The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and refuse any market smoke bombs!

I have regained some energy and would like to share an interesting story with you. A coin friend seems to have grasped the rules of the crypto world. After I mentioned that there would be funds taking over during the Asian session and that the US session would start dumping, this coin friend began to follow my line of thought. He maintained a long position after getting up in the morning and exited before noon, then shorted during the US session and exited before dawn. Following this pattern for nearly half a month, he surprisingly remained in a profitable state. His focus was almost entirely on Ethereum, and he exited around 30 points as I had mentioned. Since communicating with this coin friend, I have also reviewed nearly half a month of market trends, which indeed show a strong similarity. Without discussing the issue of rules, perhaps this naive approach seems very basic to many of you. However, in my view, this coin friend actually has a very clear sense of purpose. The rules are not related to time; rather, the importance of taking profits and cutting losses is paramount.

Not only do you all interpret what I say, but those who often read my articles should remember that I started advising everyone to maintain a bearish outlook when Ethereum was around 3700. At that time, I consistently mentioned that I would attempt to short and advised everyone to take profits on their long positions. Because at that time, it was indeed impossible to catch the absolute high. The current trend of Ethereum is somewhat beyond the norm; Bitcoin's standout performance can be accepted by major investors, but the explosive rise of Ethereum, the second-largest coin, must have its reasons. Looking at all mainstream coins, only Ethereum has received substantial funding support. Perhaps since Trump started laying out Ethereum at 3400 last year, this trend was already destined; it was just that at that time, everyone thought it was ordinary. The fact that this coin friend can profit is not merely due to grasping the rules, but there is indeed some rationale behind it. Following this friend's approach, the most commendable point is the strict execution of taking profits and cutting losses.

