Written by: Steven Ehrlich

Translated by: Saoirse, Foresight News

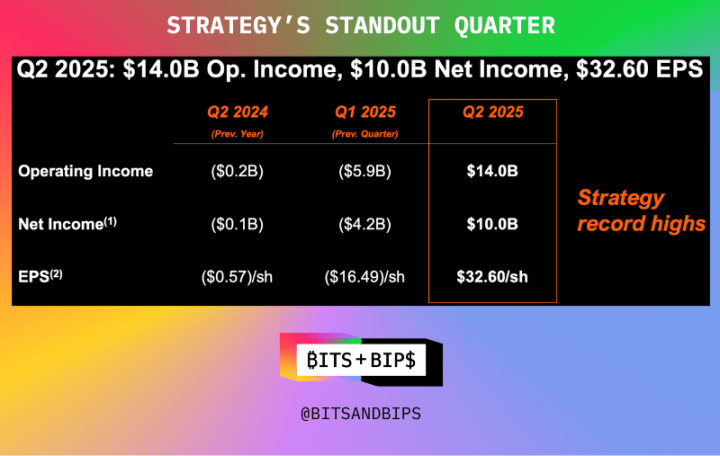

Michael Saylor, Chairman of Strategy (MSTR), received widespread acclaim in the investment community on Friday for his company's record high operating revenue, net profit, and earnings per share in the last quarter (see the chart below).

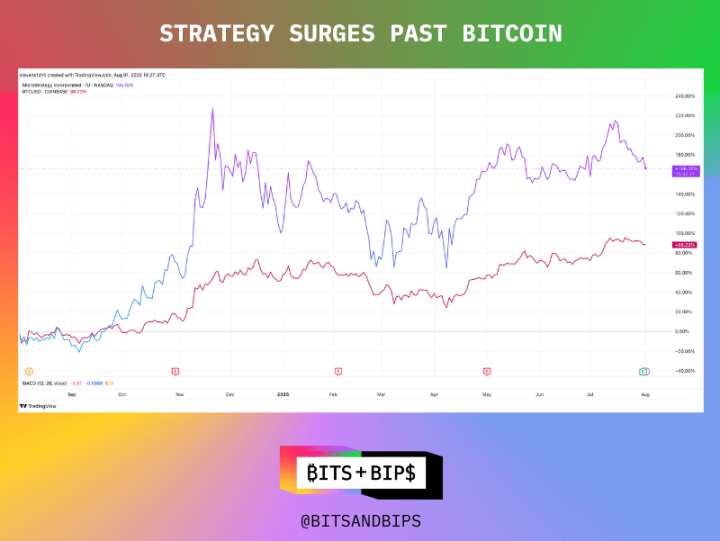

In fact, the company's stock price has risen 166% over the past year, double the increase of Bitcoin (BTC) during the same period.

(Trading View)

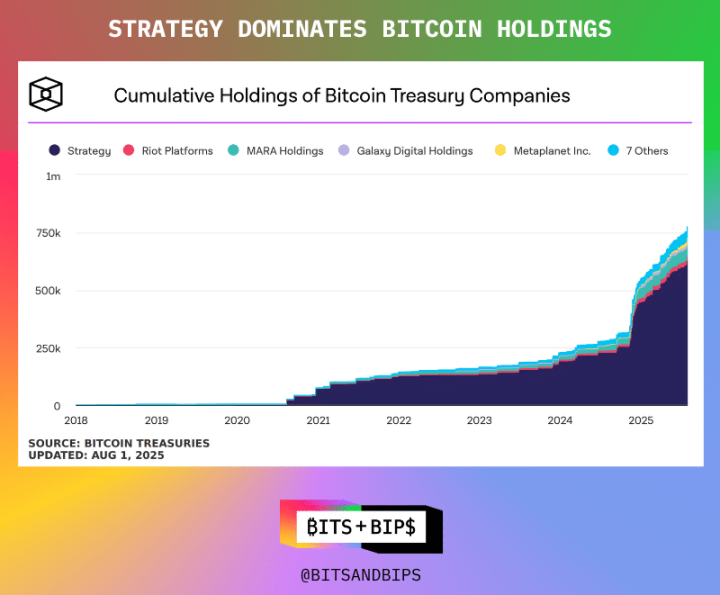

By any standard, such performance is exceptional. This is especially notable given the influx of numerous imitators that could potentially divert investor funds.

However, this does not mean that Strategy can rest on its laurels. As a leader in the cryptocurrency asset management space, it holds certain privileges and now seems poised to fully leverage this advantage.

