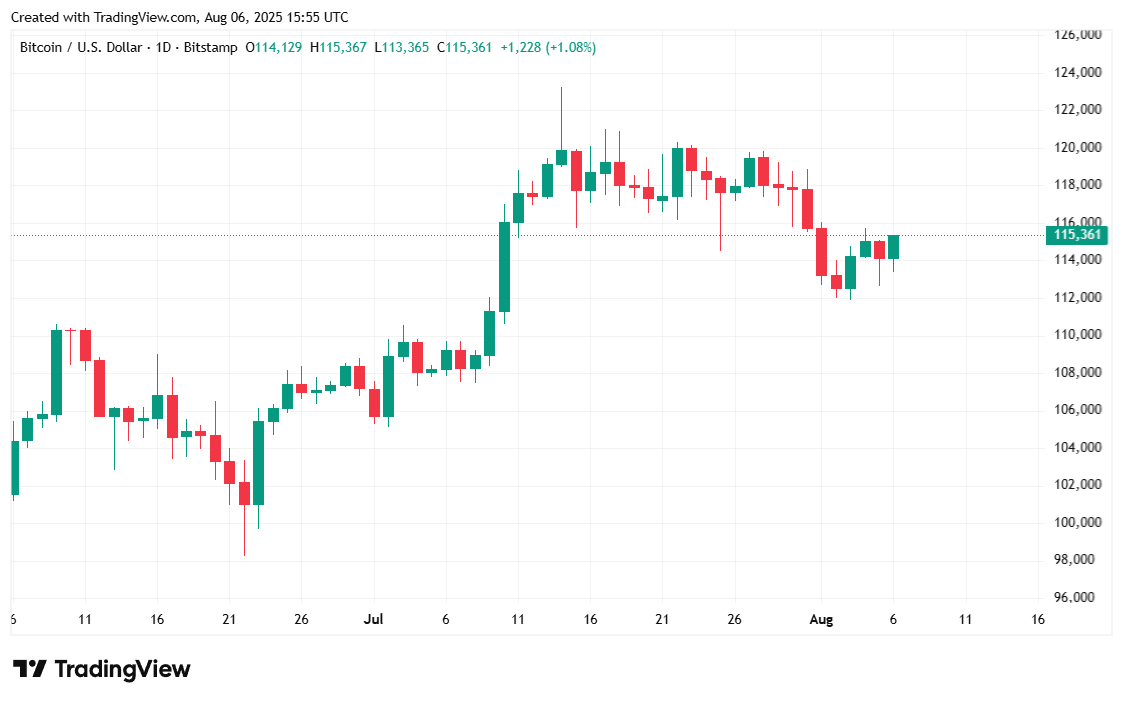

Positive corporate earnings, favorable regulatory developments, and a $100 billion investment by Apple, all appear to have lifted stocks and crypto on Wednesday. Bitcoin, which had tumbled all the way down to $112K on Tuesday, seems to have hit its stride once more, after climbing back to $115K, a level it has been hovering around for most of the morning.

The U.S. Securities and Exchange Commission (SEC) yesterday issued guidance stating that “Liquid staking activities…do not involve the offer and sale of securities.” This removes a significant amount of regulatory uncertainty surrounding staked cryptocurrencies such as ether ( ETH) and solana ( SOL). And even though staking is not part of the bitcoin protocol, the rising regulatory tide lifts all crypto ships.

Bitcoin is also not part of the corporate world, but many of its investors are. Thus, when McDonald’s $6.84 billion second quarter revenue beats analysts’ $6.7 billion estimate and when Apple decides to make a $100 billion investment in the U.S., the positive effects transcend stocks, likely explaining the roughly 2% jump in BTC today.

Bitcoin was trading at $115,169.24 at the time of reporting, up by 2.13% since yesterday, but still down by 2.32% for the week, according to Coinmarketcap. The cryptocurrency’s price has moved around between $112,707.71 and $115,322.38 over 24 hours.

( BTC price / Trading View)

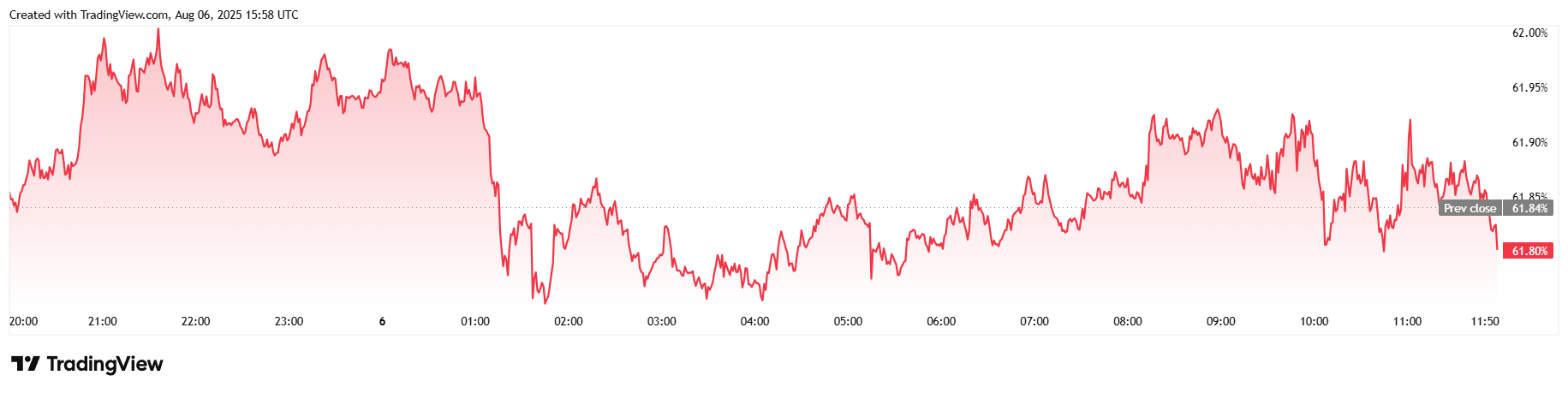

Trading volume for the day fell 6.77% to $56.38 billion but market capitalization rose 2.25% to $2.29 trillion. Bitcoin dominance was mostly flat over 24 hours and stood at 61.80%.

( BTC dominance / Trading View)

Total BTC futures open interest was also mostly flat, dipping slightly by 0.68% over 24 hours to reach $79.25 billion. Bitcoin liquidations totaled $23.19 million for the day, a number consisting of $17.91 million in short liquidations and $5.27 million in liquidated long positions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。