The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome everyone's attention and likes, and I refuse any market smoke screens!

The market continues to decline, almost reaching everyone's entry points. I believe everyone is quite confused now. When it comes to the moment of decision, the heart is still in great agony. Seeing all markets so prosperous has led everyone to overlook the fragility of the real economy. After discussing with some real operators, many friends are almost choosing to abandon the real economy and formally embrace the virtual economy. To answer the confusion of all real operators, many friends do not understand why, under the brilliance of the financial industry, the real economy is so bleak. Lao Cui only needs to ask everyone one question: when have you ever seen a bull market when the economy is good? There has never been such a situation! Because when the economy overheats, strategies often shift from loose stimulation to tight regulation, such as raising interest rates, increasing reserve requirements, and restricting credit expansion, etc.

These strategies will directly increase the cost of market funds, suppress corporate financing and investment demand, while reducing the relative attractiveness of the stock market, in order to achieve the goal of suppressing bull market trends. Therefore, most friends believe that the economy is a barometer of the stock market; in Lao Cui's eyes, these words are nonsense. A good economic situation is like gold everywhere in Shenzhen; under the prosperity of the real economy, who would invest excess funds into the stock market? The world stock market is always about wealth redistribution. Only when the world economy encounters problems and liquidity is insufficient will it start to attract funds into the stock market. When the old replaces the new, under the completed chip exchange, the economy will have liquidity. However, most stock markets have no resistance when encountering financial crises because the Americans will withdraw the main funds. If the domestic economy cannot operate, it will naturally drag down the real economy. This also explains why we cannot open up the market economy. As long as we do not open up, funds will continue to circulate within the market. Once opened, who can stop the erosion of capital?

