Fair, Fun, and Shortable

The copy on the Smart.fun official website seems to be the most straightforward answer from the Smart.fun official team to this question.

Currently, Smart.fun has launched the Trend section, utilizing AI to achieve hot topic aggregation and rapid tokenization, providing users with a brand new experience in token issuance and trading.

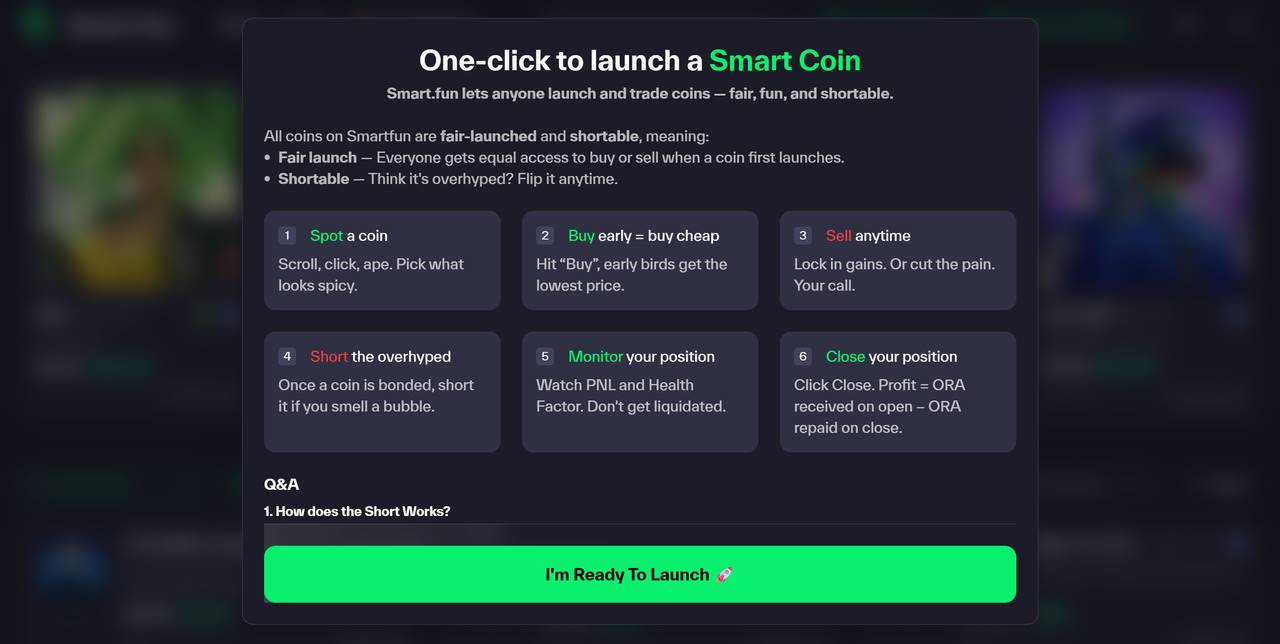

In addition to being fair and fun, the unique shorting mechanism has also become the biggest incentive for many to explore Smart.fun.

AI-Driven Trend Capture, Content Generation, and One-Click Launch

As a Launchpad, asset issuance is its core function. Smart.fun, powered by AI, offers an exceptional experience in real-time capturing of global trend hotspots and one-click launching of quality assets.

Basic One-Click Issuance: Zero Threshold to Start Your Creativity

On Smart.fun, anyone can easily issue assets within a minute:

Users simply need to click the "Create Coin" button to upload materials, including image materials (jpeg, png, webp, gif, svg, etc.) and video materials (mp4), fill in basic information such as token name and description, and they can complete the release with one click, allowing everyone to participate equally and making asset issuance truly accessible to the public.

Smart Content Generation: AI Helps Your Meme Find the Right Angle

A viral Meme requires precise marketing expression. In the face of trending topics, while many are still pondering what kind of token name and description can quickly convey the essence of the asset, Smart.fun introduces AI to handle content generation, relieving users from the hassle.

In the "Launch By URL" mode, users only need to copy and paste any valuable trending news link, and Smart.fun's powerful AI will automatically analyze the content, generating multiple versions of personalized asset proposals. Users can simply choose their preferred proposal or make minor adjustments based on the AI-generated content before completing the release with one click.

TrendFi Feature: Real-Time Capture of Global Hotspots for Viral Spread

After lowering the issuance threshold, in today's attention economy, asset issuers need more efficient tools for trend discovery and capture. Smart.fun's AI-driven TrendFi feature acts like a "hotspot radar" covering global multimedia platforms.

On the currently launched Trends page, users can not only browse trending news through the "Hot X" and "Global News" sub-sections and buy/sell related concept Memes with one click, but they can also quickly issue tokens based on these trending contents.

In the Hot X list, the left side displays trending news from the X platform, while the right side shows related concept projects. If users believe a trending post can inspire a more interesting token, they can directly click the LOGO on the right side of that information to initiate creation.

