In the midst of strategizing, we decide the outcome from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

Recently, Lin Chao has been busy trading, especially with the trend of ETH, which can basically be said to be moving in the direction Lin Chao expected without looking back (for details, see the previous article "ETH's Next Target, $4500"). During this time, many fans have messaged me, afraid of a pullback and not entering the market. When the index repeatedly rises, it is also when everyone experiences FOMO. In fact, it is not that the market has not provided opportunities, but rather that fear has taken over the mind, making people more hesitant to enter as prices rise, leading many investors to remain in cash during this round of rally. Those who missed out want to enter, while those already in the market do not know when it will turn back. How far can ETH go? Today, Lin Chao will provide a detailed analysis of ETH's future trend.

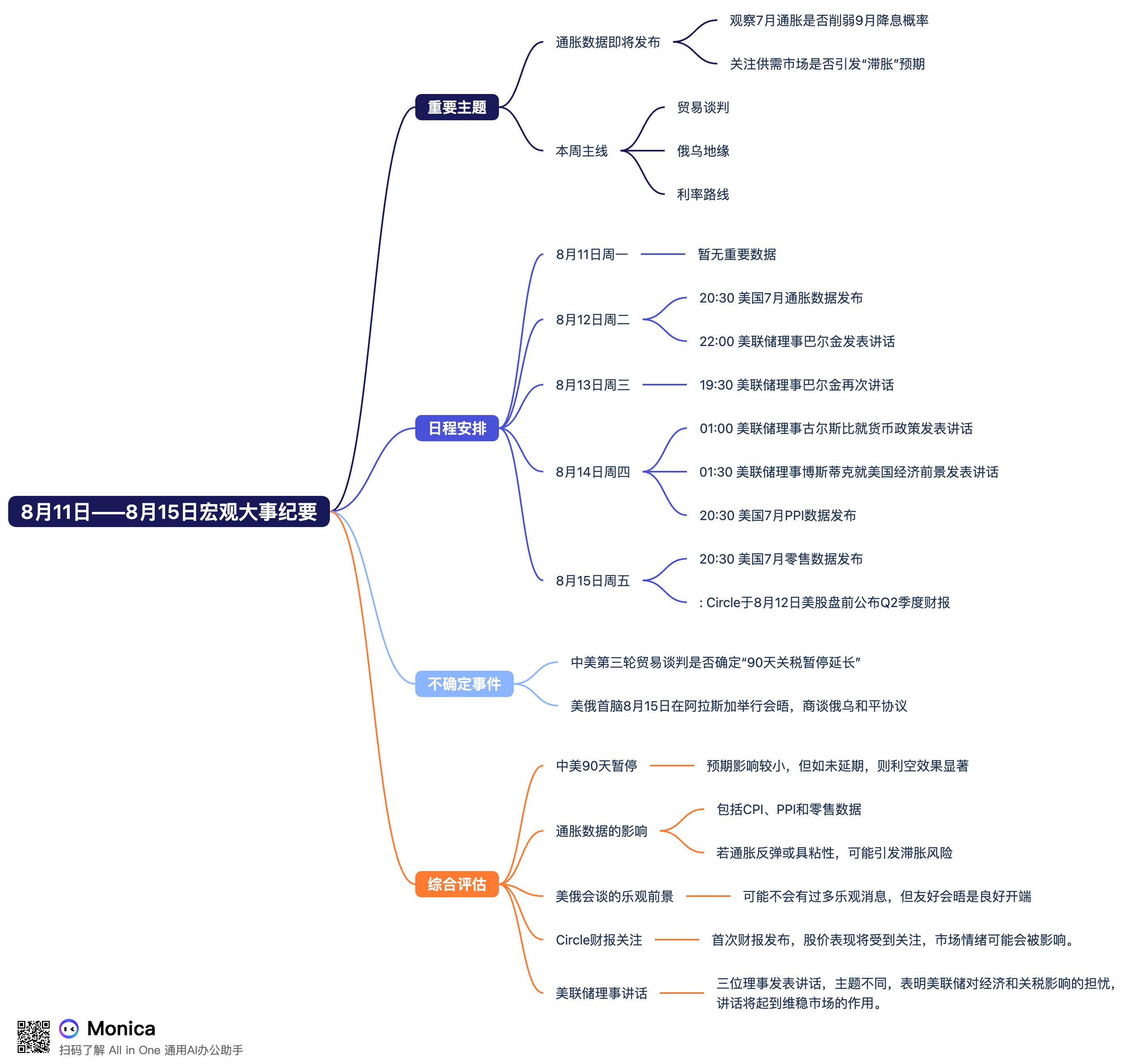

First, from a macro narrative perspective, the signals for the Federal Reserve to begin cutting interest rates are becoming increasingly clear. According to the latest data from CME's "FedWatch," the market is betting on a 90.7% probability of a rate cut in September, with a 46.5% chance of a cumulative 50 basis points cut in October. This globally watched shift in monetary policy is quietly changing the direction of capital flows and injecting new momentum into the cryptocurrency asset space.

In fact, sharp institutional capital has already taken action. The publicly traded company SharpLink is suspected of quickly converting the $200 million it recently raised into 52,809 ETH (worth $220 million) and staking it on the Ethereum network. The company's total ETH holdings have reached 621,000 (approximately $2.65 billion), with an average holding price of $3,226. Meanwhile, Trump-associated company World Liberty Financial has also announced the launch of a $1.5 billion cryptocurrency investment tool. The boundaries between traditional capital and the crypto world are rapidly dissolving.

