By Omkar Godbole (All times ET unless indicated otherwise)

Well, it's that time of the month when the market holds its breath for the latest U.S. inflation figures, which set the tone for the Fed's interest-rate policy. Bloomberg's consensus estimates indicate the July figure, due at 8:30 a.m., is likely to show an increase in prices, driven by President Trump's tariffs.

Some traders have already begun hedging with short-dated bitcoin (BTC) put options in the $115,000–$118,000 range.

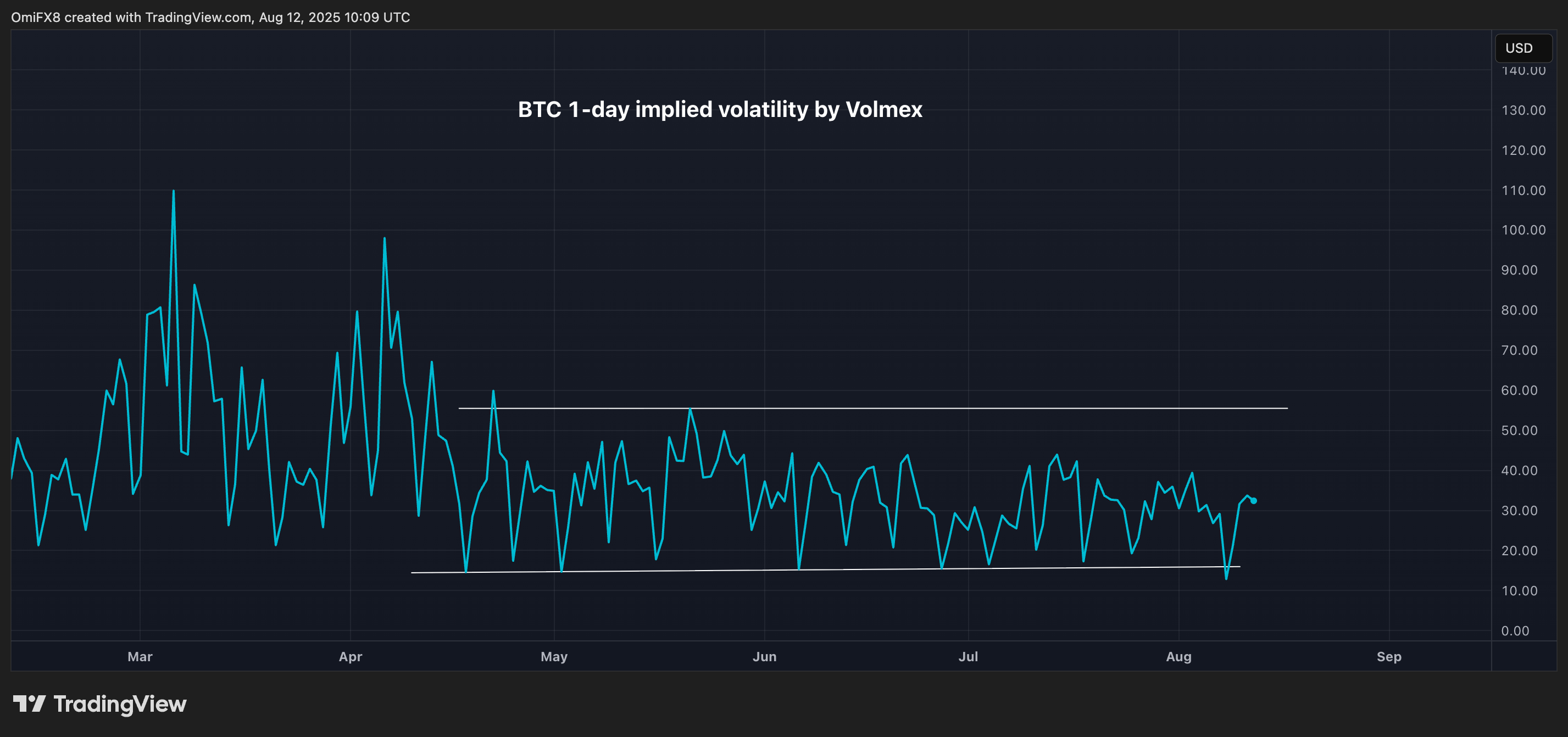

But here's the interesting part: Implied volatility metrics aren't showing any signs of panic. Volmex's 24-hour bitcoin implied volatility index stood at an annualized 31%, easily within its recent range, equating to an expected price swing of just 1.6% in the next 24 hours. The gauges for ether (ETH), solana (SOL) and XRP (XRP) showed expected swings of 3.29%, 2.9% and 4.5%, respectively. None are out of the ordinary.