On the Global News page, by clicking the Launch Coin button below the news, AI will automatically generate multiple versions of asset issuance proposals based on the news content.

In the future, Smart.fun will quickly integrate TikTok and IP hotspots to further help users seize trending opportunities in a competitive market.

0 Creation Fee, 0 Transaction Fee

To further encourage creation, the Smart.fun platform currently has no Creation Fee, and during the internal trading phase, users can trade with the $ORA token without transaction fees, significantly reducing the cost of asset issuance and operational thresholds while catalyzing further prosperity of the ecosystem.

The next viral Meme may just originate from the user's current "one-click launch."

$ORA Liquidity Incentive Drive: Making Asset "Graduate" Easily

The continuous lowering of asset issuance thresholds has led to a surge of projects, and the mixed quality of the market, combined with further fragmentation of attention, means that most projects fail before public trading. The less than 1% "graduation rate" of Pump.fun fully illustrates this point.

How to gain sufficient liquidity support in the initial startup phase is the first major challenge many projects need to overcome.

Smart.fun cleverly resolves this pain point through a deeply integrated new token economic model with the ORA ecosystem, leveraging $ORA liquidity incentives to bring sustainable development momentum to projects.

As the native token, $ORA is the core value carrier of the ORA ecosystem;

According to the description in the ORA white paper, other token assets issued within the ORA ecosystem, aside from $ORA, are referred to as Neuron. This means that assets issued based on Smart.fun are Neuron.

The liquidity pool formed by pairing $ORA tokens with Neuron tokens is called Axon.

In the new token economic model of ORA, 11% of $ORA tokens have been issued and are in active circulation, while the remaining 89% will be allocated entirely to liquidity mining and gradually released.

Each $ORA + Neuron liquidity pool (i.e., Axon) will receive $ORA reward distribution based on the proportion of that pool's liquidity to total liquidity and its usage. This means that the higher the liquidity of Axon, the higher the $ORA reward distribution it can receive. Users can participate in $ORA mining to earn additional rewards by adding liquidity to Axon.

The threshold for receiving $ORA rewards is 50,000 $ORA (which is also the graduation threshold for Smart.fun).

This strong binding liquidity mechanism endows Smart.fun with a continuously strengthening liquidity snowball effect:

ORA rewards attract users to contribute liquidity → Higher liquidity brings higher ORA rewards → Higher $ORA rewards attract more users to contribute liquidity → Forming a positive cycle that injects continuous liquidity momentum into token assets.

Once a project successfully graduates by reaching the 50,000 $ORA threshold, Smart.fun will unlock the Buy Back & Burn function: Any market participant can repurchase Meme coins from the open market and permanently destroy them, reducing circulating supply, enhancing the scarcity and potential value of remaining tokens, and further injecting long-term momentum into the project.

Borrowing and Shorting Mechanism: Efficient Risk Hedging and High-Yield Leverage

In the rules of the Meme game, wild fluctuations are commonplace.

When a crash occurs, can you only watch your assets shrink?

Smart.fun breaks this shackles by introducing a borrowing and shorting function, transforming the market into a "double-edged sword," allowing users to capture high returns even in a downtrend.

Currently, the borrowing and shorting mechanism is open to projects that have transitioned from the internal trading phase to public trading. This function is anchored in value by $ORA, specifically:

Users first need to pledge $ORA as collateral to borrow the target Meme coin. The borrowing rate specifically depends on the health factor data. According to calculations, the current borrowing ratio on the platform is about 50%, meaning that by pledging 100 $ORA tokens, users can borrow Meme assets worth approximately 50 $ORA.

After holding the borrowed Meme coin assets, users can leverage Smart.fun's AI-based trend hotspot capture capabilities to more accurately grasp market movements and, based on their own market assessments, choose to sell the borrowed Meme coins: Generally, selling is seen as opening a short position, as it indicates that the holder believes the asset will decline in the future or has limited upside potential.

After selling, users continue to monitor market fluctuations. When the price drops, they can buy back the same amount of Meme coins at a lower price to repay the platform, with the difference being the profit.

Profit = ORA obtained at opening - ORA repaid at closing

We can understand the entire logic more clearly through the following example:

Xiao Ming borrows 1,000 Meme coins and earns 100 $ORA when selling;

When the coin price drops by 20%, Xiao Ming only needs 80 $ORA to buy back 1,000 Meme coins;

Xiao Ming makes a profit of 20 $ORA.

Of course, in the highly volatile and high-risk Meme market, users also face higher liquidation risks. Smart.fun chooses to use the Health Factor as a risk control "iron gate":

Health Factor = (Collateral Value / Debt Value) × 100%

As a measure of the safety margin between collateral assets and debt, the HF must remain above 100% to ensure position safety. Once the debt value reaches 90% of the collateral (HF 100%), the system will trigger automatic liquidation, and users may lose part or all of their collateral.

