A. Market Viewpoints

1. Macroeconomic Liquidity

Monetary liquidity is improving. The Federal Reserve has maintained the federal funds rate target range at 4.25% to 4.50% for five consecutive meetings. Powell did not provide clear guidance on a rate cut in September, emphasizing inflation risks and stating that employment is stable, which dampens expectations for rate cuts this year. The dollar has risen to a two-month high, and U.S. stocks continue to reach new highs. The cryptocurrency market is underperforming compared to U.S. stocks.

2. Overall Market Trends

Top 300 by market capitalization gainers:

This week, BTC fluctuated at high levels, while altcoins performed weakly, and crypto stocks collectively plummeted. The market's main focus revolves around the ETH system.

Top 5 Gainers

Gain

Top 5 Losers

Loss

LOKA

300%

TKX

60%

ZORA

60%

FARTCOIN

30%

ZBCN

50%

M

30%

KTA

40%

VIRTUAL

20%

REKT

40%

GRASS

20%

- ZORA: A social finance project collaborating with Base chain apps. The Coinbase Foundation is backing it, with a tenfold increase from the bottom.

- ENA: The old stablecoin USDE and the new stablecoin USDTB continue to generate profits and have established a U.S. stock version of MicroStrategy for continuous buying. ENA collaborates with AAVE to release stablecoin USDE for circular loans.

- CFX: A compliant domestic public chain, with plans to issue stablecoin licenses in Hong Kong in September.

3. On-chain Data

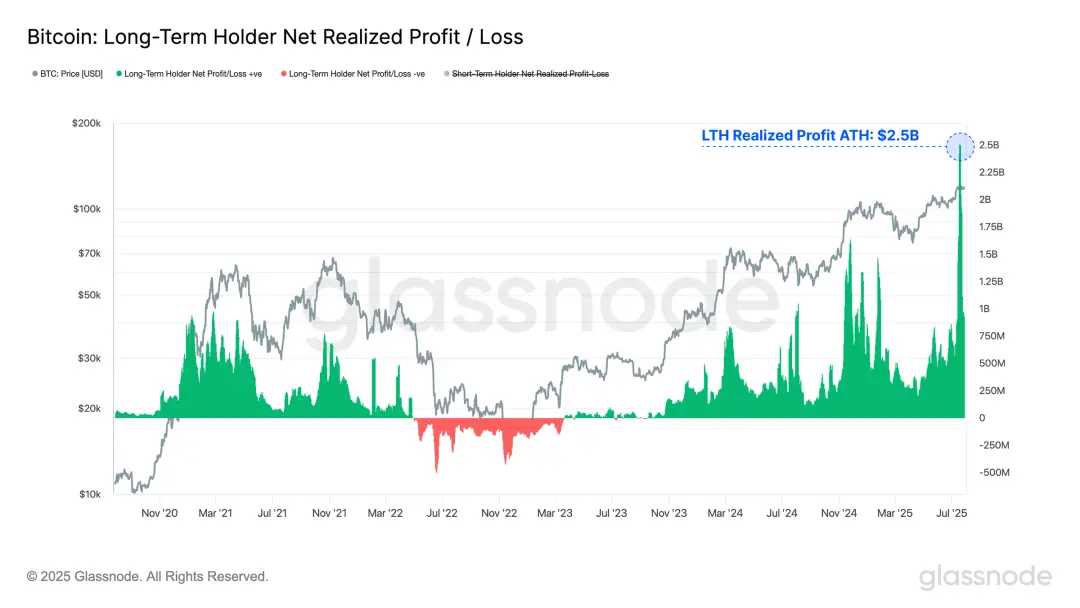

BTC liquidity is facing severe tests. An early whale sold over 80,000 BTC in over-the-counter transactions, with a trading volume of nearly $10 billion. However, the market effectively absorbed the selling pressure, with 97% of the circulating supply still in profit.