Still, traders may want to remain vigilant because August is known to bring significant volatility in stocks, which could quickly spill over into the crypto market. Wall Street's so-called fear gauge, the VIX, which measures the 30-day implied volatility in the S&P 500, spiked on Aug. 1 before calming down, a pattern that has historically presaged a surge in volatility.

"Curiously the VIX made a brief spike right about when the seasonal map said it would, and then subsequently has also calmed back down right on cue," Callum Thomas, the founder and head of research at Topdown Charts, noted. "The implication is that if this seasonal script-following persists then we are in for some heightened volatility in the coming weeks and months."

It's worth remembering that volatility is price-agnostic and can unfold bullishly if the CPI prints lower than expected. That would be a positive surprise to risk assets like cryptocurrencies.

Ether (ETH) might benefit the most, as it has recently led BTC higher on the back of corporate adoption.

"Ethereum, supported by institutional inflows and corporate treasury buying, has a potential path toward testing prior all-time highs if conditions remain favorable," XBTO's chief investment officer Javier Rodriguez-Alarcón said in an email. BTC continues to serve as an anchor, he said. In contrast, the broader market remains concentrated at the top, according to Alarcón.

In traditional markets, gold could register sharp losses in the event of hotter-than-expected CPI, as its persistent failure to stage rallies above $3,400 since April suggests bullish exhaustion. Stay alert!

What to Watch

- Crypto

- Aug. 15: Record date for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who meet pre-distribution requirements.

- Aug. 18: Coinbase Derivatives will launch nano SOL and nano XRP U.S. perpetual-style futures.

- Aug. 20: Qubic (QUBIC), the fastest blockchain ever recorded, at over 15 million transactions per second and powered by Useful Proof of Work (UPoW), will undergo its first yearly halving event as part of a controlled emission model. Although gross emissions remain fixed at 1 trillion QUBIC tokens per week, the adaptive burn rate approved by the network’s Computors, the key validators and decision makers, will increase substantially — burning some 28.75 trillion tokens and reducing net effective emissions to about 21.25 trillion tokens.

- Macro

- Aug. 12, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases July consumer price inflation data.

- Inflation Rate MoM Est. 0.37% vs. Prev. 0.24%

- Inflation Rate YoY Est. 5.34% vs. Prev. 5.35%

- Aug. 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases July consumer price inflation data.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

- Core Inflation Rate YoY Est. 3% vs. Prev. 2.9%

- Inflation Rate MoM Est. 0.2% vs. Prev. 0.3%

- Inflation Rate YoY Est. 2.8% vs. Prev. 2.7%

- Aug. 13: A series of virtual meetings involving European leaders, Ukrainian President Zelenskyy, NATO chief Mark Rutte, U.S. President Donald Trump and U.S. Vice President J.D. Vance among others to coordinate Ukraine support, apply pressure on Russia and discuss peace talks.

- Aug. 13, 3 p.m.: Argentina’s National Institute of Statistics and Census releases July consumer price inflation data.

- Inflation Rate MoM Est. 1.8% vs. Prev. 1.6%

- Inflation Rate YoY Est. 36.4% vs. Prev. 39.4%

- Aug. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases July producer price inflation data.

- Core PPI MoM Est. 0.2% vs. Prev. 0.0%

- Core PPI YoY Est. 2.9% vs. Prev. 2.6%

- PPI MoM Est. 0.2% vs. Prev. 0%

- PPI YoY Est. 2.5% vs. Prev. 2.3%

- Aug. 14, 7 p.m.: Peru's central bank announces its monetary policy decision.

- Reference Interest Rate Est. 4.5% vs. Prev. 4.5%

- Aug. 14, 10 p.m.: El Salvador's Statistics and Census Office, which is part of the Central Reserve Bank of El Salvador, releases July consumer price inflation data.

