Author: Tuo Luo Finance

The stock market and the cryptocurrency market, once two major groups that looked at each other with disdain, have finally moved from a courtroom confrontation to a warm embrace.

A few years ago, it would have been hard to find a compliment regarding the mainstream stock market's view of the cryptocurrency market; a neutral "let each take their own path" would have been considered respectful. The forces at play are mutual; the cryptocurrency market's rejection of the stock market is also evident, with most in the crypto community believing that the lofty stock market has nothing to offer, viewing it as a zero-sum game—who is more virtuous than whom?

However, this year, the two groups unexpectedly completed the process of acquaintance, understanding, and romance, quickly arriving at a point of mutual interest. The love child of cryptocurrency and stocks has thus come into being.

Unlike the tokenization of the U.S. stock market that aims to move it onto the blockchain, cryptocurrency stock companies have successfully packaged tokens in the form of stocks, going public as shell companies while the narrative remains focused on capital.

This time, the ones footing the bill are not the crypto enthusiasts, but the stock investors who once gazed at them from afar.

01 What are Cryptocurrency Stocks?

While it is difficult to define a universal concept, cryptocurrency stock companies are generally defined as publicly listed companies that establish one or more cryptocurrency reserves within their operations, bringing cryptocurrencies onto their balance sheets. Depending on different criteria, cryptocurrency stock companies can be categorized into various types, which can be further divided into three categories based on cryptocurrency treasury types, business models, and the entities constructing cryptocurrency stocks.

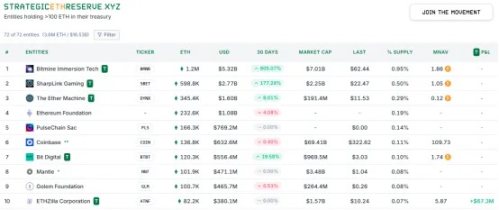

Starting with cryptocurrency treasuries, a cryptocurrency treasury refers to an investment model where a company reserves a certain cryptocurrency. Initially, there was only one category of Bitcoin treasury companies, but later ETH emerged, and now, with regulatory relaxations, various altcoin treasury stocks have also emerged, including SOL, BNB, Hyper, XRP, and DOGE, covering a wide range. According to data, there are currently 166 Bitcoin treasury companies, 72 Ethereum treasury companies, while altcoin companies are relatively limited; for example, there are only three relatively well-known treasury companies for SOL: DeFi Development, Upexi, and Sol Strategies, while BNB started later, with only VAPE as the official player.

Among all cryptocurrency stocks, the most well-known company is undoubtedly Strategy. Launched in 2020, Strategy turned the tide by leveraging Bitcoin, successfully rising from a company with a stock price of only $16 and on the brink of bankruptcy to a Nasdaq 100 company with a stock price nearing $400 and a market value of $111.83 billion, creating a successful case for this strategy in the market.

Analyzing the essence of the strategy, the core of most treasury companies lies in market capitalization premium. Taking Strategy as an example, the company's valuation model relies on the market capitalization premium rate, using equity dilution financing to increase BTC holdings and enhance the per-share BTC holding, thereby boosting the company's market value. In simple terms, it involves designing the distribution ratio between equity and Bitcoin, using bonds and stock sales to purchase Bitcoin, and then realizing capital operation through Bitcoin appreciation, ultimately constructing a positive flywheel. As of August 10, 2025, Strategy had acquired 628,946 Bitcoins at an average price of approximately $73,288, with a total holding value of about $46.09 billion. Based on a Bitcoin price of $119,000, this Bitcoin already has a scale exceeding $74.8 billion, making it the publicly listed company with the largest Bitcoin holdings globally.

02 How Does It Operate?

Why do investors accept or even default to the existence of a premium?

Firstly, market expectations for cryptocurrencies are a key factor; only with an optimistic outlook on the future of cryptocurrencies are investors willing to pay a premium. Secondly, the emergence of treasuries effectively meets the needs of investors who cannot directly access cryptocurrencies for various reasons but still wish to benefit, including but not limited to outsiders unfamiliar with cryptocurrencies, some regulated institutions, funds, and legal entities. In other words, treasuries lower the investment threshold for participants, making them willing to pay a certain "compliance" premium, which is, of course, based on the continuous rise of cryptocurrencies.

