Author: White55, Mars Finance

The cryptocurrency market is witnessing a new game that disrupts traditional perceptions—the Ethereum treasury competition.

New institutional capital operation models represented by BitMine Immersion Technologies (BMNR) and SharpLink Gaming (SBET) are accelerating the accumulation of ETH through Wall Street tools, injecting strong momentum into the market while also provoking important reflections on token economics, market capitalization management, and even risk transmission. This experiment, which deeply integrates digital assets with financial engineering, has begun to reshape market logic and ecological patterns.

Market Turbulence: BMNR's Plunge Reveals Wall Street's Crypto Capital Game Rules

SBET's stock price has fallen nearly 40% for seven consecutive trading days.

Last week, an announcement in the U.S. stock market drew close attention from the crypto market: BMNR, the current leader in the Ethereum treasury competition, experienced a significant drop in its stock price.

In-depth analysis revealed that this was directly related to the token unlocking rules for its early investors. Previous participants in the allocation received large amounts of shares at extremely low costs of $4.5, $5.4, and $10 per share, while the current BMNR stock price, despite adjustments, remains around $35. This means that even after this round of adjustments, the stock price is still significantly higher than the entry cost for early investors.

When the lock-up period constraints disappear, the enormous arbitrage space naturally drives these investors to engage in large-scale selling operations. This unlocking selling pressure caused by the equity allocation mechanism is unrelated to the company's fundamentals; it is purely an arbitrage behavior based on time and price differences at the capital level, vividly revealing the potential for short-term volatility when traditional Wall Street capital operation logic is introduced into the crypto asset accumulation field.

Although BMNR currently boasts a holding of 566,800 ETH valued at $2.13 billion, its stock price performance is not completely synchronized with the trend of ETH asset reserves, highlighting the complexity of the market under this structure.

Meanwhile, the operational model of another competitor, SBET, has also sparked in-depth discussions in the market. According to market observations and analyst assessments, SBET seems to follow a strategy cycle that is quite controversial in the eyes of some crypto investors: continuously issuing stocks to the public market (i.e., "distributing stocks to the market") to obtain incremental funds, and then efficiently allocating the raised fiat capital to continuously purchase and accumulate Ethereum (ETH) assets.

This practice has been vividly described by some market participants as "using U.S. stock investors' funds to exchange for prosperity in the crypto space." Its essence is to leverage the financing convenience of compliant public markets to provide funding support for crypto assets.

This model, especially under the operational framework centered on ETH, has led some market observers to liken SBET to "MicroStrategy in the Ethereum domain"—the latter is known for continuously issuing bonds or financing to accumulate Bitcoin on a large scale.

Facing Challengers: SharpLink Gaming and the Aggressive Layout of ConsenSys' Key Figure

In this institutional capital competition, SharpLink Gaming (SBET) has drawn strong market attention with its rapid accumulation speed. Its ETH reserves have reached an astonishing 360,800, ranking second in the ETH treasury competition leaderboard with a market value of approximately $1.35 billion.

The actions of SBET have attracted significant market attention not by coincidence; behind it stands Joe Lubin, one of the eight co-founders of Ethereum and the current leader of blockchain infrastructure giant ConsenSys.

Lubin has devised a highly aggressive asset accumulation strategy for SharpLink. In an exclusive interview with Bloomberg TV, he straightforwardly articulated the company's core development goal: "We firmly believe that on a fully diluted per-share basis, we will be able to accumulate Ethereum faster than any other project built on Ethereum, and we will inevitably lead those focused on Bitcoin projects." This declaration clearly positions it as an ambitious challenger in the Ethereum accumulation race.

To achieve this surpassing development, Lubin confirmed that SharpLink is actively preparing funds through diversified capital market operation models. They not only increase their ETH holdings daily through market trading tools but also utilize advanced staking strategies to continuously release value from their existing reserve assets to obtain additional returns. This "asset appreciation + staking yield" dual-driven model aims to accelerate the growth of SBET's reserve scale and market dominance through a compounding effect. Lubin particularly emphasized the importance of timing: "SharpLink's core strategy can be summarized as: speed wins, to accumulate the key asset Ethereum for shareholders faster than all competitors."

