The Ethereum network has been running smoothly for 10 years, 3650 days and nights, without any interruptions or maintenance windows.

Written by: Todd

First, congratulations on Ethereum's 10th anniversary!

It has been exactly 8 years since I registered my first Ethereum wallet.

There is a saying that humans undergo a large-scale cellular renewal approximately every 7 years.

Indeed, from a cellular perspective, I am no longer myself.

Yet Ethereum remains Ethereum.

My earliest Ethereum wallet is still alive, and even the little change left in the wallet back then has surprisingly grown tenfold.

At that time, I was at home typing away, discussing Ethereum;

At this moment, it is hard to imagine that I am still sitting in the same place, discussing Ethereum.

Let me talk about myself.

As is well known, I am a loyal supporter of Bitcoin, but I am not a BTC maxi (which roughly translates to a die-hard fan). I also like Ethereum, BNB, and Solana, and I enjoy researching them.

My first Ethereum wallet was not MetaMask, but an ancient wallet called My Ether Wallet. This wallet was so primitive that every time I logged in, I had to upload a file called keystore and then enter a password to unlock that file before I could use it.

The reason I wanted to register an Ethereum wallet was that I wanted to buy a CryptoKitty at that time.

Back then, two cats could breed, and some cats had rare traits, with each cat having a different breeding speed, leading to endless offspring for everyone to speculate on.

My first use of MetaMask dates back to 2020, when I wanted to speculate on the algorithmic stablecoin pioneer called AMPL, which had the characteristic that if it rose above $1, it would print money for everyone. If it fell below $1, it would deduct money from everyone's balance, achieving the effect of a stablecoin by adjusting supply and demand.

These two wallets are actually reflections of two eras; in fact, I broadly divide Ethereum into four eras:

- Era 0 (2015-2016): The Birth of Ethereum

- Era 1 (2017-2019): The ICO Era

- Era 2 (2020-2022): The DeFi Era

- Era 3 (2023-2025): The LST Era

- Era 4 (2025-Present): The Asset Era

Era 1: The ICO Era

In 2015-2016, Ethereum had only one trick: smart contracts. At that time, this was definitely a novel concept, as other altcoins, such as Ripple and Litecoin, did not have this feature.

Of course, people's development of smart contracts was also very superficial; until 2017, most people only used it to issue tokens.

After all, I was still using a wallet as primitive as My Ether Wallet, so how could I develop Dapps?

However, the ability to issue tokens was enough. In the past, if you wanted to issue a token, you needed to modify the code (for example, changing a few words from Bitcoin to Litecoin), find miners to support it, and constantly monitor the network's stability, which was extremely troublesome.

At least 80% of people just wanted a token to speculate on and did not care much about its underlying mechanism (now even the narrative is becoming less important; I regret that I did not understand this clearly back then).

Ethereum perfectly met this demand, thus becoming the absolute supernova of that year.

