Not only are star projects leading the charge, but more structural rebounds are spreading across sectors, forming a "blooming everywhere" market.

Written by: BitpushNews

In the past week, the "heat map" of the crypto market has been quietly redrawn. As Bitcoin's price fluctuates, funds are subtly accelerating their flow towards altcoins—ranging from mainstream narratives to niche tracks, multiple sectors have seen unexpected gains. Data shows that not only are star projects leading the way, but more structural rebounds are spreading across sectors, forming a "blooming everywhere" market.

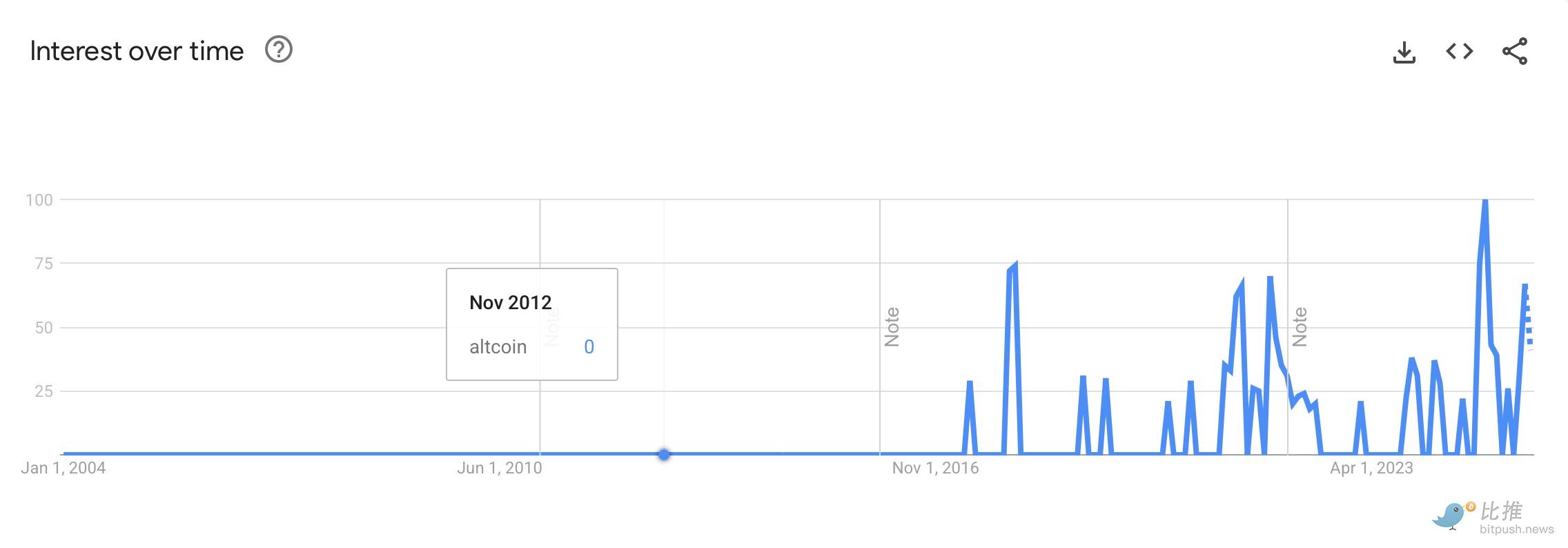

Google Trends data shows that the search popularity for "Altcoin" has reached a five-year high, while the search volume for "Ethereum" has hit a two-year peak.