- Inflation Rate MoM Prev. 0.32%

- Inflation Rate YoY Prev. -0.17%

- Aug. 12, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases July consumer price inflation data.

- Earnings (Estimates based on FactSet data)

- Aug. 12: Bitfarms (BITF), pre-market, -$0.02

- Aug. 12: Circle Internet Group (CRCL), pre-market

- Aug. 12: CoreWeave (CRWV), post-market

- Aug. 12: Fold Holdings (FLD), post-market

- Aug. 14: KULR Technology Group (KULR), post-market

- Aug. 15: Sharplink Gaming (SBET), pre-market

- Aug. 15: BitFuFu (FUFU), pre-market, $0.07

- Aug. 18: Bitdeer Technologies Group (BTDR), pre-market, -$0.12

Token Events

- Governance votes & calls

- Compound DAO is voting to appoint ChainSecurity and Certora as joint security provers, with ZeroShadow handling incident response under a $2 million, 12-month COMP-streamed budget starting Aug. 18. Voting ends Aug. 13.

- Aavegotchi DAO is voting on a Bitcoin Ben’s Crypto Club Las Vegas sponsorship: a $1,000/month corporate membership (logo on sponsor wall, team access, newsletter feature, one branded meetup/month) or a $5,000, 90-day Graffiti Wall mural with promo. Voting ends Aug. 23.

- Aug. 12, 10 a.m.: Maple Finance, Aave, Elixir, OpenEden and Mento to participate on a Stablecoin Summer X spaces session hosted by Chainlink.

- Aug. 14, 10 a.m.: Lido to host a tokenholder update Call.

- Aug. 14, 10 a.m.: Stacks to host a townhall meeting.

- Unlocks

- Aug. 15: Avalanche (AVAX) to unlock 0.39% of its circulating supply worth $38.25 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating supply worth $16.21 million.

- Aug. 15: Sei (SEI) to unlock 0.96% of its circulating supply worth $16.89 million.

- Aug. 16: Arbitrum (ARB) to unlock 1.8% of its circulating supply worth $40.76 million.

- Aug. 18: Fasttoken (FTN) to unlock 4.64% of its circulating supply worth $91.6 million.

- Aug. 20: LayerZero (ZRO) to unlock 8.53% of its circulating supply worth $56.56 million.

- Aug. 20: Kaito (KAITO) to unlock 8.82% of its circulating supply worth $26.15 million.

- Token Launches

- Aug. 12: World3 (WAI) to be listed on Binance Alpha, MEXC, Bitget and others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through Aug. 31.

- Day 2 of 3: AIBB 2025 (Istanbul)

- Day 2 of 7: Ethereum NYC (New York)

- Aug. 13-14: CryptoWinter ‘25 (Queenstown, New Zealand)

- Aug. 15: Bitcoin Educators Unconference (Vancouver)

- Aug. 17-21: Crypto 2025 (Santa Barbara, California)

- Aug. 18-21: Wyoming Blockchain Symposium 2025 (Jackson Hole)

Token Talk

By Shaurya Malwa

- Ethena surpassed $11.89B in TVL, becoming the sixth DeFi protocol to cross $10B and the second non-staking model after Aave to do so. The sUSDe APY sits at 4.72%, attracting yield-focused investors.

- The protocol’s scale underscores growing appetite for non-staking DeFi models and could influence future designs. Market reaction has been broadly positive, with industry figures noting the milestone’s significance.

- USDe maintains a $1 peg with a $10.48B market cap and $371.97M in 24-hour volume.

- Polymarket will transition UMA’s oracle from OOV2 to MOOV2 after governance approval, restricting market resolution proposals to a whitelist of vetted participants.

- The change aims to reduce disputes and market manipulation by ensuring proposals are submitted by experienced users, while keeping dispute rights open to all.

- The initial whitelist includes 37 addresses, with the shift framed as moving from open debates to a more controlled council-style resolution process.

- Pudgy Penguins secured Formula 1 branding at the Singapore Grand Prix after winning Kraken’s memecoin trading contest. PENGU branding will appear on Williams Racing’s FW47 car.

- The token gained 55.1% over the past 30 days while dipping 11.8% in 24 hours, partially rebounding with a 1.4% intraday gain.

- The exposure is expected to boost visibility among mainstream audiences and strengthen Kraken’s push into sports-linked crypto promotions.