Battle of the Leaders: Strategic Divergence and Market Struggle between BitMine and SharpLink

The core competitor currently facing SharpLink, led by Lubin, is BitMine Immersion Tech (BMNR), chaired by renowned Wall Street strategist Tom Lee.

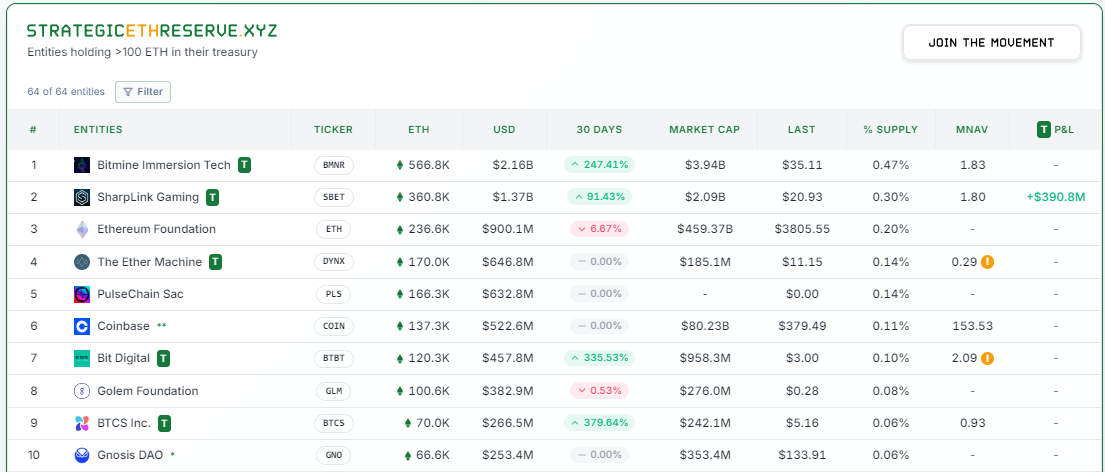

strategicethreserve data shows the top 10 companies holding Ethereum

StrategicETHReserve statistics show that the leading entities currently are institutional capital management companies:

- BitMine Immersion Technologies (BMNR): Currently holding 566,800 ETH, with a market value of approximately $2.13 billion, firmly occupying the top position.

- SharpLink Gaming (SBET): Currently holding 360,800 ETH, corresponding to a value of approximately $1.35 billion, ranking second.

- Ethereum Foundation: As a non-profit core support organization, holding 236,600 ETH.

- Ether Machine: Also an active institutional Ethereum holder.

- PulseChain: A new project and treasury competitor that has garnered significant market attention.

In addition, centralized exchange platform Coinbase, crypto mining company Bit Digital, and the non-profit organization Golem Foundation, which is dedicated to distributed computing development, have also been confirmed to hold over 100,000 ETH each, becoming important forces outside the leaderboard.

Faced with the strong BMNR, SharpLink has chosen a completely different growth path. Lubin clearly stated in the interview their high regard for risk management principles: "SharpLink is currently not using any form of leveraged financing in its operations." Compared to the complex derivatives or lending operations that BMNR may involve, SharpLink primarily relies on equity financing or its own cash flow to support its ETH accumulation. This stands in stark contrast to the debt expansion commonly employed by Bitcoin leader MicroStrategy.

However, Lubin also revealed that SharpLink is actively exploring the possibility of broadening its financing channels, particularly looking into "convertible notes" (a type of debt instrument that can be converted into company stock under certain conditions). MicroStrategy has repeatedly used this financial tool to successfully raise billions of dollars for large-scale Bitcoin asset accumulation. Lubin emphasized, "Regardless of which financial tool we choose in the future, the company will implement extremely strict leverage risk control measures." He further added, "SharpLink will always maintain a prudent attitude towards various risk exposures, as we firmly believe that through a sound and sustainable operating strategy, we will ultimately maximize long-term shareholder interests." This stance clearly reflects SharpLink's attempt to find a precise balance between accelerated expansion and risk control, avoiding systemic risks in the face of market volatility due to excessive leverage.