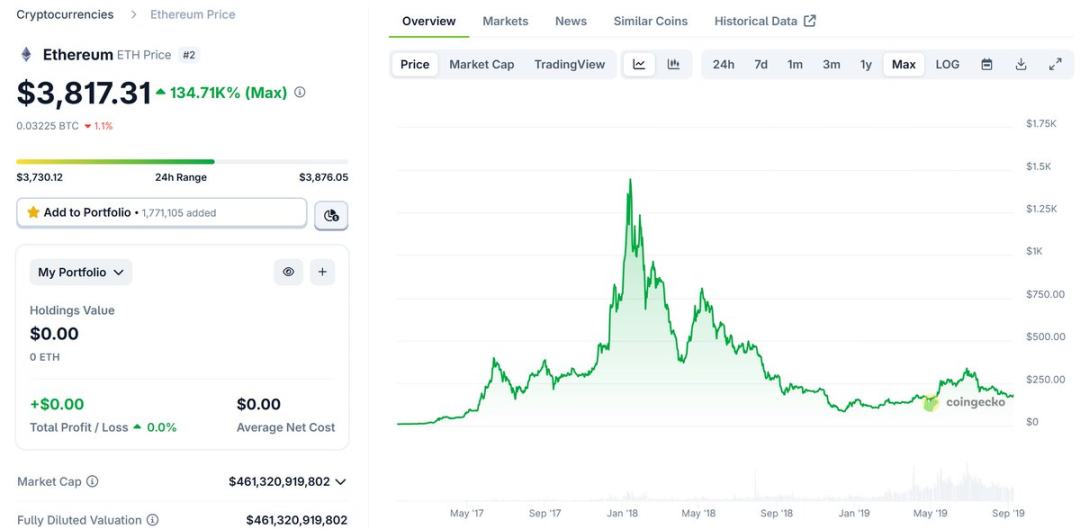

I remember vividly that when the domestic "Nine-Four" crypto ban was announced, the price of Ethereum was 1400 RMB, and six months later, Ethereum reached 1400 USD!

The peak price of Ethereum at that time was essentially driven by FOMO emotions triggered by supply and demand.

Imagine, you had to participate in 1-3 public ICOs in a group every day, each requiring Ethereum to be sent to the smart contract, and once you invested, you could earn 3-100 times your investment. How could you not hoard a little Ethereum?

Of course, that time Ethereum's reckoning was equally sudden.

I often share with my friends the stories of the Space Chain and Hero Chain breaking below their issue prices. Space Chain aimed to launch blockchain nodes into space, while Hero Chain was a gambling chain supposedly launched by Southeast Asian casino owners.

These two projects were considered top-tier projects of the ICO era, yet both broke below their issue prices at the beginning of 2018, marking the start of the breaking price wave.

When everyone discovered that projects previously financed with Ethereum began to cash out, and those who participated in ICOs with Ethereum were losing one after another, it was natural for them to start slowly dumping Ethereum.

Thus, Ethereum was surprisingly smashed down to $80 in 2019, truly a valley of despair.

I cannot escape the norm; I am not the kind of true E-guardian who maintains faith during a continuous decline.

Maintaining writing is indeed a good habit, as it helps leave tools for self-reflection. I looked back at my article from March 2018, when Ethereum was around $400, and I also questioned Ethereum's value during its low period—if it could only issue ICOs, then once the ICOs settled, what else could Ethereum do?

At that time, there were indeed some insightful comments in the comment section, and one person named LionStar sharply rebutted:

"2018 was just the beginning for Ethereum. People in the Ethereum community know that Ethereum currently has no scalability and performance; everything is still early. The grand vision of Ethereum will only take its first steps in 2018. PoS, sharding, plasma, truebit, state channels, swarm, zero-knowledge proofs, and a whole bunch of things have not yet been applied; let's look at Ethereum's development five years later. Also, the vast majority of speculators base their views solely on price; if the price goes up, they cheer, and if it goes down, they despair. This mindset is not only terrifying but also meaningless. Technology and development prospects determine true value, and price will ultimately converge towards true value."

The dark humor is that, except for PoS and zero-knowledge proofs, all of the above have failed.

Of course, this is also one of the most admirable aspects of Ethereum: it is an open framework that allows various teams to try out different ideas, such as sharding, plasma, truebit, state channels, and swarm. Most of them come from the community, where everyone expresses their opinions and puts in effort, which is the best embodiment of the spirit of the internet and open-source software.

Continuous and free trial and error have led to Ethereum's present.

The entire Ethereum community actually has two main lines.

One is technology, improving Ethereum's own performance;

The other is applications, creating applications around Ethereum.

Both sides bloom, each showcasing its own branch. After Ethereum fell into a low point, unexpectedly, DeFi slowly began to unfold.

Era 2: The DeFi Era

Everything began in 2020 when Compound announced it would start subsidizing depositors and borrowers. People were astonished to discover that meaningful applications could indeed be built on Ethereum, rather than just boring games like CryptoKitties that had only ornamental value.

Moreover, this truly meaningful application could even outperform traditional applications. Lower borrowing costs and higher deposit interest rates. There was even a time when "subsidies > borrowing interest" led to negative interest rates.

Now people take it for granted, but at that time, it was a shocking revelation.

