Author: 0xjacobzhao and ChatGPT 4o

In the current cryptocurrency industry, stablecoin payments and DeFi applications are among the few validated sectors with real demand and long-term value. At the same time, the flourishing Agent is gradually becoming the practical interface form in the AI industry, serving as a key intermediary layer connecting AI capabilities with user needs.

In the fusion of Crypto and AI, especially in the direction where AI technology feeds back into Crypto applications, current explorations mainly focus on three typical scenarios:

- Conversational Interaction Agents: Primarily chatbots, companions, and assistants. Although most are still wrappers around general large models, their low development threshold and natural interaction, combined with token incentives, have made them the first forms pushed to the market to gain user attention.

- Information Integration Agents: Focused on the intelligent integration of online and on-chain information. Projects like Kaito and AIXBT have achieved success in the online but non-chain information search integration field, while on-chain data integration is still in the exploratory stage with no obvious standout projects.

- Strategy Execution Agents: Centered around stablecoin payments and DeFi strategy execution, extending into two major directions: Agent Payment and DeFAI. These agents are more deeply embedded in on-chain trading and asset management logic, with the potential to break through speculation bottlenecks and form intelligent execution infrastructure with financial efficiency and sustainable returns.

This article will focus on the evolution path of the fusion of DeFi and AI, outlining its development stages from automation to intelligence, and analyzing the infrastructure, scenario space, and key challenges of strategy execution agents.