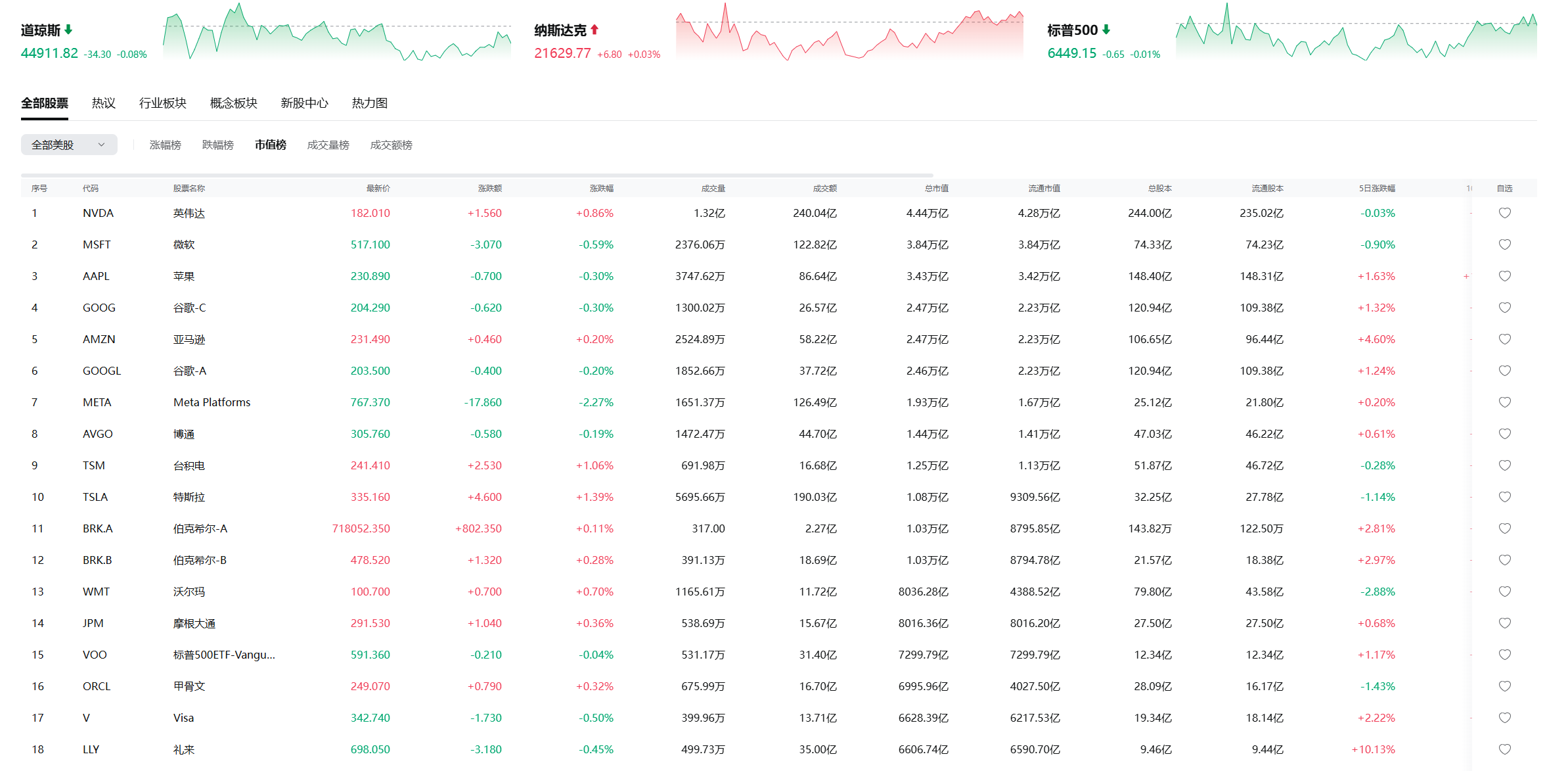

To put it bluntly, anything related to the financial industry is likely to create bubbles, and the financial industry is not linked to the real economy, allowing for greater manipulability, except for sectors like bulk energy and military. Comparing the current economic situation with the current cryptocurrency market, all funds must have an outlet, which can be any industry. Under the stimulus of interest rate cuts, more than half of the outflowing funds have entered the US stock market, creating a false impression of prosperity in the stock market while the unemployment rate is fabricated. At the height of the tariff war, US stock data continues to hit new highs, which is indeed quite ironic. The cryptocurrency market is similar; currently facing such economic problems, the new high market value in the cryptocurrency space and the continuous rise of major cryptocurrencies can only indicate that the scythe is about to swing down. Everyone can observe the turnover behavior in the cryptocurrency market; from Grayscale before its listing to BlackRock now, these two giants have already completed the exchange of control in the dark. Hasn't it been half a year since we last heard from Grayscale?

This is the new replacing the old, used to stimulate the economy. Expanding market value cannot rely solely on Grayscale's dominance. To solve the problems of the real economy is not something we financial analysts can decide; decision-making issues will be resolved by others. Everyone need not worry too much about the problems of the real economy; yin and yang coexist and give rise to each other, and this path must be walked, especially in light of the recent human rights report from the US, which also indicates a stance. Extreme oppression also leads to rebounds. The tariff issue cannot be resolved in the short term, and emerging industries are also dominated by the US. As for the real economy issues, I will not mention them again, as the depth cannot be expanded. Let's return to our previous thoughts. This morning, a notice about Hong Kong's improvement of the stablecoin legislation appeared, once again verifying Lao Cui's previous speculation that it is very likely that stablecoins will choose to switch to a more controllable public chain. The establishment of a professional committee against money laundering indicates that certain problems have been encountered, and we will need to wait for a while before relevant case explanations are available, so everyone be patient.

