Crypto Market Roundup Aug 6: BTC, DeFi, Trending Coins And Major Event

The global cryptocurrency market cap is $3.79 trillion, down 1.5% in the last 24 hours. The total trading volume reached $126 billion. Bitcoin and Ethereum dominate with 59.9% and 11.5%, respectively. Polkadot and XRP ecosystems are currently seeing notable upward activity. The total number of cryptocurrencies circulating till now in the last 24 hours is 17934

Major Crypto Events August 6

Source: Forex Factory

Crypto Market Roundup August 6

-

Bitcoin is currently priced at $113,911, reflecting a modest 0.9% dip in the last 24 hours. It dominates 59.9% of the market, with a massive $2.26 trillion market cap and $34.77 billion in daily trading volume, maintaining its top position.

-

Top 5 Trending Crypto Coins: The top 5 trending coins are MANTRA, Notcoin, Dogs, Succinct (PROVE), and MYX Finance.

-

MANTRA (OM) drops by 2.0% and is now traded at $0.25 with a 24h TV of $80.88 million.

-

Notcoin (NOT) fell 6.8% to $0.002017, with $29.53 million volume.

-

Dogs (DOGS) slipped 7.7% to $0.0001292, recording TV of $15.56 million.

-

Succinct (PROVE) fell 26.2% to $0.9771, backed by a strong $417.44 million volume.

-

MYX Finance (MYX) surged 140.2% to $1.05, with $246.03 million traded in 24 hours.

-

Top 3 Crypto Gainers: MYX Finance leads with a 156.8% surge, reaching $1.09 with a trading volume of $251,416,800. GXChain followed with a 68.9% rise, trading at $0.83 with a volume of $568,098. Imagen Network gained 61.4% to hit $0.01119 with a trading volume of $94,991.98. These coins saw significant volume spikes, drawing attention across the market.

-

Top 3 Crypto Losers: Succinct (PROVE) dropped 24.8%, trading at $1.01 with a trading volume (TV) $418,450,235. Useless Coin lost 24.9%, now at $0.20, with a TV $45,763,624. MORI Coin also dips 23% to $0.062 with TV $4,283,684. These losses reflect sharp corrections despite previous momentum, possibly due to profit booking or weak sentiment.

-

The DeFi market cap stands at $140 billion, marking a 2.9% dip in the last 24 hours. It holds 3.7% dominance in the global market, with Lido’s staked ETH accounting for 22.7%. Daily DeFi TV reached $7.36 billion.

-

The stablecoin holds a $275 billion cap, showing a minor 0.1% positive change in the past 24 hours. With a 24-hour trading volume of over $91 billion, stablecoins remain a crucial liquidity source for crypto transactions and DeFi applications.

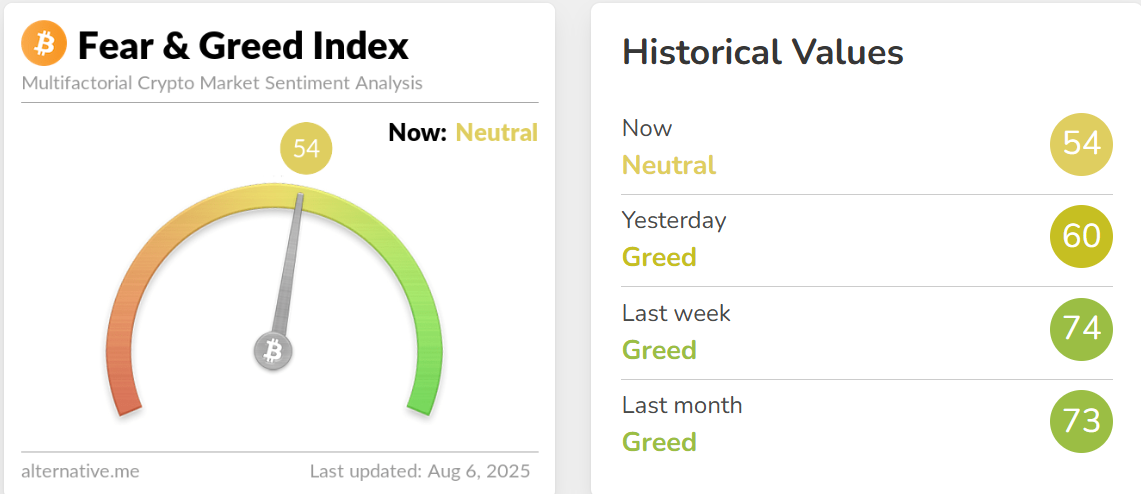

Fear And Greed Index August 6

Source: Alternative me

As of August 6, 2025, the Crypto Fear & Greed Index stands at 54, indicating a neutral market sentiment. This is a cooling off of recent bullishness: yesterday at 60, last week reaching 74, both of which were greedy.

Major Market Updates of the Last 24 Hours

The US SEC explained liquid staking , in some circumstances, is not considered a securities transaction. This ruling is favourable to DeFi platforms such as Lido and Coinbase, so long as they do not manage money or guarantee returns. Nonetheless, there is still a danger when services go over regulatory boundaries.

Investor Fred Krueger has submitted an ambitious economic proposal to the U.S.: a permanent interest rate of 3%, a flat 20% income tax, and no crypto and capital gains tax. He blamed the existing Fed policies for the slowing of GDP and inflation. Krueger also forecasted that Bitcoin would hit 250K by the end of the year, as he thinks that crypto has already won and only requires favourable regulation.

On 5 August 2025, Coinbase Base Network had a 19-minute block production stoppage because of an unsafe head delay, resulting in delays in transactions, deposits, and withdrawals. Services were restored at 14:44 (UTC+8), and the issue was resolved. The fast and open response of Base reassured users and highlighted the role of real-time monitoring and communication in the stability of blockchains.

BitMine Ethereum has increased its ETH holdings to 3 billion following purchases of 208,137 ETH, which makes it the fourth-largest crypto-holding company in the world. With the support of large institutional investors, the company plans to obtain 5% of the total supply of ETH through an aggressive approach. Its ambitious $10K ETH forecast is causing a stir in the market and drawing parallels to the MicroStrategy Bitcoin playbook.

MicroStrategy Buys Bitcoin for $18.3 billion in only 7 months of 2025, totalling its funding to $40.9 billion since 2024. With BTC trading at approximately 114K, analysts are looking for a breakout of 150K, based on historical trendline retests. The plan is an indication of robust institutional trust in the long-term direction of Bitcoin as consolidation continues.

Disclaimer: Coingabbar provides informational content on cryptocurrencies, NFTs, and other decentralised assets. This is not financial advice. Users, please DYOR, understand the risks, and consult financial professionals before investing. CoinGabbar is not responsible for any financial losses. Crypto and NFTs are highly volatile—invest wisely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。