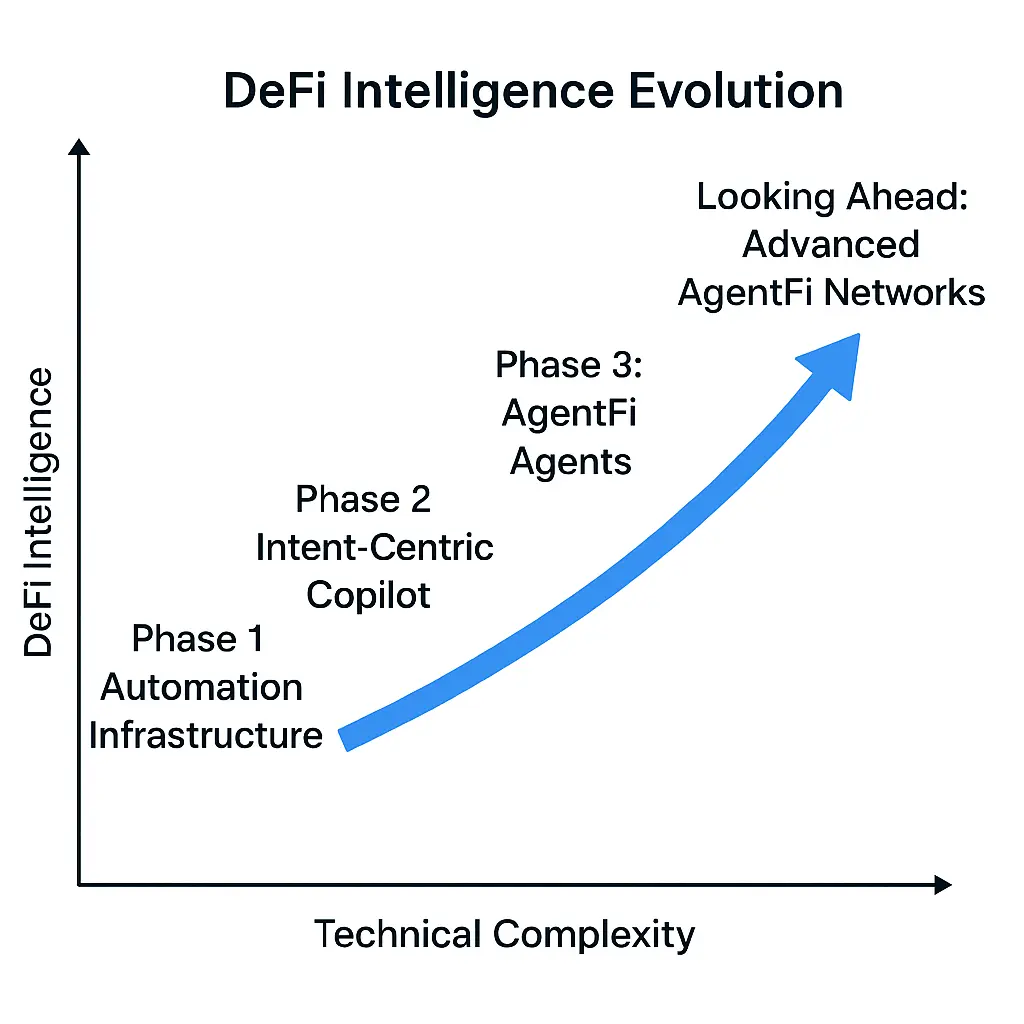

Three Stages of DeFi Intelligence: The Leap from Automation, Copilot to AgentFi

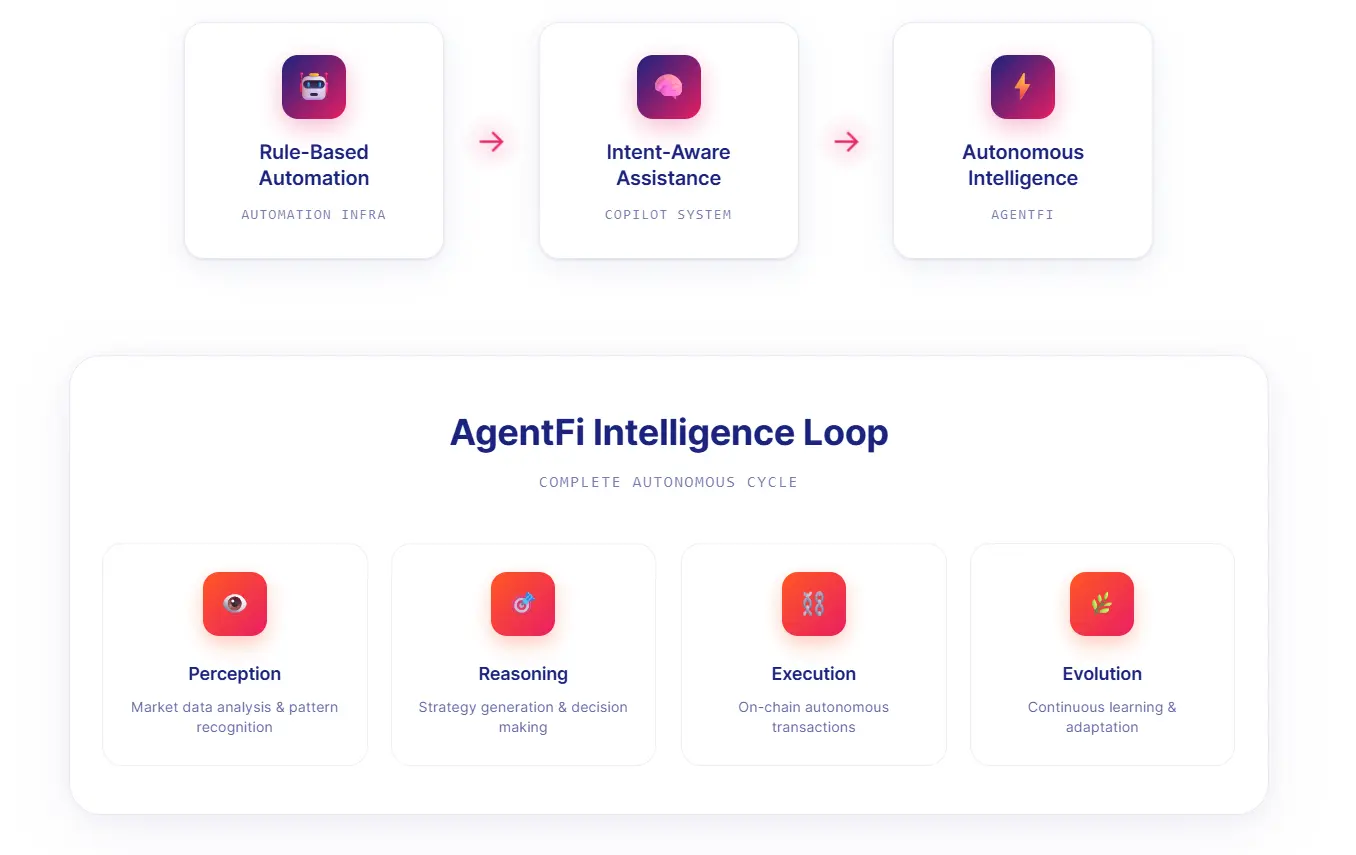

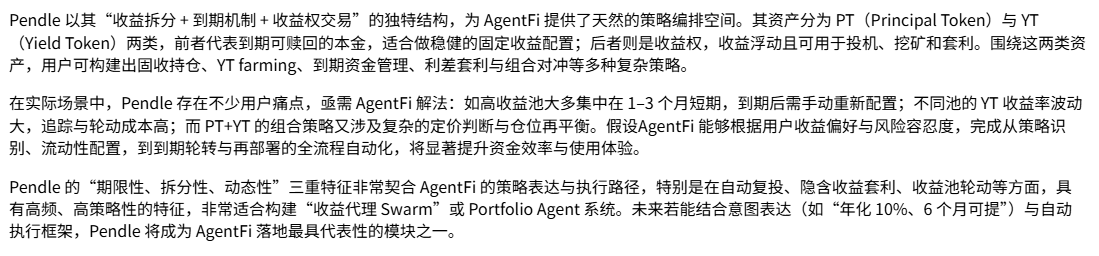

In the evolution of DeFi intelligence, we can categorize system capabilities into three stages: Automation, Intent-Centric Copilot, and AgentFi.

- Automation resembles a rule trigger: executing fixed tasks based on preset conditions, such as arbitrage, rebalancing, and stop-loss, without generating strategies or operating independently.

