Author: Martin

A silent capital revolution is sweeping through global corporate treasuries, reflecting the shift of digital assets from the margins to the mainstream.

Ignoring high coin prices! Strategy continues to buy Bitcoin, spending $2.46 billion on Bitcoin in the past week—this is the third-largest single purchase by the company since it began accumulating this cryptocurrency five years ago, measured in dollar value.

According to documents submitted to the U.S. Securities and Exchange Commission (SEC), the company purchased 21,021 Bitcoins between July 28 and August 3, bringing its total holdings to 628,791 Bitcoins, which are now valued at over $71 billion at current market prices.

At the birth of Bitcoin, it was often dismissed by traditional finance as a "geek toy" or "speculative bubble," but as of 2025, global publicly traded companies are incorporating it into their balance sheets at an unprecedented pace. When Italy's largest bank, Intesa Sanpaolo, quietly bought 11 Bitcoins, and Japan's Metaplanet boldly announced Bitcoin as a strategic reserve asset, and when GameStop transformed from a game retailer to a digital asset holder—corporate Bitcoin strategies have moved from marginal experiments to financial mainstream.

According to the latest data, as of July 2025, the number of publicly traded companies holding Bitcoin has reached 141, a 120% increase from last year. More impressively, the amount of Bitcoin purchased by companies in just the first half of the year reached an astonishing 245,000 Bitcoins, a 375% increase compared to the same period in 2024, even exceeding ETF purchases by more than double.

This silent capital revolution is reshaping the underlying logic of global asset allocation.

