After Bullish rang the bell on the New York Stock Exchange last week, becoming the second publicly listed cryptocurrency exchange in the United States, Gemini could no longer hold back. This American-based exchange, which has always emphasized "compliance," is now vying for the position of the third listed company.

In the spotlight this time are the twin brothers Tyler and Cameron Winklevoss, who have already been written into American entrepreneurship textbooks. Over a decade ago, they made global headlines due to a lawsuit against Zuckerberg; ten years later, they became some of the earliest large-scale investors in Bitcoin during the crypto wave.

Today, Gemini's listing is not just a symbol of further "compliance" for crypto CEXs, but also a way for the brothers to reclaim their standing in the new round of the American capital market. Losing in social networks, they gained in the crypto wave.

Image source: Bloomberg

IPO Season: Gemini's Listing Sprint

According to the latest news, Gemini has publicly submitted a registration statement (Form S-1) to the U.S. Securities and Exchange Commission (SEC) on August 15, 2025, intending to list on the Nasdaq Global Select Market under the ticker symbol GEMI. Prior to this public submission, Gemini had also submitted a confidential IPO application in February 2025.

The documents submitted by Gemini indicate that the company has chosen to go public through a traditional IPO, with Goldman Sachs and Citigroup serving as the lead underwriters, along with several other institutions including Morgan Stanley and Cantor Fitzgerald participating in the underwriting team. However, the prospectus has not yet disclosed the price range and specific share size. The SEC still needs to approve it, and the listing date is not yet determined.

Renaissance Capital estimates that Gemini's IPO could raise about $400 million. Additionally, the company has secured a credit line of up to $75 million from Ripple, aimed at enhancing liquidity through the RLUSD stablecoin, although it has not yet been utilized.

