Recently, the team has been researching the #RWA track and discovered many interesting and novel projects, some of which are quite different from traditional tokenization of US stocks and bonds. Today, let's take a look at the new asset DEX @OverlayProtocol, which will go live on Binance Alpha in an hour and a half. It does not engage in traditional cryptocurrency trading or serve as an ordinary contract platform, but aims to open up a brand new track—allowing any real, non-manipulable data to become tradable derivatives, and it does not require a counterparty.

Overlay Core Features: A Counterparty-Free Exchange

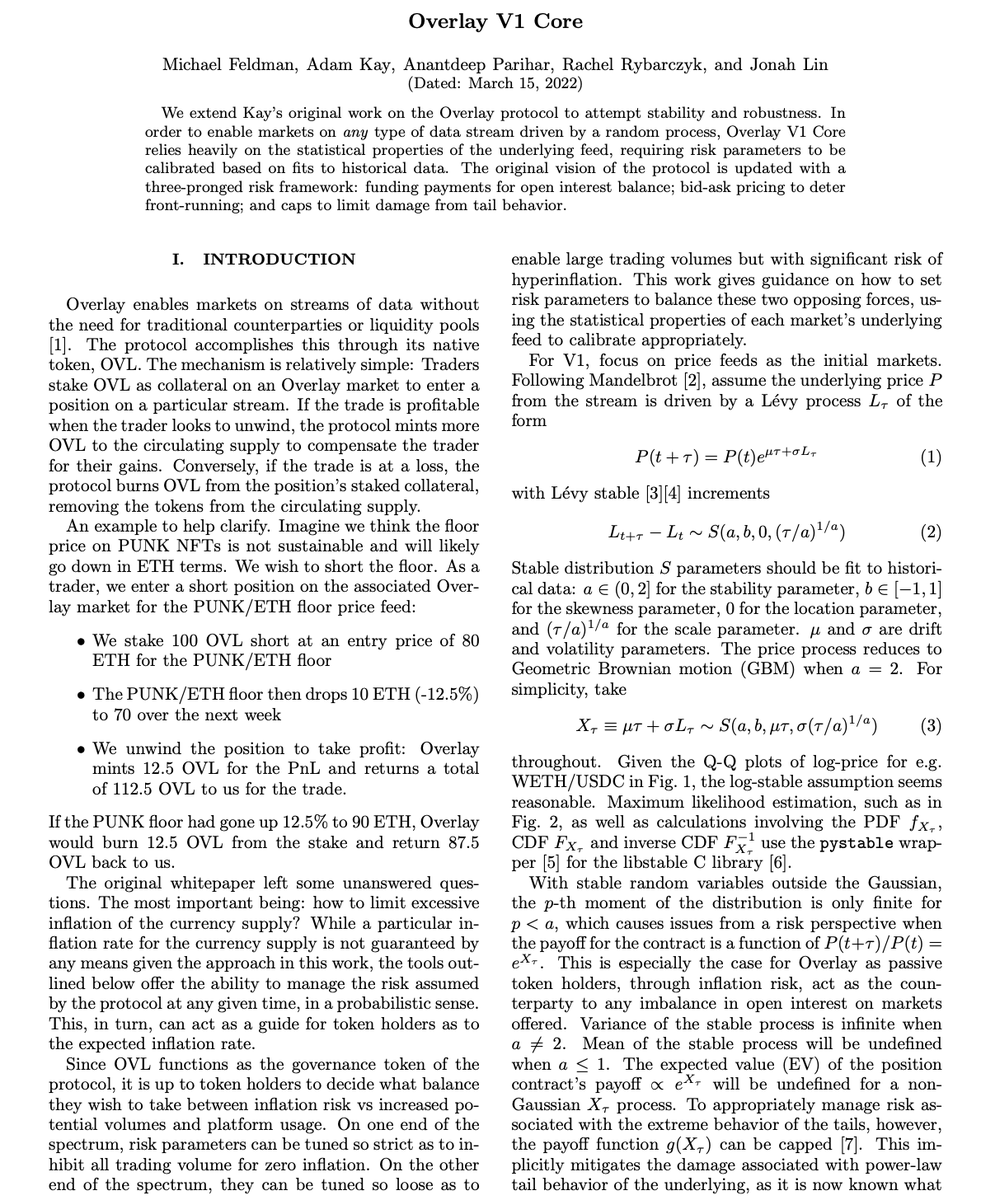

Traditional trading is either spot or contract; in either case, your counterparty is always a liquidity provider (LP) or a market maker. #Overlay directly skips these roles, allowing me as a trader to bet against the entire protocol and all $OVL holders.