I. Panorama Scan: Deep Differentiation in Corporate Holdings

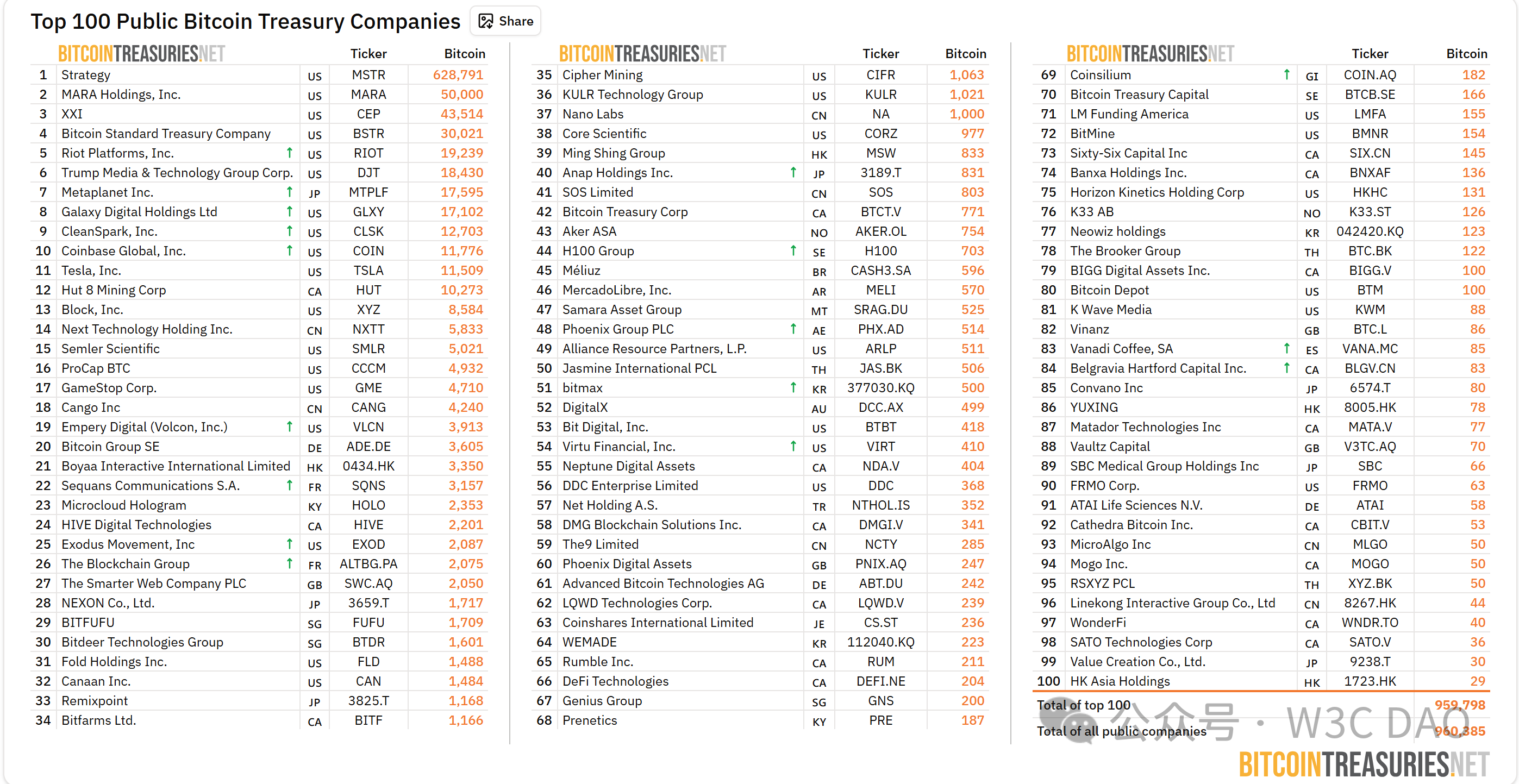

2025 has become a key year for the explosion of crypto reserves among publicly traded companies. Data shows that in June alone, 26 new companies incorporated Bitcoin into their balance sheets, bringing the total number of companies allocating crypto assets globally to over 250. The top 100 Bitcoin-holding public companies collectively hold 959,798 Bitcoins, valued at $109,416,972,000 (approximately 78.014 billion RMB).

These companies span multiple industries, including technology, energy, finance, and education, with geographical distribution across North America, the Middle East, and Asia. Among them, 64 companies officially registered with the U.S. SEC hold approximately 688,000 Bitcoins, accounting for 3-4% of the total Bitcoin supply.

Leading giants form a "Bitcoin hegemony":

• Strategy (formerly MicroStrategy): Holds 628,791 Bitcoins, valued at $71.871 billion, accounting for over 70% of total holdings among publicly traded companies, making it a "walking Bitcoin ETF."

• MARA Holdings: As one of the largest mining companies in the U.S., holds 50,000 Bitcoins, valued at $5.787 billion, building a moat through a dual strategy of mining and holding.

• XXI: Holds 43,514 Bitcoins, valued at $4.974 billion.

• Bitcoin Standard Treasury: Holds 30,021 Bitcoins, valued at $3.431 billion.

• Riota Platforms, Inc: Holds 19,239 Bitcoins, valued at $2.199 billion.

• Trump Media & Technology Group Corp: Holds 18,430 Bitcoins, valued at $2.107 billion.

• Metaplanet: A Japanese publicly traded company, holds 17,595 Bitcoins, valued at $2.011 billion, becoming the largest publicly traded company in Asia by Bitcoin holdings, effectively replicating the "MicroStrategy model."

• Galaxy Digital Holdings Ltd: Holds 17,102 Bitcoins, valued at $1.955 billion.

• CleanSpark, Inc: Holds 12,703 Bitcoins, valued at $1.452 billion.

• Coinbase Global, Inc: Holds 11,776 Bitcoins, valued at $1.346 billion.

New entrants are stirring a cross-industry wave.

In 2025, corporate Bitcoin investment shows a trend of diversification:

• Traditional finance breaks the ice: Italy's largest bank, Intesa Sanpaolo, purchased 11 Bitcoins, signaling the banking sector's entry.

• Retail transformation: GameStop announced its Bitcoin strategy and quickly purchased 4,710 Bitcoins, achieving a record transformation speed.

II. Triple Logic: The Essence of Corporate Bitcoin Strategy

1. Financial Logic: Noah's Ark in an Inflationary Era

In the context of global fiat currency overproduction and U.S. national debt exceeding $37 trillion, corporate CFOs are seeking safe havens. Apple's CFO stated, "Holding Bitcoin is not for speculation, but to build a defense against fiat currency devaluation."