- Copilot introduces intent recognition and semantic parsing capabilities, where users input natural language, and the system understands, breaks down, and suggests execution paths, but ultimately requires user confirmation, leaving the execution chain open.

- AgentFi represents a complete "perception → reasoning/strategy generation → on-chain execution → evolution" intelligent closed loop, embodying an intelligent agent with on-chain autonomous execution and continuous evolution capabilities.

Dimensions

Automation Infra

Intent-Centric Copilot

AgentFi

Core Logic

Rule trigger + conditional execution

Intent recognition + operation guidance

Strategy closed loop + autonomous execution

Execution Method

Triggered execution based on preset conditions (if-then)

Understanding user instructions, assisting in operation breakdown

Fully autonomous perception, judgment, execution

User Interaction

No interaction, execution is passively triggered

Users express intent through prompts, system assists in breakdown

No human interaction required, can collaborate with humans/agents

Intelligence Level

Low, process automation

Medium, with interactive understanding

High, autonomous strategy generation and evolution

Strategy Capability

None, executes preset tasks

Limited, relies on user instructions

Strong, can self-learn and optimize combinations

Implementation Difficulty

Low, backend service-oriented

Medium, requires strong frontend interaction design

High, requires deep collaboration of AI/execution infrastructure

On-Chain Execution

✅ Perception

❌ Decision (fixed rule trigger)

✅ Supports simple execution

✅ Perception

✅ Decision

⚠️ Execution requires user confirmation

✅ Perception

✅ Decision

✅ Complete closed-loop on-chain execution

Typical Representatives

Gelato, Mimic

HeyElsa.ai, Bankr

Giza ARMA

To determine whether a project truly belongs to AgentFi, it must meet at least three of the following five core criteria:

- Autonomous perception of on-chain status/market signals (not static input, but real-time monitoring)

- Capability for strategy generation and combination (not preset strategies, but able to formulate action plans based on context)

- Ability to autonomously execute operations on-chain (no user interaction required, capable of executing complex operations like swap/lend/stake)

- Possesses persistent state and evolution capabilities (agents have a lifecycle, can operate long-term and self-adjust based on feedback)

- Has an Agent-Native architecture (such as dedicated Agent SDKs, managed execution environments, Agent middleware, etc.)

In other words, automated trading ≠ Copilot, and even more ≠ AgentFi: automated trading is merely a "rule trigger," while Copilot can understand user intent and provide operational suggestions but still relies on human participation; true AgentFi is an "intelligent agent with perception, reasoning, and on-chain autonomous execution capabilities," capable of completing strategy closed loops and continuous evolution without human intervention.

Analysis of DeFi Scenario Intelligence Adaptability:

In the DeFi (Decentralized Finance) system, core application scenarios can be roughly divided into asset circulation and exchange types and yield-based financial types. We believe that these two types of scenarios exhibit significant differences in adaptability along the intelligence path:

1. Asset Circulation and Exchange Scenarios

Asset circulation and exchange scenarios primarily involve atomic interactions, including swap transactions, cross-chain bridges, and fiat currency deposits and withdrawals. Their essential characteristic is "intent-driven + single atomic interaction," where the trading process does not involve yield strategies, state maintenance, or evolution logic, making them more suitable for the lightweight execution path of Intent-Centric Copilot, rather than AgentFi.

Due to their lower engineering threshold and simple interactions, most DeFAI projects currently on the market are at this stage, which do not constitute AgentFi closed-loop intelligent agents; however, a few advanced complex swap strategies (such as cross-asset arbitrage, perpetual hedge LP, leverage rebalancing, etc.) actually require the capabilities of AI agents, which are still in the early exploratory stage.

Scenario Category

Is there continuous yield?

AgentFi Adaptability

Engineering Implementation Difficulty

Explanation

Swap Transactions

❌ No

⚠️ Partially adaptable (only intent transactions are not true AgentFi)

✅ Easy to implement

Single atomic operation (e.g., currency exchange), no strategy state accumulation, suitable for Copilot invocation.

Cross-Chain Bridges

❌ No

❌ Weak

✅ Easy to implement

Cross-chain is intermediary transmission, not involving strategy planning and adjustment, minimal AI participation.

Fiat Currency Deposits and Withdrawals

❌ No

❌ None

❌ Uncontrollable

Highly dependent on CeFi channels and compliance processes, on-chain agents cannot autonomously initiate operations.

Aggregation Optimization

⚠️ Not necessarily

⚠️ Partially adaptable

✅ Medium

Primarily automated tools; if able to combine multi-platform quotes or maximize yield paths, can be executed by lightweight agents, but difficult to evolve into long-term intelligent agents.

✅ Swap Transaction Combinations

✅ Potential for yield

✅ Not mature

❌ Difficult to implement

For complex strategies like cross-asset arbitrage, perpetual hedge LP, dynamic position adjustment, etc., require complex strategy engines to support, currently in prototype stage with no available agents.

