Polkadot's DOT demonstrated a significant surge in large buyers' interest during a 24-hour trading period, with corporate treasury allocations and regulatory clarity driving sustained buying pressure, according to CoinDesk Research's technical analysis model.

The model showed that price action demonstrated potential institutional-grade stability with sustained corporate interest indicators.

As of July, Bifrost had secured over 81% of DOT’s liquid staking token (LST) market, boasting more than $90 million in total value locked (TVL), according to a post on X.

The rally in DOT came as the wider crypto market also rose, with the broader market gauge, the Coindesk 20, recently up 2%.

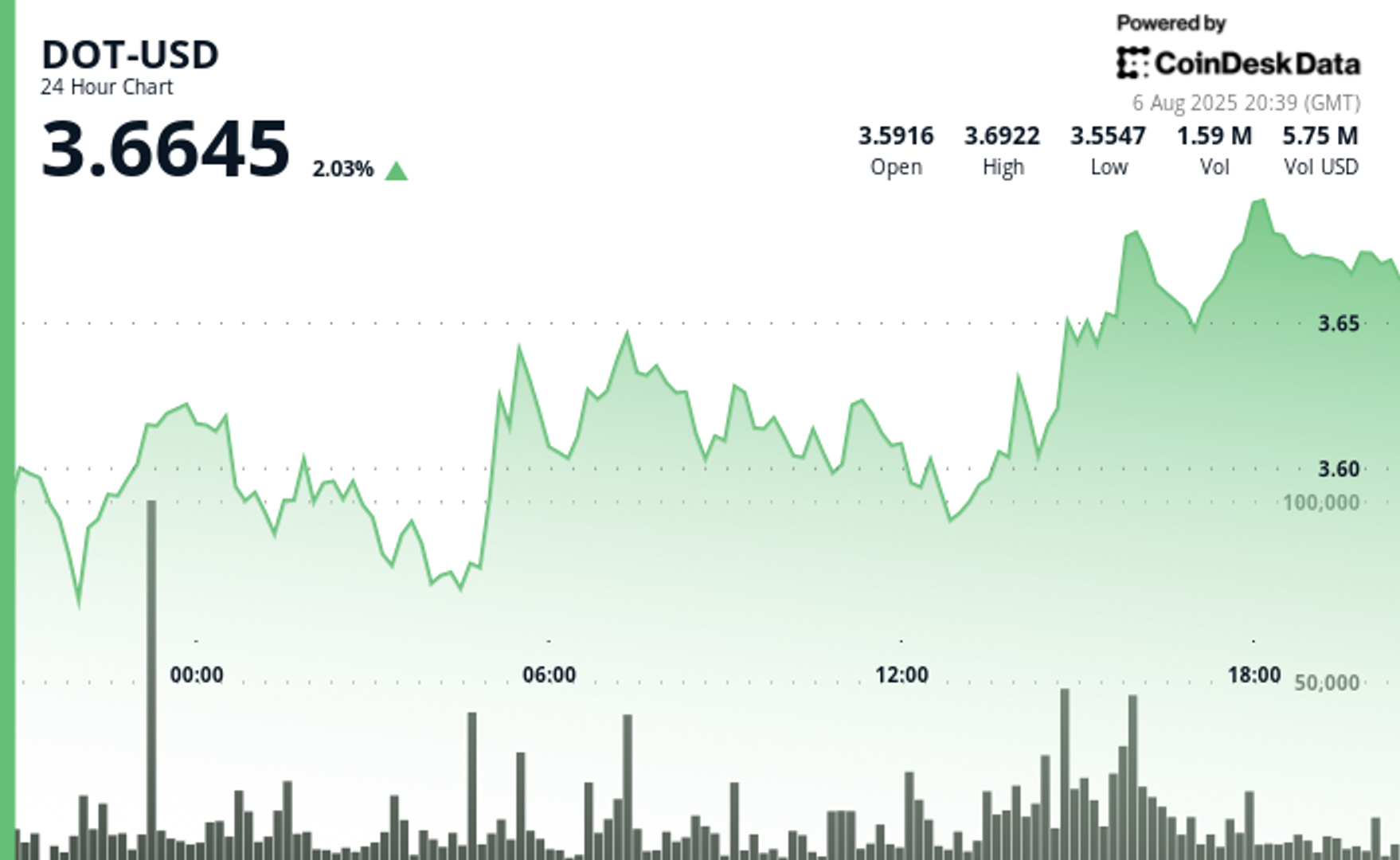

In recent trading, Polkadot was 2.1% higher over 24 hours, trading around $3.66.

Technical Analysis:

- Institutional order flow patterns established strong support levels reflecting corporate investment committee decisions, according to the model.

- Corporate treasury allocation discussions potentially contributed to resistance formation near key technical levels.

- Trading volume exceeded institutional thresholds during standard corporate decision-making hours.

- After-hours volume spikes aligned with typical corporate announcement timing patterns.

- Reduced volatility periods suggest institutional accumulation phases ahead of potential enterprise adoption news.

- Price action demonstrated institutional-grade stability with sustained corporate interest indicators.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。