Let’s explain liquidation with another example:

Xiao Ming pledges 100 $ORA to borrow 1,000 Meme coins worth 50 $ORA (with a borrowing rate of 50%). If the price of Meme coins continues to rise, the debt value of 1,000 Meme coins approaches 90% of the collateral value, causing the health factor to drop below 100%, putting the position at risk of liquidation.

Smart.fun breaks the single "chasing the rise" investment model of Memes. The introduction of the borrowing and shorting mechanism not only increases the depth of market speculation, allowing users to make investment operations and earn profits even in a downtrend, but also shows the potential for the Meme ecosystem to evolve towards a more mature DeFi model.

Ecological Synergy: The Mutual Achievement of ORA and Smart.fun

Just as Pump.Fun's success relies on the underlying technical support and ecological resources of Solana, Pump.Fun's success in turn becomes a traffic engine for Solana. The Web3 ecosystem always welcomes this kind of mutually beneficial closed loop.

As the next key project with breakout potential in the ORA ecosystem, Smart.fun aims to become the ORA ecosystem's version of Pump.Fun, while the bidirectional ecological symbiotic engine between Pump.Fun and Solana continues between Smart.fun and ORA.

Backed by the ORA ecosystem, Smart.fun enjoys a series of support from the ORA ecosystem:

From an ecological incentive perspective, higher liquidity can earn more $ORA token rewards, providing native liquidity support for projects issued based on Smart.fun, helping more projects graduate to the public trading market.

From a technical perspective, as a project that has been deeply engaged in the AI field since its inception in 2021, the technical accumulation of the ORA ecosystem provides a solid backing for Smart.fun's leap from "Fun" to "Smart."

The ORA ecosystem has several well-known technological research achievements and AI products: the economically efficient machine learning framework opML based on game theory aims to significantly reduce the operational management costs of on-chain AI; the hybrid model opp/ai, tailored for on-chain artificial intelligence, is dedicated to achieving privacy-preserving and efficient on-chain AI; the verifiable decentralized AI oracle OAO provides a trust foundation for on-chain AI; the Initial Model Offering (IMO) serves as a solution for the tokenization of AI models, having birthed several hit products including OpenLM… A series of technological innovations and product accumulations directly empower Smart.fun's AI capabilities, providing a better user experience in trend capture, content generation, and intelligent trading.

In addition, as a large ecosystem, ORA's resource feedback in terms of users, developers, and community exposure also allows Smart.fun to reach a broader audience.

For ORA, the rich assets created by Smart.fun will also drive ecological demand, solidifying the value of ORA:

As a Launchpad, Smart.fun enriches the asset categories of the ORA ecosystem, injecting more innovative vitality into the ecosystem's prosperity with the support of more projects, more users, and more funds.

At the same time, every token issued based on Smart.fun, with graduation as the goal, will generate demand for $ORA. As more and more assets are issued based on Smart.fun, it will create huge demand for the $ORA token, further providing value support for $ORA.

In this way: project creators issue assets on Smart.fun, $ORA incentives attract more users to provide liquidity, prompting more Smart.fun projects to graduate to public trading, combined with the innovative borrowing and shorting function, increasing the likelihood of Smart.fun producing breakout hit projects;

Hit projects attract new traffic, leading more people to choose to issue assets based on Smart.fun, bringing greater demand for $ORA and solidifying the value foundation of $ORA;

More valuable $ORA attracts more users to provide liquidity, earning $ORA rewards, promoting healthier and faster growth of Smart.fun projects, creating a cycle of continuous expansion and growth of the ecosystem.

The ecological synergy between ORA and Smart.fun is not a simple addition but a multiplicative effect. The strong flywheel built by the mutual achievements of the two brings greater possibilities for the exponential expansion of the ecosystem.

Conclusion

After Pump.fun proved the enormous potential of the Launchpad business model, countless homogeneous competitors emerged in the market, aiming to replicate the successful formula of "low-threshold token issuance + high-frequency trading fees." In the current market, where leading projects are continuously optimizing and new projects are emerging in clusters, it is not easy to secure a place in the Launchpad competition. However, Smart.fun has created a more imaginative evolutionary path:

AI empowerment upgrades asset issuance from "chasing trends" to "creating trends," allowing creators to capture market sentiment more accurately;

Liquidity incentives address the industry pain point of 99% of projects "dying at birth," providing a sustainable development path for quality projects;

The shorting mechanism breaks the one-way speculation of Meme coins, introducing more mature risk hedging tools to the market.

Of course, for Smart.fun to truly break out, it may still need to better leverage the AI advantages of the ORA ecosystem, maximizing AI's differentiated advantages in lowering thresholds, market monitoring, and content generation. Additionally, regarding the liquidation risks under the borrowing and shorting mechanism, Smart.fun will need to continuously refine its approach for more precise control in the future.

The crypto market's pursuit of asset issuance and liquidity efficiency is relentless. The Launchpad is an ongoing competition. As Smart.fun is set to aggregate more platform hotspot trends and further refine its DeFi trading functions, attracting more users and funds, Smart.fun is committed to becoming an innovative variable in the Launchpad competitive landscape.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。