Artificial intelligence technology is not eliminating collaboration platforms; rather, it is making true collaboration platforms more scarce and valuable.

Have you ever wondered why, in an era where AI can generate everything, a "drawing tool" has become more valuable? On July 31, Figma officially listed on the New York Stock Exchange, closing on its first day with a market value of up to $56.3 billion, with a P/S ratio exceeding 60 times. In contrast, the average P/S ratio in the SaaS industry is only 7 times. This figure not only far exceeds the valuation levels of mature SaaS companies like Adobe and Salesforce but is even more shocking than Adobe's $20 billion bid to acquire it two years ago. What is even more thought-provoking is that this valuation is given against the backdrop of an explosion in AI design tools, where ChatGPT can quickly produce design drafts and Midjourney can generate exquisite images. According to conventional logic, when AI can automate design work, the value of traditional design tools should be weakened, but the reality is quite the opposite.

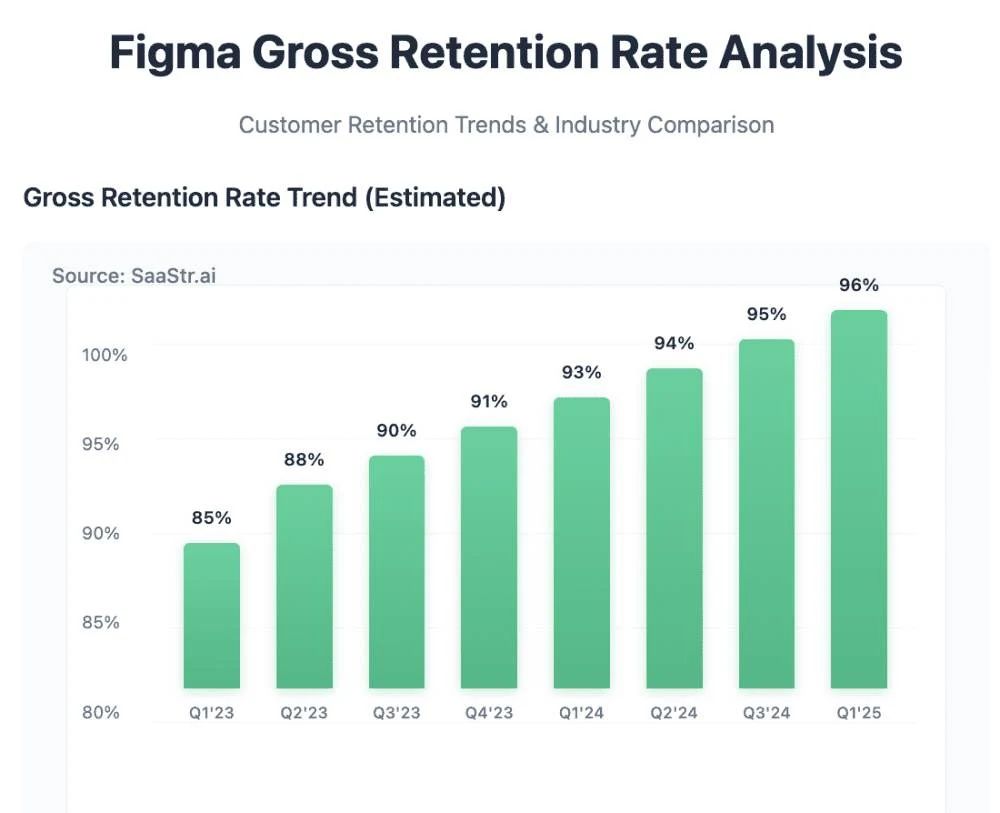

Why are investors willing to pay such a high valuation for a collaborative design platform? What does this reflect about future judgments? As I delved into Figma's IPO prospectus, analyzing its over $900 million in annual recurring revenue, 46% annual growth rate, and 132% net revenue retention rate, I discovered a disruptive realization: Artificial intelligence technology is not eliminating collaboration platforms; it is making true collaboration platforms more scarce and valuable. This scarcity is redefining the value logic of the entire software industry and providing us with a new perspective to understand the global technology investment landscape. In this redefinition process, some high-quality targets with significant strategic value are waiting to be rediscovered.