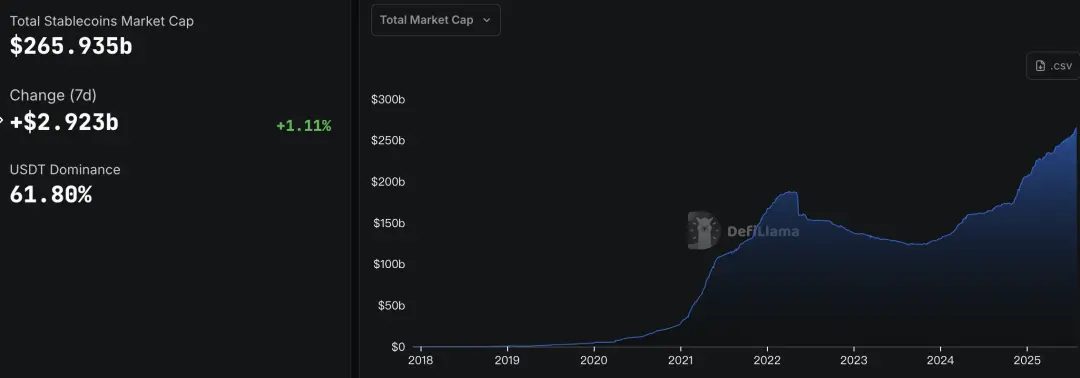

The supply of stablecoins continues to grow by 1%.