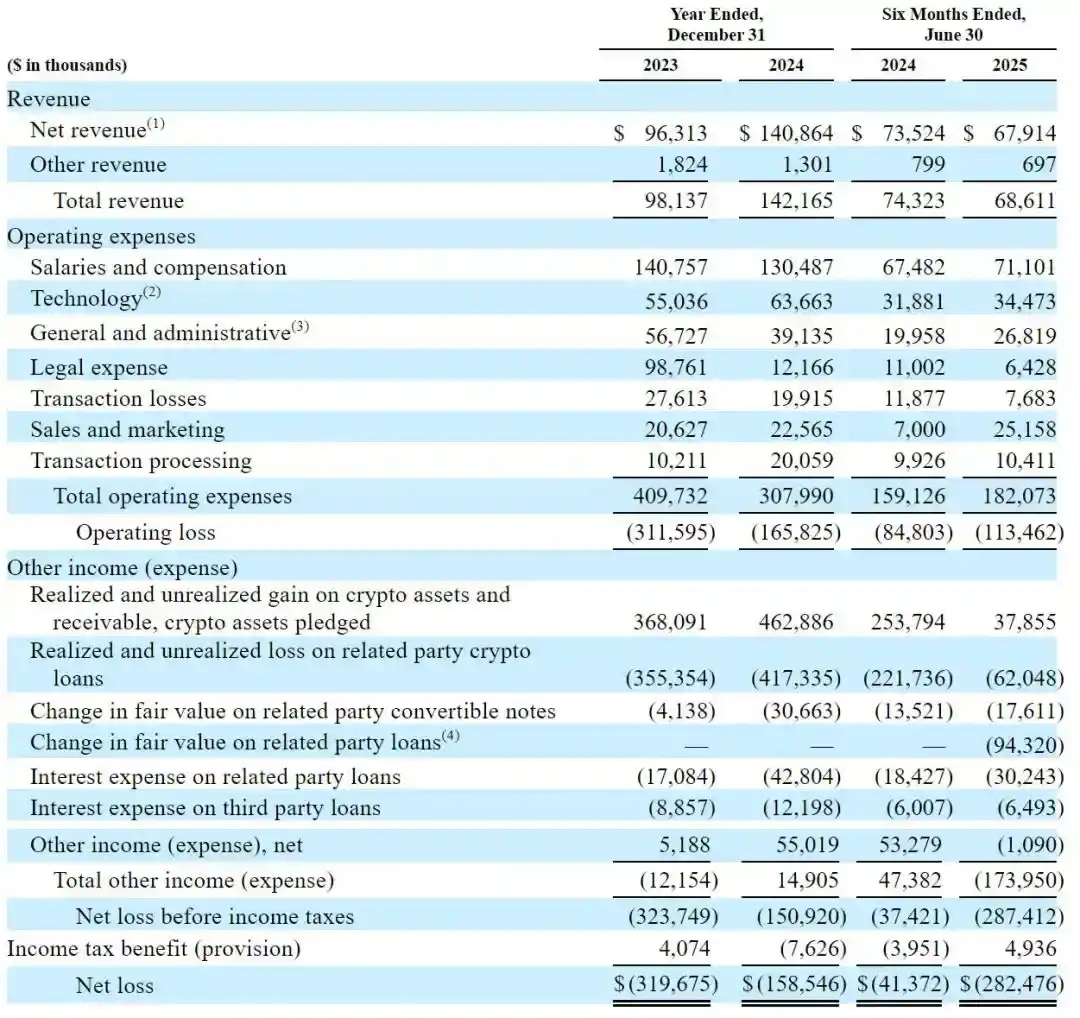

It is worth noting that Gemini is currently experiencing financial growing pains. According to the S-1 filing, for the six months ending June 2025, the company's revenue was $68.6 million, but it reported a net loss of $282.5 million, far exceeding the $41.4 million loss from the same period last year. Trading fees remain the primary source of income, accounting for about 66% of total revenue in the first half of 2025; in addition, Gemini also offers custody, staking, and the issuance of the GUSD stablecoin.

This round of IPO activity is taking place in the context of a general recovery in the U.S. IPO market, especially with digital asset companies frequently making appearances. Circle (a stablecoin issuer) and Bullish (a crypto trading platform) completed their listings a few months ago and last week, respectively, while Coinbase has also been included in the S&P 500 index, significantly increasing market recognition of compliant trading platforms.

The Most In-Tune Twins on Wall Street

Compared to Gemini itself, the story of its founders may be even more interesting.

In the summer of 1981, Tyler and Cameron Winklevoss were born into a family rich in both academia and wealth. Their father, Howard, was a professor of actuarial science at the Wharton School of the University of Pennsylvania and also an investor. The brothers grew up in Greenwich, Connecticut, a quiet town populated by the wealthy, where neatly trimmed lawns and yacht docks were part of the daily scenery.

A photo of the Winklevoss brothers with their father

In their youth, the Winklevoss brothers were almost a "perfect" template: excellent grades, handsome appearances, and boundless energy. They taught themselves programming and were able to tinker with web pages by the age of thirteen or fourteen, also taking turns playing guitar and drums in a band. Their mother often said that they were reflections of each other from the moment they were born: the same blue eyes, the same high cheekbones, and even their cries had a certain synchronized rhythm.