The Business Secret Behind an Astonishing Statistic: Two-Thirds of Users Are Non-Designers

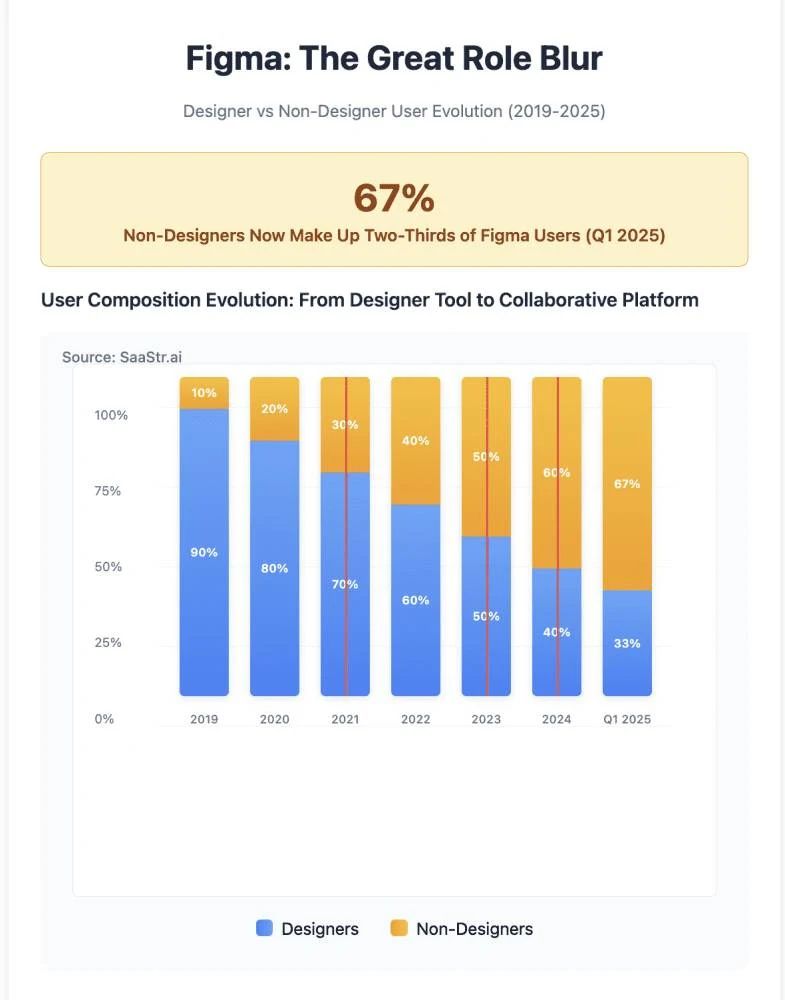

Figma's most disruptive aspect is not its revenue or features, but its user composition: two-thirds of its 13 million users are not professional designers. This reflects a profound shift in corporate collaboration methods—from process-centric to collaboration-centric systems. Figma is no longer just a design tool; it has become a cross-functional collaboration platform. In the AI era, companies are willing to pay for tools that "enable better collaboration" rather than "allow individuals to work in isolation."

Let me first share a shocking statistic: two-thirds of Figma's 13 million monthly active users are not designers. This means that product managers, developers, marketers, operations personnel, and even CEOs are using this software, which was initially defined as a "design tool." If you think this is just a natural expansion of the user base, you are gravely mistaken. This statistic hides a fundamental transformation in modern corporate work methods and a paradigm shift that is about to occur in the software industry.

In traditional corporate workflows, design is a relatively isolated professional field. Designers create in their specialized software, hand off the files to product managers for review, then pass them to developers for implementation, and finally, operations personnel promote them. This linear, segmented workflow was effective in the early days of the internet when product complexity was relatively low and iteration speed was slow. However, in today's era, where product lifecycles are measured in weeks or even days, this way of working has become a significant barrier to efficiency.

