Author: Thejaswini M A

Translation: Saoirse, Foresight News

“We are in the early stages of a disruptive technology that has the potential to bring about significant changes to the world, much like the internet.”

Jeremy Allaire has accurately predicted the future three times. The first was in 1990, when most people had never heard the word "internet," and he foresaw the transformative potential of the World Wide Web. This insight led to the creation of ColdFusion software, earning him millions.

The second time was in 2002, when he predicted that anyone would be able to distribute video content globally without the need for television networks. This vision gave rise to Brightcove, bringing him hundreds of millions in revenue.

The third time was in 2013, when he realized that cryptocurrency could become the cornerstone of a new financial system. This bet could forever change the way currency operates.

At 54, Allaire has spent three decades building the invisible infrastructure that supports the digital world. The USDC stablecoin he created processes trillions of dollars in transactions annually, becoming a bridge between traditional finance and the crypto economy.

But for someone whose profession is to see what others do not, Allaire's steps toward building the future have never ceased.

A Decade of Internet Awakening

1990, in a dormitory at Macalester College, Minnesota.

Jeremy Allaire's roommate did something nearly unbelievable. As a staff member of the school's computer services department, he managed to connect their dorm to the internet. At that time, most people thought "web" was just a spider's web, while Allaire was about to glimpse the future.

The moment he logged onto the internet for the first time, everything changed.

He said, "This will change the world," with a tone that was far from a casual remark of a college student. By the time he graduated in 1993, the internet had become his "primary passion."

Consider the context of the time: when Allaire first encountered the internet, Netscape had not yet been born, Yahoo had not yet been founded, and the term "cyberspace" was hardly known. He saw the next chapter of human civilization ahead of time.

But the foundation for this moment had been laid years earlier.

1984, in the Allaire family living room in Winona, Minnesota.

Thirteen-year-old Jeremy made a small request to his parents: to lend him $5,000 to trade baseball cards. His father, Jim, a psychologist, and his mother, Barb, a newspaper editor, understood people and information but were baffled by their son wanting to use a large sum of money to trade cardboard.

While other kids collected cards for fun, Jeremy took a different approach: he saw market inefficiencies, price trends, and opportunities to buy low and sell high.

In the end, he doubled his initial investment.

1993, freshly graduated and full of thoughts about the internet.

Jeremy faced a challenge: almost no one understood what he was talking about. The internet? Most businesses had never heard of it. So, he did something reasonable—he started his own company.

"Global Internet Vision" was born, providing consulting for media publishers wanting to understand this mysterious "network." But consulting could not change the world.

In 1995, a conversation with his brother J.J. would either make them rich or leave them broke.

They used J.J.'s $18,000 savings to establish Allaire Corporation, which was nearly all their assets.

The brothers' collaboration was perfect: J.J. handled programming, while Jeremy focused on market needs. It was 1995, and Netscape had not yet monopolized the browser market; businesses had not yet realized the opportunities the internet held.

The launch of ColdFusion changed everything almost overnight. This software turned static web pages into interactive applications that could connect to databases, manage user accounts, and process transactions.

Suddenly, companies like MySpace, Target, Toys "R" Us, Lockheed Martin, Boeing, and Intel could create dynamic websites without hiring large numbers of programmers. This software became the foundation of e-commerce, a pillar of content management, and an engine driving the growth of the internet bubble.

Starting with a 12-person team in Minnesota, they quickly became profitable.

Realizing that the pace of internet development was far exceeding expectations, they partnered with Boston's Polaris Ventures and secured their first real funding: $2.5 million.

When they tried to move to Silicon Valley, landlords rejected them for being "too small," so they went to Boston instead. This rejection may have saved them. Boston's tech scene provided them with resources and talent without the self-centered culture of Silicon Valley.

Annual revenue skyrocketed from just over $1 million in 1996 to about $120 million in 2000. The company grew to over 700 employees, with offices across North America, Europe, Asia, and Australia. In January 1999, as one of the early success stories proving that the internet was not just a hype, they went public on NASDAQ.

March 2001, the phone call that tested everything.

Macromedia wanted to acquire Allaire Corporation and offered $360 million.

At 29, Jeremy was about to become very wealthy.