2. Asset Yield Financial Scenarios

Asset yield financial scenarios have clear yield objectives, complex strategy combination spaces, and dynamic state management needs, naturally fitting the AgentFi model of "strategy closed loop + autonomous execution." Their core features are as follows:

- Quantifiable yield objectives (APR / APY) facilitate agents in establishing optimization functions;

- Broad strategy combination space, covering multiple assets, multiple timeframes, multiple platforms, and multiple interaction processes;

- Operations require frequent management and real-time adjustments, suitable for execution and maintenance by on-chain intelligent agents.

Ranking

Scenario Category

Is there continuous yield?

AgentFi Adaptability

Engineering Difficulty

Explanation

1

Liquidity Mining

✅ Yes

✅✅✅ Extremely high

❌ High

Strategies require frequent dynamic adjustments (e.g., reinvestment, migration, dual pool strategies, etc.), most suitable for deploying AI strategy agents.

2

Lending

✅ Yes

✅✅✅ Extremely high

✅ Low

Interest rate fluctuations + collateral status readable, risk warnings and automatic adjustments are easy to implement.

3

Pendle (PT/YT Yield Rights Trading)

✅ Yes

✅✅ High

❌ High

Diverse yield terms and structures, complex combination trading, agents can optimize buying and selling timing and yield stability.

4

Funding Rate Arbitrage (Perp/CeFi/DeFi Mixed)

✅ Yes

✅✅ High

❌ Extremely high

Multi-market arbitrage has AI advantages, but the complexity of off-chain interactions and collaboration is very high, still in the exploratory stage.

5

Staking / Restaking / LRT Strategy Combinations

⚠️ Fixed yield

⚠️ Conditionally adaptable

⚠️ Medium

Static staking is not suitable for agents, but dynamic combinations of multiple LSTs + lending + LP can involve agents.

6

RWA (Real World Assets)

⚠️ Stable yield

❌ Low

⚠️ Compliance heavy

Stable yield structure, high compliance thresholds, and lack of interoperability between protocols, short-term does not have space for AgentFi strategy implementation.

Due to multiple factors such as yield terms, volatility frequency, on-chain data complexity, cross-protocol integration difficulty, and compliance restrictions, the adaptability and engineering feasibility of different yield scenarios in the AgentFi dimension exhibit significant differences, with priority recommendations as follows:

High-Priority Business Implementation Directions:

- Lending / Borrowing: Interest rate fluctuations are easy to track with standardized execution logic, suitable for lightweight intelligent agents.

- Yield Farming: Pools are dynamic and frequent, with a large strategy combination space and high yield fluctuations. AgentFi can significantly optimize annual returns and interaction efficiency, but engineering implementation poses certain challenges.

Medium to Long-Term Exploratory Layout Directions:

- Pendle Yield Rights Trading: Clear time dimensions and yield curves, suitable for agents to manage maturity rotations and inter-pool arbitrage.

- Funding Rate Arbitrage: Theoretical yields are considerable, but challenges in cross-market execution and off-chain interactions need to be addressed, with high engineering difficulty.

- LRT Dynamic Combination Structure: Static staking is not suitable; attempts can be made to automatically adjust strategies like LRT + LP + Lending.

- RWA Multi-Asset Portfolio Management: Difficult to implement in the short term, but agents can assist in portfolio optimization and maturity strategies.

Introduction to DeFi Scenario Intelligence Projects:

1. Automation Tools (Automation Infra): Rule Triggering and Conditional Execution

Gelato is one of the earliest infrastructures for DeFi automation, previously providing conditional trigger task execution support for protocols like Aave and Reflexer, but it has now transformed into a Rollup as a Service provider. The main battlefield for on-chain automation has also shifted to DeFi asset management platforms (DeFi Saver, Instadapp). These platforms integrate standardized automated execution modules, including limit order settings, liquidation protection, automatic rebalancing, DCA, grid strategies, etc. Additionally, we see some more complex DeFi automation tool platform projects:

Mimic.fi (https://www.mimic.fi/)

Mimic.fi is an on-chain automation platform serving DeFi developers and projects, supporting the construction of programmable automation tasks on chains like Arbitrum, Base, and Optimism. Its core functionality is achieved through "if-then" rule triggers for cross-protocol operation automation, with an architecture divided into three layers: Planning (task and trigger definition), Execution (intent broadcasting and execution bidding), and Security (triple verification and security control). Currently, it adopts an SDK integration method, and the product is still in the early deployment stage.

AFI Protocol (https://www.afiprotocol.ai/)

AFI Protocol is an algorithm-driven agent execution network that supports 24/7 unmanaged automation operations, focusing on solving issues of execution decentralization, strategy thresholds, and risk response in DeFi. Its design targets institutions and advanced users, providing orchestrated strategies, permission management, and SDK tools, and has launched the yield-bearing stablecoin afiUSD as its native asset. It is currently in the Sonic Labs internal testing phase and has not yet been publicly launched or opened for retail user access.