According to Deloitte's research, 57% of business leaders predict that AI will "substantially change" their companies in the next three years, but this change is not a simple replacement relationship. The change in Figma's user composition actually reflects the urgent need for real-time collaboration and cross-functional cooperation in enterprises. When product managers can directly annotate requirements on design files, developers can view design specifications in real-time, and operations personnel can quickly create marketing materials, the efficiency of the entire product development process undergoes a qualitative leap. More importantly, this collaborative approach eliminates losses and misunderstandings in the information transfer process, bringing the final product closer to the original design intent.

I found that this change in Figma's user composition actually heralds a grander trend: currently, the boundaries of software are disappearing. In the past, we were accustomed to categorizing software by function: design software, development tools, project management software, communication and collaboration software, etc. However, with the development of AI technology, these boundaries are becoming increasingly blurred. An excellent collaboration platform is no longer just about providing specific functions; it has become the infrastructure that supports the entire workflow. The value of this infrastructure far exceeds the simple sum of traditional functional software.

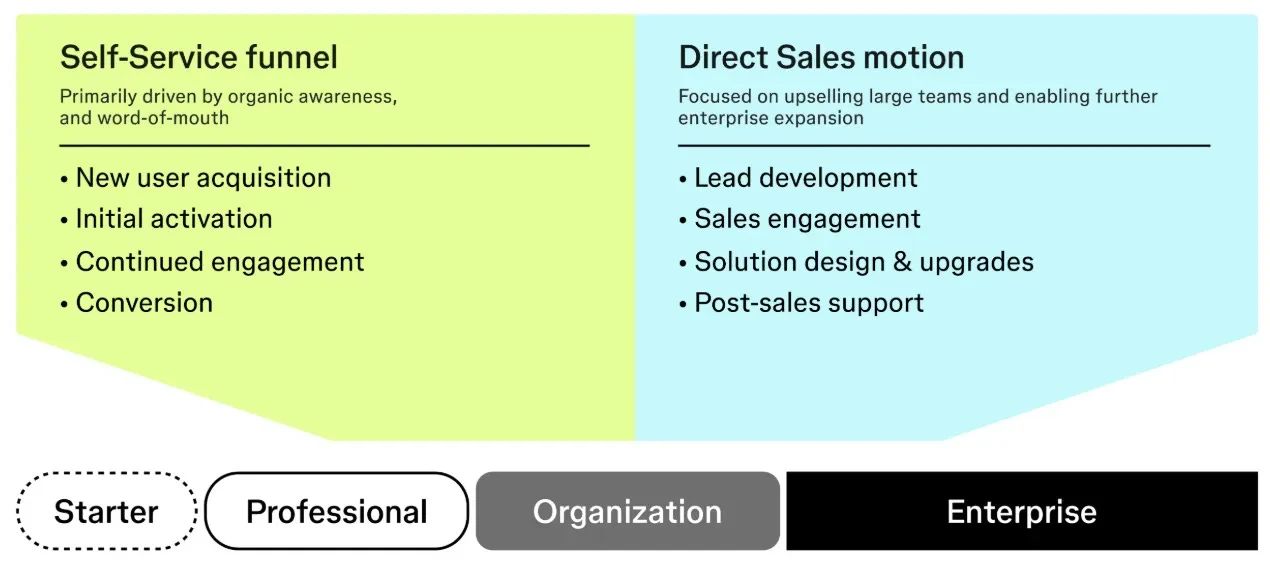

From a business model perspective, this change in user composition has led to a fundamental optimization of the revenue structure. Companies are essentially paying for management and collaboration, not just for tools for the designer role. Traditional design software primarily relies on payments from designers, which has a clear ceiling. But when two-thirds of users are non-designers, the platform's scalability becomes nearly limitless. Each company's designers may number only a few, but the number of product managers, developers, and operations personnel is several times or even dozens of times that of designers. This change in user structure brings exponential revenue growth potential to the platform and explains why investors are willing to give Figma such a high valuation premium.

