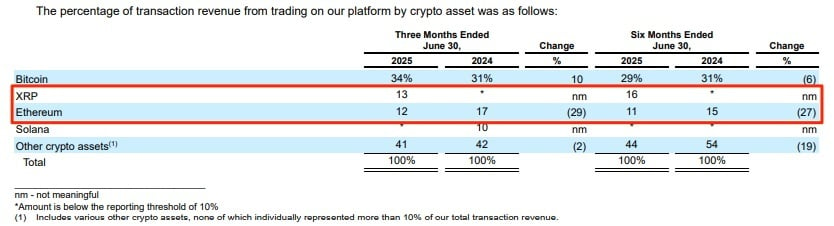

Crypto exchange Coinbase (Nasdaq: COIN) disclosed in its Form 10-Q filed with the U.S. Securities and Exchange Commission (SEC) on July 31 that XRP surpassed ethereum in trading revenue for the first half of the year. XRP accounted for 16% of total transaction revenue through June 30, overtaking ethereum’s 15%.

The change reflects not only increased spot trading activity but also regulatory clarity. Bitwise Asset Management’s head of research, Ryan Rasmussen, commented on social media platform X:

Wow, XRP trading accounted for more of Coinbase’s trading revenue this year than ETH trading. Last year XRP wasn’t even broken out.

Coinbase’s earnings report. Source: Coinbase

Coinbase had delisted XRP in 2021 following the SEC’s lawsuit against Ripple, citing regulatory uncertainty. The crypto asset was relisted in 2023 after a federal court ruled that XRP was not a security when sold on exchanges, allowing trading to resume. The subsequent rebound in XRP activity has been pronounced, with the token contributing 13% of Q2 transaction revenue—again ahead of ethereum’s 12%.

The expansion of XRP-related products has further accelerated this momentum. In its Q2 2025 shareholder letter, Coinbase emphasized the growth of its derivatives platform, stating: “Over the past two years, 75% of global crypto trading volume has come from derivatives, yet the U.S. market makes up only a fraction of this volume, which presents a significant growth opportunity.” The crypto firm described that Coinbase Derivatives is now “the first U.S. regulated futures exchange to offer 24/7 futures trading for BTC, ETH, SOL, and XRP, with weekend volumes now approaching weekday volumes.”

Additionally, Coinbase Institutional has announced that nano XRP U.S. perpetual-style futures will launch on Coinbase Derivatives on Aug. 18. The company said the addition expands its suite of perpetual-style products aimed at broadening market access for U.S. investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。