2. Intent-Centric Copilot: Intent Expression and Execution Suggestions

The DeFAI concept, which was once popular at the end of 2024, aside from some speculative hype centered around meme tokens, most projects essentially belong to the Intent-Centric Copilot type—expressing user intent through natural language, with the system providing trading suggestions or completing basic on-chain operations. Its core capability remains at the "intent recognition + Copilot-style assisted execution" stage, lacking a complete strategy closed loop and continuous optimization mechanism. Many products exhibit significant shortcomings in semantic understanding, cross-protocol invocation, and feedback response, leading to generally poor user experiences and relatively limited functional boundaries.

HeyElsa (https://app.heyelsa.ai/)

HeyElsa is an AI Copilot positioned for Web3 scenarios, empowering users to complete various on-chain operations, including trading, cross-chain bridging, NFT purchases, stop-loss settings, and Zora token creation, through natural language interaction. As a multifunctional conversational crypto assistant, it covers a range from novice users to advanced traders (including highly active degen groups) and currently supports real-time interaction across more than 10 mainstream blockchains. The platform's daily trading volume has reached $1 million, with daily active users maintained between 3,000 and 5,000. The system has integrated yield optimization strategies and automated intent execution modules, initially building the foundational capability framework for AgentFi applications.

Bankr (https://bankr.bot/)

Bankr is an intent trading assistant that integrates AI, DeFi, and social scenarios, allowing users to issue commands in natural language on the X platform or dedicated terminals to complete operations such as swaps, limit orders, cross-chain bridging, token issuance, and NFT minting, supporting Base, Solana, Polygon, and Ethereum mainnet. Bankr has built a complete Intent → Compile → Execute link, emphasizing a minimalist trading experience and seamless operations within a social environment, and activates the ecosystem through token incentives and revenue-sharing mechanisms.

Griffain (https://griffain.com/)

Griffain is a multifunctional AI agent platform deployed on Solana, supporting users in natural language interaction with the Griffain Copilot to perform on-chain operations such as asset queries, swaps, NFT trading, and LP management. The platform includes multiple intelligent agent modules and encourages community participation in agent creation and sharing. Technically built on the Anchor Framework and components like Jupiter and Tensor, it emphasizes mobile adaptation and frontend composability. Currently, it supports over 10 core agent modules, demonstrating strong execution capabilities and ecological linkage.

Symphony (https://www.symphony.io/)

Symphony is an on-chain execution infrastructure for AI agents, building a full-stack system covering intent modeling, intelligent path discovery, RFQ execution, and account abstraction, aiming to become the core module of the DeFi intelligent execution layer. The platform has launched the conversational assistant Sympson, which features market query and strategy suggestion functions, but on-chain execution has not yet been opened. Symphony provides the core components needed for AgentFi, which can support collaborative execution and cross-chain operations among multiple agents in the future.

Hey Anon (https://heyanon.ai/)

HeyAnon is a DeFAI platform that combines intent interaction, on-chain execution, and intelligence analysis, supporting multi-chain deployment (Ethereum, Base, Solana, etc.) and cross-chain bridging (LayerZero, deBridge). Users can complete operations such as swaps, lending, and staking through natural language and obtain on-chain sentiment and market dynamics analysis. Although the project has gained high attention due to founder Sesta, it is still in the Copilot stage, with core strategies and execution intelligence not fully realized, and long-term development needs to be observed.

Project Name

Core Positioning

Does it have on-chain execution?

Brief Review

Rating

HeyElsa

Conversational DeFi assistant for novices or degens

⚠️ Limited (basic on-chain interaction)

Intent → Agent → execution closed loop is initially formed, strongest multi-chain support capability, user-friendly interaction, and clear positioning.

4

Bankr

Natural language trading assistant + social embedding

⚠️ Limited (Beta 0.5)

Can execute basic trading operations, interface is rudimentary but the closed loop is taking shape, user social embedding experience is prominent.

3.5

Griffain

Multi-agent Copilot platform on Solana

⚠️ Limited (basic functionality)

Supports multiple module calls, but strategy combination and intelligence are relatively weak, Solana limits its multi-chain adaptability.

3.0

Symphony

Cross-chain execution infrastructure + account abstraction

❌ No (only conversational suggestions)

Solid architecture with key modules needed for AgentFi execution, but not connected to actual user scenarios.

2.0

HeyAnon

Multi-chain DeFi intent assistant + market intelligence analysis

❌ No (only text dialogue)

Product remains at the Q&A level, lacks actual on-chain capabilities, has not formed an execution closed loop, and contains some market hype elements.

1.5

The above rating system is primarily based on the current usability, user experience, and feasibility of executing the public roadmap, and has a certain subjectivity. Please note that this assessment does not involve code security checks and does not constitute investment advice; your understanding is appreciated.

3. AgentFi Intelligent Agents: Strategy Closed Loop and Autonomous Execution

We believe that AgentFi is a more advanced form on the path of DeFi intelligence leap compared to Intent Copilot. Agents possess independent yield strategies and on-chain automatic execution capabilities, significantly enhancing users' strategy execution efficiency and capital utilization. By 2025, we are pleased to see more and more AgentFi projects being launched or planned, primarily focusing on lending and liquidity mining directions, with representative projects including Giza ARMA, Theoriq AlphaSwarm, Almanak, Brahma, and the Olas series.

