Author: Kraken

Summary: Felix, PANews

Cryptocurrency exchange Kraken has announced its financial results for the second quarter (Q2) of 2025, achieving a revenue of $412 million, a year-on-year increase of 18%. The adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) was $80 million.

The total trading volume for Q2 was $186.8 billion, a year-on-year increase of 19%. Following a strong performance in the first quarter, the market experienced turbulence due to U.S. tariffs and broader macroeconomic uncertainty. Trading volume in Q2 saw a quarter-on-quarter decline, as the second quarter is typically a slow season for trading activity across the industry.

Kraken's number of funded accounts reached 4.4 million, a year-on-year increase of 37%. As of the end of Q2 2025, the total assets on the platform amounted to $43.2 billion, a year-on-year increase of 47%.

Kraken's financial performance in Q2 remained robust, primarily reflected in the following three key trends:

- Expanded trading volume market share: Kraken continued to increase its market share in spot trading volume. This was attributed to Kraken's ongoing investment in enhancing product experience and its position in the stablecoin sector, with stablecoin spot trading volume share growing from 43% to 68%.

- Growth investments: As traditional finance and the crypto market converge, Kraken is strategically investing in innovation and expanding its product portfolio to accelerate growth. In Q2, Kraken expedited product delivery and platform improvements while conducting targeted marketing campaigns that yielded strong and efficient returns.

- Cost control: To solidify its business across all market cycles, Kraken has consistently focused on improving operational leverage to build a sustainable business.

Professional Product Updates

European Perpetual Futures: Kraken launched the largest cryptocurrency futures suite in Europe regulated under MiFID. It introduced 24/7 forex perpetual futures (EUR, GBP, AUD, JPY, and CHF currency pairs) on Kraken Pro, expanding access to derivatives under a trusted regulatory framework.

U.S. Futures: Kraken launched regulated U.S. derivatives services for U.S. users, allowing direct access to cryptocurrency futures listed on the Chicago Mercantile Exchange (CME) through an integrated Kraken Pro trading experience.

Institutional Product Updates

Kraken Prime: Kraken has established a full-service institutional brokerage, providing institutional clients with best execution trading, qualified custody, deep multi-venue liquidity, and 24/7 white-glove support.

Kraken Custody: Kraken has added yield-bearing USDG for institutional clients and high-net-worth individuals, along with increased custody support for SOL and XRP.

Kraken Embed: Kraken launched a white-label cryptocurrency-as-a-service solution, enabling banks, brokers, and fintech companies to add fully compliant cryptocurrency trading within weeks. Europe's second-largest neobank, bunq, and Alpaca are among the first partners to integrate this product, with other integration projects in preparation.

Consumer Product Updates

Commission-Free Stock Trading: Kraken has launched U.S. stock trading features in its app for most states, allowing customers to manage both stocks and cryptocurrencies simultaneously.

xStocks: Kraken has tokenized 55 blue-chip stocks and 5 ETFs on the blockchain, providing eligible customers outside the U.S. with around-the-clock stock exposure and seamless on-chain transfers.

Krak App: Kraken has introduced a globally available wallet app, enabling customers to make payments, transfers, and earn yields using over 300 cryptocurrencies and fiat currencies in more than 160 countries and regions.

Brazil-Specific Services: Kraken has added instant BRL funding recharge features, fully localized web and mobile applications, and 24/7 Brazilian Portuguese support, bringing Kraken's global platform closer to Brazilian users.

Kraken+: Kraken has launched a premium membership service offering zero-fee trading limits, priority support, and higher USDG rewards. The service has been well-received, with over 100,000 subscribers and more than $1 billion in funds on the platform, including both new and experienced investors.

Significant Regulatory Progress

Regulatory transparency is continuously improving in both developed and emerging markets.

Kraken became the first exchange authorized by the Central Bank of Ireland under MiCA, enabling the company to accelerate its growth in 30 European markets. Kraken also obtained a restricted dealer license in Canada, further expanding its regulatory coverage.