The scarcity design of Bitcoin (total supply of 21 million) makes it an ideal hedging tool. Data shows that the average unrealized gain of corporate Bitcoin holdings ranges from 49% to 243%. Block, for instance, achieved a 243% return with a cost basis of $30,405, far exceeding traditional asset returns.

2. Market Logic: The Magic Wand of Valuation Reconstruction

When Strategy's stock price is correlated with Bitcoin prices by over 90%, the capital market shows recognition of a new valuation model. This phenomenon is referred to by Strategy CEO Michael Saylor as a "Bitcoin-driven valuation amplifier"—holding Bitcoin not only improves the balance sheet but also attracts younger investors, creating a positive cycle for stock prices.

The market votes with real money to support corporate crypto asset strategies, which have low correlation with traditional financial assets, optimizing the risk structure of investment portfolios.

3. Strategic Logic: The Ticket to the Web 3.0 Era

Data from Coinbase custody shows that over 60% of publicly traded companies that purchased Bitcoin also launched NFT or smart contract businesses simultaneously, with Bitcoin becoming a bridgehead for companies entering the Web 3.0 ecosystem:

• Microsoft supports metaverse land acquisitions through Bitcoin holdings.

• Walmart uses blockchain technology for product traceability.

• Tesla integrates Bitcoin payments with its energy business.

The boundaries between traditional industries and the crypto economy are dissolving.

Phoenix Group's market performance in the second quarter validated the effectiveness of this strategy, with its stock price increasing over 72% from April to June, ranking among the top five best-performing stocks on the Abu Dhabi Exchange.

III. Value Foundation: The Underlying Support of Bitcoin

Top institutions like Standard Chartered and VanEck have recently raised their Bitcoin price expectations, locking in a target range of $180,000 to $250,000 for 2025, while HC Wainwright more aggressively raised its target price from $145,000 to $225,000.

The ultimate value anchor of Bitcoin is becoming increasingly clear: as sovereign debt risks rise and the credibility of fiat currencies fluctuates, Bitcoin, with its algorithmically guaranteed absolute scarcity and decentralized architecture, becomes a new trust vehicle. This is the result of the interplay of three core driving forces:

1. The Ultimate Manifestation of Digital Scarcity

The total supply of Bitcoin is fixed at 21 million, and the halving mechanism every four years continues to strengthen its scarcity. After the 2024 halving, the block reward will drop to 3.125 Bitcoins, with the annual inflation rate falling below 1%, officially surpassing gold in scarcity.

This absolute scarcity is particularly valuable in an era of fiat currency proliferation. Bitwise data shows that in 2025, corporate Bitcoin purchases (196,000 Bitcoins) have reached 3.3 times the new supply (60,000 Bitcoins), with the supply-demand gap continuing to widen.

2. The Decentralized Trust Machine

The distributed ledger technology of the Bitcoin network creates a value transfer channel without intermediaries, and its SHA-256 encryption algorithm ensures that transactions are immutable. The network, composed of thousands of nodes globally, has far superior attack resistance compared to centralized systems.

When traditional banks are constrained by geopolitical factors, Bitcoin provides multinational companies with a value transfer channel that is resistant to censorship, allowing Middle Eastern companies to bypass dollar sanctions for cross-border settlements.

"Bitcoin is not a speculative tool, but a key anchor for rebuilding trust," as industry observers put it, "It addresses the fundamental question of the digital age—what should we trust when traditional institutions devalue?"

3. The Cutting-Edge Carrier of Technological Innovation

The Bitcoin technology ecosystem is experiencing key breakthroughs in 2025:

• Lightning Network: Transaction speeds increase to millions per second, with fees dropping to nearly zero.

• Quantum-resistant encryption: A defense system against quantum computing threats is being tested.

• Cross-chain interoperability: Compatibility with Ethereum smart contracts is achieved through Rootstock.

Technological upgrades are evolving Bitcoin from a mere store of value to a functional asset.