You must know that other popular coins at that time were mostly about distributed storage or even solar-powered cannabis game chains created for the sake of creation. Ethereum, however, had something that could surpass traditional applications, which was incredibly cool, akin to being the first college student in the village.

Additionally, not all ICOs were bubbles; they brought some new things, and the predecessor of AAVE, EthLend, also came from the ancient ICO era.

Thus, Ethereum broke and then stood up again, marking the official start of the DeFi era.

DeFi also triggered changes in supply and demand, as both Uniswap and Sushiswap required a large amount of Ethereum as liquidity providers, which dramatically increased the demand for Ethereum.

Holding Ethereum and casually mining something, bearing a little impermanence, could yield annualized rates of return exceeding 100%. Who could resist such interest rates?

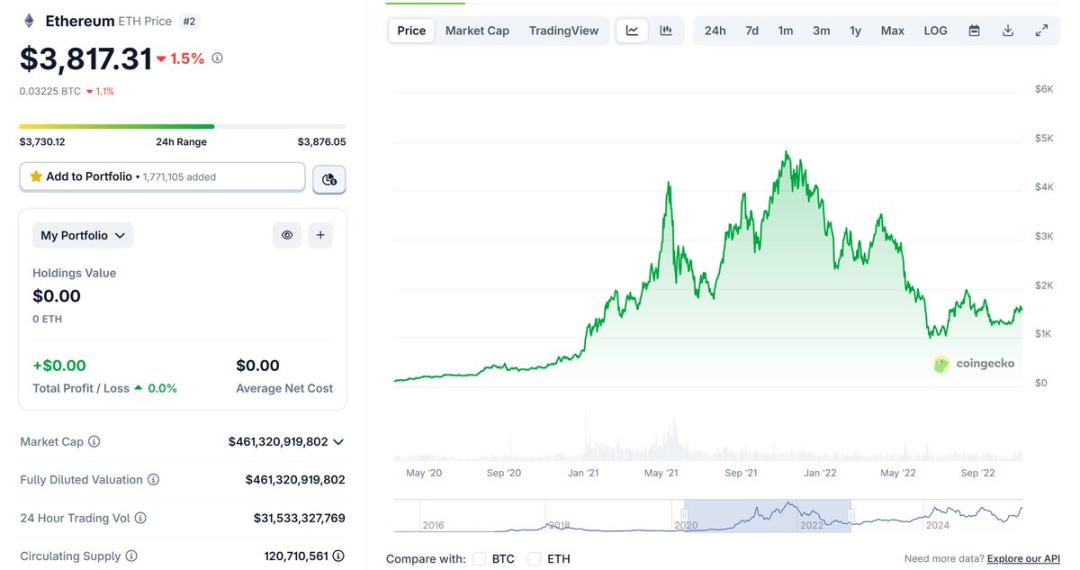

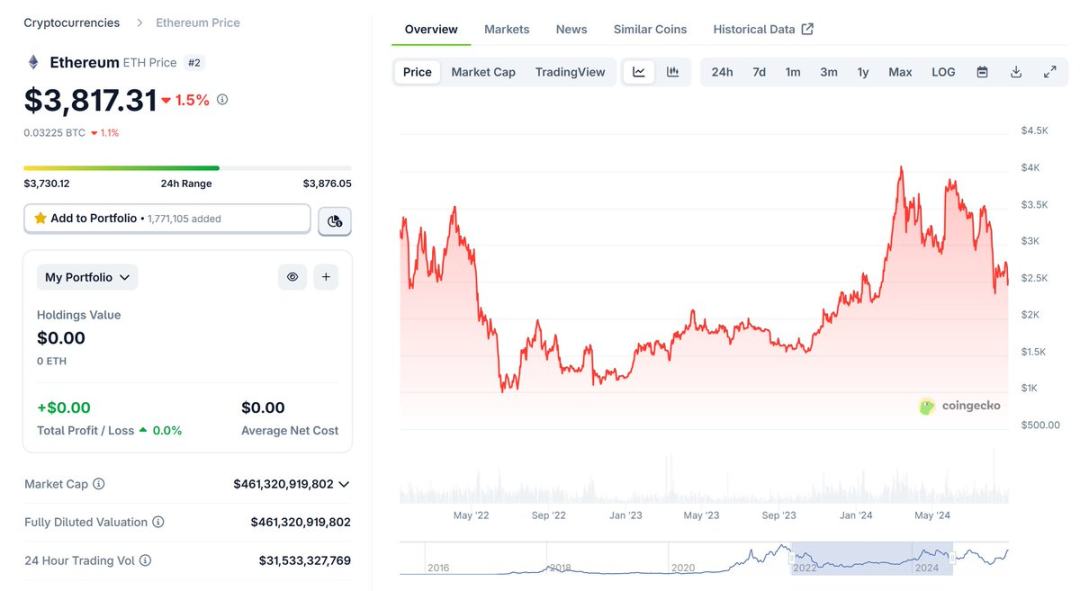

With the intense demand for Ethereum from DeFi, Ethereum first climbed to $4100, and then reached a historical high of $4800 in 2021. This included people's (including mine) fantasies about Ethereum being able to consume traditional finance.

However, unlike the ICO era, Ethereum in 2021 faced a pack of wolves. DeFi was born on Ethereum, but the good news quickly spread to competing chains. Ethereum's competitors had lower fees and faster performance. In the ICO era, the difference in gas fees was not obvious, but in the DeFi era, the term "noble chain" was undoubtedly the worst advertisement for Ethereum, not a compliment.

Time quickly moved to 2022, and Luna—hardly considered DeFi since it was a Ponzi scheme from the start. Its sudden collapse brought down the market, taking FTX and 3AC with it, and it also crushed the DeFi boom that these institutions deeply participated in, abruptly halting the DeFi summer.