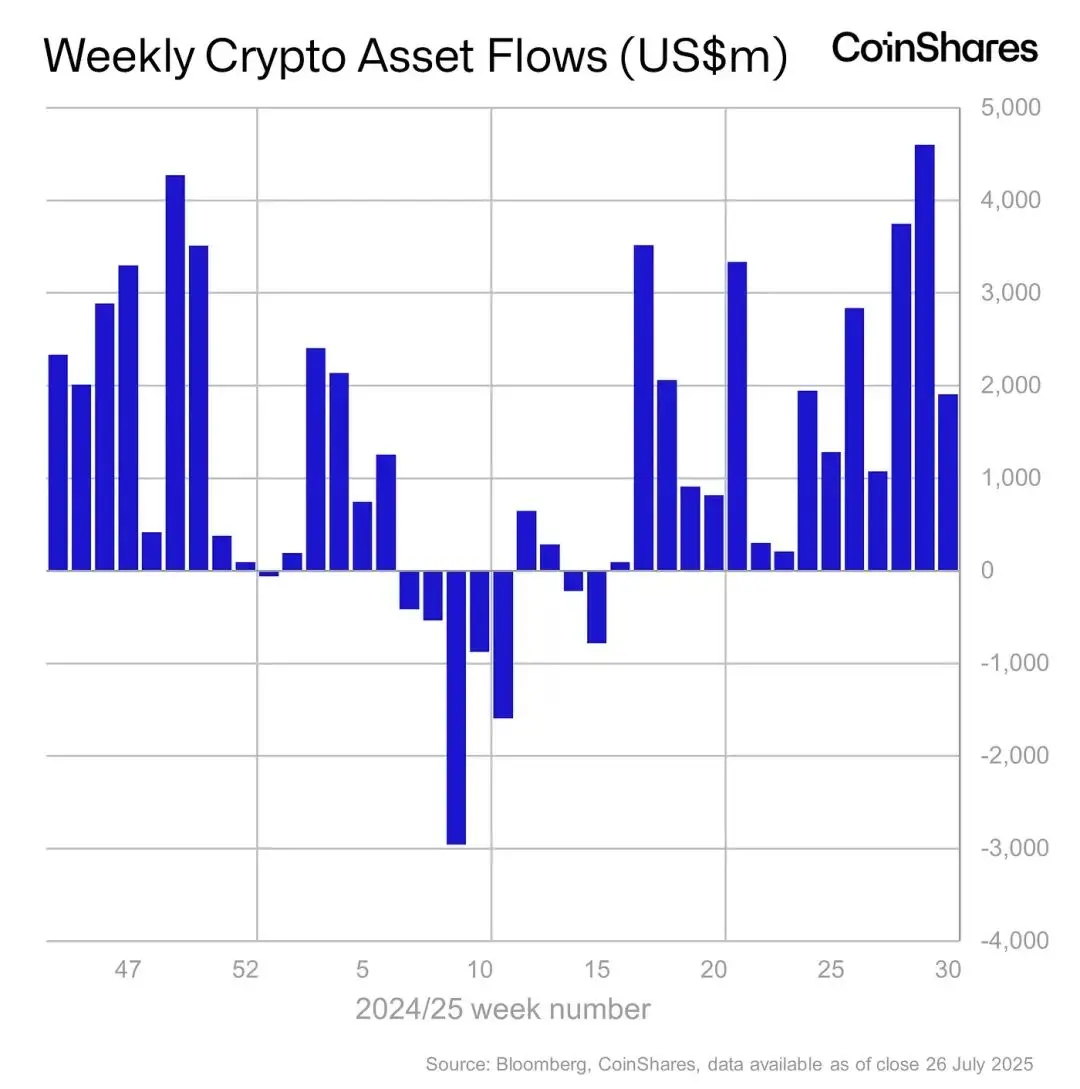

Institutional funds have seen continuous net inflows. ETH has driven a surge in inflows, with the amount since the beginning of the year exceeding the total for 24 years.

The long-term trend indicator MVRV-ZScore, based on the total market cost, reflects the overall profit status of the market. When the indicator is greater than 6, it indicates a top range; when it is less than 2, it indicates a bottom range. MVRV has fallen below the critical level of 1, indicating that holders are generally in a loss state. The current indicator is 2.6, close to the middle range.

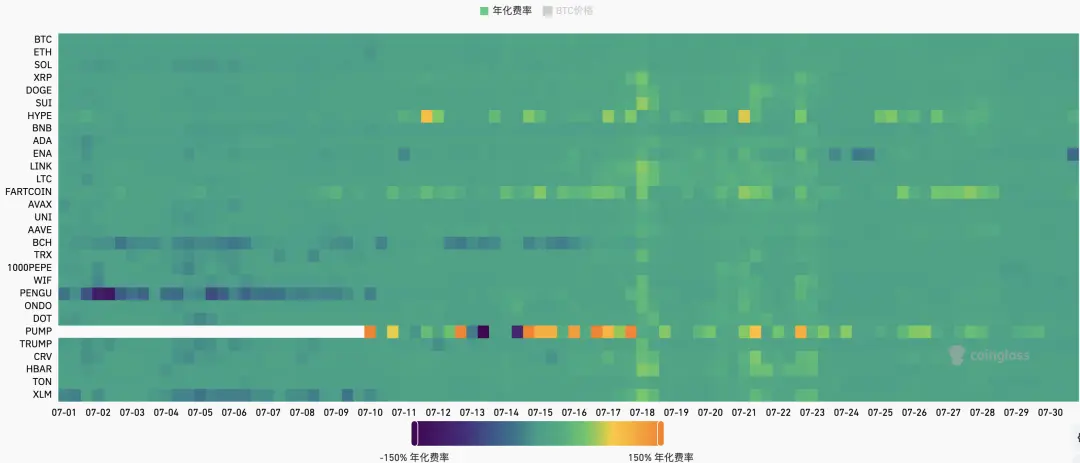

4. Futures Market

Futures funding rate: This week, the rate is 0.01%, which is normal. A rate of 0.05-0.1% indicates a high level of long leverage, suggesting a short-term market top; a rate of -0.1-0% indicates a high level of short leverage, suggesting a short-term market bottom.

Futures open interest: This week, BTC open interest has started to decline.

Futures long-short ratio: 1.1, indicating neutral market sentiment. Retail sentiment often serves as a contrarian indicator; below 0.7 indicates fear, while above 2.0 indicates greed. The long-short ratio data is highly volatile, reducing its reference significance.

5. Spot Market

BTC fell this week, while the ETHBTC exchange rate remains strong, with a few altcoins related to stablecoin concepts leading the way. The market is rotating from BTC to ETH and then to altcoins, with risks expected to gradually accumulate in the later stages.