He agreed. Jeremy and J.J. sold Allaire Corporation to Macromedia, with Jeremy becoming the Chief Technology Officer of the multimedia giant, while J.J. exited the tech world to pursue other interests.

The Video Revolution

In 2002, as Macromedia's Chief Technology Officer, Jeremy walked into a meeting room with an idea that might unsettle the bosses.

He understood the significance of the data before him: Macromedia's Flash technology, which powered early internet multimedia animations, videos, and games, was installed on 98% of computers worldwide, and broadband was becoming widespread. Everything was in place, except for the right opportunity.

He proposed Project Vista: a browser-based video capture, upload, and publishing system that would allow anyone to become a broadcaster and reach a global audience.

Imagine YouTube, but this concept came years before Google even heard of video platforms.

The executives at Macromedia listened politely and then rejected the project.

Jeremy watched helplessly as his company missed the future of the media industry. The company that brought Flash (the core technology of early internet multimedia) to the world had just turned down the opportunity to enter the online video space, thus missing out on being part of a crucial component of the web.

In February 2003, Jeremy resigned from Macromedia.

His colleagues thought he was crazy. As the Chief Technology Officer of a large tech company, earning a good salary and responsible for important products, why would he give it all up?

Because he saw the future, and Macromedia had no intention of building it.

Jeremy joined General Catalyst as an entrepreneur-in-residence. Over the next year, he studied the market, observed various elements coming together, and prepared to challenge the entire television industry. He was just waiting for the right moment.

In 2004, he co-founded Brightcove, with the vision of "creating an environment for independent video creators to deliver content directly to consumers, bypassing traditional television networks and channels."

Compared to his first company, Jeremy's strategy had changed: instead of being self-sufficient with borrowed money, he decided to "secure venture capital immediately and grow quickly." Challenging the television industry required substantial funding and partnerships with major content producers.

The company's mission reflected Jeremy's deepening understanding of the democratizing power of internet technology. Subsequent events proved Jeremy right: content creators who could not afford television network fees suddenly had global distribution channels; independent filmmakers could reach audiences without begging media moguls.

In 2012, Brightcove went public, valued at $290 million, with Jeremy holding 7.1% of the shares.

He successfully created a market where thousands of creators could reach global audiences without having to beg television networks, film companies, or media executives. But as Brightcove conquered the online video space, he stepped down as CEO in 2013 to become chairman.

Why leave when everything was going well? This was the second time. But Jeremy's eyes were already set on the next corner.

The Currency Revolution

In 2013, Jeremy Allaire once again stared at his computer screen, just as he had 23 years earlier in a dormitory in Minnesota.

This time, he was studying something called Bitcoin.

The 2008 financial crisis made him question everything about traditional banking. Lehman Brothers collapsed, Bear Stearns disappeared, and the global financial system nearly crumbled. Jeremy wondered if there was a better way.

When he first encountered Bitcoin, the feeling was familiar, almost déjà vu. "I had the exact same feeling about digital currency, especially Bitcoin," he told Fortune magazine, "We are in the early stages of a disruptive technology that has the potential to bring about significant changes to the world, much like the internet."

He saw what he called "a universal flow of funds system, just as the HTTP protocol is the foundation for information dissemination on the internet."

In October 2013, Jeremy co-founded Circle with Sean Neville.

Their vision was to help create the world's first global currency based on the internet and open platforms and standards like Bitcoin.

Accel Partners and other well-known venture capitalists immediately joined in. Everyone felt that this was not a gradual improvement of existing financial services.

Jeremy wanted to create a programmable currency that could settle payments almost instantly, at a cost that was just a fraction of traditional wire transfers. They were not looking to improve existing financial services but to create an entirely new category that could operate globally without relying on the intermediary banking relationships that made international transfers slow and expensive.

But Circle's early attempts at consumer-facing Bitcoin applications and trading platforms were not very successful. It wasn't until Jeremy realized that the issue was not with the technology, but with volatility, that the breakthrough came.

The Birth of USDC in 2018

Through the Centre Consortium in partnership with Coinbase, Circle launched USD Coin (USDC). This is a stablecoin backed by actual US dollar reserves, with each USDC token worth exactly 1 dollar.

