The cryptocurrency market remains active amid rising expectations of macro liquidity, with particularly strong institutional demand signals for Ethereum (ETH). David Duong, head of research at Coinbase Institutional, stated on social media today that the demand for ETH is far from over. Since early August, leading ETH treasury reserve companies have accumulated over 795,000 ETH (worth approximately $3.6 billion), and these institutions now control more than 2% of the total ETH supply. Meanwhile, BitMine Immersion Technologies (BMNR) has raised $20 billion in new funding, bringing its total purchasing power to $24.5 billion.

- July 2014: Initial issuance at a price of $0.308

- October 2015: After falling to an all-time low, ETH stabilized around $1 after a period of adjustment

- November 2021: All-time high price of $4,871

- 2024: Highest price of $4,108, lowest price of $2,051

- August 2025 (as of press time): Highest price of $4,790, lowest price of $3,355

ETH Supply Tightening from BMNR's Perspective

David Duong's observations are based on on-chain and corporate announcement data. BitMine Immersion Technologies (BMNR) has become the world's largest ETH treasury holder. As of August 10, its ETH holdings exceeded 1.15 million, valued at nearly $4.96 billion, accounting for about 1% of the total supply. The company raised nearly $4.5 billion through stock sales, almost all of which was used for ETH acquisitions, leaving only $723 in remaining funds. BMNR plans to continue buying ETH through a newly authorized $20 billion stock sale, targeting a total supply lock of 5% (currently valued at about $25 billion). This strategy is led by Tom Lee, co-founder of Fundstrat, and the company has rapidly increased its holdings from 833,137 ETH (worth $3 billion) to 1.15 million, adding 320,000 ETH worth $2 billion in just one week.

SharpLink Gaming (SBET) is also following suit, with holdings of approximately 728,800 ETH and raising $900 million for further acquisitions. These companies employ staking strategies to lock in their holdings, with 99% of BMNR's ETH staked, generating an annualized return of 3% (about $87 million), utilizing low-cost energy to enhance network security and reinforce scarcity. Overall, since early August, institutional net purchases have reached 795,000 ETH, raising the control ratio to over 2%, consistent with Duong's data. This reflects a shift in corporate treasuries towards ETH: transitioning from Bitcoin mining companies to ETH reserve companies, viewing it as a "programmable asset."

On-chain data supports strong demand. The weekly trading volume of ETH ETFs reached $17 billion, with cumulative inflows of $10.2 billion, led by funds like BlackRock. BMNR executed large transactions, such as purchasing 135,000 ETH (worth $600 million) through FalconX, Galaxy Digital, and BitGo within 10 hours, bringing its total holdings to 1.297 million ETH, valued at $5.77 billion. This speed is record-breaking, highlighting institutions absorbing supply through over-the-counter platforms to avoid market shocks.

Interest Rate Cut Expectations and the Evolution of ETH Positioning

Why are institutions accelerating in August?