B. Stablecoins and RWA

1. Stablecoin Sector

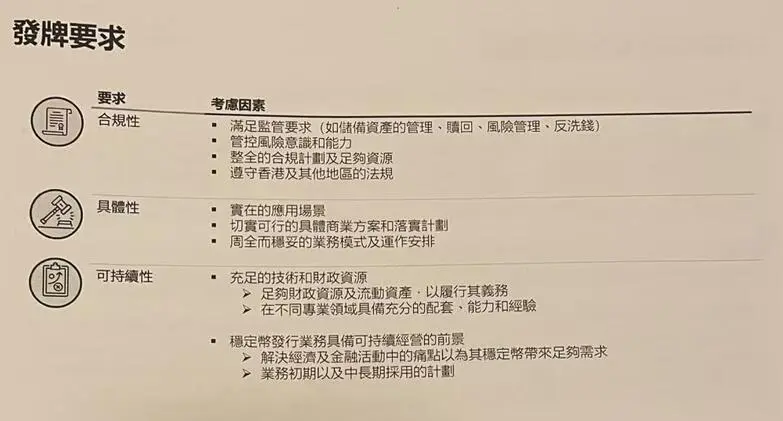

Hong Kong Monetary Authority: The first license may be issued early next year, and initial stablecoin holders in Hong Kong must be real-name verified.

At a technical briefing on the regulatory framework for stablecoin issuers, HKMA Vice President Chen Weimin stated that the number of stablecoin issuer licenses to be issued in the first phase is still uncertain and will depend on the quality of the application materials submitted by the applying institutions. The first stablecoin issuer license is expected to be issued early next year, emphasizing that "the threshold for approval is very high," and entering the "sandbox testing" does not guarantee license approval. Chen also mentioned that the HKMA holds an open attitude towards fiat currency types, allowing stablecoin issuers to apply for licenses linked to a specific fiat currency or a basket of fiat currencies, with the focus being on specifying the fiat currency type at the time of application.

The HKMA will open the first batch of stablecoin issuer license applications from August 1 to September 30, 2025, marking the formal implementation phase of stablecoin regulation in Hong Kong. All compliant stablecoin holders in Hong Kong must undergo verification, akin to a real-name system, to strengthen the fight against money laundering and financial crime risks. HKMA Assistant Vice President (Regulation and Anti-Money Laundering) Chen Jinghong pointed out that this arrangement is stricter than the previous "whitelist" system in the anti-money laundering consultation document, but if technology matures in the future, there may be opportunities to relax regulations.

JD.com registers JCOIN and JOYCOIN, possibly names for its stablecoins

JD.com has registered the names "JCOIN" and "JOYCOIN" under its JD Chain, leading to speculation that these may be the names of its stablecoins. The registration indicates that related services include electronic fund transfers and cryptocurrency financial transactions through blockchain technology. JD Chain is one of the participants in the HKMA's stablecoin issuer sandbox program and previously collaborated with Tianxing Bank to test a stablecoin-based corporate cross-border payment solution last July.

This move is closely related to the "Stablecoin Regulation" that Hong Kong will implement on August 1, and JD.com is actively testing stablecoin trading scenarios based on the Hong Kong dollar. Analysts believe that the issuance of stablecoins by JD.com could significantly reduce cross-border payment costs and enhance settlement speed, helping it gain an edge in the international supply chain and retail payment sectors.

JD.com's trademark registration action demonstrates its determination to lay out in the blockchain finance field and reflects Hong Kong's attractiveness as a digital asset financial center. In the future, the actual implementation and application of this stablecoin will further promote traditional e-commerce companies' transition to the Web3 era.

PayPal allows U.S. merchants to accept payments in over 100 cryptocurrencies

On July 28, 2025, PayPal announced the launch of a new payment feature in the U.S. market, allowing small merchants to accept payments in over 100 different cryptocurrencies, including mainstream coins like Bitcoin and Ethereum. This significantly expands PayPal's service range in the cryptocurrency payment sector, encouraging more merchants to participate in digital currency transactions.

PayPal's plan focuses on small and medium-sized merchants, aiming to lower the barriers for merchants to use crypto assets and enhance their flexibility and operational innovation capabilities. As more merchants begin to offer cryptocurrency payment services, it is expected to promote the adoption and implementation of crypto assets in everyday business scenarios.

The open payment network created by PayPal is expected to serve as a bridge connecting traditional finance and the crypto ecosystem, providing merchants with new revenue channels and offering practical support for the usability of cryptocurrencies. Additionally, this strategy enhances PayPal's competitive advantage in its fintech transformation.

WLFI makes a strategic investment of $10 million in Falcon Finance

WLFI will strategically invest $10 million in Falcon Finance, a synthetic dollar stablecoin project supported by DWF Labs.