In-Depth Interpretation: The Logic and Market Resonance Behind the Treasury Competition

Why are these institutional treasuries, fueled by ample ammunition from the U.S. stock market, so fervently competing for Ethereum? The core logic of their behavior goes far beyond mere hoarding, containing deep strategic implications.

Seizing Core Digital Infrastructure Entry Points: In the evolution of the Web3 technology system, Ethereum, with its largest and most mature decentralized application ecosystem, is widely regarded as the core infrastructure of the new economy of the future. A large number of application protocols with real user bases and economic vitality are built on the Ethereum platform. Purchasing and holding ETH is essentially a form of equity allocation to the long-term value of this future core digital infrastructure, aiming to capture the dividends brought by the network's continuous growth.

Locking in Limited Scarce Assets for Excess Returns: Unlike company stocks that can be issued infinitely, the total supply of ETH is strictly limited by algorithms, with its annual issuance rate tending towards extremely low levels or even entering a deflationary state under the mechanism design. The large-scale continuous purchasing behavior of the treasury itself is actually accelerating the consumption of publicly available market liquidity; this long-term reserve strategy based on hard scarce assets is seen as an effective tool to counter the potential dilution forces of global fiat currencies.

Creating compliant crypto exposure to provide institutional-grade channels: Currently, direct investment in native ETH assets still poses multifaceted challenges for traditional large institutions, including regulatory compliance, custody security, and accounting treatment. The ETH treasury companies publicly listed on NASDAQ or the NYSE (such as SBET and BMNR) provide an efficient alternative: institutional and individual investors can gain exposure to the underlying Ethereum assets simply by purchasing standardized stocks, achieving risk isolation and compliance conversion.

Surging Demand: Institutional FOMO Effect Drives ETH Value Reassessment

This unprecedented institutional treasury competition has had an immediate and profound impact on the supply-demand balance in the Ethereum market.

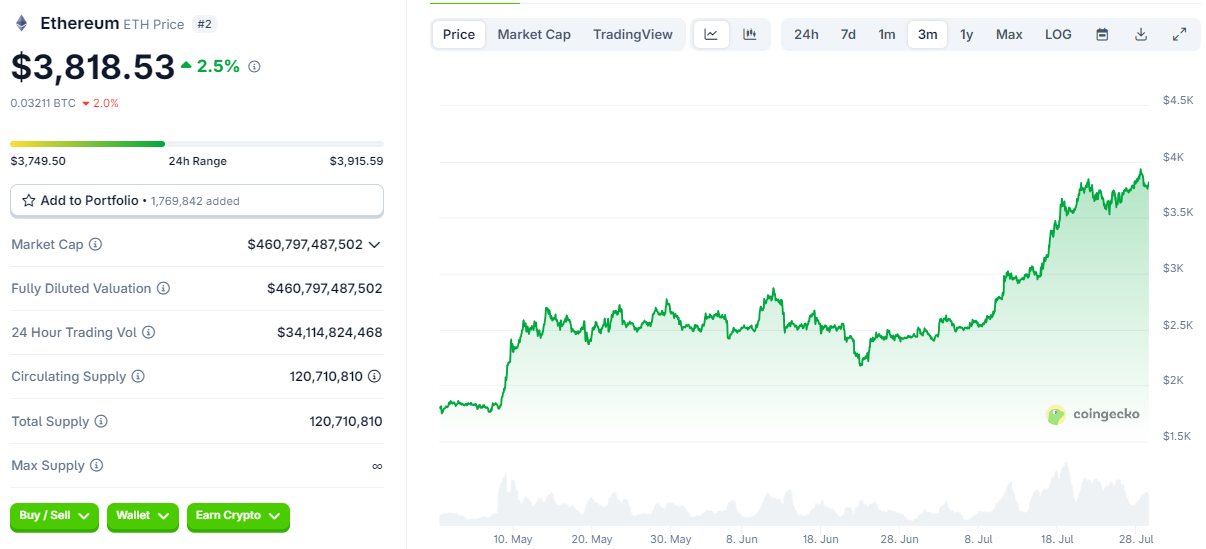

According to CoinGecko statistics, the value of ETH has surged by 110% in just ninety days, with the current price approaching the $3,800 mark.