Similar to the previous ICO era, due to the reverse change in supply and demand, people stopped participating in liquidity mining, and Ethereum began to enter a long downward channel. Especially with the decline in its exchange rate against BTC, countless dreams were shattered.

When DeFi thrived, Ethereum thrived; when DeFi declined, it was naturally hard for Ethereum to hold up, especially when other chains were promoting transaction fees below one cent.

Why has Ethereum been vigorously promoting the L2 strategy instead of the L1 expansion strategy in recent years?

I think you probably understand by now.

This is indeed a critical moment for survival! Ethereum must immediately slow down the departure of DeFi, even at the expense of its mainnet's status. Thus, a large number of L2 solutions were born at this moment.

There are pioneering ones like Arb, OP, ZK, institutional-led ones like Base, Mantle, OPBNB, mother chains like Metis, and novel ideas like Taiko, as well as application-led ones like Uni.

Ethereum does not need a long-term implementation plan; what it needs is a very quick, very simple, and even desperate immediate expansion plan, and that is L2.

It has been proven that L2 has played its intended role, solidifying the EVM brand and preventing a large number of DeFi developers from leaving the ecosystem due to high fees.

The funds and users may have left the ETH mainnet, but at least:

(1) They did not go to competitors;

(2) They did not give rise to more competitors.

Imagine, without the L2 strategy, Coinbase would definitely have launched its own chain; that is human nature. But with L2, at least nominally, Base, Uni, and others still regard Ethereum as the "sovereign of the realm."

As long as the EVM does not collapse, Ethereum will not lose.

Era 3: The LST Era

Next is the third chapter of Ethereum, which is also the chapter with the worst market conditions.

Following the ICO era and the DeFi era, Ethereum has now entered the LST era.

