The crypto firm, Coinbase Global Inc. (Nasdaq: COIN) plans to issue $1 billion in notes maturing in 2029 and another $1 billion maturing in 2032. According to the announcement, early buyers will have a 13-day window to grab up to an extra $150 million from each batch.

These senior unsecured notes will pay interest twice a year and are set to mature in October 2029 and October 2032, unless they’re repurchased, converted, or—when it comes to the 2032 notes—redeemed. The move comes shortly after Coinbase posted a hefty $1.43 billion Q2 profit, powered by crypto market gains and sharp strategic plays.

Coinbase also plans to strike capped call agreements with select financial institutions for each series of notes. The company says these arrangements are designed to limit potential dilution of its Class A common stock if the notes are converted, while helping offset any cash payments above the principal amount of converted notes—within an agreed cap.

Interestingly, Coinbase noted that the option counterparties setting up hedges could enter derivative trades or purchase Coinbase stock near the pricing date, which might influence both the stock and note prices. The company added that later hedge adjustments could also sway market prices and potentially alter the conversion terms for noteholders.

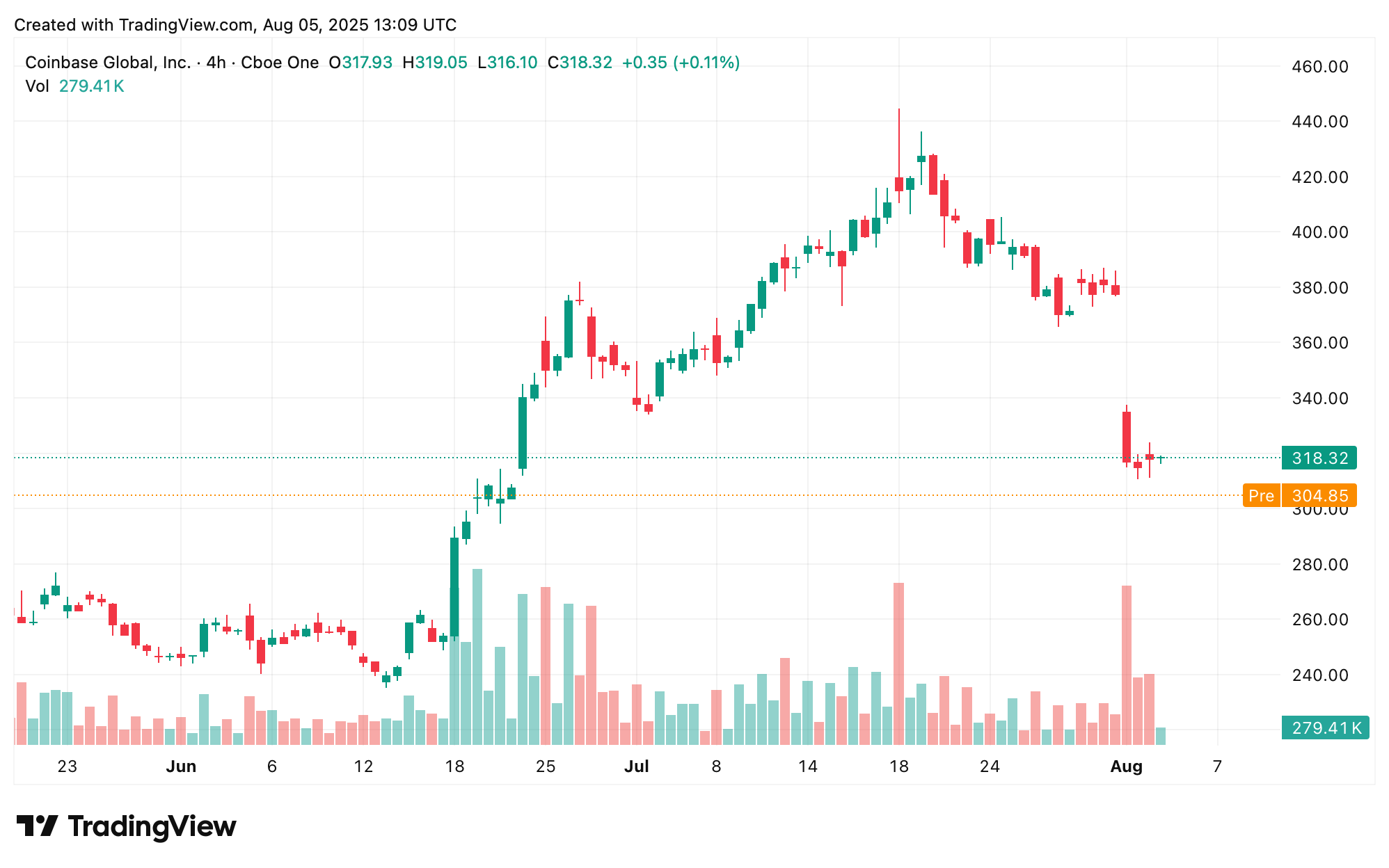

Coinbase’s Nasdaq-listed stock, COIN, closed Monday at $318.17, up about 1% for the day. While the share price recently notched an all-time high, it has slipped 16.9% over the past week and more than 9% since last month. Still, year-to-date, COIN is up nearly 25% against the U.S. dollar. On Tuesday, the company said part of the net proceeds from the private sale will fund the capped call transactions.

If the additional note options are exercised, those proceeds will also be directed toward more capped calls. Any remaining funds are slated for general corporate use, which could include working capital, new investments, acquisitions, or repurchasing other debt and equity securities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。