At this point, businesses could enjoy the benefits of cryptocurrency, including instant global transfers, 24/7 availability, and programmable smart contracts, without enduring the extreme price volatility of Bitcoin.

The regulatory path Jeremy chose was fraught with risks. Unlike many crypto companies operating in gray areas, Circle worked directly with financial regulators to ensure that USDC met the highest standards of transparency and compliance.

This decision sometimes put Circle at a competitive disadvantage: other stablecoin issuers, less concerned with compliance, acted more quickly. But Jeremy was playing a longer game.

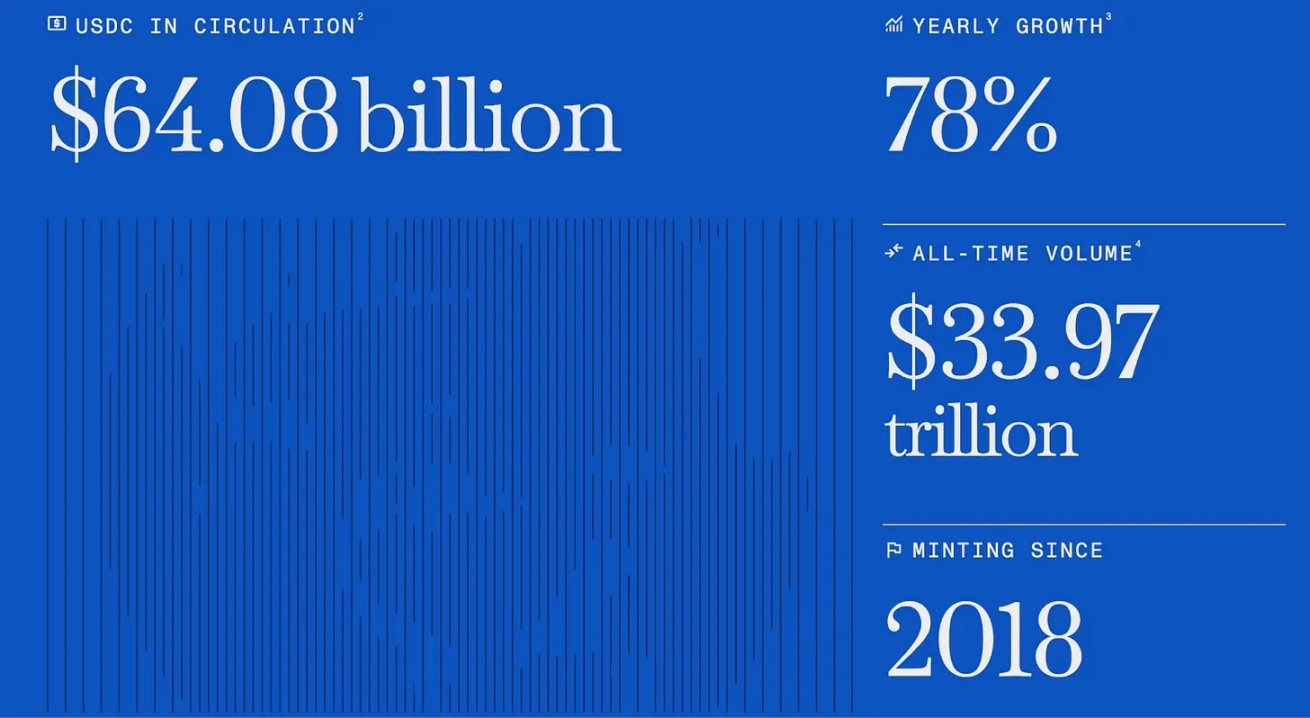

By 2025, USDC had become the second-largest stablecoin by market capitalization, with a circulation exceeding $64 billion. Businesses used it for international payments, developers built financial applications on it, and individuals used it for instant cross-border remittances.

Jeremy's success came after overcoming what industry observers called the "nearly impossible distribution challenge." Unlike Tether, which gained widespread adoption through early partnerships with Asian crypto exchanges, Circle had to build its distribution network from scratch.

Circle's response was to establish a strategic partnership with Coinbase: Circle paid 50% of its net interest income to Coinbase in exchange for distribution rights on its network.