Another noteworthy reason is the unique leveraged operation model of treasury companies, which typically raise large amounts of capital at very low interest rates, allowing them to further expand their purchasing scale, and they can maintain strong resilience even during market downturns. According to data from crypto consulting firm Architect Partners, U.S. publicly listed companies have announced plans to raise over $91 billion this year for purchasing cryptocurrencies.

Where does the money come from?

Looking at the current cryptocurrency treasury companies, the four main fundraising methods are PIPE (Private Investment in Public Equity), ATM (At-the-Market), CB (Convertible Bonds), and SPAC (Special Purpose Acquisition Company). PIPE involves privately selling financial products to specific investors through brokers or OTC platforms, allowing for quick capital recovery while bypassing the public market; ATM involves issuing additional shares to sell at current market prices for cash, usually with a longer cycle and relatively free operation; convertible bonds are more "cunning," as companies borrow money from the market, but this money can later be converted into cash or company stock, creating selling pressure for a longer time; SPAC is relatively well-known for raising funds through reverse mergers. Strategy, a leader in fundraising capabilities, initially focused on issuing convertible bonds but has shifted to at-the-market fundraising as its stock price skyrocketed in recent years.

Returning to the business model, cryptocurrency stock companies can be divided into two categories: one imitates Strategy, focusing on accumulating coins as the main business and achieving capital appreciation through premiums; in other words, cryptocurrency reserves are the business model. Due to the relatively low entry threshold, this category has attracted many following companies. The other category is more rational, adding a treasury segment to their existing business, making cryptocurrencies a supplementary business. This type of cryptocurrency stock is particularly dominated by Ethereum treasury companies, as Ethereum has the basic function of staking for yield, unlike Bitcoin, which primarily serves as a store of value.

In fact, the division based on entities also focuses on Ethereum treasury companies, which can be divided into native camps, with typical cases like SharpLink, and Wall Street camps, with typical cases like BitMine. The difference lies in the holders behind them; SharpLink's shareholders almost cover the entire chain capital of the Ethereum ecosystem, including native giants like Consensys and Pantera, as well as infrastructure players like Arrington, with holders being native OGs. In contrast, BitMine is entirely a product of Wall Street, with mainstream U.S. stock structure investors like Galaxy Digital, ARK Invest, and Founders Fund as its core components. Currently, the arms race between the two in ETH is intensifying, with BitMine, which has a more aggressive capital rhythm and CEOs who are better at "storytelling," leading the way, successfully raising 83,313 ETH in just 35 days, surpassing SharpLink's 280,706 ETH, becoming the largest Ethereum treasury company globally.

03 Will Altcoins Reappear in Cryptocurrency Stocks?

The rise of cryptocurrency stocks is clearly not just about supporting cryptocurrencies. Regardless of how much they emphasize decentralization or introduce various new narratives like cryptocurrency valuation anchors and digital gold, what companies fundamentally care about is still the straightforward factor of profit.

Among the hundreds of cryptocurrency stock companies, many are chasing trends. The feedback from these trends is indeed very timely; almost all cryptocurrency stock companies experience rapid and significant increases after officially announcing their entry. There are numerous examples: after announcing its treasury strategy on May 27, SharpLink's stock price surged by 433.18% on the same day, reaching $124.12 on May 30, more than 24 times its previous low of $5. On June 27, BitMine's stock price was $4.26, and by July 3, it peaked at $135. Compared to these large holders, small-cap stocks also saw impressive short-term gains; a nearly bankrupt Swedish biotechnology company, H100 Group, surged 15 times within a month after announcing support for a Bitcoin treasury, while Bluebird Mining Ventures recovered four times its stock price through Bitcoin reserves.

Currently, it appears that after nearly two months of FOMO, the cryptocurrency stock craze is showing signs of cooling. Taking Strategy, the largest Bitcoin treasury company, as a reference, its market capitalization premium has dropped from a peak of 2 times to 1.49 times. Recently, BitMine, which just became the largest buyer of ETH, has seen its stock price fall from a high of $135 to $62.44, while it is worth noting that ETH is still on the rise, having already surpassed $4,600 today.