Simply put:

• When I profit, the protocol mints new $OVL for me as my earnings.

• When I incur losses, my collateral $OVL will be burned.

The advantages of this mechanism are:

• No need to worry about insufficient liquidity.

• Niche markets can be opened without waiting for LPs to provide liquidity.

But the cost is— the protocol relies on mathematical models and inflation/deflation control to avoid being exploited by arbitrage players. If interested, you can check out their official white paper, which is filled with mathematical formulas. I read it 3-4 times, and with the help of #AI explanations, I finally grasped the basics (as shown in Figure 2).

📝 Types of Tradable Markets: Limitless Imagination

The focus of #Overlay is on "non-manipulable, unpredictable" data sources (provided by oracles that feed prices periodically; as long as the oracle data is secure and non-manipulable, the protocol can operate normally). If it meets this condition, a market can be opened.

This means that the range of tradable items is vast:

• On-chain unconventional indicators: Bitcoin hash rate, gas fees, ETH burn rate, NFT floor prices, DeFi yields.

• Off-chain quirky markets: eSports scores, sports game data, sneaker prices, weather temperatures, and even "adult content popularity."

• Social & scientific data: probabilities of political events, research experiment results, etc.

This openness is the biggest highlight of #Overlay, meaning it can capture "long-tail markets"—those assets that traditional exchanges could never list. This brings immense imaginative space to non-standard assets in the real world. If this algorithm is proven to be feasible for large-scale practice in the market, the #RWA market will become significantly richer and more exciting.

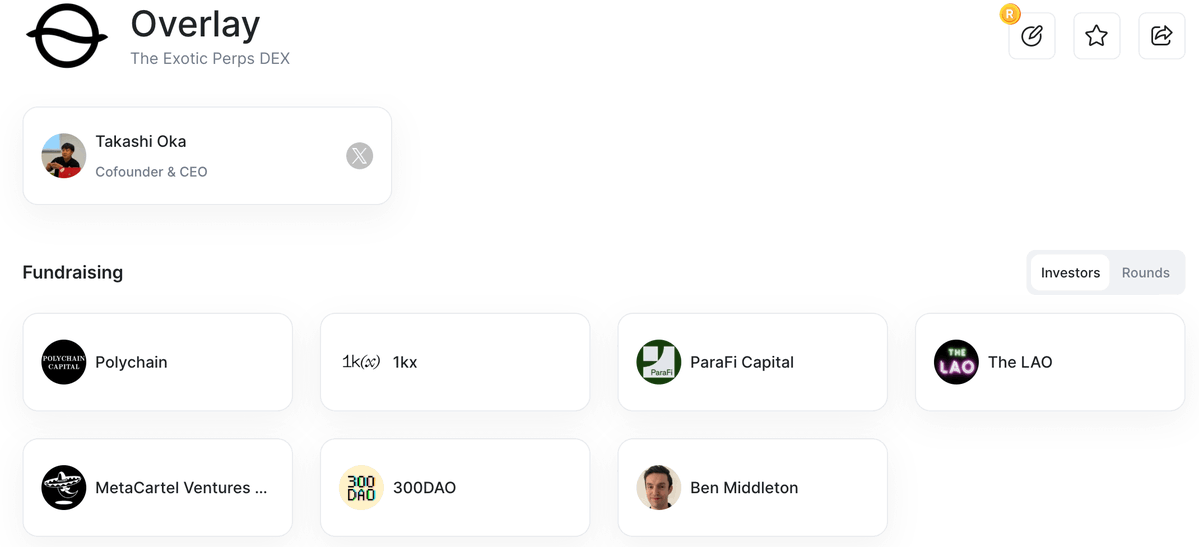

As an innovative DEX, #Overlay has garnered the favor of top-tier capital, including investment institutions like #Polychain, #1kx, and #ParaFi (as shown in Figure 3).

