SEC Approves In-Kind: Will BlackRock's Crypto ETFs Surge?

SEC Approves In-Kind Creations for Ethereum and Bitcoin ETFs

In-kind creations and redemptions for Ethereum and Bitcoin exchange-traded funds have been authorized by the SEC, which could increase institutional investors' interest in crypto ETFs by reducing expenses and increasing efficiency.

Source: Website

Applicants to list and trade funds that hold options on "certain spot bitcoin ETPs," funds with higher position limits, and funds holding both spot bitcoin and spot ETH +0.80% were all approved, according to the USSEC.

Accelerated Approvals Granted to Major U.S. Exchanges

Following that, the SEC Approves In-Kind creation gave "accelerated approvals" to the Nasdaq Stock Market LLC, NYSE Arca, Inc., and Cboe BZX Exchange to permit creations and redemptions for a number of ETFs, including the Ethereum and bitcoin ETFs offered by BlackRock. ETFs from Ark21, Fidelity, VanEck, and Franklin Templeton are also on that list.

Paul Atkins: ‘A New Day for Crypto Regulation’

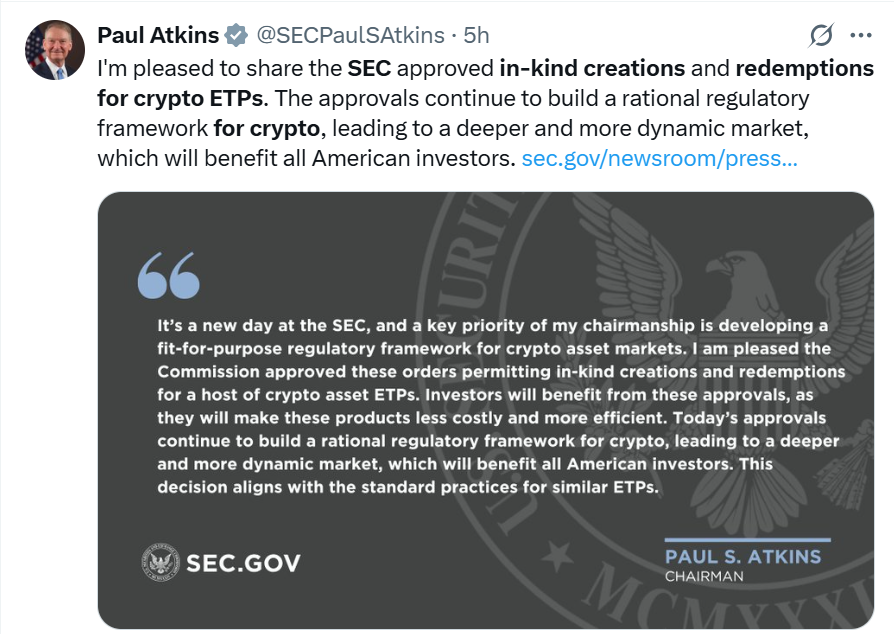

"It's a new day at the US Security and Exchange Commission, and a key priority of my chairmanship is developing a fit-for-purpose regulatory framework for crypto asset markets,” Chairman Paul Atkins said in his post. "Investors will benefit from these approvals, as they will make these products less costly and more efficient."

Source: X profile

“Today’s approvals continue to build a rational regulatory framework for crypto, leading to a deeper and more dynamic market, which will benefit all American investors,” Chairman Paul Atkins said. “This decision aligns with the standard practices for similar ETPs.”

SEC Approves In-Kind creation is the first major crypto-friendly policy change since Paul Atkins was appointed head earlier this year. As a former commissioner known for his pro-market views, Atkins has long advocated for a more lenient regulatory environment with regard to digital assets.

Approves Redemptions After Long-Awaited Push by ETF Issuers

More than a year ago, businesses were working out technical intricacies of the redemption procedure for spot bitcoin ETFs before the SEC approves In-Kind creation. The Security and exchange commission supported a cash model that mandated companies such as BlackRock remove bitcoin from storage, sell it immediately, and then return the investor's money. This change brings more efficiency and lower costs for institutional investors. Hester Peirce stated in June that in-kind redemptions for cryptocurrency ETFs were "on the horizon." ETF issuers have been requesting in-kind redemptions for months.

SEC Approves In-Kind Creations and Redemptions to Boost Institutional ETF Adoption

The recent announcement by Chair Atkins and Commissioners has sparked a call for the staking of ETFs with the most institutional trust, lowest friction, and cleanest mechanics. This move will accelerate flows into products like BlackRock's $IBIT and $ETHA while excluding legacy trusts. It also aligns crypto ETPs with other physical metal ETPs, allowing affiliates to deliver and receive commodities in kind. This move promotes a more efficient market, improves the experience for fund shareholders, and makes it harder for potential manipulation of ETP shares.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。