Giza ARMA (https://arma.xyz/)

ARMA is the intelligent agent product launched by Giza, specifically designed for stablecoin cross-protocol yield optimization. It is deployed on the Base network and supports multiple mainstream lending protocols such as Aave, Morpho, Compound, and Moonwell, with core capabilities including cross-protocol rebalancing, automatic compounding, and intelligent token swapping. ARMA's strategy system can monitor stablecoin APR, transaction costs, and yield differences in real-time, automatically adjusting capital allocation, with actual yields significantly higher than static holdings. Its architecture consists of smart accounts, session keys, core agent logic, protocol access, risk management, and accounting modules, ensuring safe and efficient automated execution in a non-custodial mode.

ARMA is now fully online and continuously iterating. With its modular architecture, security mechanisms, and good early operational data, ARMA has become one of the most viable agent products in DeFi automated yield management, being one of the few AgentFi projects that combine deep concepts with practical products.

Reference research report "A New Paradigm for Stablecoin Yields: From AgentFi to XenoFi" link: https://x.com/0xjacobzhao/status/1925226999699964158

Theoriq (https://www.theoriq.ai/)

Theoriq Alpha Protocol is a multi-agent collaboration protocol focused on DeFi scenarios, with its core product Alpha Swarm concentrating on liquidity management, aiming to build a full-chain automated closed loop of "perception—decision—execution." It consists of three types of agents: Portal (on-chain signal perception), Knowledge (data analysis and strategy selection), and LP Assistant (strategy execution), enabling dynamic asset allocation and yield optimization without human intervention. The underlying Alpha Protocol provides agent registration, communication, parameter configuration, and development tool support, serving as the operational foundation for the entire Swarm collaborative system, regarded as the "agent operating system" for DeFi. Through AlphaStudio, users can browse, invoke, and combine various agents to build a modular and scalable automated trading strategy network.

As one of the first projects on the Kaito Capital Launchpad, Theoriq recently completed a $84 million community fundraising and is about to conduct its TGE. Theoriq has recently launched the AlphaSwarm Community Beta testnet, with the mainnet version set to be officially released soon.

Reference research report "Theoriq Research Report: The Evolution of AgentFi in Liquidity Mining Yields" link: https://x.com/0xjacobzhao/status/1948545449016918511

Almanak (https://almanak.co/)

Almanak is an intelligent agent platform for DeFi strategy automation, combining a non-custodial security architecture with a Python strategy engine to help traders and developers deploy sustainable on-chain strategies.

The platform's core consists of Deployment (execution components), Strategy (strategy logic), Wallet (Safe+Zodiac security module), and Vault (strategy assetization), supporting yield optimization, cross-protocol interaction, liquidity provision, and automated trading. Compared to traditional DeFi tools, Almanak emphasizes AI-assisted market perception and risk management capabilities, already possessing 24/7 intelligent operation capabilities, and plans to introduce multi-agent and AI decision-making systems, aiming to create the next generation of AgentFi infrastructure.

Almanak's strategy system is built on a state machine program in Python, serving as the "decision brain" for each agent, automatically formulating and executing on-chain operations based on market data, wallet status, and user-defined conditions. The platform provides a complete Strategy Framework, supporting the encapsulation of on-chain trading, lending, liquidity provision, and other operational modules (Action Bundle) without the need to write underlying contract code, and ensures strategy confidentiality and operational security through cryptographic isolation, permission control, and monitoring mechanisms. Users can write strategies via SDK, and future support for natural language strategy creation is planned, enabling a smooth transition from complex logic to a no-code experience.

Currently, the product has launched a USDC lending Vault based on the Ethereum mainnet, while more complex trading strategies are in the testing phase and require whitelist access. Almanak is set to join the cookie.fun cSNAPS campaign for community public fundraising, which is highly anticipated.

Brahma (https://brahma.fi/)

Brahma is positioned as "The Orchestration Layer for Internet Finance," dedicated to abstracting on-chain accounts, execution logic, and off-chain payment processes, helping users and developers efficiently manage on-chain and real-world assets. Through Smart Accounts, continuously running on-chain agents, and the Capital Orchestration Stack, Brahma provides users with an intelligent capital management experience without backend operations.

Currently, representative agents that have been launched include:

- Felix Agent: Automatically optimizes feUSD debt warehouse interest rates, preventing liquidation and saving interest;

- Surge & Purge Agent: Tracks volatility and executes automated trading;

- Morpho Agent: Deploys and rebalances Morpho treasury funds;

- ConsoleKit Framework: Supports the integration of any AI model, unifying execution strategies and asset management.

