This year, with the popularization of the RWA concept and the growth of the stablecoin market, the number of related projects has rapidly increased.

Last week, the stablecoin protocol USD.AI completed a $13 million Series A financing round in the primary market. The project connects fields such as DePIN, AI, RWA, and stablecoins by introducing GPU ownership, which can be seen as a form of "Infra-Fi," potentially providing new insights for DePIN.

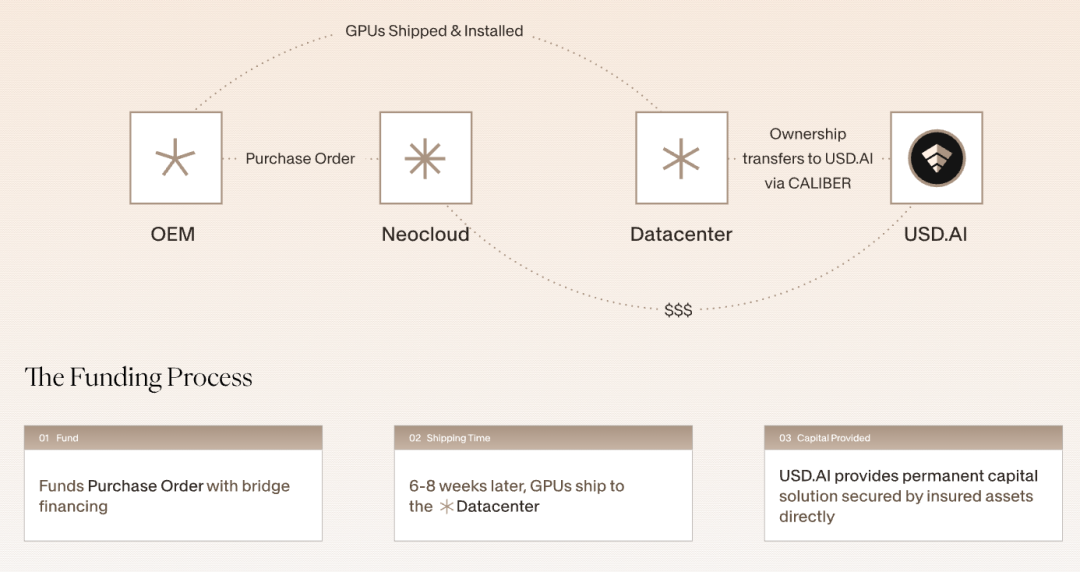

USD.AI is positioned as a decentralized credit protocol: emerging AI companies can use their owned GPU hardware as collateral to obtain loans. USD.AI has created the CALIBER standard, which represents GPU ownership in the form of on-chain NFTs and binds insurance, assessment, and redemption mechanisms on-chain.

USD.AI has created the CALIBER standard, which represents GPU ownership in the form of on-chain NFTs and binds insurance, assessment, and redemption mechanisms on-chain.

This means that the ownership, collateralization, and redemption of GPUs can all be executed on-chain. Analyzing USD.AI's business model, it operates as a revenue-generating stablecoin project, with revenue sources from AI hardware devices and U.S. Treasury bonds: GPU hardware generates income through computing power leasing, and the loan interest is distributed to sUSDAI stablecoin holders.

In this model, GPUs are not just hardware and computing power, but also cash flow generated from AI training/inference services, thereby supporting the value of the collateral. If there are no borrowers temporarily, idle funds will be invested in U.S. Treasury bonds to earn returns.

The protocol has designed a dual-token model:

USDai: pegged to the U.S. dollar, serving as a settlement tool for loan issuance and clearing.

sUSDai: a revenue-generating stablecoin, whose value is supported by the income generated from GPUs (such as AI training leasing income) and distributes returns to investors.

Based on this, the official has previously set a target APR of 15% to 25% (the currently displayed APR is 6.76%, with an expected 7.83%, and the TVL during the testing period is nearly $50 million). This decentralized credit model aimed at AI startups uses computable and liquid computing power assets as collateral, which aligns well with the collateral logic and risk model. However, whether this interest rate can be achieved through low-liquidity ownership raises questions and challenges regarding the opacity of RWA and decentralized transparency.

Regardless, the financialization of GPU ownership and transforming "physical property rights" into programmable financial assets also provides new ideas for DePIN + DeFi. In the DePIN track and the Infra-Fi concept, we can observe the following trends:

1. Machine Collateralization, Assetization of Computing Power, and Infra-Fi

In the on-chain market, hardware infrastructure such as GPUs can serve as productive assets, transforming from hardware resources into a new asset class that can be collateralized and lent. In the future, the business space of DePIN and RWA may no longer be limited to areas strictly constrained by legal/compliance regulations off-chain. DePIN and AI-related infrastructure, along with more enterprise-level hardware devices, may participate in the market.

2. DePIN + RWA

The off-chain assets involved in DePIN typically have practical application scenarios and business revenue. How to transfer the revenue-generating capability of off-chain assets to the on-chain DeFi yield pool is a key focus for DePIN projects. In this case, machinery serves as both on-chain collateral and RWA assets, indirectly entering the cycle of the DeFi market.

3. Integration/Acceleration of AI and Crypto

This innovation will make the financing costs for AI companies more market-oriented: for small AI teams, obtaining loans by collateralizing GPUs further lowers the threshold, but also raises higher demands for interest rate returns; for stablecoin holders, even without understanding the AI market, they can indirectly participate in investments similar to "AI corporate bonds" to gain returns and potential incentives.

4. Parallel Narratives

In the same cycle, market sentiment may switch between different tracks, likely reflecting different facets of the same logic, warranting further attention to the combination and progress of BTCFi with RWA, DePIN, and other directions.

In the original DePIN flywheel, the core logic is "resource sharing," where users transform into resource providers, driving development through "resource sharing + user incentives." The lending of GPU ownership releases liquidity through hardware financialization, enabling companies to drive financing and monetize computing power, generating cash flow and forming a new flywheel.

The new model drives cash flow back, creating synergy between decentralized capital markets and the production capacity of the AI industry (such as GPU clusters, AI model training), shifting from "shared resources" to assetization and financialization. Hardware resources can not only generate cash flow through leasing but also serve as on-chain collateral, accelerating credit expansion and capital market circulation.

If development proceeds smoothly, this could open a financial market for "machine collateralization," transforming Infra into a financializable "machine version" of RWA through on-chain protocols, entering the DeFi market. The asset range may also broadly include data storage, computing, bandwidth, electricity, etc., promoting the "liquidity" of DePIN in a new cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。