Derivatives

- Futures open interest in major tokens has decreased over the past 24 hours, indicating a capital outflow. It's also suggestive of price losses being driven by the unwinding of long positions rather than outright short sales.

- XMR's perpetual futures appear overheated, with annualized funding rates exceeding 200%. The extremely high figure may prompt arbitrageurs to take a simultaneous long position in the spot market and a short position in futures, allowing them to pocket the funding safely.

- Funding rates for other major tokens remain pinned at around 10%, reflecting a moderately bullish bias.

- On the CME, open interest in ETH futures has seen a renewed uptick from 1.51 million ETH to 1.70 million. Meanwhile, BTC open interest remains flat near 138K BTC, the lowest since April.

- On Deribit, BTC options out to August expiry show a slight bias toward protective put options. ETH options, meanwhile, show a bullish bias across all tenors.

- ETH's IV term structure steepened while BTC IVs remain unchanged. Flows over OTC desk Paradigm featured a long position in the BTC $115K put expiring on Aug. 13 and demand for $!50K calls expiring in September.

- Volumes were substantial, with $3.3 billion traded at Paradigm.

Market Movements

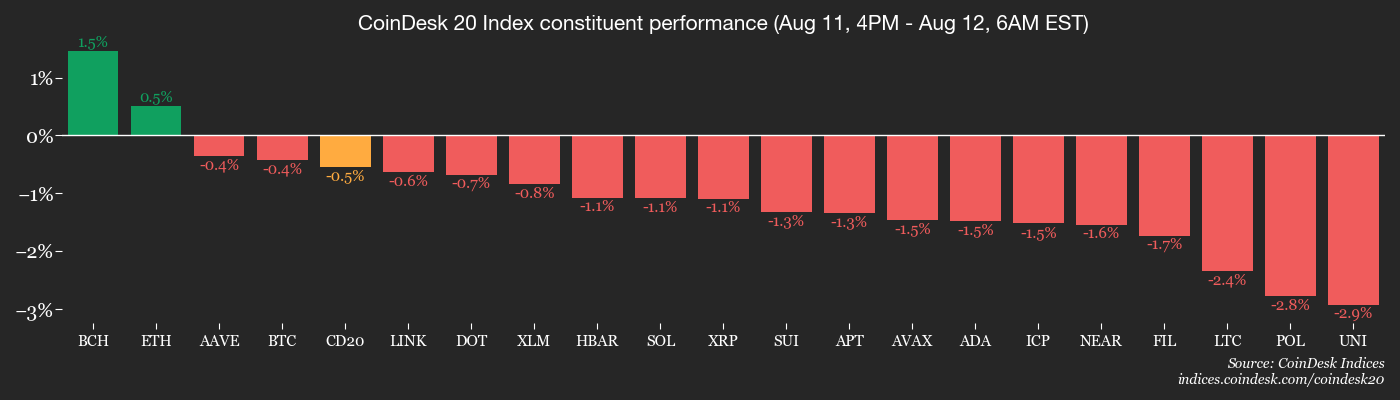

- BTC is down 0.35% from 4 p.m. ET Monday at $118,412.69 (24hrs: -2.36%)

- ETH is down 1.17% at $4,195.12 (24hrs: +1.05%)

- CoinDesk 20 is down 0.35% at 4,082.37 (24hrs: -2.6%)

- Ether CESR Composite Staking Rate is up 1 bp at 2.92%

- BTC funding rate is at 0.005% (5.4827% annualized) on Binance

- DXY is unchanged at 98.58

- Gold futures are down 0.21% at $3,397.50

- Silver futures are unchanged at $37.78

- Nikkei 225 closed up 2.15% at 42,718.17

- Hang Seng closed up 0.25% at 24,969.68

- FTSE is up 0.34% at 9,161.10

- Euro Stoxx 50 is down 0.14% at 5,324.34

- DJIA closed on Monday down 0.45% at 43,975.09

- S&P 500 closed down 0.25% at 6,373.45

- Nasdaq Composite closed down 0.30% at 21,385.40

- S&P/TSX Composite closed unchanged at 27,775.23

- S&P 40 Latin America closed down 0.36% at 2,648.54

- U.S. 10-Year Treasury rate is unchanged at 4.275%

- E-mini S&P 500 futures are unchanged at 6,403.25

- E-mini Nasdaq-100 futures are unchanged at 23,643.75

- E-mini Dow Jones Industrial Average Index are up 0.12% at 44,138.00

Bitcoin Stats

- BTC Dominance: 60.56% (-0.27%)