The Counterintuitive Phenomenon in the AI Era: Exponential Growth in Collaboration Demand

Many people believe that AI can weaken collaboration demand, but the reality is counterintuitive: AI increases information complexity, compresses decision cycles, and brings more non-design roles into participation. Design is no longer about "creating one version," but rather "real-time debugging of multiple versions." Figma ensures brand consistency through design systems and has become the decision-making hub for intelligent collaboration. Collaboration does not diminish; instead, it upgrades to become one of the foundations of AI systems.

As I analyzed Figma's strategic layout and user behavior changes in the wave of AI, I discovered an extremely counterintuitive yet logical phenomenon: the development of AI technology has not diminished the value of collaboration platforms; rather, it has strengthened their strategic position in an unprecedented way. The logic behind this phenomenon reveals a fundamental cognitive bias in our understanding of AI's impact and provides important clues for judging the future direction of the software industry.

The traditional view holds that when AI can automatically generate design drafts, write code, and create charts, the value of corresponding professional software and collaboration tools will be weakened. This viewpoint seems reasonable: since AI can directly produce results, why do we still need complex tools and cumbersome collaboration processes? However, Figma's actual data completely overturns this expectation. In 2024, Figma launched 180 new feature updates, most of which are related to AI capabilities, including automatic layout optimization, intelligent component recommendations, design specification checks, and more. The introduction of these AI features has not reduced the frequency of user collaboration; rather, it has significantly boosted team collaboration activity.

The key lies in our understanding of the essence of "design work." Design has never been simply about "generating graphics" or "creating visuals"; it is a complex problem-solving process that includes understanding requirements, user insights, strategy formulation, solution exploration, feedback integration, and iterative optimization. AI can indeed provide strong support in the "solution generation" phase, allowing designers to quickly explore more possibilities, but this, in turn, makes other phases more important and complex. When AI can generate 10 design proposals, how do we discuss the pros and cons of these proposals within the team? How do we combine user feedback and business goals to select the best proposal? How do we ensure that the selected proposal can be correctly implemented and deployed? These questions all require stronger collaborative mechanisms to resolve.

AI technology has also compressed the timeline of design work. In traditional models, a design project might take several weeks to complete, giving teams ample time for gradual communication and adjustments. However, when AI can quickly generate design proposals, the project timeline is significantly compressed, requiring teams to have higher real-time collaboration capabilities. Asynchronous email communication and regular meeting reviews can no longer meet this fast-paced work model; real-time collaboration, instant feedback, and rapid iteration mechanisms based on the platform are needed.

At the same time, this compression of the timeline also brings a deeper challenge: although AI improves and assists in generating content for various tasks, we all know that AI's biggest problem is making mistakes and being imprecise. When multiple roles begin to use AI to quickly produce content, ensuring brand consistency and design quality becomes a key issue. This is precisely where the value of collaborative design platforms lies—Figma ensures that content generation from different roles does not fall apart through online collaboration and design systems, maintaining consistency in enterprise software, experience, and branding.

Furthermore, the application of AI technology actually increases the complexity of design decisions. This complexity requires teams to possess stronger collective intelligence and decision-making mechanisms, and collaboration platforms are the carriers for this collective intelligence to function. The platform must not only accommodate the diverse content generated by AI but also provide effective evaluation, discussion, and decision-making tools to help teams make optimal choices among numerous options.

From a business perspective, the growth in collaboration demand driven by AI creates new revenue opportunities for platforms. Traditional SaaS models primarily charge based on user numbers and usage duration, but in an AI-enhanced collaboration model, platforms can price based on the complexity of collaboration, the volume of work processed by AI, and the value of intelligent services. This multidimensional value creation and capture model brings greater commercial imagination to collaboration platforms.

The New Logic of Platform Economy: From Functional Stacking to Ecological Synergy

76% of Figma users utilize multiple products, not because of abundant features, but due to strong synergy. AI allows data, processes, and permissions to span multiple roles and scenarios; the deeper users flow within the ecosystem, the higher the migration costs. The number of clients paying over $100,000 annually has surged by 47%, indicating that enterprises view Figma as a "highly sticky collaboration platform" rather than a single-point tool. This represents a new paradigm of the moat for platform companies.