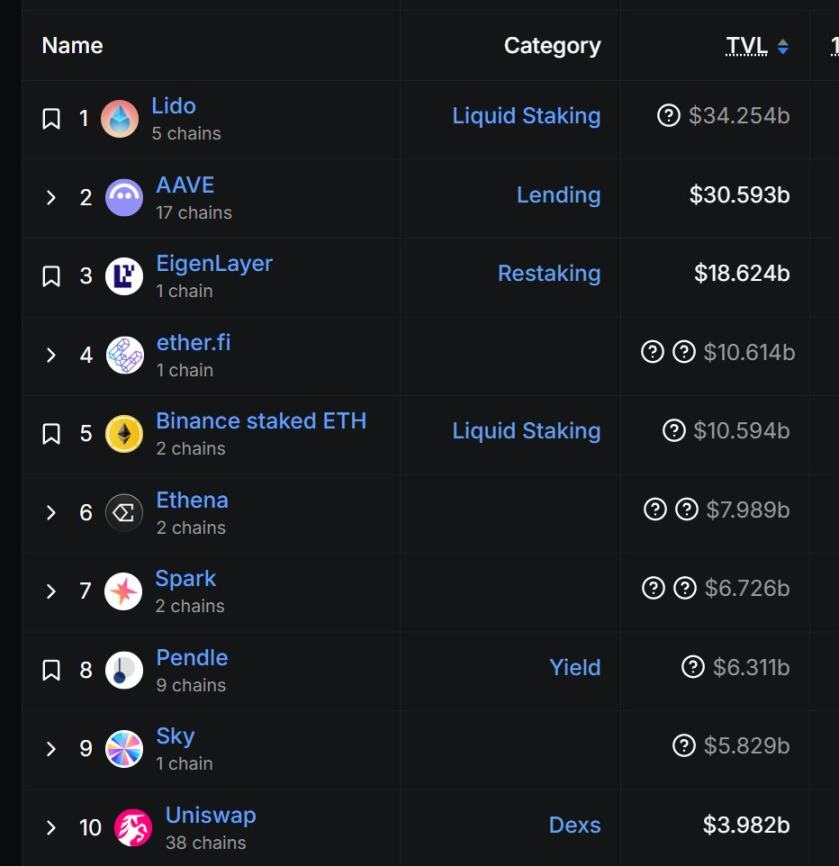

With the Shanghai upgrade, Ethereum's transition to PoS has been completely successful. From the perspective of TVL, Lido has risen, EtherFi has emerged, and countless ETH LSTs have sprung up like mushrooms after rain.

Every new era carries the strong imprint of the previous one; just look at DeFillama, where the top-ranking DeFi projects on Ethereum are basically LSTs or LST-related units.

Source: DeFillama

What are LST-related units?

For example, circular lending; EtherFi's circular lending can easily achieve over 10% yield in Ethereum terms (feel free to DM me if you're interested in discussing). However, "lending" requires a borrowing venue, so AAVE and Morpho's large TVL actually comes from the demand for circular lending, which is why, although they are DeFi, I liken them to LST-related units.

DeFi has propelled the birth of LSTs, and LSTs have become DeFi's largest clients.

On a side note, our company Ebunker was also established at this time, on September 15, 2022, which is also the day Ethereum successfully merged to PoS.

To this day, over 400,000 Ethereum are running on our nodes in a non-custodial manner, which makes me quite satisfied with the decision I made at that time.

After all, every E-guardian wants to take practical action to safeguard Ethereum's security (I do this by running nodes).

Back to the main topic, if you pay attention, you will notice that I have been emphasizing "the dramatic change in supply and demand has affected Ethereum's price."

However, LSTs (including non-custodial staking) have not improved the supply-demand relationship; Lido's ETH yield has long remained at 3%, and EtherFi can reach 3.5%, but that is already the limit.

Neither EigenLayer nor other subsequent re-staking initiatives have changed the essence of this benchmark interest rate.

But just like everyone hopes for a rate cut in the U.S. every day, this 3% benchmark interest rate has, in a miraculous way, additionally suppressed the virtual economic activities of Ethereum, this virtual nation.

Ethereum's gas fees have started to decrease (of course, this is also due to the efforts of L1 expansion and the L2 strategy), but the economic activities on it remain quite sluggish.

This is reminiscent of the two historical instances of supply-demand imbalance.

Thus, LSTs did not become a summer but instead accompanied Ethereum on its downward journey.

Because a 3% interest rate does not provide a reason for large holders to buy Ethereum; it can at most delay their selling. However, we still have to thank LSTs, as many large holders have deposited Ethereum into staking, at least preventing a crash similar to the $80 pit in 2019.