- Ether-bitcoin ratio: 0.03619 (1.69%)

- Hashrate (seven-day moving average): 893 EH/s

- Hashprice (spot): $58.16

- Total fees: 4.42 BTC / $531,812

- CME Futures Open Interest: 138,165 BTC

- BTC priced in gold: 35.4 oz.

- BTC vs gold market cap: 10.02%

Technical Analysis

- The Dow Jones Industrial Average (DJIA) has dived out of an ascending channel after failing to penetrate the December-January top.

- The pattern is indicative of buyer exhaustion and points to a potential correction ahead.

Crypto Equities

- Strategy (MSTR): closed on Monday at $400.25 (+1.3%), -0.56% at $398 in pre-market

- Coinbase Global (COIN): closed at $319.62 (+2.92%), +0.4% at $320.91

- Circle (CRCL): closed at $161.17 (+1.35%), +0.92% at $162.66

- Galaxy Digital (GLXY): closed at $28.48 (+2.52%), -1.93% at $27.93

- MARA Holdings (MARA): closed at $15.66 (+1.82%), -0.89% at $15.52

- Riot Platforms (RIOT): closed at $11.11 (+0.27%), -0.36% at $11.07

- Core Scientific (CORZ): closed at $14.53 (+0.83%), +0.21% at $14.56

- CleanSpark (CLSK): closed at $9.87 (-1.99%), -1.11% at $9.76

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.06 (+0.4%)

- Semler Scientific (SMLR): closed at $35.28 (-2.35%), -1.19% at $34.86

- Exodus Movement (EXOD): closed at $30.12 (-5.58%), unchanged in pre-market

- SharpLink Gaming (SBET): closed at $22.34 (-6.63%), +0.27% at $22.40

ETF Flows

Spot BTC ETFs

- Daily net flows: $178.1 million

- Cumulative net flows: $54.59 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily net flows: $1.02 billion

- Cumulative net flows: $10.85 billion

- Total ETH holdings ~5.77 million

Source: Farside Investors

Chart of the Day

- Volmex's bitcoin one-day implied volatility index remains locked in a sideways range despite concerns today's U.S. CPI data could show increased price pressures in the economy.

- The calm means the market might react violently should the CPI print above estimates.

While You Were Sleeping

- Bitcoin $115K Bets In Demand as Downside Fear Grips Market Ahead of U.S. CPI Report (CoinDesk): Some bitcoin traders are buying short-term $115K put options to guard against a hotter-then-estimated CPI reading. One analyst says cooler inflation would reinforce expectations for a Federal Reserve rate cut in September.

- U.S. Spot Ether ETFs Hit $1B Daily Inflow for First Time (CoinDesk): BlackRock's ETHA led the way, registering inflows of just under $640 million, while Fidelity's FETH came second with $276.9 million.

- Watch Out for Potential Bitcoin Double Top as Bulls Fail to Break $122K Again (CoinDesk): Bitcoin’s latest rally stalled after twice failing to clear a major resistance level, with analysts watching whether a clear break below $111,982 could pave the way for a slide toward $100,000.

- Sidelined From Trump-Putin Talks, Ukraine Warns the World Not to Trust Russia (CNBC): Ukraine President Zelenskyy, excluded from Friday's Trump-Putin summit, said Russia is gearing up for new offensives and fears secret negotiations could pressure Kyiv into ceding territory without its consent.

- China Urges Firms Not to Use Nvidia H20 Chips in New Guidance (Bloomberg): Beijing is concerned that China-only versions of Nvidia and AMD AI chips could have functions such as remote shutdown, and is urging firms to avoid them in government or security-sensitive work.

- Mexican Peso Soars as ‘Carry Trade’ Reignites After Tariff Delays (Financial Times): The currency has strengthened from about 21 to just over 18.5 per dollar as investors borrow overseas to buy local bonds, boosted by the 90-day tariff pause Mexico secured July 31.

In the Ether

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。