In-depth research into the evolution of Figma's business model reveals a key characteristic of the platform economy in the current era: the synergy effect of multiple products is becoming the core factor determining platform value, while traditional functional competition is gradually losing significance. This change not only redefines the product strategy of software companies but also provides a new perspective for understanding the development laws of the platform economy.

76% of Figma users utilize two or more products, and this seemingly simple statistic hides profound changes in modern enterprise software consumption. In the traditional SaaS era, companies typically purchased corresponding specialized software for each specific need: design needs were met with design software, project management with project management software, and communication and collaboration with instant messaging software. This "point procurement" model was effective in an era of relatively independent functions, but in today's deepening digital transformation, this fragmented software usage has become the biggest obstacle to efficiency improvement. Issues such as data silos, difficult process connections, and inconsistent user experiences have led to significant hidden costs for enterprises.

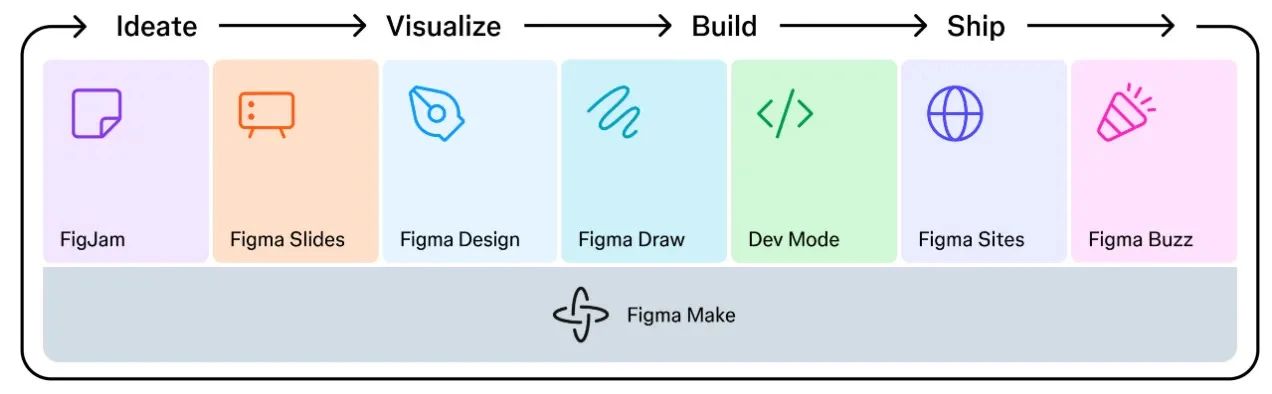

Figma's multi-product strategy is essentially building a complete digital product lifecycle ecosystem. From initial creative discussions (FigJam) to specific design execution (Figma Design), from development delivery (Dev Mode) to content marketing (Figma Buzz), from website building (Figma Sites) to presentation reporting (Figma Slides), each product covers key stages in the digital product development process. More importantly, these products do not simply stack functions; they form an organic collaborative relationship: ideas generated in FigJam can be directly transformed into design elements in Figma Design, components in Design can automatically generate code specifications in Dev Mode, and design assets can be seamlessly applied to presentations in Slides.

The value of this product collaboration is further amplified in the current context. AI technology makes data flow and intelligent processing between different products smoother, allowing user behaviors and preferences in one product to be learned by AI and applied to optimize experiences in other products. For example, color combinations and font styles frequently used by users in Figma Design can be recognized by AI and automatically applied to template recommendations in FigJam; code preferences in Dev Mode can influence AI's layout suggestions in Design; presentation styles in Slides can guide AI in content generation in other products. This cross-product AI collaboration creates user experiences that traditional tools cannot achieve.

From the perspective of user stickiness, the migration costs associated with multi-product usage grow exponentially. When users utilize multiple related products simultaneously, the migration costs include not only the individual costs of each product but also the systemic costs of re-establishing collaborative relationships between products. More importantly, the "soft assets" accumulated in a multi-product ecosystem, such as workflows, collaboration habits, and data associations, are often more difficult to migrate than specific files and settings. These soft assets constitute the strongest moat for the platform.