Olas (https://olas.network/)

The AgentFi products launched by Olas Network, the BabyDegen series, include Modius Agent and Optimus Agent, both deployed on-chain, covering a multi-chain ecosystem (Solana, Mode, Optimism, Base), and possessing complete on-chain interaction capabilities, strategy execution capabilities, and autonomous asset management mechanisms.

- BabyDegen is an AI trading agent running on Solana, implementing automatic buying and selling based on CoinGecko data and community strategy libraries, currently integrated with Jupiter DEX and in the Alpha testing phase.

- Modius Agent targets the Mode network, focusing on USDC and ETH portfolio management, already integrated with Balancer, Sturdy, and Velodrome, supporting users to set preferences for 24/7 automatic strategy execution.

- Optimus Agent is compatible with the three mainnets of Mode, Optimism, and Base, integrating more protocols such as Uniswap and Velodrome, providing flexible multi-chain strategy combinations suitable for intermediate to advanced users to build automated asset management systems.

Axal (https://www.getaxal.com/)

Axal's core product Autopilot Yield offers a one-stop, non-custodial, verifiable yield management experience, integrating mainstream protocols such as Aave, Morpho, Kamino, Pendle, and Hyperliquid, with on-chain strategy execution and risk control as the core design philosophy, empowering ordinary users to easily enter complex on-chain yield networks.

- Conservative Strategy focuses on low-risk, mainstream stable yield scenarios, primarily deploying funds on well-established platforms like Aave and Morpho, with an annual yield of about 5–7%. It achieves steady appreciation through TVL monitoring, stop-loss mechanisms, and top strategy screening, suitable for users pursuing capital safety and long-term returns.

- Balanced Strategy offers medium risk with higher yield potential (10–20% APY), using wrapped stablecoins (such as feUSD, USDxL), liquidity provision, and arbitrage neutral positions. The strategies are more diverse, with complex yield compositions, controlled through Axal's automatic monitoring and dynamic adjustments.

- Aggressive Strategy targets users with a high-risk, high-reward preference, covering strategies such as high-leverage LP, cross-platform linking, low liquidity asset market making, and volatility capture, with theoretical annual yields potentially exceeding 50%. Axal's intelligent agents can set stop-loss, automatic exit, and redeployment logic at the strategy level, providing users with a final layer of protection in high-risk environments.

Fungi.ag (https://fungi.ag/)

Fungi.ag is a fully automated AI agent designed for USDC yield optimization, capable of automatically reallocating funds among multiple lending protocols such as Aave, Morpho, Moonwell, and Fluid, achieving optimal capital allocation based on yield rates, fees, and risks. Users do not need to operate manually; they only need to authorize a Session Key to enable the agent to automatically execute strategies in a non-custodial mode. Currently, it supports the Base chain and plans to expand to Arbitrum and Optimism. Fungi also opens the Hypha custom strategy script interface, supporting community development of strategies such as DCA and arbitrage, and co-building the ecosystem through DAO and social platforms.

ZyFAI (https://www.zyf.ai/)

ZyFAI is a DeFi intelligent assistant platform deployed on the Base and Sonic networks, combining an on-chain interaction interface with AI-assisted modules to help users manage assets intelligently under different risk preferences. Its core is divided into three types of strategies:

- Safe Strategy: Designed for conservative users, focusing on mainstream protocols such as Aave, Morpho, Compound, Moonwell, and Spark that have been audited and verified, emphasizing single-sided deposits of USDC and stable yield opportunities, highlighting asset safety and long-term reliability.

- Yieldor Strategy: Targeted at high-risk preference users, requiring the holding of 20,000 ZFI tokens to unlock, covering high-yield protocols including Pendle, YieldFi, Harvest Finance, and Wasabi, supporting complex strategies such as DEX LP, yield splitting, and leveraged vaults, with future expansions planned for looping and delta-neutral structured products.

- Airdrop Strategy: A future strategy still under development, aimed at obtaining more airdrop incentives.

Project Name

Core Positioning

Does it have on-chain execution?

Brief Review

Rating

Giza ARMA

Stablecoin yield optimization agent

✅ Complete

Well-functioning, good security mechanisms, excellent yield performance, currently a representative product of AgentFi.

4.5

Theoriq

DeFi intelligent execution system

⚠️ AlphaSwarm whitelist testing, temporarily no agent automatic execution

Complete architecture, solid team, high technical content, on-chain execution not yet open.

4

Almanak

Quantitative strategy automation platform

⚠️ USDC lending has been launched, whitelist testing ongoing

Strong strategy customization, excellent security design, but the product is not yet open, with high testing thresholds.

4

Brahma

Multi-strategy execution intelligent account platform

✅ TWAP / DCA and Morpho Agent have been launched, others in development

Multiple functional agents have been deployed, emphasizing ConsoleKit modular integration, user-friendly experience, and strong strategy capabilities.

