This is the key at the technical level. To achieve seamless dialogue between different systems (whether traditional core banking systems or different blockchain networks), universal technical standards must be established. Standardized Application Programming Interfaces (APIs) and Open Protocols are the "universal language" that enables this interoperability. They allow the flow of value to evolve from the current segmented relay-style handover to a truly integrated seamless transfer, eliminating barriers between systems (CGAP, Key Considerations for Open Finance).

Aiying's Conclusion: Embracing the Exciting, Chaotic, but Necessary Evolution

The "value relay" model is an exciting, chaotic, but absolutely necessary chapter in the history of financial evolution. It pragmatically demonstrates the enormous potential of emerging technologies like blockchain to transform core financial processes while ruthlessly exposing the deep-seated challenges of liquidity, security, and regulation that we must address on the road to the future.

For today's enterprises and financial institutions, the key is not to cling to old models or to try to perfect this transitional model. The true wisdom lies in drawing valuable experiences and lessons from the practice of "value relay," understanding its advantages, avoiding its risks, and actively participating in building the next generation of a more open, intelligent, and inclusive global value network.

Future competition will no longer be merely about payment speed and cost. It will be a higher-dimensional competition regarding the programmability of financial services and the network ecosystem integration capability. Those participants who can understand and navigate the evolution logic from "value relay" to "unified ledger" will undoubtedly emerge victorious in this historic transformation. Aiying will continue to focus on and deeply engage in this process, providing our clients with cutting-edge insights and the most reliable compliance navigation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。