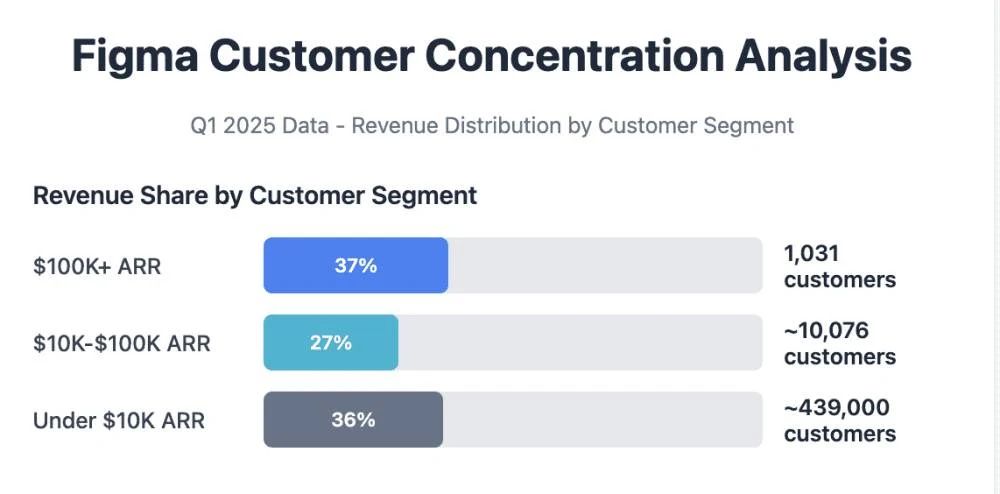

I noticed that the number of Figma clients paying over $100,000 annually has increased by 47%, reaching 1,031, and these clients contribute 37% of total revenue. This revenue concentration reflects the Matthew effect of platform value: the larger the organization, the more complex the cross-departmental collaboration needs, and the more value they can derive from multi-product collaboration, making them more willing to pay higher fees for this value. Large organizations typically have dedicated design teams, product teams, development teams, and operations teams, and the collaboration efficiency among these teams directly impacts the competitiveness of the enterprise, thus enhancing their perception of the value of collaboration platforms and their willingness to pay.

The deeper business logic lies in the fact that multi-product platforms are changing the competitive dimensions of the software industry. In the platform era, the core of competition has shifted to the integrity of the ecosystem and the efficiency of collaboration. Users are no longer just concerned about the strength of a product's functions; they care more about whether the entire platform can support a complete workflow, provide a consistent user experience, and achieve seamless connections between data and processes.

From the development trends in the global software market, I predict that the future enterprise software market will be primarily dominated by such multi-product collaboration platforms. This trend presents new strategic choices for all software companies: either develop into a platform, become part of a platform ecosystem, or face the risk of being eliminated from the market.

Unique Opportunities in the Chinese Market: Rediscovery of Strategic Value

China has a relatively large group of designers and an active digital economy, creating unique opportunities for local collaboration platforms. MasterGo, as the only domestic platform comparable to Figma, possesses technical strength, recognition from leading clients, localization advantages, and policy benefits. In terms of AI deployment, it even started earlier than Figma, representing an important strategic value target.

When I shifted my analytical perspective from Figma to the global software market landscape, I discovered an extremely interesting and opportunity-filled phenomenon: although the U.S. has produced benchmarks like Figma in collaborative design platforms, the uniqueness and complexity of the Chinese market have created a vast and relatively independent value gap for local innovation. This gap exists not only at the market demand level but also manifests in various dimensions such as technological development paths, business model innovation, and ecosystem construction. Within this value gap, there is a high-quality target with significant strategic value waiting to be rediscovered.

The uniqueness of the Chinese design software market is first reflected in scale effects. China has a relatively large group of designers and a vibrant digital economy ecosystem. From the design of product pages on e-commerce platforms to HMI design in the new energy sector, to the construction of digital systems for enterprises, the design demands in the Chinese market are leading globally in terms of quantity, variety, complexity, and iteration speed. This market environment provides rich application scenarios and rapid growth soil for collaborative design tools, while also imposing higher requirements on the performance, stability, and adaptability of these tools.

