On July 28, Mill City Ventures III, Ltd. (stock code: MCVT) announced a $450 million private placement to launch the SUI treasury strategy. The hedge fund Karatage acted as the lead investor, with the Sui Foundation also providing an equal investment. Notable institutions such as Galaxy Digital, Pantera Capital, and Electric Capital have also shown support, with Galaxy Asset Management overseeing Mill City's financial operations, further enhancing market confidence.

Driven by this news, MCVT's stock price soared from $2 to a peak of $8 within three days, with a cumulative increase of up to 400%, closing at $6.65 yesterday. This not only marks the formal entry of a traditional publicly listed financial company into a new era of crypto infrastructure but also announces the official launch of another "altcoin microstrategy." Following ETH, SOL, and BNB, SUI is now experiencing its moment of institutional consensus.

Two major institutions join forces to promote the SUI microstrategy: Karatage and the Sui Foundation

Non-bank lending institution and financial company Mill City Ventures III, Ltd. recently announced that it has signed a securities purchase agreement to invest in public equity through private investment, purchasing and selling 83,025,830 shares of common stock at a price of $5.42 per share, with expected total proceeds of approximately $450 million. This issuance is expected to be completed around July 31, 2025. The company plans to use about 98% of the net proceeds from the private placement to acquire the native token SUI of the Sui blockchain, and about 2% to support the company's short-term lending business. SUI will serve as the company's primary financial reserve asset. This strategic shift marks Mill City's transformation from its traditional business of short-term lending and specialized financing to a new era of financial structure centered around crypto-native assets.

The smooth advancement of this transformation is inseparable from the deep involvement and full support of Karatage and the Sui Foundation.

This round of financing is led by the London-based hedge fund Karatage. This proprietary fund, focused on digital assets and cutting-edge technology, was co-founded by Marius Barnett and Stephen Mackintosh. They not only participated in the investment but also directly engaged in the strategic formulation and governance restructuring of Mill City—Barnett will serve as the chairman of the board, while Mackintosh will take on the role of chief investment officer, fully responsible for the execution of SUI investments and asset management.

In fact, Karatage's involvement is not a spur-of-the-moment decision but is based on profound strategic groundwork. The fund participated in the construction of core protocols such as Walrus and Suilend early in the Sui ecosystem and established a long-term partnership with Sui's original contributor, Mysten Labs, accumulating rich experience in ecosystem operations. Mysten Labs is the technical core supporting the Sui Network, founded in 2021 by former Meta-Novi R&D head Evan Cheng and chief engineer Sam Blackshear, leading the development of key infrastructures such as Sui Wallet and Sui Explorer.

Stephen Mackintosh, co-founder of Karatage, pointed out, "We are at a critical moment when institutional cryptocurrency and artificial intelligence are reaching critical mass, which will bring significant opportunities for the entire blockchain infrastructure. Sui possesses the speed and efficiency required by institutions for large-scale cryptocurrencies, as well as a technical architecture capable of supporting AI workloads while maintaining security and decentralization, making it fully capable of mass adoption."

With these early deep engagements and technical collaborations, Karatage has a profound understanding of the architecture and ecological development path of the Sui network, providing strong confidence endorsement and execution support for Mill City's strategic transformation.

Additionally, the Sui Foundation is also one of the important promoters of this strategic transformation, not only participating in this round of financing but also continuously supporting the development and growth of the entire Sui ecosystem in various ways.

As an independent organization dedicated to promoting the construction and application of the Sui network, the Sui Foundation is not only an early core investor but also an important driving force behind the ecosystem's prosperity. The Sui Foundation has been committed to building the Sui ecosystem, including providing funding to developers, supporting the construction of the next generation of decentralized applications (dApps), and further improving the core infrastructure on the Sui network, such as the DeepBook centralized limit order book (CLOB), automated market maker mechanism (AMM), liquid staking protocols, and lending systems.

The foundation consistently adheres to a "buyback and redistribution" strategy, reasonably allocating resources to channel funds back into the projects that drive the most growth for the network. Meanwhile, the Sui Foundation continues to incentivize SUI tokens for top DeFi protocols, with nearly all leading projects in the ecosystem receiving official support, significantly boosting the Sui network's TVL and actual usage popularity, and driving the price of SUI tokens through market cycles with long-term stable performance.

As Christian Thompson, managing director of the Sui Foundation, stated: "The establishment of Sui is to provide the necessary scalability, speed, and security to support the next generation of decentralized applications and real-world crypto use cases, aimed at both consumers and institutions—from stablecoins to artificial intelligence, to gaming and broader finance."

As a groundbreaking Layer 1 blockchain hailed as "one of the most outstanding blockchain networks," Sui, with its industry-leading throughput and concurrent architecture, is attracting increasing attention and trust from developers and institutions, becoming a significant focus of altcoin microstrategies in the crypto world.

Summary

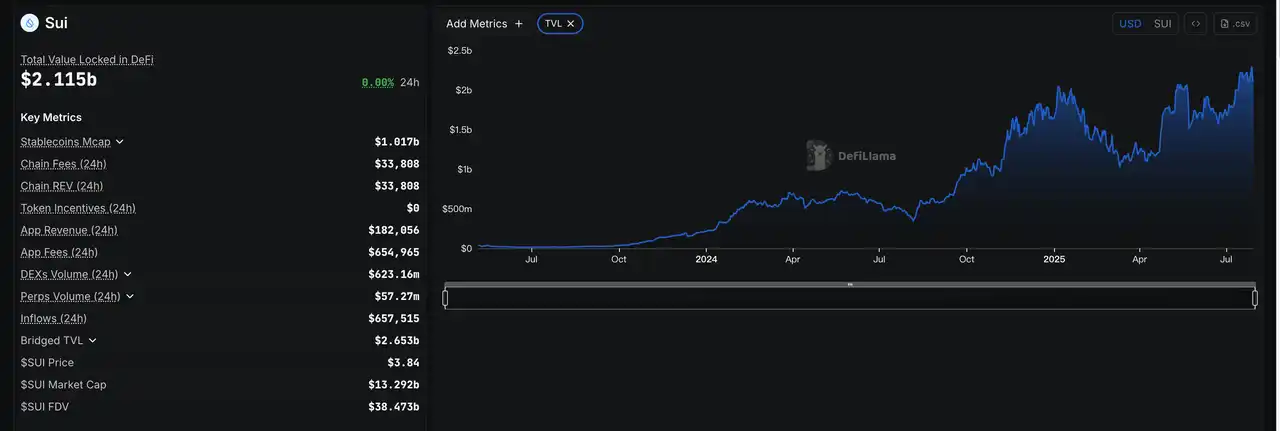

The Sui ecosystem is experiencing a surge in popularity due to artificial intelligence and decentralized finance. Currently, the total value locked (TVL) on Sui has surpassed $2 billion, setting a historical record, and daily trading volume is steadily increasing, significantly enhancing ecosystem activity. On July 27, the price of SUI briefly rose to $4.5, reaching a new high in six months, making it one of the most outstanding altcoins recently.

From Mill City's treasury microstrategy to the collaboration between Karatage and the foundation, Sui not only demonstrates strong capital attraction but also proves that its technical architecture and ecological potential are gaining mainstream recognition. A microstrategy paradigm driven by institutions and powered by the ecosystem is gradually taking shape, and Sui's subsequent performance is worth looking forward to.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。