Era 4: The Asset Era

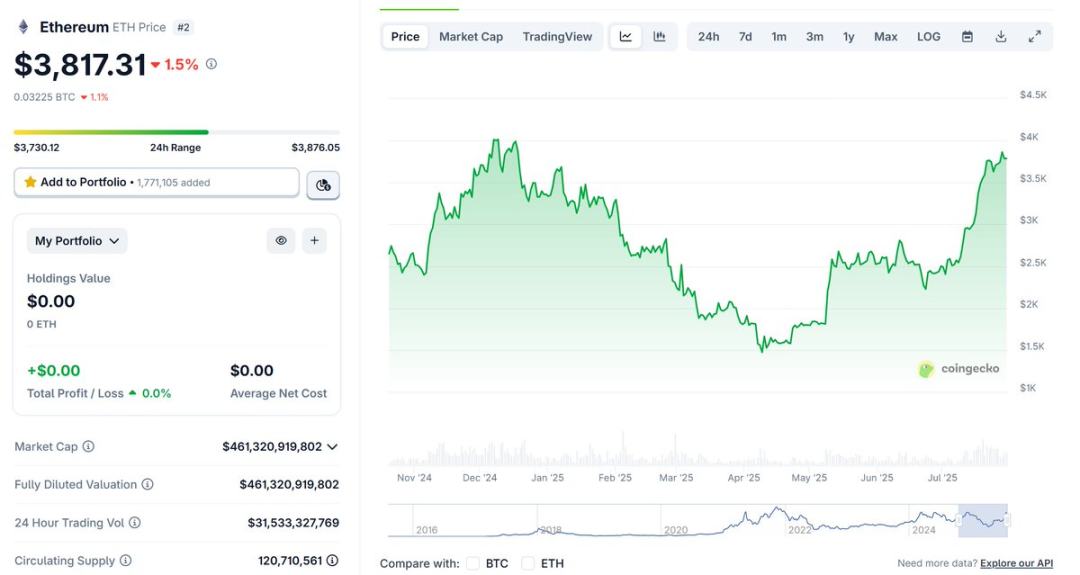

Fortunately, following Bitcoin, Ethereum has also successfully landed on the U.S. spot ETF, which briefly created hype for Ethereum. In fact, this has already opened the fourth major chapter of Ethereum—the Asset Era.

The process of transforming from an alternative asset to a mainstream asset is long. Thus, as everyone watched the ETH/BTC exchange rate gradually drop below 0.02, Ethereum faced its third "great doubt."

In fact, the entire community should thank that man, Saylor, for inventing the great MicroStrategy play.

Companies first buy Bitcoin/Ethereum, using these assets to issue more stocks and debts, then buy more Bitcoin/Ethereum, continue to issue more stocks and borrow more bonds, and then buy even more Bitcoin/Ethereum.

The success MicroStrategy achieved with Bitcoin inspired the Ethereum community.

Led by Consensys, capital within the circle has dominated sharplink, and traditional funding representatives like Bitmine, supported by Cathie Wood, have begun to compete for the leading position in Ethereum's MicroStrategy.

They and a host of imitators successfully ignited the resonance between U.S. stocks and cryptocurrencies.

Yes, that's right; this time it has again changed the supply-demand relationship of Ethereum.

Institutions are making large purchases of Ethereum at market prices, and just like before, the LST era has also laid a foundational effect, locking up a large amount of Ethereum liquidity through staking, naturally creating the FOMO of coin-stock linkage at this moment.

Of course, this also relies on the good impression Ethereum has left on both the crypto and traditional funding circles over the years.

