Original Author: @0xkyle__

Compiled by: Zen, PANews

The term "Internet Capital Market" encompasses many meanings. In today's context, the Internet Capital Market refers to the "alchemy" results born purely from the advantages of blockchain technology: financial technology that ignores geographical boundaries. You can use "magical internet currency" for lending, tokenize treasury bonds and private credit, issue stablecoins—in today's world where traditional finance intersects with digital assets, people refer to all of this as the "Internet Capital Market."

However, for veterans who have lived and breathed this asset class in the on-chain trading field, the meaning of the Internet Capital Market is not just "on-chain treasury bonds"—it refers to NFTs, DeFi, ICOs, and various speculative tools invented over the past decade, as well as tokens that have been tradable since the deployment of the first smart contract on Ethereum in 2015.

This article aims to focus on the original logic behind cryptocurrencies, narratives, tenfolds, hundredfolds, and airdrops, analyzing this aspect of the Internet Capital Market. We are about to welcome a "new meta," as described by OG crypto players. To analyze this, we must first observe these capital formation mechanisms and the differences they bring.

Evolution of Market Financing Mechanisms

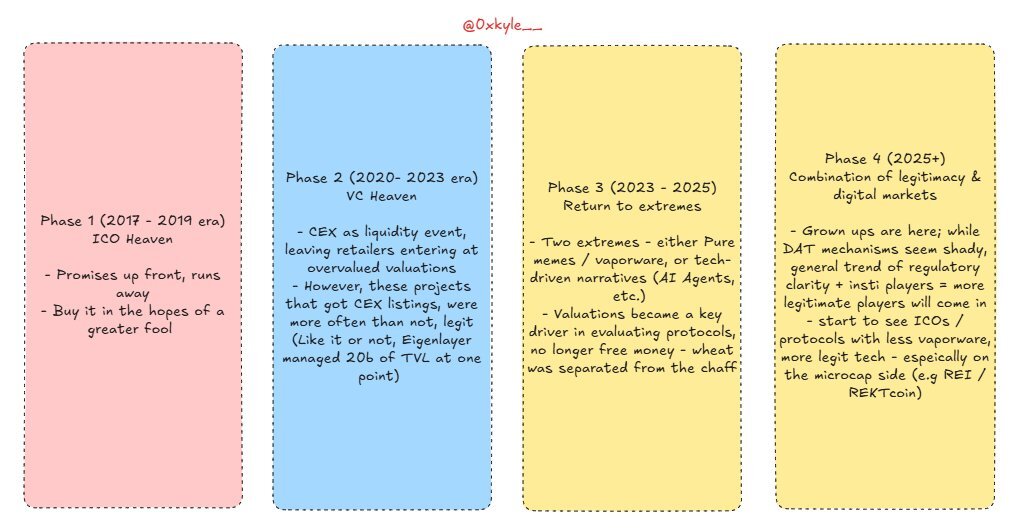

Looking back over the past few cycles, we see that market financing mechanisms are constantly changing. From ICOs to centralized exchange altcoins (CEX Alts), to meme coins… The above image summarizes this, which can be briefly summarized as:

Original ICOs (2017 Era)

In this mechanism, funding is based on the "promises" of the project parties, with the aim of selling to larger "fools." The technology is often not genuinely usable or provides no real value. Most of the time, it is a "pass-the-parcel" game. Typical cases include Bitconnect, Dentacoin, etc.

VC Paradise (2021 Bubble Period)

This wave attracted institutional capital, but looking back, it caused great harm to the industry—outrageous valuations and poor incentive designs (who would still work with a hundred million dollars?). However, this wave also brought more reliable products—so it cannot be dismissed entirely. Although inflationary valuations were severe, many of the protocols you love today were born from it. Take Ethena as an example: I really like it, but the mechanism of "giving too much too early" did harm its early performance of "token appreciation"; however, it is undeniably one of the best crypto products currently. This was also the era of the rise of projects like Solana and Uniswap. Even today, there may be disagreements about their governance or operations, but it cannot be denied that not everything was entirely bad.