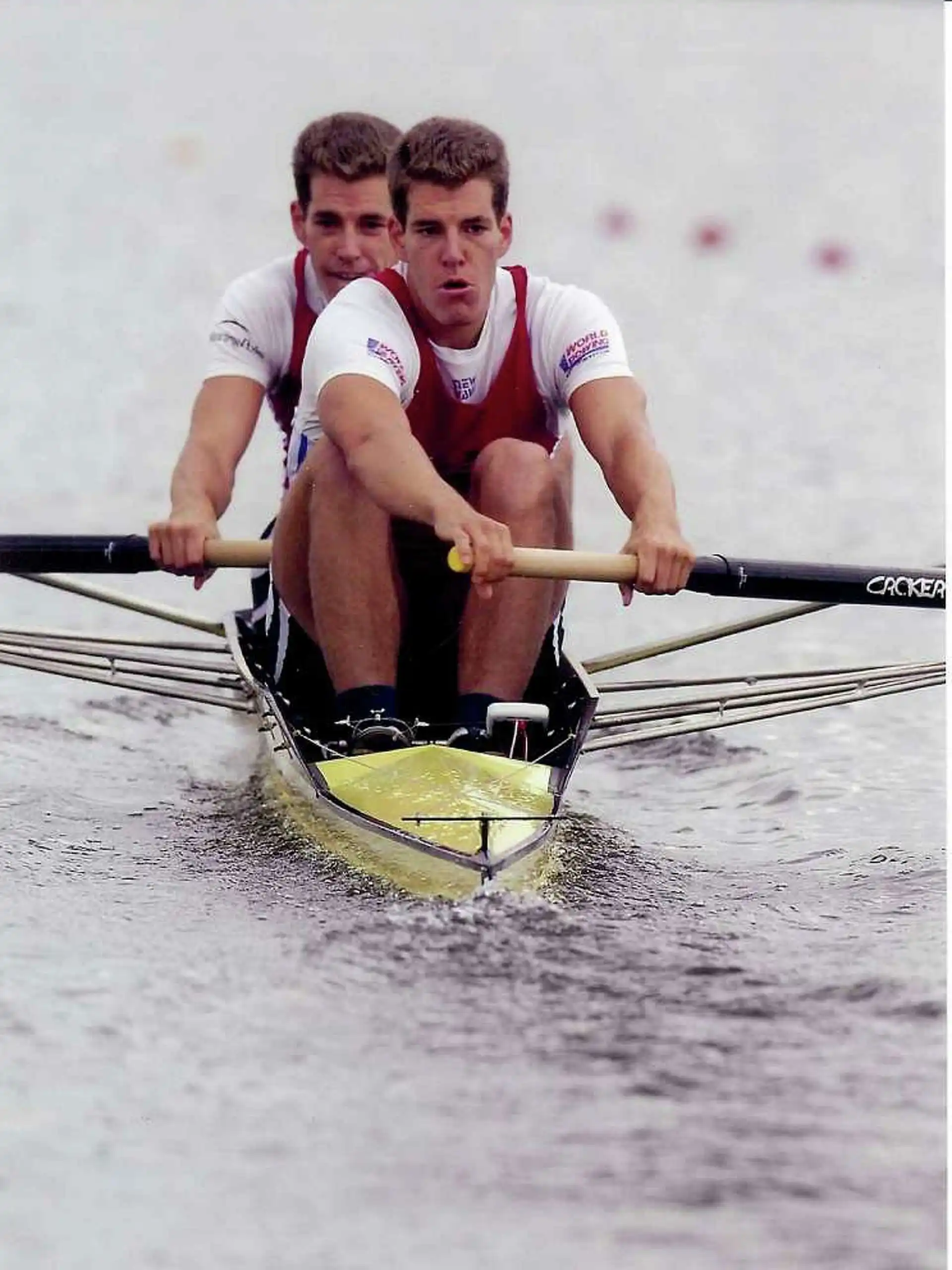

Their subsequent teenage trajectories were almost completely overlapping: undergraduate economics at Harvard University, further studies at Oxford University, and a rowing career that would be recorded in sports history. At Harvard, they were the backbone of the university's rowing team, known as the "God Squad" for their synchronized rowing strokes.

The Winklevoss brothers rowing

In 2008, they represented the United States in the men's double sculls event at the Beijing Olympics, finishing in sixth place. Although they missed out on a medal, their long-term synchronized breathing, muscle, and will training on the water laid the foundation for their future collaboration in entrepreneurship.

The Entanglement with Zuckerberg

In their junior year at Harvard, they launched a campus social networking site called HarvardConnection. This was a new idea they had been mulling over: if they could put Harvard students' profiles, photos, and social connections on one website, it might become a new way of socializing.

This idea later evolved into their entanglement with Zuckerberg.

The brothers were initially stars on the rowing team, skilled at putting their oars in the water, but they were equally passionate about technology. However, they were not top-notch programmers, so they enlisted the help of classmate Divya Narendra to plan the website's development. During this process, they found a sophomore student to help write code—his name was Mark Zuckerberg.

The story's development was more dramatic than fiction. Initially, the brothers had high hopes for Zuckerberg, believing he could help complete the website's core functions. But weeks later, Zuckerberg's communication dwindled, and progress stalled. He always had various excuses: heavy coursework, bugs in the system, needing more time. Until one day, the brothers discovered that Zuckerberg had quietly launched a website called TheFacebook. The interface was strikingly similar to their envisioned HarvardConnection, just with a different name and domain.

Anger quickly turned into a lawsuit. In 2004, the brothers and Narendra sued Zuckerberg, accusing him of stealing their ideas and source code. The litigation dragged on, while Zuckerberg's Facebook rapidly expanded, becoming one of Silicon Valley's hottest companies.

This entangled story was also brought to the big screen in Hollywood's "The Social Network."

In 2008, they settled for $65 million, which included a substantial amount of Facebook stock. At that moment, they became known as "the ones who lost Facebook." But fate often enjoys a twist: years later, this money became their ticket into the world of cryptocurrency.

In 2012, they first heard about Bitcoin. At that time, few truly understood the technology, but the brothers keenly sensed its potential. They used part of their settlement funds to purchase Bitcoin, accumulating a holding of up to 70,000 coins, which accounted for about 1% of the total supply at the time. What was a small bet then has now become a legendary fortune worth billions of dollars.

Some jokingly say that without the entanglement with Facebook, there might not be a Gemini today.

In 2014, Gemini was born. The brothers decided not to be the "ones who missed Facebook" but to firmly grasp the direction in this new wave of technology. Unlike the trading platforms that were growing wildly and operating in gray areas at the time, Gemini embraced regulation from the start, applying for a trust license from the New York State Department of Financial Services (NYDFS) and strictly adhering to Wall Street's compliance standards. The brothers even introduced a daily Bitcoin auction mechanism, mimicking Nasdaq-style trading rules, hoping to reassure institutional investors.

The division of labor between the brothers also became clearer. Tyler leaned more towards internal affairs and strategy, excelling in management and detailed execution; while Cameron was the spokesperson, more willing to appear in public and tell the story of Gemini. They complemented each other, with distinct roles, almost instinctively in sync.

Compared to Binance and OKX, Gemini did not have a "stormy" expansion; compared to Coinbase, Gemini lacked a bit of Silicon Valley's engineer romance. Their label has always been "compliance-oriented," consistently appearing in suits at congressional hearings and media events, emphasizing that cryptocurrency needs institutionalization and legal protection.

Today, according to Bloomberg's estimates, the brothers each hold over 5% of Gemini, with personal net worth reaching $7.5 billion, totaling $15 billion in wealth. Their names are no longer just tied to the story of their feud with Zuckerberg but are deeply connected to the rise of Bitcoin and the emergence of compliant trading platforms.

The past defeat has been reversed by another wave of technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。