According to Coinglass data, total BTC futures open interest (OI) stands at 692,490 BTC, equivalent to $79 billion. CME leads with 139,350 BTC ($15.88 billion), capturing 20.1% of the market.

Binance follows closely with 121,580 BTC ($13.87 billion), representing 17.55% of total OI. Bybit holds 79,250 BTC ($9.04 billion), OKX maintains 37,480 BTC ($4.27 billion), and Gate commands 69,010 BTC ($7.87 billion). Kucoin, Bitget, WhiteBIT, BingX, and MEXC round out the top ten exchanges.

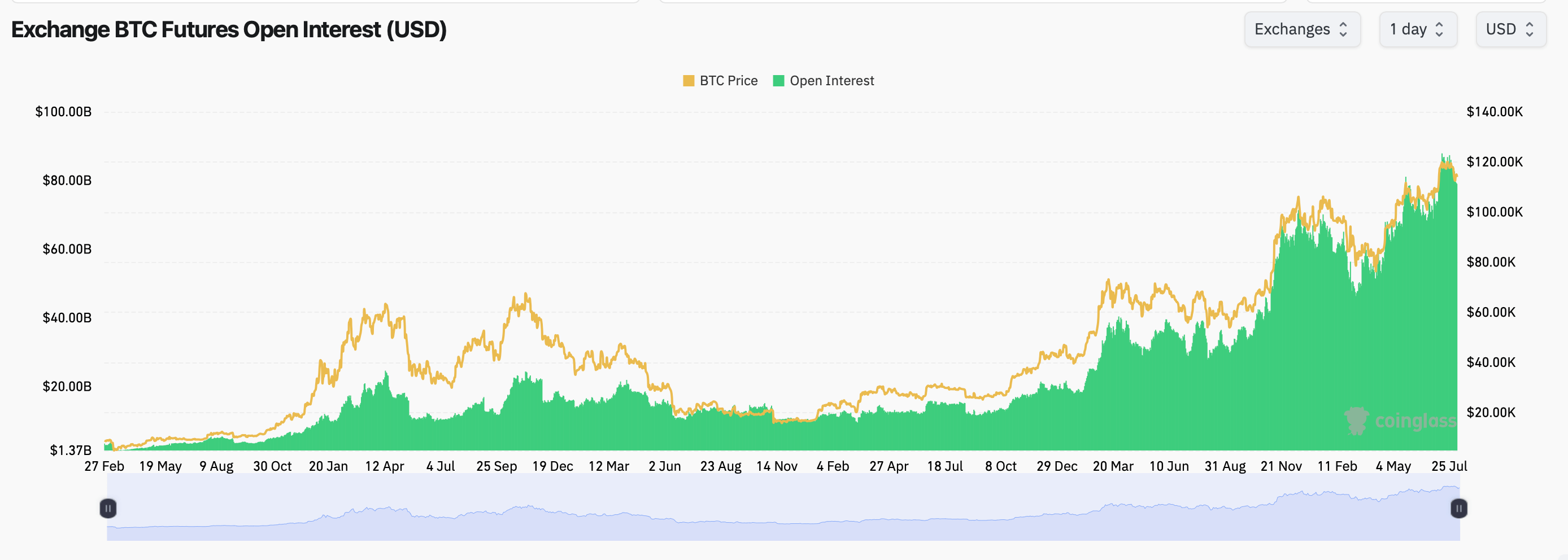

Bitcoin futures open interest data from coinglass.com.

Futures OI has been on a steep climb in 2025 alongside bitcoin’s price, now hovering around 5% under the $120,000 range. CME’s institutional-heavy contracts and Binance’s retail-driven flows remain key drivers of the buildup, with CME’s OI change flat on the hour but up 0.20% over four hours, while Bybit saw a modest 0.02% uptick in the last hour.

On the options front, open interest is equally elevated. Total BTC options OI sits near $60 billion, reflecting 232,476 BTC in calls (61.43%) and 145,957 BTC in puts (38.57%). This bullish skew suggests traders are positioning for potential further upside.

However, the last 24 hours have seen more defensive flows. Options volume shows 39.64% in calls (19,711 BTC) and 60.36% in puts (30,018 BTC), indicating short-term hedging activity despite the longer-term bullish bias.

Deribit commands the bitcoin options market. Its single biggest position is a December 26, 2025 call giving buyers the right to purchase BTC at $140,000; that contract holds about 10,727 BTC in open interest. Close behind are a Sept. 26, 2025 call at the same $140,000 strike (9,912 BTC) and a December 26, 2025 call at $200,000 (8,614 BTC). On the bearish side, traders have stacked roughly 6,489 BTC into an Aug. 8 put that protects them if prices slip below $110,000.

During the past 24 hours, Deribit’s busiest trades were short-dated put options—contracts that pay off if bitcoin falls. The Aug. 29 contract with a $112,000 strike changed hands for about 2,068 BTC, and the Aug. 15 $115,000 put traded roughly 1,632 BTC. Heavy demand for these downside hedges has pushed near-term implied volatility higher, showing traders are preparing for a potential pullback.

Options expiry data reveals concentration around Aug. 29, Sept. 26, and Dec. 26, with significant notional value stacked in both calls and puts. Aug. 29 holds the heaviest balance, heavily weighted toward puts but with robust call interest at $120,000 and $124,000 strikes.

Deribit’s options volume trend has been rising steadily, with notable spikes during recent price surges. The exchange has maintained a dominant share of global BTC options activity, followed by Binance’s emerging presence.

Market watchers note that elevated OI across both futures and options often precedes periods of heightened volatility. With BTC’s price consolidating near all-time highs, traders appear split between hedging gains and pressing for further upside.

The derivatives market’s current configuration — high notional exposure, bullish OI skew, and near-term put-heavy volumes — suggests that while long-term sentiment remains optimistic, traders are positioning for possible short-term turbulence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。