Interestingly, the trends of cryptocurrency stocks closely mirror the patterns of the crypto market. Similar to the development of altcoins, cryptocurrency stocks also exhibit a polarized pattern. Data from Architect Partners shows that cryptocurrency treasury stocks holding mainstream tokens like Bitcoin, Ethereum, or Solana have a median return of 92.8% since announcing their holding strategies. In contrast, cryptocurrency treasury stocks investing in altcoins have a median return of -24% since their announcements. From the most intuitive market data perspective, almost all altcoin stocks have seen their prices cut in half from their peak; for example, Hyperion DeFi, which reserves Hyperliquid, has seen its stock price drop by 62% since changing its name to HYPD and altering its stock code on July 2.

It can be seen that the nightmare of the altcoin market seems to be reappearing in cryptocurrency stock companies, with the performance of altcoins transmitting to cryptocurrency stock companies. Due to the leverage effect during this period, when price performance is poor, the resulting chain reaction is even greater, leaving investors who bought at high prices helplessly standing guard at the peak. Objectively speaking, it is not just altcoins; as cryptocurrency stocks link the cryptocurrency and stock markets, the influence between the two is further amplified.

The emergence of cryptocurrency stocks has essentially created a new narrative system. For project teams, the existence of cryptocurrency stock companies not only provides buying support, helping to solidify prices, but can also serve as a marketing tool to enhance token visibility. Furthermore, project teams can even manage prices through self-built treasuries, influencing the two-way market by unilaterally driving up prices, a practice colloquially known as "stepping on the left foot while stepping on the right." In an optimistic scenario, this can lead to a situation where both price increases and sales occur simultaneously. This "stepping on the left foot while stepping on the right" is vividly demonstrated in ETH, where large institutional buy orders have led to a 58% surge in ETH within a month due to FOMO. Perhaps due to such considerations, there are also increasing cases of foundations collaborating with companies on treasuries; for example, Mill City Ventures III, which initiated the SUI treasury, has financial cooperation with the SUI Foundation. For most companies, cryptocurrency stocks are not only a way to strategically transform but also a practical means to achieve rapid profits and save their businesses. Even if it is merely to open new business segments, this long-term attention-grabbing trend is hard to abandon.

From the investor's perspective, cryptocurrency stocks allow them to bypass the complicated wallet operations and compliance hurdles, opening up a new avenue for profit in the cryptocurrency field, diversifying their investment portfolios, and seeking higher returns, which is certainly advantageous.

However, there are also negative impacts. Currently, the core of the treasury is the value support and long-term trend of the cryptocurrency itself. In this regard, aside from BTC, which has already been embraced by institutions, other cryptocurrencies, including ETH, lack relative certainty. Once a downward cycle begins and market prices plummet, cryptocurrency stock companies will face a double whammy: falling cryptocurrency prices lead to falling stock prices, and selling cryptocurrencies further drives down prices, especially since most cryptocurrency stocks are purchased with debt, posing significant potential risks. After introducing cryptocurrencies, the primary concern for cryptocurrency stock investors is facing greater volatility; after all, the price fluctuations of tokens are much more thrilling than a roller coaster ride.

Overall, although cryptocurrency stocks are still thriving, the long-term development prospects for most companies are unclear, especially for those centered around altcoins, which face more realistic challenges under the premise that the altcoin season is unlikely to be replicated. From a market perspective, among mainstream currencies, leading companies with high market capitalizations are expected to capture more industry dividends, presenting a winner-takes-all scenario to some extent. Altcoins, on the other hand, rely more on the resource-linking capabilities of the project teams themselves, with certain positive expectations for altcoin stocks that have direct official involvement or resource backing. However, it is certain that most companies rushing into the market today will inevitably face a thorough cleansing at some point.

For the average participant in the cryptocurrency space, compared to the unclear experience of buying stocks, directly purchasing cryptocurrencies may be the best choice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。