Polarization

After the extreme return of the FTX collapse, the crypto space faced an existential crisis—distrust spread, and many began to believe that "everything is a scam." I once felt the same way, but we need to see the subtle differences. While it may seem like a casino, not everything is a casino—stablecoins and tokenization are uncovering tremendous value in real scenarios, not just issuing memes or trading pairs in niche assets like the dollar. During this stage, pure memecoin projects like dogwifhat, pepe, and more "serious" narratives, such as AI agents, emerged. Valuations fell sharply, and you might ask, "Is it all just memes?" But in reality, just because something is labeled as a "meme" does not mean it is destined to remain at that label stage. Maturity is a slow process, and some projects have crossed from "label" to "serious," such as REI.

Legitimacy and the Combination of Digital Markets

We are entering the "adult era"—institutions have arrived and are genuinely excited. However, having been "inside the factory" for a long time, seeing how "sausage is made," I can't help but hold a pessimistic view of Circle's IPO.

Knowing too much has become a curse—everything is labeled as "meme," which only causes you to lose faith. Looking at Ethereum: for two years, it was the worst-performing asset, and many heavy investors cut their losses and left, with the media constantly singing its demise.

However, look at the current situation: do you think Tom Lee knows (or cares) about the awkward video of the Ethereum Foundation leadership singing and dancing on stage? Do you think institutions like BlackRock, which launched tokenized funds on Ethereum, care about the Ethereum Foundation's "soy-boy mentality"?

The answer is no, and this is something you must internalize. Most cryptocurrencies have forgotten how to "dream," while traditional finance is learning to "dream" again. This will bring more opportunities—as digitalization and mainstreaming progress, more high-quality builders will dive in.

Future Landscape of the Internet Capital Market

This is what I mean by the Internet Capital Market. We are entering an unprecedented period of prosperity in the past five years—an ideal combination of regulation, technological strength, and capital, a significant portion of which will occur on-chain. I am not joking when I say that I believe some of the most valuable companies will issue tokens on-chain in the coming years.

In fact, this is already happening. Hyperliquid is the pinnacle representative of the Internet Capital Market. It did not accept VC investment and has no equity burdens; it is purely an on-chain token project that initially did not launch on exchanges.

To emphasize again: Hyperliquid was once a company with a market value of $40 billion, without roadshow materials or equity structure burdens. This pure on-chain giant took market dominance as soon as it appeared and is now moving towards an annual revenue of $1 billion—from zero to one. It is the purest embodiment of how the Internet Capital Market operates.

But please do not misunderstand; this is not me praising Hyperliquid. I believe that in the coming years, there will be more such cases. Isn't it exciting? We are moving towards a bountiful era—don't let your cynicism stifle the dreams of the past. Sadly, this is obvious to many, yet they are busy chasing a random garbage coin for a 50% return because that is what we have been trained to do over the past four years. It is time to have bigger dreams—the script has already been written.

Now, the shackles that bound us no longer exist. People have long been constrained by past structures—but in the era of the Internet Capital Market, having 5-10% of your own currency and turning it into a product worth $100 million to $1 billion will yield returns far beyond people's expectations.

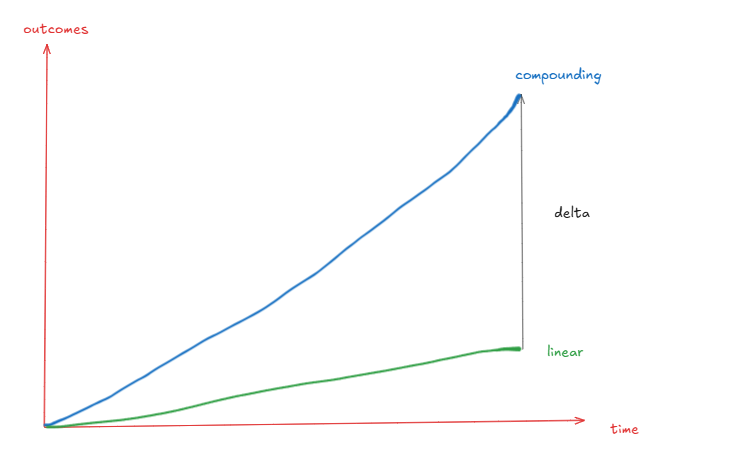

Yes, financing is still necessary, and ICOs are not without merit. But looking at Hyperliquid's path: if you have confidence in the product, issue on-chain tokens, retain sufficient shares, and let the market, the arbiter of truth, determine the value. What is the problem with capitalism? It makes participants too shortsighted. It does indeed push innovation in the right direction but fails to truly drive innovation. Too many people are satisfied with quick money and miss out on the greater returns that long-term compounding can bring.