Was it costly? Yes. Was it effective? Undoubtedly.

USDC became the primary alternative to Tether in Western markets.

Crisis Test

On March 10, 2023, in Dubai. This was supposed to be the weekend of Jeremy's son's 13th birthday.

At 2 AM local time, the phone began to ring.

Silicon Valley Bank was facing collapse, and Circle had $3.3 billion in USDC reserves at this bank.

Within hours, USDC decoupled, dropping to $0.87. Traders panicked, and the stablecoin that Jeremy had spent five years building seemed to be on the verge of becoming nearly worthless overnight.

Jeremy set up a virtual war room on Google Meet, working with a team on the East Coast, eight hours behind. His son's birthday party was forgotten; this was about protecting the funds of millions who trusted Circle.

Plan A: Immediately transfer funds to other banks.

Plan B: Rely on the Federal Deposit Insurance Corporation (FDIC) to cover any losses.

Plan C: Negotiate with companies willing to purchase Circle's assets at Silicon Valley Bank at a discount.

Under the watchful eye of the entire crypto world, Jeremy made a personal commitment: if the deposits at Silicon Valley Bank could not be recovered, Circle would "make up the entire funding gap."

This crisis tested all the cornerstones of Jeremy's reputation: transparency, accountability, and the determination to do the right thing in difficult times.

Circle published a detailed blog post explaining what had happened and what steps they were taking to protect customer assets.

Three days later, federal regulators guaranteed the deposits at Silicon Valley Bank.

USDC regained its peg to the dollar, and the crisis was over.

Jeremy proved that Circle could withstand severe external shocks while maintaining customer trust. His choice to cooperate with regulators rather than confront them paid off at the most critical moment.

Throughout Circle's development, Jeremy positioned himself as the most prominent "advocate for a clear regulatory framework" in the cryptocurrency space. Many crypto entrepreneurs disagreed, preferring to minimize regulation. But Jeremy testified before Congress, participated in regulatory working groups, and collaborated with global policymakers to shape the regulatory framework for cryptocurrencies.

In 2024, Circle became the first major global stablecoin issuer to comply with the EU's Markets in Crypto-Assets Regulation.

This strategy paid off.

Subsequently, Jeremy decided to take Circle public.

The path to going public was not smooth. In 2021, they made an initial attempt to merge via SPAC but did not receive SEC approval. However, Jeremy persevered.

In July 2025, Circle successfully went public on the New York Stock Exchange.

IPO documents indicated that it was a company with substantial revenue, clear compliance, and a large scale of operations. Circle's public debut was valued at over $4.6 billion. Jeremy's decade-long bet on stablecoins yielded astonishing returns.

Today, Circle trades under the ticker symbol CRCL, with a market capitalization exceeding $40 billion. Since the July IPO, the stock price has risen by over 430%, making it one of the most successful public market debuts in crypto history.

Jeremy believes that stablecoins are approaching their "iPhone moment": when technology becomes practical and user-friendly, leading to widespread adoption.

Genius Moment

On July 18, 2025, President Donald Trump signed a bill that vindicated Jeremy Allaire's efforts over the past decade. The "GENIUS Act" became the first comprehensive stablecoin regulatory bill in the United States. Jeremy's advocacy for compliance positioned USDC perfectly.

The GENIUS Act accomplished three things that Jeremy had been advocating for years: first, it confirmed that stablecoins are not securities, eliminating regulatory uncertainty that had plagued the industry; second, it required stablecoins to be fully backed by safe assets like government bonds, addressing reserve transparency issues; third, it brought stablecoin issuers under the same compliance framework as traditional banks.

Jeremy spent years building the infrastructure, and now governments around the world are scrambling to adapt to an inevitable world of programmable currency.

The visionary who saw the potential of the internet in 1990, foresaw the popularization of video in 2002, and recognized the cryptocurrency revolution in 2013 has just witnessed his third prediction redefine currency itself.

In an industry obsessed with "acting fast and breaking norms," he proved that the most transformative changes often come from patience, persistence, and the wisdom to see what others overlook.

Three predictions, three industries with profound impacts. If his track record is any indication, even more significant changes lie ahead.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。