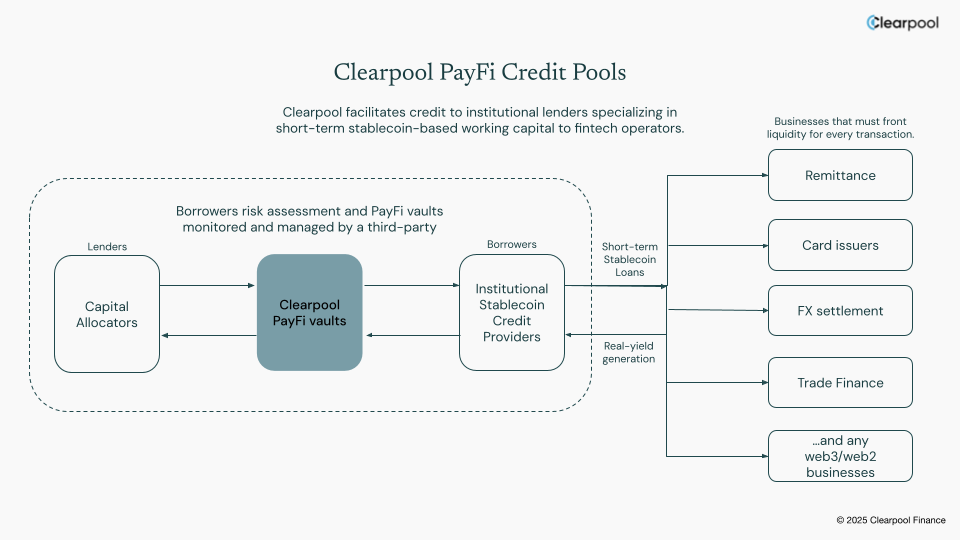

Clearpool, a decentralized credit marketplace, unveiled a suite of products to finance payments, targeting fintech firms processing cross-border transfers and card transactions.

The products include stablecoin credit pools for payment finance (PayFi) and cpUSD, a permissionless token that generates yield from short-term lending to payment providers.

"What many overlook is that while stablecoins settle instantly, fiat does not, forcing fintechs to front liquidity to bridge that gap," CEO and co-founder Jakob Kronbichler said in a statement on Thursday.

Clearpool’s PayFi pools aim to supply credit to institutional lenders serving these companies, with repayment cycles ranging from one to seven days.

The cpUSD token, backed by PayFi vaults and liquid, yield-bearing stablecoin, aims to deliver returns tied to real-world payment flows rather than speculative crypto activity.

Clearpool's expansion underscores the broader trend of stablecoins becoming core infrastructure in global payments, particularly in emerging markets where traditional banking rails remain slow or costly. The protocol said it has already originated more than $800 million in stablecoin credit to institutional borrowers, including Jane Street and Banxa.

Read more: PayPal Expands Crypto Payments for U.S. Merchants to Cut Cross-Border Fees

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。