However, the path of integration is not smooth. David Sacks, the White House AI and crypto affairs director, publicly questioned: Why do leading financial institutions like Bank of America, Morgan Stanley, and JPMorgan still prohibit or restrict their wealth management platforms (managing a total of $31 trillion in assets) from accessing Bitcoin ETFs? This exposes the traditional financial system's hesitation towards emerging assets. The conflict between institutional entry and existing rules has become a key variable in the market's evolution.

But a market driven by government backing will not change due to minor conflicts; the issuance of stablecoins is actually a significant force in the U.S. Treasury market. Tether recently disclosed that it holds over $100 billion in U.S. Treasury bonds, surpassing the holdings of sovereign nations like the UAE and Germany. Other issuers like Circle are also rapidly increasing their holdings. Lin Chao believes that if stablecoins continue to absorb deposits from the banking system, they could threaten the stability of the traditional credit system, even if their current share is small; their potential systemic impact cannot be ignored. However, this is also an inevitable path for the transformation of traditional finance. Banks are destined to be products of a bygone era.

Lin Chao's Summary

From the market perspective, it is now certain that ETH has broken through the $4100 resistance level, just as Lin Chao previously anticipated. When the index breaks out of the range, the next target is $4800. What is uncertain now is when it will reach that point and whether it will pull back for adjustments along the way. Based on the current market trend, standing above $4100 is very decisive, with no signs of hesitation. This indicates that the large institutions holding ETH do not want to turn back at this point. The expectation of interest rate cuts can still be leveraged for speculation, and this wave will not stop immediately. In fact, attentive investors should have already noticed that when BTC is on the rise, ETH tends to be relatively stagnant or even slightly pull back, indicating that ETH and BTC have begun to diverge. This is also why Lin Chao mentioned in previous articles that the later stage of the crypto market has entered a "difficulty mode." People can no longer rely on habitual thinking, believing that as long as BTC rises, the entire crypto market will rise.

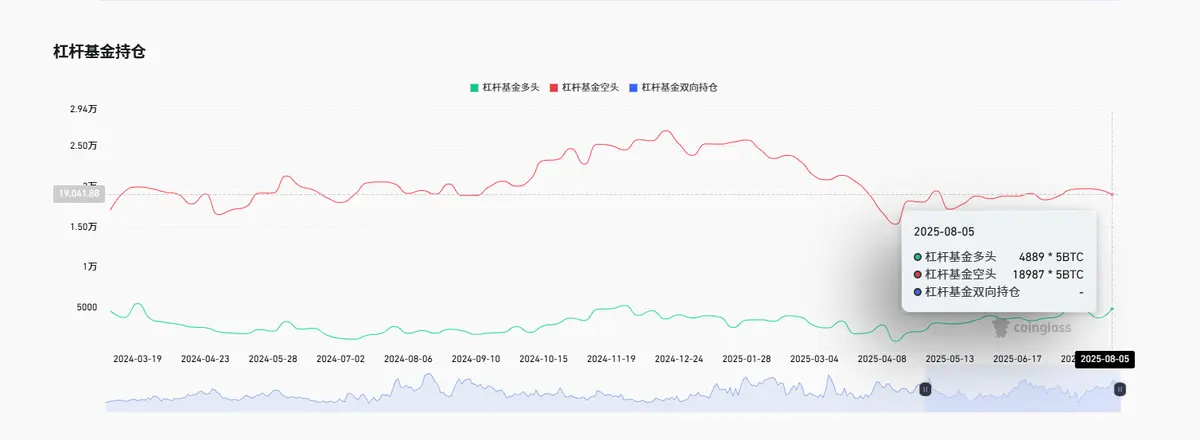

From on-chain holding data, the short sentiment among large holders and leveraged funds is concentrated and high. Lin Chao previously mentioned that the current situation is no longer a game between institutions and retail investors; it has long been a game between institutions, with retail investors merely following along. To put it bluntly, large institutions actually look down on the chips in the hands of retail investors. Big fish eat small fish, and small fish eat shrimp. Currently, the story of big fish eating small fish is unfolding, and retail investors can hold their positions with peace of mind.

We do not speculate on how the market will move; we only focus on the direction and make plans. When the market enters different stages, we should respond with different strategies. Now ETH has reached a stage where retail investors are hesitant to enter. In fact, maintaining a position with contracts can alleviate some of the FOMO emotions, but position control is key. At this stage, whether to participate in the market will have corresponding reasons. Those already in the market should not exit easily, and those in cash should not fear missing out. Next, we will see where the macro narrative will lead the market. It is very likely that a reversal will occur after the "good news is fully priced in." Lin Chao reminds everyone to always be prepared for a market pullback and to be a "smart investor."

If you are feeling lost—unable to understand the technology, unsure how to read the charts, not knowing when to enter the market, unable to set stop losses, not understanding take profits, randomly increasing positions, getting stuck while trying to bottom out, unable to hold onto profits, missing out on market opportunities… these are common issues for retail investors. Lin Chao can help you establish the correct trading mindset. A single profitable trade is worth more than a thousand words; repeatedly failing is not as good as finding the right direction. Instead of frequent operations, it is better to strike precisely, making each trade more valuable.

The success of investing depends not only on choosing good targets but also on when to buy and sell. Preserving capital and making good asset allocations are essential for steady progress in the ocean of investments. Life is like a long river flowing into the sea; what determines victory or defeat is never just the gains and losses of a single pass or a moment in time, but rather a well-thought-out plan followed by action, knowing when to stop and what to gain.

The global market is ever-changing, and the world is a whole. Follow Lin Chao to gain a top-tier global financial perspective.

This article is merely a personal opinion and does not constitute any trading advice. The crypto market has risks; invest cautiously!

For real-time consultation, feel free to follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。