In such a market environment, MasterGo, as the only collaborative design platform in China that can compete with Figma, has demonstrated remarkable development potential. From a technical architecture perspective, MasterGo also adopts a web-native collaborative design architecture, supporting core functions such as real-time editing by multiple users, version management, and design systems. After years of technical accumulation and product refinement, MasterGo can now stably support large-scale team collaboration with hundreds of users online simultaneously, with individual projects supporting editing of up to 100,000 layers, achieving international advanced levels in performance and stability. More importantly, MasterGo also has privatization deployment capabilities, providing ideal solutions for clients with high security requirements, such as financial institutions and government enterprises.

Deeper opportunities arise from cultural and working style differences. The organizational culture of Chinese enterprises emphasizes collective decision-making and cross-departmental collaboration, which creates unique demands for collaborative design tools. For instance, Chinese enterprises are more accustomed to refining design proposals through group discussions, place greater importance on real-time communication and quick feedback during the design process, and require design tools to support simultaneous online collaboration for large teams. Additionally, decision-making speed in Chinese enterprises is generally faster, and product iteration cycles are shorter, necessitating design tools that can support high-frequency version updates and rapid design changes. These demand characteristics significantly differ from those in overseas markets, and MasterGo has established strong product advantages in these areas.

From a market performance perspective, MasterGo has already gained high recognition from leading clients. Through the "Co-Creation Program," MasterGo has deeply engaged with top enterprises such as China Telecom, China Merchants Bank, Meituan, Baidu, and iFlytek, achieving nearly 80% market share within three years of launch, with over a hundred leading enterprises paying for its use. This client base not only brings stable revenue sources but also builds a strong word-of-mouth effect and industry influence. MasterGo's NPS (Net Promoter Score) exceeds 50%, with 63% of users ranking its experience as the best, a level of user satisfaction that is quite rare in the enterprise software field.

In terms of payment capacity and commercialization potential, the Chinese market shows enormous value creation space. I noticed an interesting statistic about Figma: although international users account for 85% of its total users, international revenue only accounts for 53% of total revenue. This mismatch between users and revenue reflects differences in payment capacity, payment habits, and value recognition across different markets. Chinese enterprises typically have a strong willingness to pay and a high price tolerance for tools that can significantly enhance efficiency and competitiveness. Especially in first-tier cities and leading enterprises, investment in professional design tools has become a standard configuration for digital transformation. This provides a solid market foundation for MasterGo's commercialization.

Changes in the policy environment have created unprecedented development opportunities for domestic software. The implementation of regulations such as the Data Security Law and the Cybersecurity Law has transformed the requirement for software autonomy and controllability from an "optional" to a "mandatory" choice. Particularly among important client groups such as government agencies, financial institutions, and large state-owned enterprises, using software with independent intellectual property rights has become a compliance requirement. Figma has previously faced supply risks with Chinese companies like DJI, which has made many enterprises realize the importance of having autonomous and controllable design tools. As a representative of domestic collaborative design software, MasterGo not only fills this gap but also addresses enterprises' core concerns regarding data security and business continuity.

More strategically significant opportunities lie in the deep integration of AI technology with local needs. In terms of AI capability deployment, MasterGo has demonstrated impressive foresight and execution. According to public information, MasterGo has acted quite swiftly in the AI wave, launching features for AI Coding Agents that generate website code even earlier than Figma, and is among the first software platforms globally to announce support for and expansion of MCP (Model Context Protocol). This proactive attitude and rapid execution capability in applying AI technology reflect the team's deep understanding of technological trends and keen sensitivity to product innovation.

The design needs in the Chinese context, the interaction habits of Chinese users, and the collaboration models of local enterprises provide a unique data foundation and application scenarios for training AI design assistants that "better understand Chinese users." When this localized AI capability is combined with a powerful collaboration platform, it will create differentiated value that overseas products find difficult to replicate. Based on a deep understanding of the Chinese market, MasterGo has the opportunity to achieve breakthroughs in the localized application of AI capabilities, thereby establishing stronger competitive barriers.