Users can mint USDf by using stablecoins (USDT, USDC, DAI, USDS, USD1, FDUSD) or mainstream cryptocurrencies (such as ETH, BTC, SOL, XRP, and other top 100 altcoins, typically requiring an over-collateralization rate above 100%) or Tokenized T-Bills (Superstate's USCC) as collateral. Currently, the circulation of USDf has exceeded $1 billion.

Several reasons for rapid growth:

- Strong asset access capability: Supports various assets such as stablecoins, ETH/BTC, RWA (e.g., U.S. Treasury bonds) as collateral.

- Revenue mechanism: USDf holders can stake for sUSDF and participate in on-chain revenue distribution (sources include interest rate arbitrage, exchange funding rates, RWA income, etc.), attracting a large number of user conversions.

- Expectations for points and airdrops.

2. RWA Sector

U.S. crypto policy report expected to include positions on tokenization and market-defined crypto legislation.

On July 30, 2025, the digital asset working group established by the Trump administration released an important policy report, marking its first public direction on cryptocurrency regulations since taking office. The working group includes core officials from the Treasury Department, the Office of Management and Budget, and SEC Chairman Paul Atkins, aiming to implement the executive order signed by the president earlier this year and advance a unified, innovation-friendly crypto policy framework.

The report proposes several core recommendations, including:

- Requiring the SEC and CFTC to quickly clarify regulatory rules for crypto asset registration, custody, trading, etc., using existing authorities;

- Promoting Congress to pass legislation such as the "Clarity Act" (clarifying SEC and CFTC responsibilities) and the "Genius Stablecoin Act";

- Supporting blockchain tokenization of securities, opposing the issuance of central bank digital currency (CBDC) in the U.S., and promoting the integration of crypto technology into traditional financial infrastructure.

Hong Kong Secretary for Financial Services and the Treasury: Hong Kong has normalized the issuance of tokenized bonds.

On July 30, 2025, the Hong Kong government mentioned in a Q&A document released at the Legislative Council that the "2025 Digital Asset Policy Statement" (Policy Statement 2.0) has officially been launched, confirming Hong Kong's commitment to becoming a global digital asset innovation center. This is an upgraded version following the first policy statement in 2022, which clearly supports the sustainable development of the virtual asset ecosystem.

Hong Kong launched a licensing system for virtual asset trading platforms in June 2023 and will implement stablecoin regulations on August 1, 2025. Additionally, the government is advancing the draft for virtual asset trading and custody licenses, aiming to issue licenses to more institutions within three years. Regulatory authorities have also established a regulatory sandbox mechanism to encourage the testing of innovative technologies such as blockchain, AI, and tokenized assets in a controlled environment.

Hong Kong is actively strengthening cooperation with international anti-money laundering organizations (such as FATF), mainland China, and other jurisdictions to jointly promote the establishment of digital asset regulatory standards and cross-border anti-money laundering mechanisms. At the same time, the Hong Kong Monetary Authority and the Securities and Futures Commission are implementing projects like Project Ensemble to explore the application of traditional asset tokenization and promote the actual implementation of tokenized bonds, funds, and other products.

Japan's MUFG Bank acquires a high-rise building in Osaka and will launch real estate tokenization products

MUFG Trust Bank has acquired a high-rise office building in Osaka for over 100 billion yen (approximately $680 million) and plans to tokenize the asset using blockchain technology to issue digital securities. Institutional investors will primarily participate through private REITs, while ordinary retail investors can also purchase tokenized shares for fractional ownership through the Progmat platform.

This initiative narrows the gap between retail investors and high-quality commercial real estate, significantly lowering the entry barrier and allowing ordinary users to realize their investment potential. MUFG's token issuance caters to both institutional and retail investors, merging traditional REIT structures with new digital securities, thereby significantly enhancing asset liquidity and market transparency.

MUFG holds a 42% stake in the Progmat platform, which serves as an important infrastructure for the continued token issuance by its partner Mitsui Digital. Although Mitsui has established its own Alterna Trust, it continues to use Progmat, reflecting a competitive yet cooperative ecosystem. This case marks Japan's gradual transition to a new phase in the asset tokenization market, characterized by a blend of institutional leadership and retail integration.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。