1. Market Observation

Recently, the economic and trade leaders of China and the United States held candid and constructive talks in Stockholm, Sweden. Both sides reached a consensus to continue pushing for a 90-day extension on the 24% reciprocal tariffs that the U.S. had suspended, as well as China's countermeasures, which has brought some relief to the market. However, the global market still faces challenges and is holding its breath for the Federal Reserve's interest rate decision. Although the general expectation is that the Federal Open Market Committee (FOMC) will keep rates unchanged for the fifth consecutive time at this week's meeting, the real focus is on the timing of the first rate cut, with Wall Street divided into two camps. One camp, represented by Goldman Sachs and Wells Fargo, predicts that as signs of economic weakness become more apparent in the summer, the Fed will begin its rate-cutting cycle in September; while the other camp, led by Societe Generale and Nomura, believes that due to inflation uncertainties caused by tariffs, policymakers will remain cautious and delay the first rate cut until December or even later.

In this context, Bank of America strategist Michael Hartnett warned that global central bank easing, financial regulatory relaxation, and the policy shift of the Trump administration are collectively giving rise to a "larger bubble" driven by "more retail investors, more abundant liquidity, and more extreme volatility." With a series of significant events approaching, including U.S. second-quarter GDP data, the Fed's decision, earnings reports from tech giants, and the July non-farm payroll report, the global market is entering a critical "Super 72 Hours," the outcome of which will set the tone for the market for the remainder of the year.

The Ethereum market is undergoing a structural transformation driven by institutional capital. HashKey's chief analyst Jeffrey Ding pointed out that since July, Ethereum has risen over 50%. He believes this rally is primarily driven by favorable macro policies, micro capital inflows, and a shift in investor sentiment. Ding noted that the U.S. Congress's active promotion of cryptocurrency legislation has injected confidence into the market, while the massive capital inflow into Ethereum spot ETFs serves as the most direct catalyst. This indicates that Ethereum's asset attributes are shifting from "fuel for the world computer" to "yield-bearing reserve assets." As Ethereum transitions to PoS, its staking generates on-chain yields, attracting institutional funds seeking actual returns. Ding also mentioned that the relative decline of Bitcoin's market dominance may prompt capital to rotate into mainstream "altcoins" like Ethereum, thus initiating a new upward cycle.

Bitcoin's price has recently consolidated in the $117,000 to $120,000 range, with analysts expressing divergent views. Trader Roman and others believe the market may first dip to the $108,000 area to clear liquidity before rebounding. Material Indicators also stated that whales are selling at high levels, and if $116,750 cannot be held, BTC's price may quickly drop to the $110,000 range. Crypto trader Killa's accumulation plan is distributed at two positions: $113,850 and $112,000. Killa stated that if Bitcoin's price successfully recovers $120,000, the expectation of a dip will be negated, and the market may directly target $125,000. He suggests that investors can choose to continue holding long positions above $123,000 or wait for clearer entry opportunities. Analyst Axel Adler Jr. pointed out that if a breakout occurs, the short-term target would be $122,000, which could trigger about $2 billion in short liquidations. Markus Thielen, founder of 10x Research, suggested that breaking above $120,000 would signal a buying opportunity, but a more ideal entry point might be to wait for a price pullback to the previous resistance level of $111,673.

Regarding Ethereum, as the price returns to $3,800, analysts generally exhibit strong bullish sentiment, with its futures open interest (OI) reaching a historical high of $5.8 billion. Analyst Merlijn The Trader believes that the current data is a confirmation signal, and the continuous inflow of leveraged funds is injecting momentum for a "vertical rise." Glassnode's data also indirectly confirms the market's optimistic sentiment, indicating that funds are shifting from Bitcoin to Ethereum, with its open interest proportion rising to nearly a two-year high of 40%. Analyst Elja analyzed from the perspective of on-chain activity, believing that the significant increase in active addresses and transaction volume on the Ethereum network makes it only a matter of time before it reaches a historical high. Bitcoinsensus also stated that Ethereum has shown strong momentum and is ready for an upward breakout. In terms of specific key price levels, analyst Daan Crypto Trades emphasized that the $4000 to $4100 range is the core focus for further upside, and successfully breaking through this range is key to initiating the next phase of the upward trend.