Long-term thinking often leads to geometric rather than arithmetic results—for example, doubling in 2 years, increasing fivefold in 4 years, and increasing tenfold in 5 years.

Of course, you can develop a product and then abandon it to earn $10 million, or you can spend a few more years developing that product and earn $300 million.

Conclusion: From Speculation to True Ownership

Finally, let's talk about the speculative nature of the market. In the short term, the market is undoubtedly still a voting machine—"worthless" asset prices will rise, and "good assets" prices will exceed intrinsic value, with team sell-offs possibly repeating.

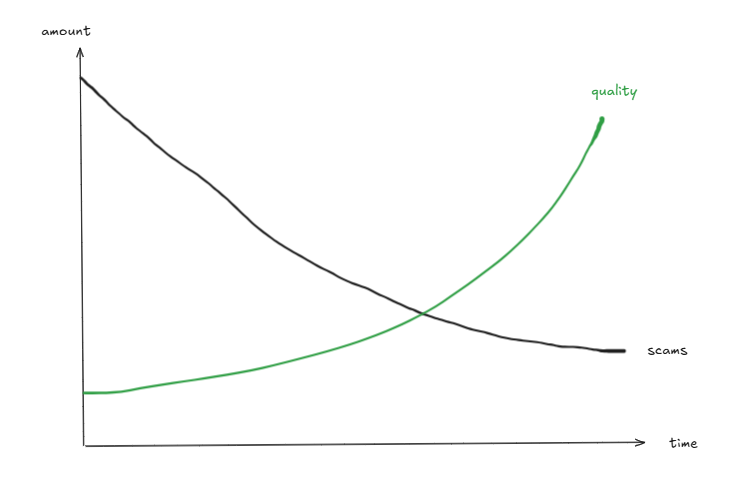

But the key point is that this wave of digitalization will attract more excellent, truly constructive founders to enter the field. I believe this is the turning point of the trend, which will give birth to more outstanding on-chain products.

Think of that schematic: it will never go to zero, but it doesn't have to go to zero. Look at Hyperliquid, Ethena, Aave—they all have $1 billion in annual revenue, stablecoin TVL reaching $10 billion, and net deposits of $60 billion. Look at Pengu, Rekt—totaling 197 trillion views, selling 2 million pieces of merchandise globally, and even having drinks on the shelves of 7-11 convenience stores across the U.S. They all have on-chain tokens backing them.

The more S/A level projects/founders there are, the less attention is paid to C-level and below founders—less focus on air coins and more focus on projects that can achieve compound growth.

We can argue whether they are overvalued or undervalued, but I would rather discuss this than return to an era where you could only buy "empty promises." An era where you were forced to purchase the assets of companies that sold promises but delivered no results. I would rather own something tangible than pretend to play a game of pass-the-parcel.

If you keep treating every coin as a "meme," you are wasting opportunities. The tokens issued by projects like Hyperliquid are no longer a fantasy. The next Steve Jobs is likely to issue tokens on-chain. Some of these assets will ultimately become on-chain giants that control the future of finance. And we all have the opportunity to buy them. Reducing it to "just a meme" is a great way to miss out on thousandfold returns.

This is the evolution of speculation: we have moved from trading worthless air to today, where we can truly own solid, durable, and most importantly, on-chain assets that will determine the future world.

It is time to regain faith, forget the shackles of the past, and reshape dreams. The future is bright; don't let the shadows of the past cloud your optimism for the future.

This—this is the future in my eyes: Internet. Capital. Markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。