Bitcoin Reserves Continue to Increase, but Strategy Has New Changes

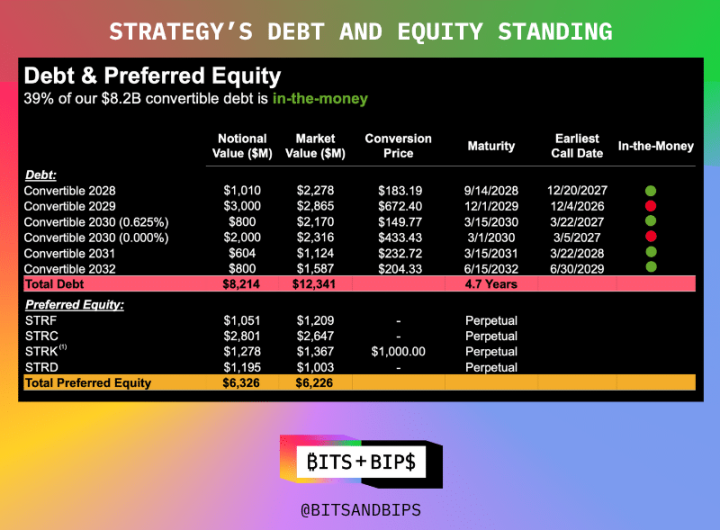

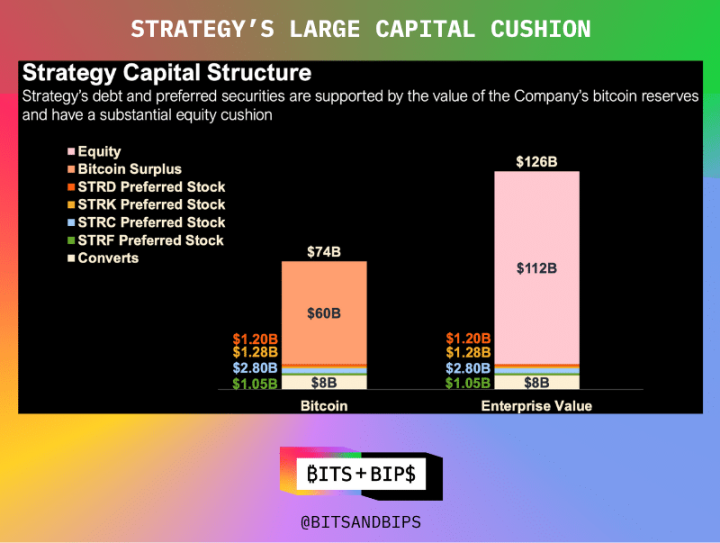

As of the writing of this article, Strategy holds 628,791 Bitcoins, valued at $71.9 billion. The company has accumulated this asset portfolio through various means: issuing common stock, multiple types of preferred stock (which can provide dividends or conversion rights in the coming years), and convertible bonds. Details of the various preferred stocks are shown in the chart below.

However, the company now plans to make significant adjustments to its financing methods — specifically, to completely eliminate debt. Although its balance sheet appears healthy (with a corporate value of $126 billion and debt of only $8.2 billion), the company still aims to reduce its debt to zero. In the investor conference call following the earnings report on July 31, the company announced plans to redeem its issued convertible bonds and focus instead on multiple rounds of preferred stock issuance.

This means that its $6.3 billion preferred stock issuance scale is expected to increase significantly. In fact, during the investor presentation, the company announced plans to refinance $4.2 billion through its latest preferred stock product, Stretch (STRC), which targets a monthly yield of 10%.

"This decision reflects the positive development of Strategy's ability to raise capital in the markets. The convertible bond market is filled with hedge funds and arbitrageurs who establish long positions in Strategy by purchasing convertible bonds, but simultaneously reduce their net risk exposure by shorting a large amount of stock (about 25%). In other words, for every bond they buy, they sell a significant amount of stock, which means they are only mildly bullish on Strategy," said Lance Vitanza, Managing Director at TD Cowen, in an interview with Unchained (the full discussion can be viewed on X platform or YouTube). "A few years ago, convertible bonds were the best financing channel for the company. But as Strategy has evolved, they have been able to enter the preferred stock market, where the terms are better, the appreciation potential is greater, and pricing efficiency is higher."

This move further confirms why Saylor is regarded as a "demigod" in the Bitcoin community — he is not only revered for hoarding Bitcoin but also respected for his responsible operational approach. With few exceptions, he almost never uses leveraged financing, primarily relying on the equity market.

Although its robust capital structure can avoid forced liquidation (unless Bitcoin prices plummet by more than 80%), Saylor continues to push the limits.

Always Imitated, Never Surpassed

But don’t expect the many followers in the fields of Bitcoin, ETH, SOL, BNB, etc., to emulate this approach. These institutions are just getting started, and as I pointed out in other related reports, they are eager to scale quickly through competition.

This means they will utilize all tools available in the capital markets: including private investments in public equity (PIPEs), credit lines, and of course, debt.

In previous reports, I wrote: "Each method has its pros and cons. Private financing can raise large amounts of capital in a short time, helping to kickstart reserve strategies, but it can create significant selling pressure. Issuers can also choose to register their stocks with the SEC before issuing, but the financing cycle is longer. Nowadays, more companies are adopting a hybrid model: one-third of the funds come from private financing, while the rest is raised through convertible bonds or credit instruments. This approach can delay selling pressure but increases leverage on the balance sheet, which can lead to problems if prices crash."

This means that debt is very practical for financing: shareholder dilution may not become apparent for years, and in the current bubble market, coupon rates are almost zero. For example, Bitcoin asset management company Twenty One raised $485 million in May through the issuance of convertible bonds to kickstart its strategy; Anthony Pompliano raised $235 million for his Bitcoin asset management company ProCap Financial through convertible bonds in June.

This is essentially a "buy now, pay later" model.

A Unique Existence

For investors, this means they must always remember: in today's crowded cryptocurrency asset management field, Strategy remains a unicorn. Currently, it is the only company able to enter the preferred stock market. Its first preferred stock issuance was in January of this year, and future issuance scales are expected to expand significantly.

For other companies, entering the preferred stock market and eliminating debt is still just a vision. "Most of these companies will start from the convertible bond market, hoping that some of them can grow and eventually qualify for entry into the preferred stock market," Vitanza said.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。