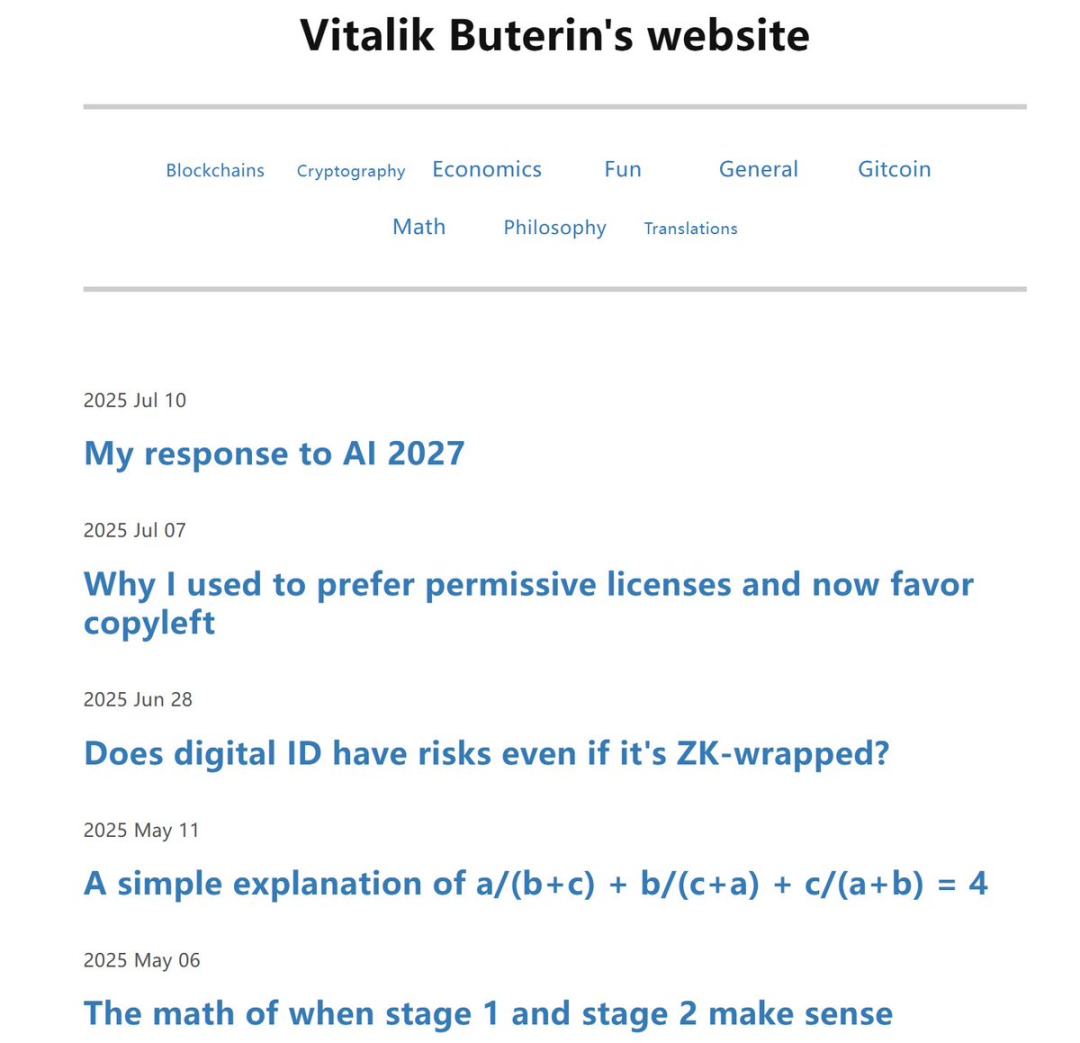

Vitalik did not flaunt luxury cars or villas, nor did he endorse scam projects; instead, he continuously contemplated how technology could influence Ethereum's future, such as ZKVM, privacy, L1 simplification, and so on.

He has never even mentioned sbet or Bitmine once on Twitter.

Ethereum being chosen by the market and entering this fourth era is due to the goodwill and reputation that Ethereum and Vitalik have accumulated over the years.

It can be said that Vitalik is an important part of my recognition of Ethereum's values.

In conclusion

As Binji said, the Ethereum network has been running smoothly for 10 years, 3650 days and nights, without any interruptions or maintenance windows.

During this time:

- Facebook went down for 14 hours;

- AWS Kinesis froze for 17 hours;

- Cloudflare shut down 19 data centers.

Indeed, Ethereum's robustness is fascinating.

I hope, and I believe, that I will still be analyzing everything about Ethereum on Twitter 10 years from now.

Happy 10th birthday, Ethereum!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。