Recently, discussions about the regulation of stablecoins in Hong Kong have become increasingly heated. Numerous interpretations have emerged online, suggesting that "stablecoin holders need to undergo real-name verification (KYC)," which has sparked widespread controversy:

"If on-chain transfers require KYC, how can it be decentralized?"

"Isn't the regulation too conservative, hindering financial innovation?"

These voices are not without reason, but do they accurately reflect the regulatory intentions of the Hong Kong Monetary Authority (HKMA)? After a thorough study of two key documents—the "Guidelines for the Supervision of Stablecoin Issuers" and the "Anti-Money Laundering and Counter-Terrorist Financing Guidelines"—we arrived at a more technically detailed and legally bounded answer:

???? Not all holders need to undergo KYC, provided that the issuer can demonstrate that its risk control mechanisms are sufficiently effective.

This article will clarify the applicable logic of stablecoin KYC from the perspective of customers vs. non-customers and the distinction between the Primary and Secondary Markets, elucidating the true bottom line of regulation and providing a judgment framework applicable to both project parties and compliance teams.

Who is a customer, and who is not?

First, we need to clarify: within the HKMA's regulatory framework, "stablecoin holders" are not equivalent to "customers of stablecoin issuers."

According to the definition in Chapter 4 of the "Anti-Money Laundering and Counter-Terrorist Financing Guidelines," only when a user directly requests the issuance or redemption of stablecoins from the issuer, or establishes a business relationship, will they be considered a "customer" (customer stablecoin holder), and this group must strictly adhere to KYC/KYB processes.

Users who receive, transfer, or trade stablecoins on-chain but have never interacted directly with the issuer (for example, users who acquire stablecoins through DEX purchases or transfers between wallets) are classified as "non-customer stablecoin holders" and, in principle, do not need to undergo KYC.

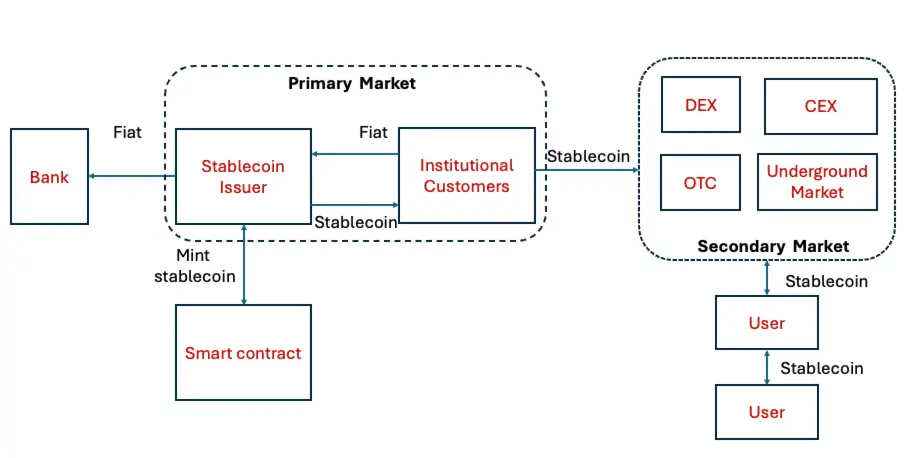

As shown in the diagram below, only institutional users in the Primary Market are considered customers, while participants in the Secondary Market are not defined as customers within the HKMA's regulatory framework.

However, this does not mean they are completely outside the regulatory purview. Chapter 5 of the guidelines clearly states: issuers have an ongoing obligation to monitor all circulating stablecoins, including those held by both customers and non-customers.

KYC is not the only method, but it is the regulatory bottom line

Many interpretations that lead to misunderstandings often overlook an important premise set by the HKMA:

???? "Non-customer stablecoin holders may not need to undergo KYC, but the premise is that the issuer must establish an effective on-chain risk control mechanism and be able to demonstrate to the regulatory authority that it is sufficient to prevent money laundering and terrorist financing risks."

In other words, KYC is not the only means, but it is the last line of defense.

If the issuer employs methods such as blockchain analysis tools, address blacklists, transaction risk scoring, wallet profiling, and freezing mechanisms (5.10) to monitor the flow and use of coins, and can satisfy the HKMA (to the HKMA’s satisfaction - 5.11), then these technical risk control measures can serve as alternatives, and it is not necessary to enforce KYC on all holders individually.

However, if this cannot be achieved, or if these measures prove insufficient to mitigate risks in practice, then regulatory expectations will automatically revert to the most conservative option—identity verification for all holders, regardless of whether they are customers. It is important to note that even if KYC is required for holders, stablecoin issuers can delegate the KYC process to VASPs and trusted third parties.

For issuers, it is a "choose one" compliance dilemma

For stablecoin issuers, this is essentially a "choose one" compliance decision:

- Either establish a comprehensive risk monitoring system covering the entire chain, including real-time address profiling, suspicious transaction identification, blacklist interception, freezing mechanisms, and STR reporting processes;

- Or accept a more direct but costly solution: conduct KYC on all holders, even if they only received a stablecoin on-chain.

From a regulatory perspective, this design is not conservative; rather, it links technical capabilities with regulatory obligations: you may not need to verify every user’s identity, but you must have the ability to control risks. Otherwise, you must revert to the most basic method—conducting KYC.

This is also the key point this article aims to clarify:

"Do stablecoin holders need KYC?" is not a one-size-fits-all question, but rather depends on whether the issuer's risk control capabilities are trustworthy.

Conclusion: Regulation is clear, technology must deliver

The regulation of stablecoins is not about stifling technology but about establishing a clear red line:

You can choose technical solutions to replace real-name verification, but you cannot evade the responsibility of risk control.

For issuers, the most critical question is not "Should we conduct KYC?" but rather—do you have the capability to convince the HKMA that you can forgo it?

Under the principle of "same activities, same risks, same regulation," stablecoins, as quasi-payment tools, are moving towards compliance requirements similar to those of traditional finance. For Web3 projects, this is not the end but a new beginning: regulation is clear, and technology must deliver.

Finally, here is a quick reference table for rapid inquiry into regulatory requirements.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。