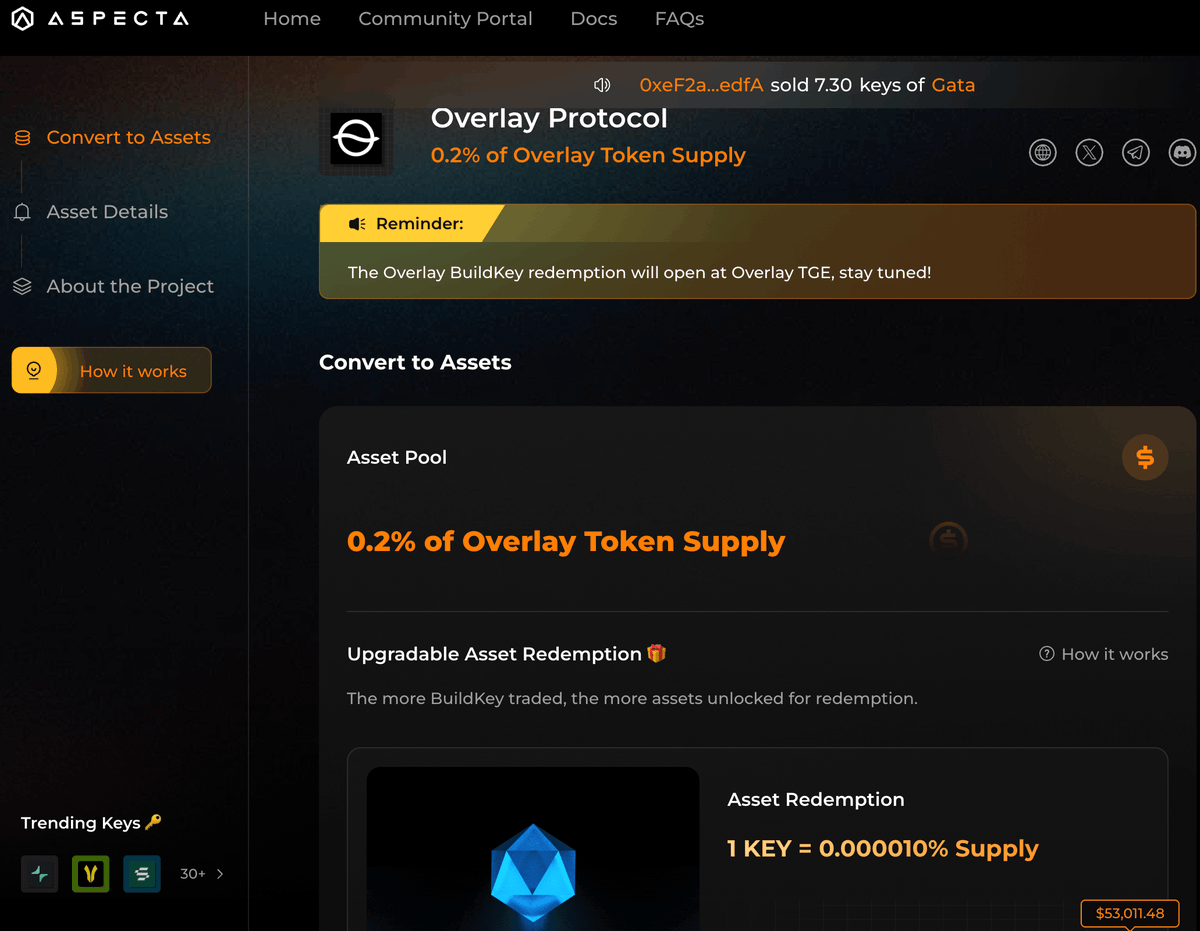

The project was initially issued through BuildKey by @aspectaai (as shown in Figure 4), which also gained significant attention. Recently, several projects launched on @aspectaai have directly discovered prices and gone live on #BinanceAlpha, undoubtedly making it the best alpha hunting ground during the altcoin season. It is worth paying close attention to and using! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。