It is worth noting that today marks the tenth anniversary of Ethereum's birth, with its price completing a rise from $0.3 to $3,800, climbing to the 28th position among global assets. The Layer2 network Linea within the ecosystem has also finally announced its token economics, planning to airdrop 10% of the tokens to early community users, aiming to build the network into an "ETH capital base." In Asia, the Hong Kong Monetary Authority announced that it will open the first batch of stablecoin issuer license applications starting August 1, requiring all compliant stablecoin holders to implement real-name verification (KYC). This policy is also expected to trigger short-term market fluctuations, with Hong Kong-related projects CFX and CKB experiencing a brief surge before retreating.

2. Key Data (As of July 30, 12:00 HKT)

(Data Source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $117,951 (YTD +26.06%), daily spot trading volume $40.132 billion

Ethereum: $3,803.76 (YTD +14.12%), daily spot trading volume $33.228 billion

Fear and Greed Index: 74 (Greed)

Average GAS: BTC: 1 sat/vB, ETH: 1.38 Gwei

Market Share: BTC 60.7%, ETH 11.9%

Upbit 24-hour trading volume ranking: OMNI, XRP, ETH, BTC, CKB

24-hour BTC long/short ratio: 48.65%/51.35%

Sector performance: AI down 3.89%; RWA down 3.67%

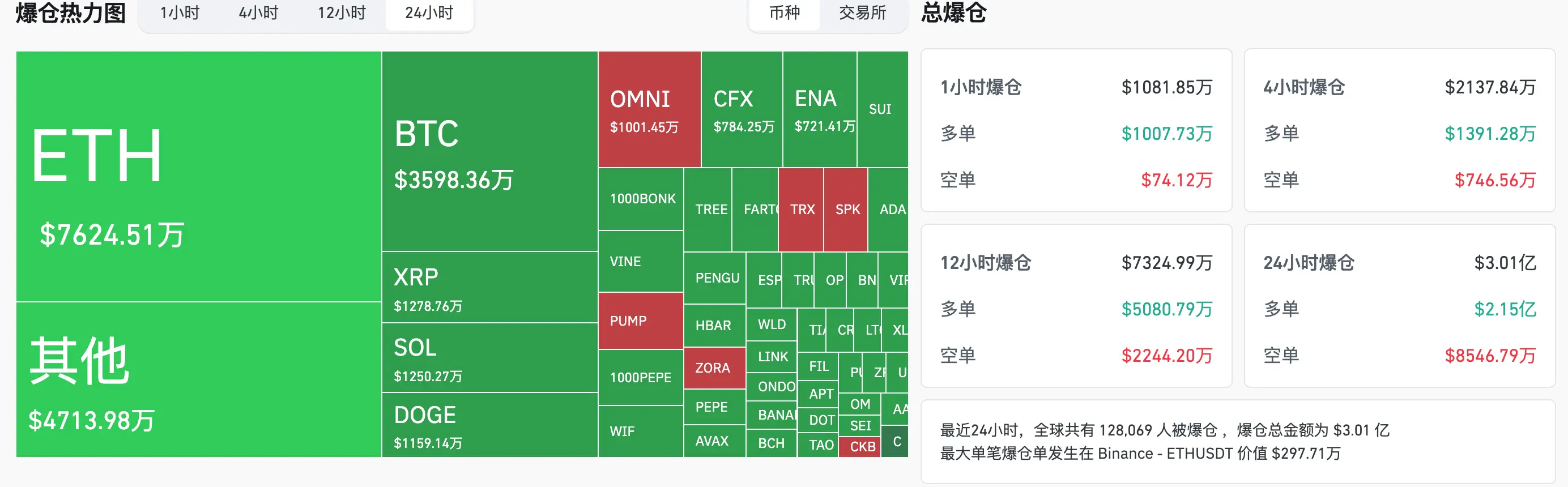

24-hour liquidation data: A total of 128,069 people were liquidated globally, with a total liquidation amount of $301 million, including $35.98 million in BTC liquidations, $76.24 million in ETH liquidations, and $12.78 million in XRP liquidations.