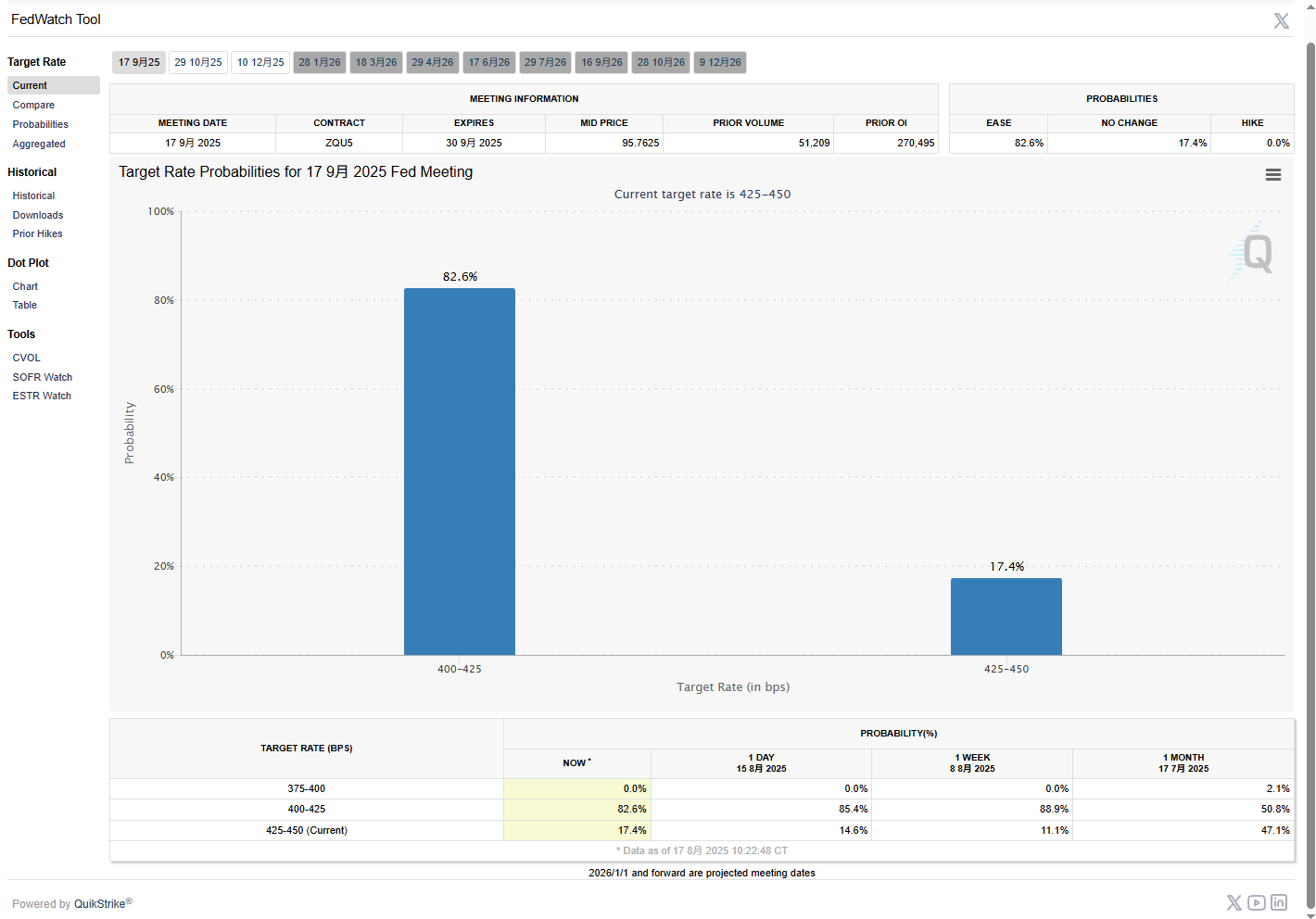

- On a macro level, the probability of a Federal Reserve rate cut in September is 82.6%, indicating liquidity injection. The greed index at 60 suggests market sentiment is optimistic, with crypto assets benefiting from a rebound in risk appetite. As the leading altcoin, ETH benefits from a decline in Bitcoin's dominance (from 65% at the beginning of the year to 59%).

- On an ecological level, ETH is transitioning from speculation to reserve. Companies like BMNR view ETH as "government bond-grade collateral," supporting DeFi and tokenization. The asset management scale of tokenized assets has reached $270 billion, with ETH accounting for 55%. PayPal's PYUSD stablecoin exceeds $1 billion, and BlackRock's BUIDL fund is expanding. Monthly on-chain transaction value is $238 billion, a 70% increase; transaction volume is 46.64 million, with 17.55 million active addresses. The staking ratio exceeds 30%, locking in supply and further tightening circulation. Institutional investors like ARK's Cathie Wood, Founders Fund, and Pantera support BMNR, injecting confidence. The company's average daily trading volume is $2.2 billion, ranking 25th in the U.S., surpassing JPMorgan and Micron Technology. This enhances liquidity, facilitating ETF arbitrage and institutional allocation. BMNR also announced a $1 billion stock buyback, reducing supply and increasing per-share ETH exposure.

Short-Term Volatility and Long-Term Supply Shock

The current price of ETH is $4,369, down 1.66% in 24 hours, but institutional buying provides a buffer. Since early August, ETH rebounded, briefly surpassing $4,790. ETF inflows reached $2.9 billion, with analysts targeting $4,800-$5,000. BMNR's average holding cost is $3,491.86, realizing a floating profit of $423 million.

In the long term, supply shocks may drive prices higher. If corporate treasuries hold 10% of circulating ETH, combined with staking and ETF locks, liquid supply could be halved. This creates reflexivity: scarcity drives prices, and rising prices attract adoption. ETH's market cap is $534.5 billion, with 24-hour trading volume of $78.2 billion, low inflation, and DeFi dominance.

However, risks exist. In the short term, L2 transfer transaction volumes may divert from the mainnet; macro data fluctuations like PPI may affect correlations. Although BMNR's stock price has risen (up 11.7% intraday, 62% weekly), valuations are high (price-to-sales ratio of 30.36, price-to-book ratio of 57.52), with negative earnings. Regulatory uncertainties persist, such as EU banking reviews and the UK’s Revolut initiatives, while Monzo freezes accounts.

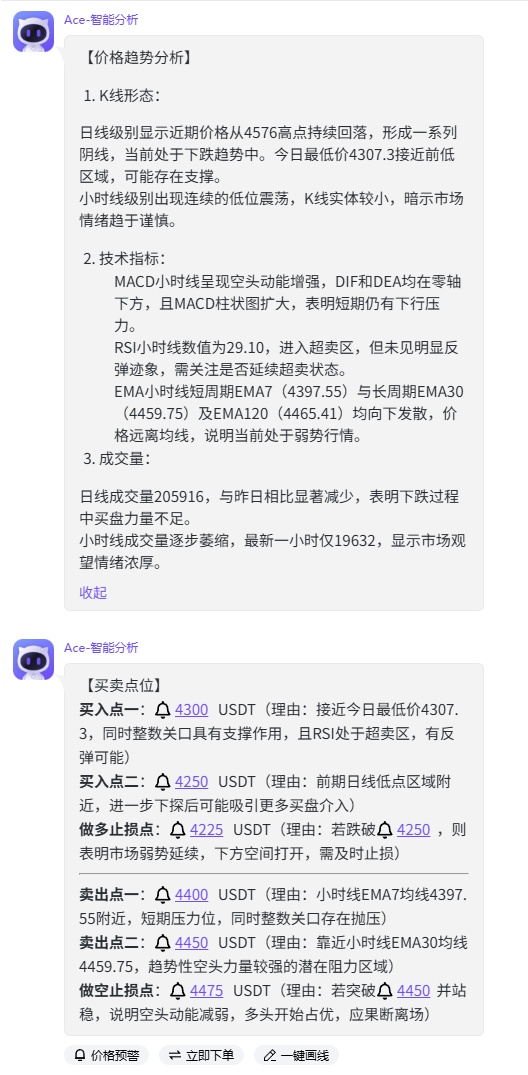

Daily charts show recent prices have continued to decline from a high of $4,576, forming a series of bearish candles, currently in a downtrend. Today's lowest price of $4,307.3 is close to previous low areas, indicating potential support.

Hourly charts show continuous low-level fluctuations, with small candlestick bodies, suggesting market sentiment is becoming cautious.

This article is for informational sharing only and does not constitute any investment advice for anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。