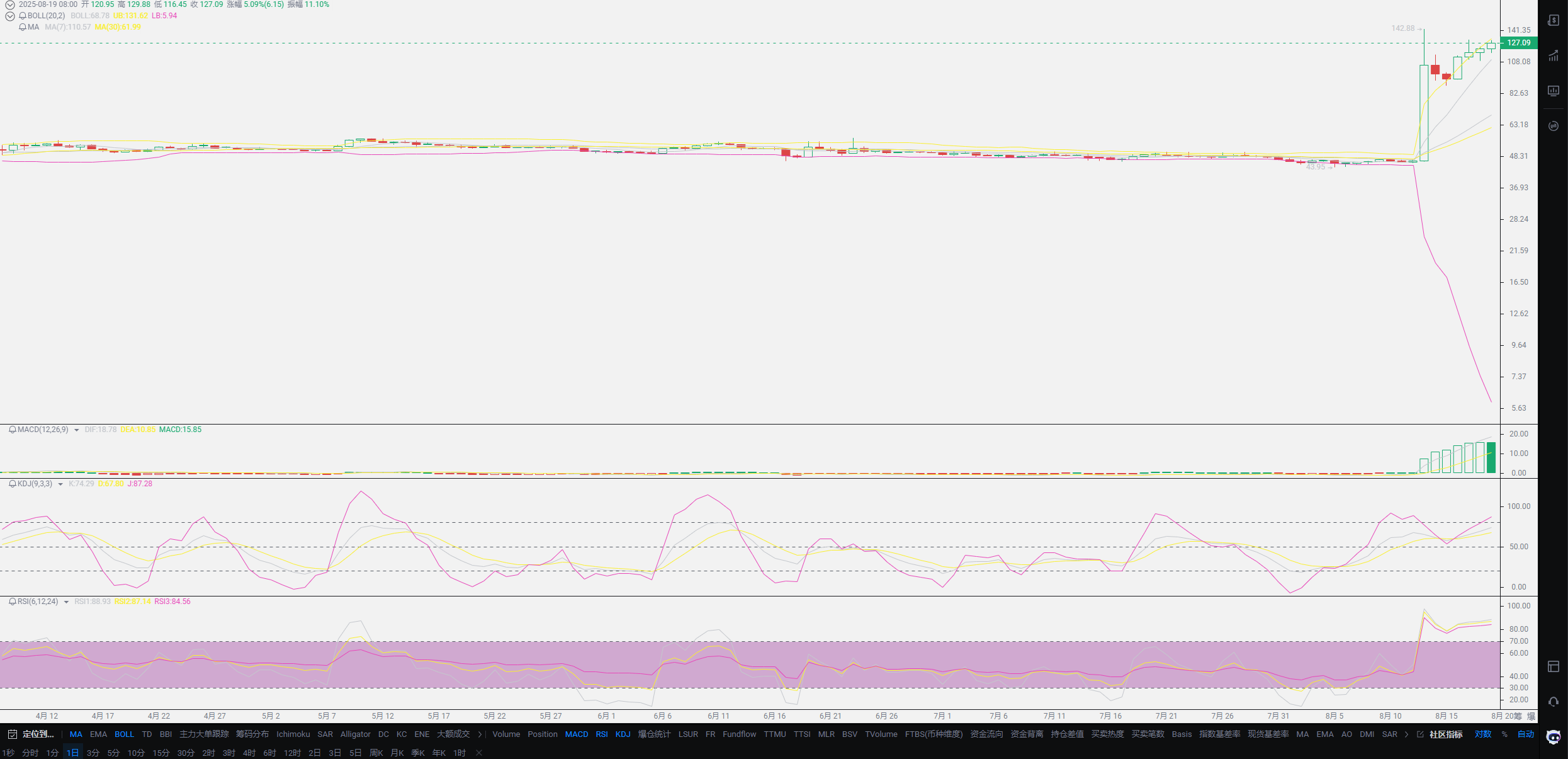

Observing OKB from the side for a while, its recent rise is quite remarkable. Lao Cui's current average holding price for OKB is between 90-100. Users with some thoughts can consider this cryptocurrency. Previously, I specifically wrote an article for OKB, and if my speculation can continue to be verified, perhaps OKB will become a dark horse this year. Even if it cannot achieve the results I envision, the issue of doubling this year should not be too difficult. OK is currently competing fiercely for the domestic market, having once surpassed Binance to become the leader in the country, showing a subtle trend of rebound. Stablecoins can utilize its channels, at least achieving a threefold increase. At this stage, I do not consider exiting; all spot positions will be decided at the end of the year. Regarding the contract market, this year the main players have gained the most, primarily profiting in the contract market. The current market trend revolves around short positions, and contract users should try to remain silent.

Since what Lao Cui does is published in self-media, many viewpoints cannot be expressed in depth. Whether it's ambiguous or due to lack of skill, I hope that those who wish to invest can have a correct understanding, at least being clear about why they incur losses after losing money. This lays a good foundation for future profits. Coincidentally, today Goldman Sachs predicts that the US may cut interest rates three times this year. As long as it is a rate-cutting cycle, a bear market will not come. Everyone needs to be clear about this point. These three rate cuts are not baseless; Trump's actions are aimed at making rate cuts controllable, and Trump himself is a strong supporter of rate cuts. What he cares about is his achievements while in office, and the economy is part of that achievement, so he will definitely promote this aspect vigorously. The rate-cutting committee increases seats and supports a Federal Reserve chairman who is more willing to cut rates. Everyone should understand the purpose of these actions. Being in the financial market, one would certainly want to see him succeed. Once he really breaks through the estimated two rate cuts, the peak may become even more unpredictable.

Lao Cui summarizes: Today I will provide an accurate range; Lao Cui's personal prediction is the main focus. If you currently do not have positions in the market, you can start laying out from the current price position. Lao Cui's estimate is that Bitcoin will have a bottom effect around 110,000-112,400. Of course, excluding spike events, even if spikes occur, the recovery speed will be very fast. The SOL range is 155-170, and the Ethereum range is 3900-4100. At this stage, the market will operate around short positions, and this is also the best time to start laying out. It depends on how everyone understands the trend of this pullback. In Lao Cui's view, this short-term short position range is not worth investing in holding short positions unless your current spot is in a loss state, in which case you can use contracts to make up for some losses. As long as the spot is in a profitable state, there is no need for excessive operations. The above ranges are also suitable for users with small amounts of capital to hold contracts, and they can expand when reaching the stop-loss position. OKB can be entered at any time, and the upper range is unpredictable!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the ultimate victory in chess. The novice, however, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent troubles.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。