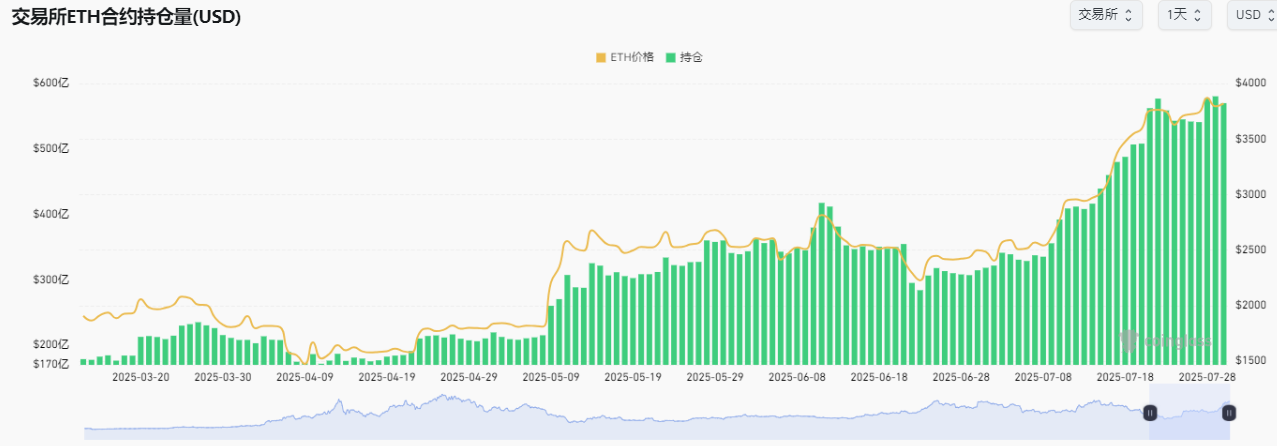

Coinglass data shows that during the same period, the open interest in Ethereum contracts skyrocketed from $17 billion to the current $58 billion.

This performance has far exceeded the growth rates of many early leading token assets such as Bitcoin (BTC) and Solana (SOL) during the same period.

Crucially, this outperformance occurs against the backdrop of ETH's relatively lower market heat compared to other competitive public chain networks, making this strong rebound even more worthy of in-depth analysis.

The market has keenly sensed the changes in capital structure: capital from professional fund managers is continuously injecting energy into ETH. A large amount of ETH is locked in these institutions' balance sheets as long-term strategic reserves, which directly leads to a rapid contraction in the supply of spot ETH available for trading in the secondary market. This "effective circulation tightening" combined with "institutional allocation demand expansion" forms a solid underlying logic driving the systematic value reassessment of ETH. Especially when this mechanism creates a positive feedback loop, more value discovery will attract broader new capital attention.

Future Outlook: The Path to Digital Bonds and a New Financial Order

The Ethereum treasury competition is far from a short-term market craze; it is a large-scale selection mechanism for financial capital regarding the next generation of core value storage vehicles and a key evolutionary stage for the tokenization of digital economic infrastructure.

From the early foray of MicroStrategy in the Bitcoin space to the current situation where multiple publicly listed companies in the Ethereum ecosystem are rushing to seize this strategic high ground, this competition has escalated into a complete economic experiment.

The core of this experiment lies in exploring the efficiency of value transfer between public capital markets and core blockchain digital assets. It validates the following issues in a near-real-world high-frequency interaction scenario: Can capital markets create safe and controllable channels to efficiently allocate large-scale capital forces into core crypto assets? And can core crypto assets, as underlying value storage vehicles, support the continuous growth and value realization of publicly listed companies? Ultimately, can this nested structure create a reliable pathway for the long-term consistent and collaborative growth of company shareholders and token holders' interests?

Regardless, the institutional treasury competition has irreversibly activated the deep value discovery process of Ethereum.

Ethereum's strong aggregation capability at this moment is accelerating its transition from a mere blockchain technology platform to an indispensable value foundational protocol in the digital economy world. The institutional treasury competition is just a starting point; its true endpoint points to the construction of a new value order based on global collaboration, open-source rules, and operating on code.

Regardless, institutions have FOMO; regardless, Ethereum has risen; regardless, regardless.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。