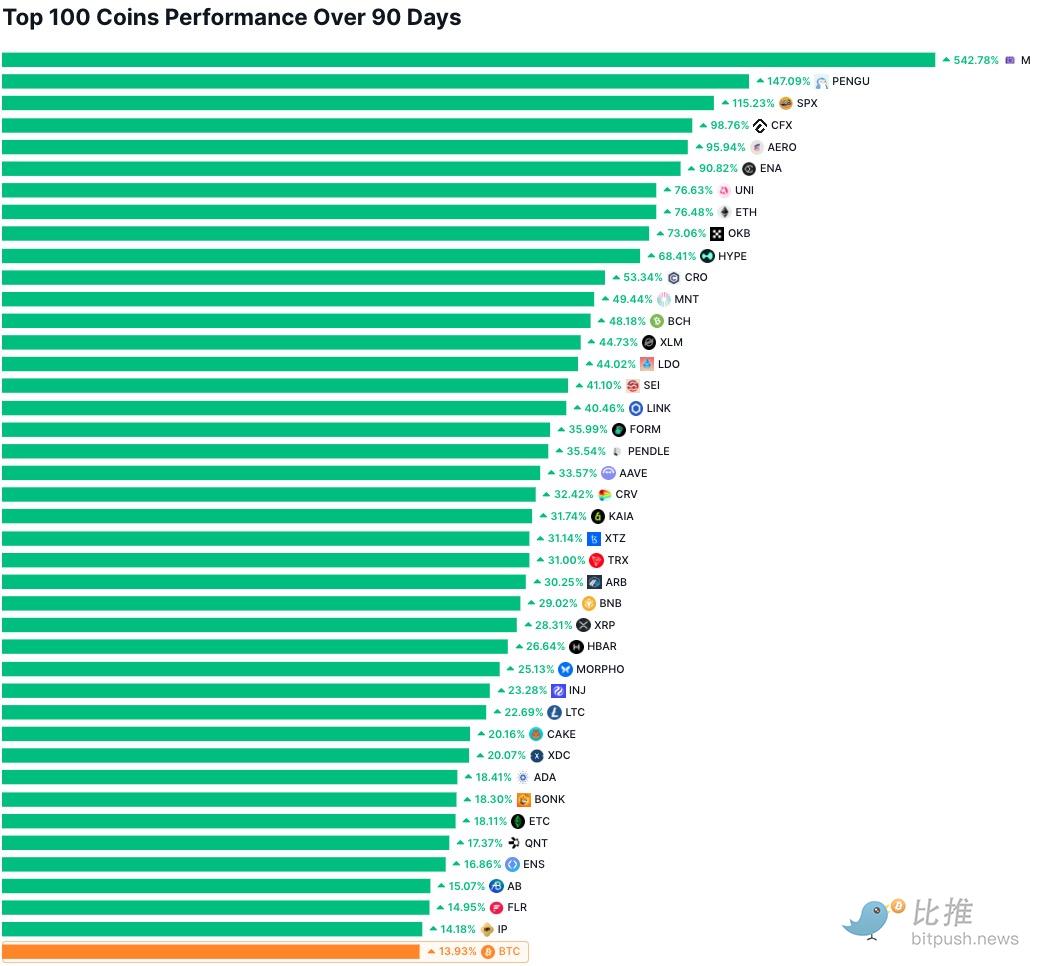

Simultaneously, the total market capitalization of cryptocurrencies worldwide has increased to $4 trillion, with the altcoin sector performing significantly better than Bitcoin (data as of August 14, Eastern Time):

- Ethereum has risen 79% in the past 90 days, while Bitcoin has only increased by 14% during the same period.

- The Altcoin Season Index has risen from 29 a month ago to 40.

- The U.S. has received 31 applications for altcoin spot ETFs in the first half of the year, covering mainstream public chains and ecosystem tokens such as SUI, SOL, XRP, LTC, DOGE, ADA, DOT, HBAR, AVAX, etc.

On the funding side, ETFs and corporate treasuries are changing the supply-demand structure:

- The Ethereum spot ETF alone recorded a net inflow of $2.3 billion in three days, equivalent to 500,000 ETH.

- Corporate treasuries are diversifying their allocations, with Ethereum, Solana, and Chainlink being heavily held and staked for returns.

- The total value locked (TVL) in DeFi has returned to $96.9 billion, approaching the historical high of 2021.

This pattern of funding + narrative resonance provides a solid foundation for the comprehensive rotation of altcoins.

Meme Sector: PENGU and SPX Ignite Emotion

In this structural rotation, PENGU, SPX, and AERO have shown the most prominent upward trends, representing three main lines of the current altcoin market: Meme narrative, technical pattern trading, and platform entry dividends.

PENGU: Transition from Meme to Financial Product

PENGU, which burst onto the scene, is essentially a meme coin centered around a penguin image, but this time it has gained legitimacy on the financial level.

In March, Canary Capital submitted an ETF application that includes PENGU spot, planning to allocate over 80% of funds to the token itself, with the remainder held in Pudgy Penguins NFTs. This is the first time NFT IP has been packaged with a crypto token into an ETF product. The ETF narrative has directly increased PENGU's visibility among institutional investors.

Both offline and online exposure have simultaneously boosted its popularity. In early August, PENGU's trading volume on the South Korean exchange Upbit briefly surpassed that of Dogecoin, Coinbase changed its official social media avatar to Pudgy Penguins NFT, and Robinhood also listed the token.

On the technical side, PENGU broke through a descending trend channel while increasing in volume, providing an entry signal for short-term funds. This combination of "cultural IP × ETF expectations × technical breakthroughs" gives PENGU a high degree of price elasticity.

SPX6900: Meme-style Capital Rotation Driven by Technicals

Compared to PENGU, which is more emotionally driven, SPX's rise has a more rational support from strategic trading. It uses "parodying the S&P 500 index" as its IP, with a financial pun built into its name.

The daily chart has formed a classic "cup and handle" pattern—with a neckline at $1.74. Once it breaks upward, it will form a technical target of $2.28–$2.88. This pattern is highly attractive to technical traders.