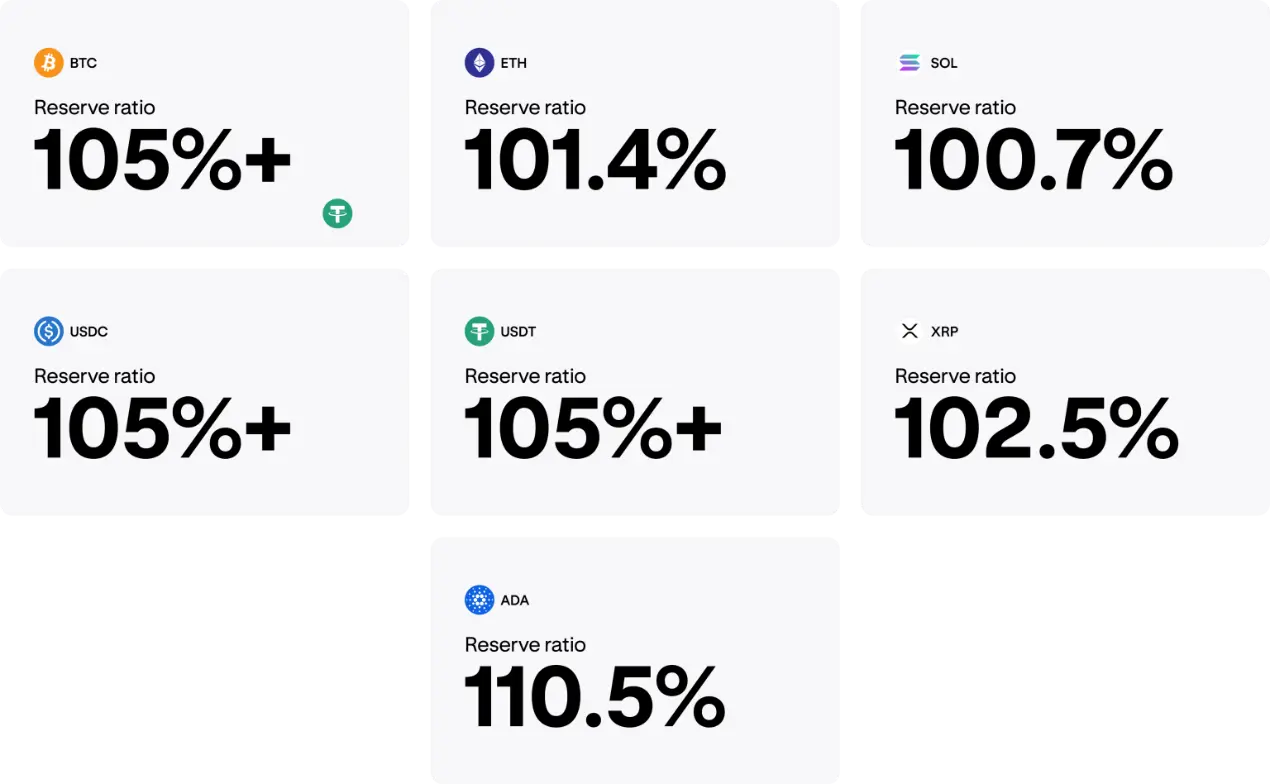

Achieving Transparency Through Proof of Reserves

Kraken also announced that it has completed its latest proof of reserves, covering the cryptocurrencies supported by Kraken's secure custody.

As of June 30, 2025

Kraken customers can confirm each quarter that their assets are fully supported on-chain. They can verify whether their account balances are included in the "proof of reserves" report independently verified by a third-party accounting firm.

Kraken was the first to implement regular "proof of reserves" practices and remains one of the few platforms executing this process.

Upcoming Key Initiatives from Kraken Include:

International Stocks: Expanding commission-free stock and ETF trading to major markets outside the U.S., starting with the UK, Europe, and Australia.

Tokenized Stocks: Introducing tokenized stocks in more jurisdictions and steadily increasing the number of listed assets.

Kraken Debit Card: Launching physical and virtual debit cards issued in partnership with Mastercard, enabling seamless spending of fiat and cryptocurrencies in-store and online through the Krak app.

NinjaTrader Development: Accelerating the platform's coverage in the UK, Europe, and Australia, and achieving frictionless multi-asset trading between the Kraken and NinjaTrader ecosystems.

Related Reading: The Crypto Circle Welcomes New Assets: A Comprehensive Analysis of the Tokenization Paths of Robinhood vs Kraken

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。