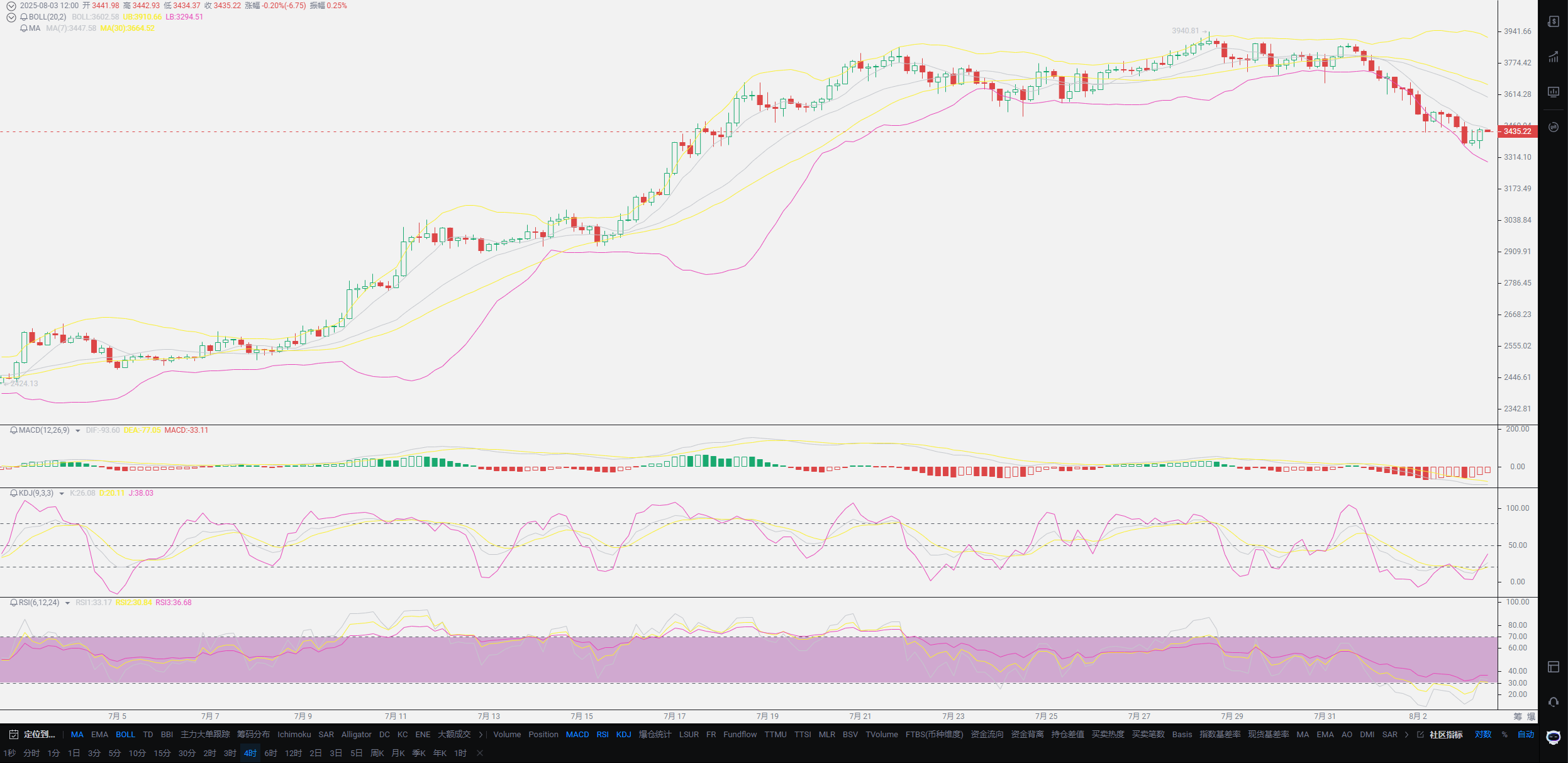

Take last night's market as an example; using the four-hour chart, the current downtrend almost started at 16:00 on July 31. The overall drop began from the high of 3872 to the lowest point of 3353 this morning. Overall, there was almost no strong pullback during this period, and this coin friend only captured about thirty points each day. Additionally, today marks only four days of downward movement, with a total decline of 513 points, and this coin friend only made a profit of about 120 points. Calculating this, the profit is merely about 20% of the overall market movement, which might make you feel that the profit is not much. I also believe that among many fans, there are certainly users whose profits exceed fifty percent of the market, but their trading methods also have their merits. Maintaining a high win rate, the core point is the proper grasp of the trend; the overall market is in a downtrend, so going with the trend is the way to go.

Secondly, it is the strict execution and clear sense of purpose. Regardless of how the market fluctuates, this user can be said to only take a scoop from the vast waters. Even if the daily fluctuation is around 200 points, he only needs 30. So, considering a 200-point market, taking 30 makes the entry position seem not so important. This is also why I was able to pull from 3700 all the way to around 3940 in an uptrend, with a growth of 240 points, allowing me to profit over 2WU, still entering in a short position, which actually has a similar essence. In practice, I do not have a significant psychological burden, perhaps because of the clarity of my goals. Even if the market moves beyond my understanding, I would not regret going short. The story of this user is not only because I find it interesting but also because I hope everyone can reflect on their own issues and think about the main reasons for their mistakes. Many contract users are actually in a state of loss in this current trend.

Regarding losses, it may be due to being different from this user. Even if you are currently living by going long, you can still capture a 30-point rebound, and such market conditions will appear daily. Alright, I will stop here, and we will focus on the trend of the market moving forward. Among all coins, only Ethereum's downtrend is evident, while other coins mainly follow suit. Therefore, the trend is centered on ETH, with a new low appearing today at 3353, currently in a repair phase. You can observe that the new lows each day generally maintain around 100 points. The rebound strength is also quite evident during the Asian session, with new lows often leading to a continuous surge of 150 points. This kind of rebound strength indicates that users looking to buy the dip are still present. As long as there is no large-scale panic selling, especially with Bitcoin's clear directional sense, this sign indicates that almost everyone is waiting for the injection of funds from interest rate cuts.