From the perspective of the ecosystem, China has a complete and unique digital toolchain ecosystem. From collaboration platforms like DingTalk and WeChat Work to various project management, code hosting, and continuous integration tools, the digital tool stack of Chinese enterprises significantly differs from that of overseas markets. A successful collaborative design platform needs to deeply integrate with these localized tools to provide seamless data flow and workflow connections. This ability to integrate with the local ecosystem is a core competitive advantage that overseas products find difficult to establish quickly and is one of MasterGo's important advantages over Figma.

The most important thing is that the Chinese market is still in the early stages of popularizing collaborative design tools, presenting significant growth potential. While leading internet companies and design agencies have widely adopted professional design tools, a large number of small and medium-sized enterprises, as well as traditional industry companies, are still using relatively outdated design methods. As these enterprises deepen their digital transformation, the demand for collaborative design tools will experience explosive growth. During this growth process, platforms with localization advantages will find it easier to gain user recognition and market share compared to overseas products.

Considering these factors, I believe MasterGo represents an important strategic value product in the Chinese collaborative design software market. It not only possesses technical capabilities and product advantages similar to Figma but, more importantly, has localization advantages and policy benefits that Figma lacks. When Figma closed its first day with a market value of $56.3 billion, it established a clear value benchmark for the entire collaborative design platform industry. As the only platform in the Chinese market that can compete with Figma, MasterGo's strategic value is waiting to be rediscovered.

In Conclusion: Opportunities of the Era and Value Discovery

Figma successfully established a value benchmark for collaborative design platforms, signaling a shift from the tool era to the platform era. The uniqueness of the Chinese market creates opportunities for local enterprises to overtake competitors, marking a critical juncture where AI redefines software value.

As I completed an in-depth analysis of Figma's IPO, several clear viewpoints emerged in my mind:

The reconstruction of software value in the AI era is underway. We are at an important turning point in the development of the software industry. Collaborative platforms are not weakened by AI; rather, they become key infrastructures connecting people and AI, with value being redefined and amplified. Figma's market value of over $50 billion is not only a recognition of a single company but also a rediscovery of the value of the entire collaborative platform sector.

Technical architecture determines commercial fate. A web-native, cloud-first architecture has decisive advantages in the AI era, which is more important than merely stacking functions. Companies based on traditional desktop software architectures, no matter how powerful their functions, will find it difficult to adapt to the rapid changes and collaborative demands of the AI era.

The platform economy exhibits new characteristics. Successful software companies are no longer the providers of the most powerful tools but platform enterprises capable of building intelligent collaborative ecosystems and connecting diverse user groups. Multi-product collaboration, ecosystem integration capabilities, and user collaboration stickiness have become the core drivers of valuation.

Unique opportunities exist in the Chinese market. China has a relatively large group of designers and an active digital economy ecosystem, with unique work culture and rapid decision-making pace creating differentiated advantages for local collaborative platforms. The policy environment's requirement for autonomy and controllability provides historic opportunities for domestically developed platforms with technical strength.

I believe that now is a critical moment to reassess the strategic value of collaborative design platforms. Figma's successful IPO clearly demonstrates the infrastructural value of such platforms in the digital age, while MasterGo, as the only product in the Chinese market that can be compared to it, holds significant strategic value that extends far beyond the product itself. In an era where AI redefines software boundaries, as Chinese enterprises accelerate their digital transformation, and in a policy environment where autonomy and controllability have become rigid demands, MasterGo represents not just a product platform but also China's strategic layout in key software fields.

True strategic value is often hidden at critical junctures of era change. When the underlying logic of an industry undergoes fundamental change, those enterprises that can grasp the direction of transformation and possess core capabilities often become important cornerstones of the new era. Figma's success marks the transition of the collaborative software industry from the tool era to the platform era, and MasterGo is an important representative of China in this transformation process. As AI technology is applied more deeply and collaborative demands continue to grow, the importance of such strategic assets will further highlight.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。