BTC medium to long-term trend channel: upper line ($118,878.55), lower line ($116,524.52)

ETH medium to long-term trend channel: upper line ($3,645.91), lower line ($3,573.71)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (As of July 29)

Bitcoin ETF: +$79.9781 million, continuing 4 days of net inflow

Ethereum ETF: +$219 million, continuing 18 days of net inflow

4. Today's Outlook

Binance will launch the A2Z/USDT trading pair on July 30, with LOKA being swapped at 1 LOKA = 20 A2Z

Strategy plans to announce its second-quarter financial report on July 31

Big Time (BIGTIME) will unlock approximately 600 million tokens on July 30, worth about $32 million

Kamino (KMNO) will unlock approximately 229 million tokens on July 30, accounting for 9.53% of the current circulation, worth about $13.8 million

Optimism (OP) will unlock approximately 31.34 million tokens on July 31, accounting for 1.79% of the current circulation, worth about $22.8 million

U.S. Federal Reserve interest rate decision (upper limit) as of July 30 (July 31, 02:00)

Federal Reserve Chairman Powell will hold a monetary policy press conference (July 31, 02:30)

U.S. initial jobless claims for the week ending July 26 (10,000): previous value 21.7, forecast value 22.4 (July 31, 20:30)

U.S. June core PCE price index year-on-year: previous value 2.7%, forecast value 2.7% (July 31, 20:30)

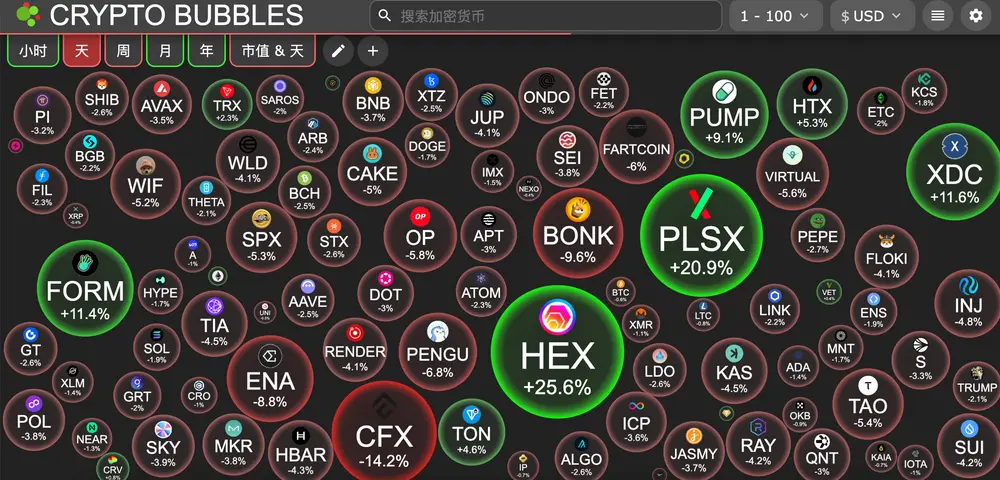

Today's top gainers in the top 100 by market cap: HEX up 25.4%, PulseX up 20.7%, XDC Network up 11.4%, Four up 11%, Pump.fun up 10%.

5. Hot News

Anchorage Digital Accumulates Over $1.19 Billion in Bitcoin Within 9 Hours

Ark Invest Purchases $15.3 Million Worth of BitMine Shares Again on Tuesday

BTCS Plans to Raise $2 Billion to Increase Cryptocurrency Investments

Linea Announces Token Distribution Details, 9% Distributed to Users via Airdrop

Multiple Addresses Accumulate 648,000 ETH in Half a Month, Worth $2.44 Billion

Market News: pump.fun Promises to Use 100% of Daily Revenue for Buybacks

DEGEN Foundation Discusses Phased Burn of 32.5% of Its Total Supply of DEGEN Tokens

This article is supported by HashKey. HashKey Exchange is the largest licensed virtual asset exchange in Hong Kong and the most trusted fiat gateway for crypto assets in Asia. It aims to set a new benchmark for virtual asset exchanges in terms of compliance, fund security, and platform protection.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。