4

Olas

Multi-chain DeFi portfolio management agent

✅ Multi-chain operation (Mode, Base, etc.), requires installation of the Pearl system

The BabyDegen/Modius/Optimus three agents have clear functions, a closed-loop for strategy execution, and strong autonomy

4

Axal

Multi-strategy risk-return agent

⚠️ Requires whitelist application

Offers Conservative / Balanced / Aggressive strategies, product not yet launched

3.5

Fungi.ag

Stablecoin lending yield optimization

✅ Supports Base, launched Open Beta version

Functionally similar to ARMA, with weaker technical and ecological performance, currently more of a follower role

3.5

ZyFAI

AI-assisted asset management platform

✅ Base + Sonic

Clear strategy division (Safe/Yieldor), user-friendly operation paths, but generally weaker in combination management AI

3

The Real Path and High-level Imagination of AgentFi

Undoubtedly, lending and yield farming are the most realistically valuable and easily implementable business scenarios for AgentFi, having matured in the DeFi world and naturally suited for the introduction of agents due to the following common characteristics:

Wide strategy space with multiple optimization dimensions

In lending, besides chasing the highest yield, strategies such as interest rate arbitrage, leverage cycles, debt refinancing, and liquidation protection can be developed;

Yield farming encompasses a rich array of strategy orchestration space, including APR tracking, LP rebalancing, compound reinvestment, and strategy combinations.

Highly dynamic, suitable for real-time perception and response by agents: Changes in interest rates, fluctuations in TVL, changes in reward structures, new pool launches, and the emergence of new protocols all affect the optimal strategy path and require dynamic adjustments.

Existence of execution window opportunity costs, significant value of automation: Funds not allocated to the optimal pool will drag down yields and need to be automatically migrated.

It is particularly noteworthy that lending agents, due to stable data structures and relatively simple strategies, have a high feasibility for implementation. For example, Giza's Arma and other lending AgentFi projects have officially launched. In contrast, the management of yield farming requires real-time responses to price fluctuations, volatility changes, and fee accumulation, placing extremely high demands on agents' data perception, strategy judgment, and on-chain execution. LP agents must not only accurately predict market conditions but also perform dynamic rebalancing and yield redistribution on-chain, making the engineering complexity relatively high. This is also a challenge that projects like Theoriq are working to overcome.

Beyond lending and yield farming, there are imaginative explorations for medium to long-term layout directions based on the adaptability of AgentFi:

Pendle Yield Rights Trading: Clear time dimension and yield curve, suitable for agent management of maturity rotation and inter-pool arbitrage

Funding Rate Arbitrage: Theoretical yields are considerable, but cross-market and cross-chain interaction challenges present significant engineering difficulties

Staking and Restaking: Naturally not well-suited for AgentFi, but dynamic combinations with LRT have certain possibilities

RWA Assets: US Treasury-like protocols are not ideal scenarios, but multi-asset portfolio management structures have exploratory value

Swap Trading Combinations, upgrading from Intent infrastructure to AgentFi strategy engine

DeFi Intelligent Evolution Roadmap: From Automation Tools to Agent Networks

In summary, we have witnessed the evolution path of DeFi intelligence from automation tools to intent assistants to agents.

The first stage is "Automation Tools (Automation Infra)," characterized by rule-triggered and condition-executed basic on-chain operation automation. For example, triggering trades or rebalancing tasks based on preset conditions such as time and price, with representative systems being underlying execution frameworks, typical projects include Gelato, Mimic, etc.

The second stage is "Intent-Centric Copilot," emphasizing the expression of user intent and the generation of execution suggestions. Systems in this stage are no longer limited to "what to do," but attempt to understand "what the user wants" and then provide the best execution path suggestions. Representative projects include Bankr and HeyElsa, primarily enhancing intent recognition and interaction experience to lower the barriers to DeFi usage.

The third stage is "AgentFi Agents," marking the formation of strategy closed loops and on-chain autonomous execution. Agents can automatically complete perception, decision-making, and execution based on real-time market conditions, user preferences, and strategy logic, truly achieving 24/7 non-custodial on-chain fund management. Meanwhile, AgentFi can autonomously manage user funds without requiring user authorization for each step, raising significant discussions about security and trust mechanisms, which also become unavoidable core issues in AgentFi design. Representative projects include Giza ARMA, Theoriq AlphaSwarm, Almanak, Brahma, etc., all of which have certain implementation capabilities in strategy deployment, security architecture, and product modules, forming the backbone of the current DeFi agent direction.

We look forward to the emergence of "Advanced AgentFi Agents" in the future, which not only achieve autonomous execution but also cover complex cross-protocol and cross-asset business scenarios. This is our vision for the advanced form of future DeFi intelligence:

- Pendle Yield Rights Trading: Future agents will fully take over maturity rotation and strategy orchestration, maximizing capital efficiency.

- Funding Rate Arbitrage: Cross-chain arbitrage agents are expected to precisely capture every opportunity in funding rate differentials.

- Swap Strategy Combinations: Swaps are key nodes in the multi-strategy yield paths of agents, achieving a leap in combined value.

- Staking and Restaking: Agents will continuously optimize staking combination strategies, dynamically balancing yield and risk.

- RWA Asset Management: As the on-chain world welcomes diversified physical assets, agents will allocate globally stable yield assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。