Meanwhile, the SPX community is highly active, and the efficiency of capital rotation is extremely high—holders quickly reinvest their profits into new presale projects like Pepe Dollar, creating high-frequency capital transmission and interception.

SPX's explosion is not only the result of technical patterns but also a reflection of the synergy between Meme × trading momentum × community activity.

AERO: Platform Entry as a Capital Accelerator

AERO's upward momentum is highly practical. As a core decentralized exchange (DEX) token on the Base chain, it received significant positive news in early August—being integrated into the Coinbase App, allowing one-click buying and selling without redirection. This enables millions of trading users to directly access liquidity pools on the chain. Within a week, AERO's trading volume surpassed a six-month high, and its price rose over 43%. Meanwhile, Ethereum's TVL rebounded to approximately $96.9 billion, and trading activity on the Base chain surged, making Aerodrome a "capital turnaround point."

This wave of increase shows that "platform entry" has the ability to translate into on-chain trading behavior, serving as a central node for driving price diffusion and explosion.

Other Sectors Also Stand Out in Structural Rebounds

Other sectors have also shown samples of structural market trends, with funds gradually penetrating more areas:

L2 / Scaling Sector

Representative projects like MNT (+49.06%) and ARB (+30.52%) have benefited from the resurgence of activity in the Ethereum ecosystem and increased on-chain trading volume, reactivating the valuation logic of layer two networks. As user demand for low fees and high throughput continues to strengthen, L2 has become not only a performance optimization solution but also the launch pad for various new protocols. Some funds believe that these foundational sectors exhibit "slow bull" characteristics; although their short-term elasticity is not as high as that of memes, they excel in ecological stability and long-term narratives.

DeFi Protocol Sector

Uniswap (+76.37%) continues to hold a core position in decentralized liquidity, with cross-chain aggregation and increased fee income being the main reasons.

FORM (+35%) has reduced the complexity of operations for retail investors through "portfolio strategy management," while PENDLE (+34.89%)'s "yield splitting" products bridge fixed income and derivatives, meeting the diverse needs of institutions and advanced traders. It can be seen that current funds are not blindly chasing highs but are inclined to invest in DeFi protocols with unique mechanisms that can form a moat.

Infrastructure Sector

LINK (+40.46%), KAIA (+31.93%), and XDC (+20.19%) represent three types of demand: "oracles," "cross-chain infrastructure," and "enterprise chains."

LINK's monopoly position in the oracle sector makes it an indispensable underlying component in DeFi and RWA narratives; KAIA, as a cross-chain hub, benefits from the continuous rise in inter-chain interoperability demand; XDC has gained attention for long-term stable allocation funds due to its integration with traditional enterprise supply chains and trade financing scenarios. The commonality among these assets is that regardless of market sentiment fluctuations, their use cases can continuously generate rigid demand.

Platform Token Sector

The strong performance of platform tokens like OKB (+72.98%), CRO (+52.95%), and BNB (+29.12%) benefits from the increase in platform revenue driven by the recovery of trading volume, as well as the long-term expectations of buyback and burn mechanisms. For funds, the logic of platform tokens is closer to "equity-like assets," and as the exchange ecosystem expands, their intrinsic value is expected to steadily increase.

Payment Chain Sector

BCH (+48.27%), XLM (+44.49%), and TRX (+31.18%) have seen a revival in the context of cross-border payments and stablecoin transfers. BCH remains a frequent player in offline payments and OTC scenarios in some emerging markets; XLM has gained incremental growth through partnerships with international clearing and remittance services; TRX maintains capital attractiveness based on stablecoin issuance and on-chain activity. These assets tend to have relatively strong anti-drawdown characteristics during market fluctuations and are more likely to attract medium- to long-term funds.

Special Narratives / Derivatives Sector

SPX's strength has been mentioned earlier, but similar projects like HBAR and INJ are also gaining revaluation opportunities through differentiated narratives (such as DAG architecture and depth in derivatives trading). Especially at this stage, projects that can provide additional risk-return curves outside mainstream narratives often receive unexpected capital boosts towards the end of the market cycle.

Overall, the rebound in these sectors confirms a trend: funds are migrating from major assets to targets with more elasticity and sector depth, seeking new sources of alpha.

Conclusion

The current rotation market makes the entire market resemble a multi-level chess game: mainline sectors continue to attract attention, but other squares on the board are also quietly lighting up. Whether it is long-term stable infrastructure or short-term explosive concept coins, they are providing different risk preference options for funds.

In the future, market differentiation may become more pronounced—some assets will continue to rise due to the combination of narrative, funding, and fundamentals, while others will quickly recede in the absence of sustained driving forces. For investors, the real challenge is not finding coins that are rising, but judging how long they can continue to rise and when to exit.

After all, this market is never short of surprises, but it is also never short of unexpected events.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。