Every week, this day is the most exhausting, mainly because of writing the weekly report, and this week's content is particularly abundant. The market's volatile environment is extremely troublesome, with several data points causing the market to fluctuate frequently. The main event today is the impact of the non-manufacturing PMI on the market, primarily due to concerns that the U.S. economy may enter a downturn, especially after last week's non-farm payroll data.

However, the main contention currently lies between Trump and the Federal Reserve regarding monetary policy and U.S. tariffs. In this regard, Kuger’s departure gives Trump more room to maneuver. Just early this morning, Trump stated that a candidate to fill Kuger’s vacancy will be proposed this weekend, and this candidate is likely to be the next Federal Reserve Chair.

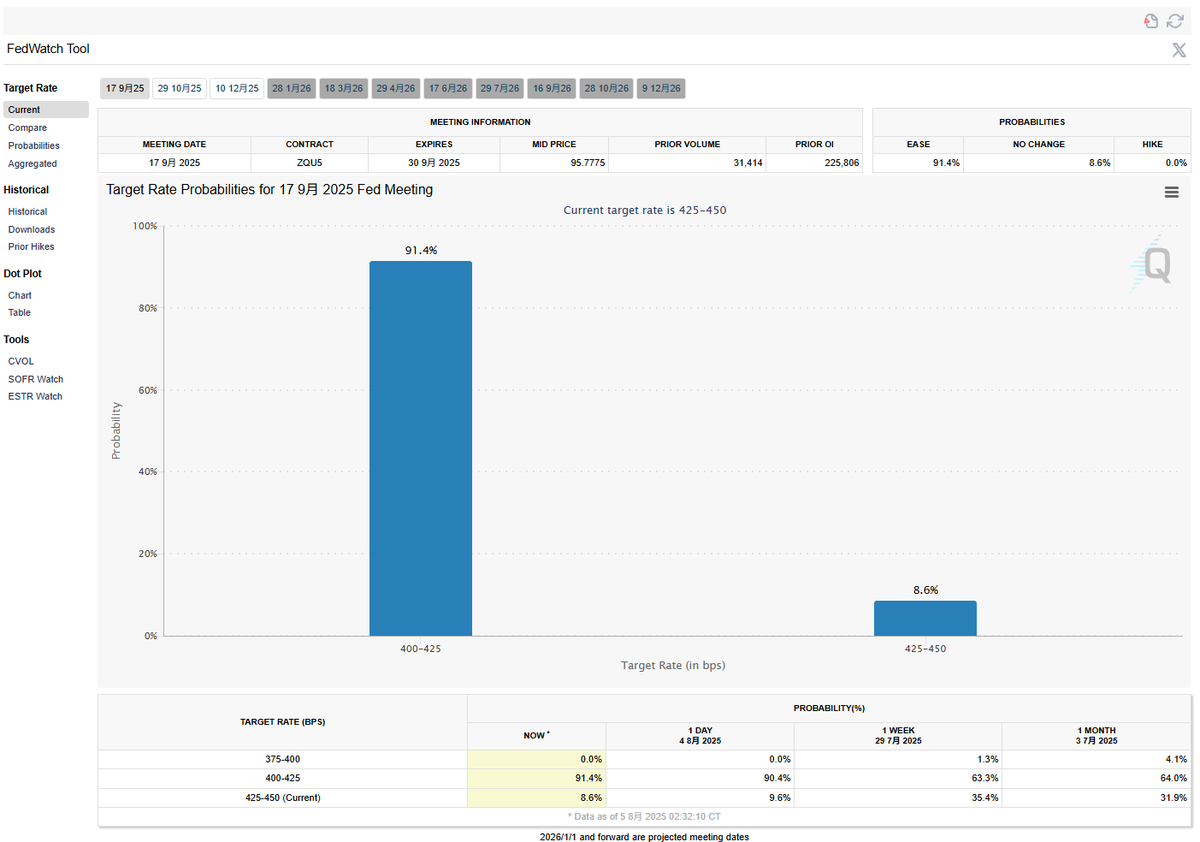

So, from an overall trend perspective, although the economy may face risks, the market still wants to believe that as long as the Federal Reserve lowers interest rates early, the economy will not enter such a severe recession. The internal contention within the Federal Reserve also helps to raise investors' expectations for rate cuts, with the probability of a rate cut in September now exceeding 91%.

However, it should be noted that Kuger’s successor may not be able to attend the September meeting, and the earliest they could participate would be in October. On the tariff front, things are relatively easier to discuss.

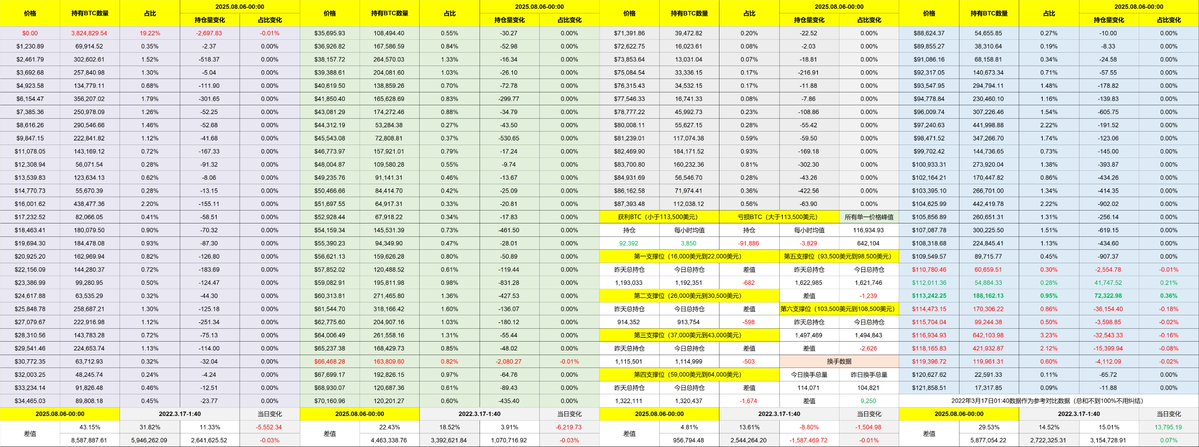

Looking back at Bitcoin's data, the turnover rate has increased in the last 24 hours, with a slight rise in investors' panic sentiment. The main turnover comes from recent loss-making investors, while earlier investors still maintain a wait-and-see attitude. Today, the SEC cleared the last hurdle for the $ETH spot ETF pledge, which also helps the market sentiment somewhat.

The supporting data remains very stable. Although the price of $BTC has been fluctuating around $113,000, there has been no breach of support. Overall, investor sentiment is still relatively good, but it is worth noting that BlackRock investors have suddenly exited significantly, so it is advisable to observe for a few more days.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。