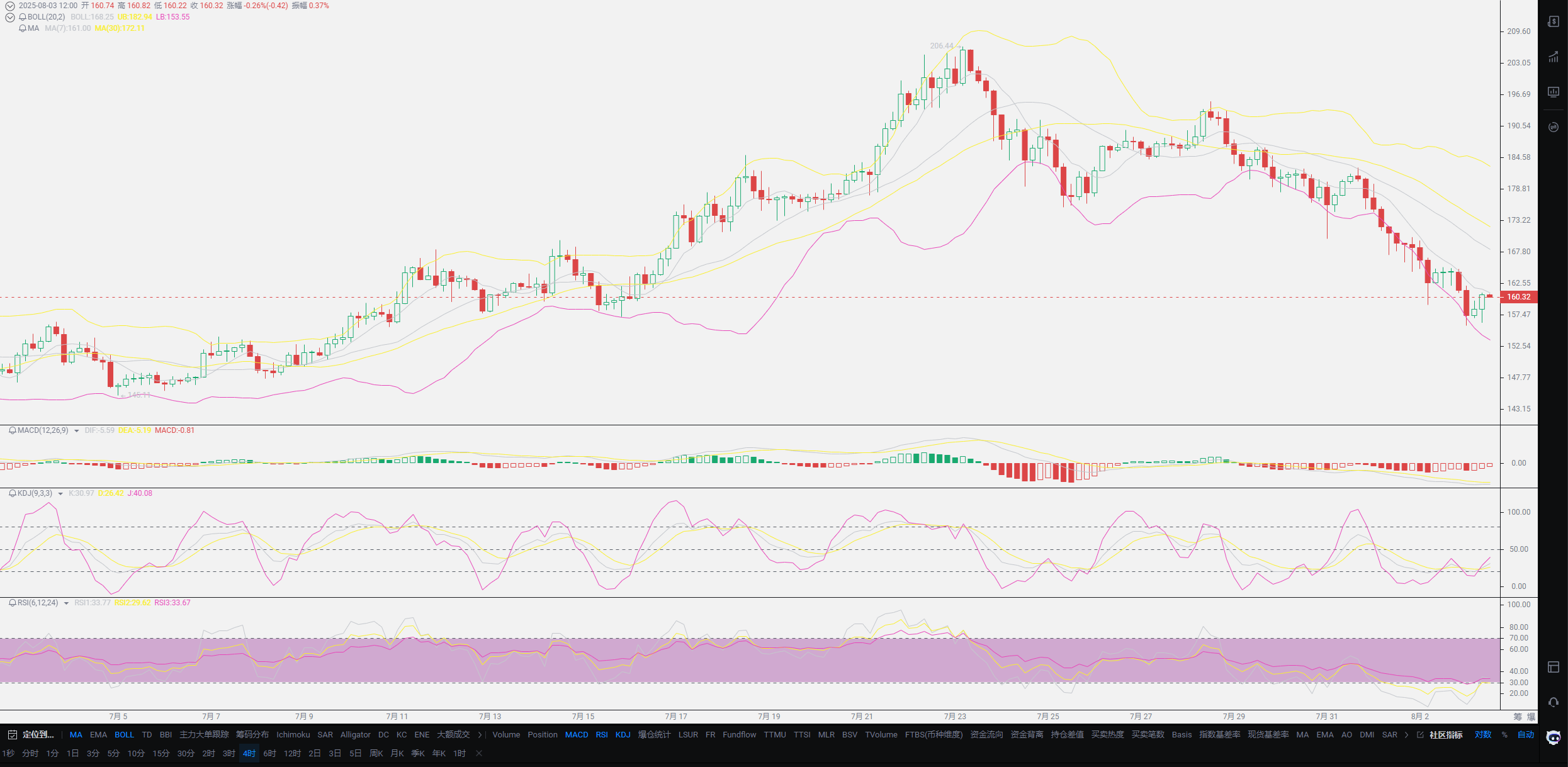

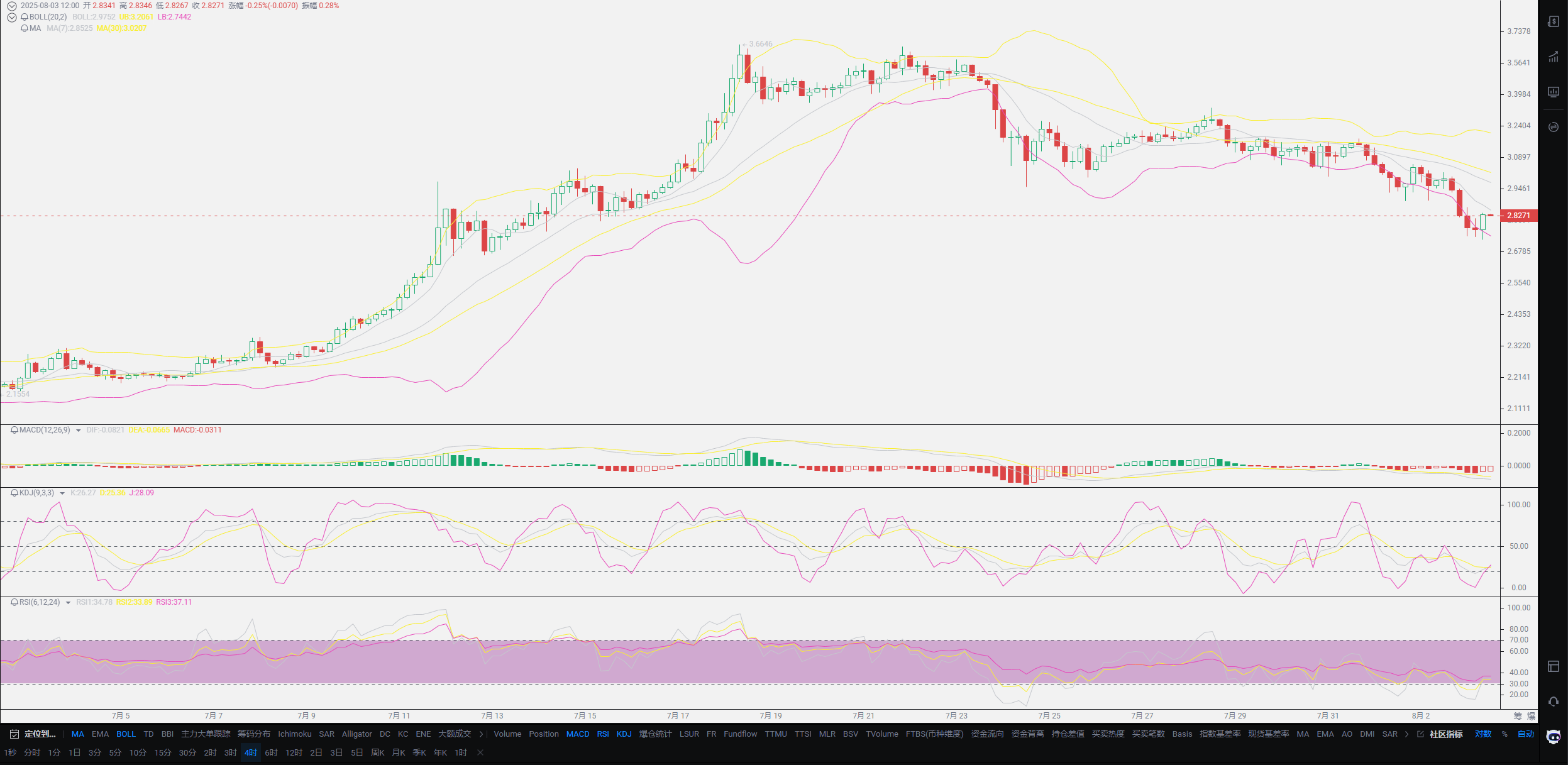

The trend of SOL has dropped from around 200 to today's new low of 156, showing about a quarter of a downtrend. However, the phenomenon of buying the dip is also very evident, and I need to emphasize the coin DOGE. Many friends consider Dogecoin to be a mainstream coin. I would never view it that way; after the new high of 0.7, Musk has basically maintained a selling state. Especially after the stablecoin bill was passed, the selling volume has almost surged. Comparing it with other coins during the same period, SHIB is almost on the verge of exiting the crypto market, which is an extremely outdated concept. Musk's thoughts and purposes are also very clear; he merely wants to use the crypto market to recoup his assets and break international boundaries. Now, Musk can achieve this channel through stablecoins, and DOGE may become a part he abandons. Do not easily get involved in the opposition between business and politics; the only thing you lose is your own chips. Users holding these coins must find a position to clear their holdings, and choosing mainstream currencies is the best option.

In summary, Lao Cui believes that the current trend in the crypto market will continue to revolve around bearishness before interest rate cuts. For spot users, my approach has always been to buy the dip proportionally, without worrying about the price; the goal for August is to keep everyone in the market. The bull market will not end easily, and my thoughts are very straightforward; it is very likely that the peak of this bull market will become the historical peak of the crypto market, marking the final song of the crypto world. A historically significant new high, without historical policy support in the future, will not allow any crypto asset to replicate such miracles. The US acknowledging the value of the crypto market and launching supportive policies is already the greatest blessing. Do not harbor unrealistic fantasies; this is the biggest positive news in the crypto market, and do not fantasize that we will accept the crypto market. When the stablecoin bill chooses Hong Kong instead of Shanghai, it has already clearly informed you that the crypto market cannot be legal in the domestic market. Whether in strategy or finance, the crypto market will not have any legal status on the mainland; this is an important measure to protect domestic assets from outflow, and this bottom line is indisputable. The crypto market will almost follow the old path of foreign exchange, with only Hong Kong being able to operate legally. Therefore, at this stage, you must focus on spot layout; whether to engage in contracts is up to you, but if you do, try to focus on shorting to offset losses in the spot market. Once the market reverses, exit the contracts in a timely manner!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this carries risks!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。