IV. Future Outlook: Three Major Trends in Corporate Holdings

Institutional funds are flooding in at an unprecedented scale, with net inflows into Bitcoin spot ETFs reaching $32 billion in 2024, while continued accumulation by giants like BlackRock and Fidelity could see ETF managed assets soar to $190 billion in 2025. This structural change is causing the daily circulating Bitcoin supply to decrease by about 3.5 times, far exceeding miners' daily output.

The depreciation of currencies in emerging market countries is accelerating adoption from another dimension. In countries like Argentina, where the local currency depreciated by over 50% annually, residents are turning to crypto assets for value storage, with related trading volumes surging 217% year-on-year in the fourth quarter of 2024.

In the future, corporate Bitcoin holdings will exhibit these three major trends:

1. Adoption Rates Growing Exponentially

The executive chairman of Strategy predicts, "The annual growth rate of corporate Bitcoin investment will reach 30%-60%, and by 2026, the number of holding companies may exceed 700." This prediction is based on:

• Improved regulatory frameworks: The U.S. FIT21 Act is advancing, and the MiCA framework is being implemented in the EU.

• Optimized accounting standards: New FASB regulations allow Bitcoin assets to be measured at market value.

• Robust infrastructure: CME has launched corporate holding hedge contracts, with open interest exceeding $8 billion.

2. Acceleration of Sovereign State Participation

In March 2025, Trump signed an executive order to establish a U.S. Bitcoin reserve, signaling a policy shift. If the "Bitcoin Act" is passed, the U.S. plans to purchase 1 million Bitcoins (5% of the total supply) within five years, potentially triggering a global currency hoarding race.

Countries like Japan and Switzerland have already explored the synergy between central bank digital currencies and the Bitcoin ecosystem, marking the arrival of the sovereign-level allocation era.

3. Fundamental Changes in Market Structure

As corporate Bitcoin holdings account for 16% of Bitcoin's circulating supply (3.32 million), the market mechanism is quietly transforming:

• Price discovery mechanism: Shifting from retail-driven to institution-led capital flows.

• Volatility characteristics: Historical volatility has decreased from over 100% to 40-60%, moving towards a "slow bull" market.

• Ecological role reconstruction: Miners are transitioning from sellers to hoarders, with net positions decreasing by 90% in 2024.

Standard Chartered predicts that under the backdrop of continuous institutional inflows, Bitcoin prices may approach $200,000 by the end of 2025.

V. The Hidden Reefs Behind Prosperity and the Dawn of a New Treasury Era

Despite the bright prospects, corporate Bitcoin strategies still face challenges:

Policy risk: Regulatory fragmentation may lead to market fragmentation, as seen with the coexistence of the EU's MiCA framework.

Financial risk: Bitcoin's annualized volatility exceeds 80%, making highly leveraged companies susceptible to a "death spiral."

Technological risk: Quantum computing threats (despite existing defense solutions) and cybersecurity vulnerabilities.

Competitive risk: CBDCs squeezing payment scenarios and competing coins like Ethereum diverting funds.

As XBIT analysts warn: "Companies trading close to net asset value may face 'death spiral' risks—declining Bitcoin prices will impact balance sheets, leading to stock price drops."

As Strategy's Bitcoin reserves surpass the gold reserves of many countries, as Metaplanet uses Bitcoin to hedge against yen depreciation, and as GameStop transforms its game cartridge warehouse into a digital asset vault—corporate treasury management is undergoing a paradigm shift.

Bitcoin is evolving from a "geek toy" to a "standard configuration for corporate treasuries," driven by profound historical logic: in an environment of weakened fiat currency credibility and lackluster traditional asset returns, algorithmically guaranteed scarcity and global liquidity have become new value anchors.

The declaration of Strategy founder Michael Saylor is coming true: "We are not buying Bitcoin; we are redefining the future of corporate wealth." As 141 publicly traded companies collectively pivot, a new financial era has begun—this is not just a replacement of assets but a transformation of the philosophy of value storage.

The ultimate significance of corporate Bitcoin strategies may not lie in short-term gains but in reflecting on and transcending the traditional financial system. In this silent capital revolution, pioneers are quietly writing the wealth map for the next decade.

The world has never stopped reshaping value; this time, algorithms have become the authors of the new rules.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。