Strategy, known until recently as Microstrategy (Nasdaq: MSTR), has fundamentally transformed since 2020 from a business intelligence software firm into a corporate bitcoin ( BTC) treasury vehicle. Under Executive Chairman Michael Saylor, the company now holds 629,376 BTC, making it the world’s largest corporate holder of the cryptocurrency. This pivot has shifted its valuation model from traditional earnings-based metrics to one centered on its bitcoin reserves.

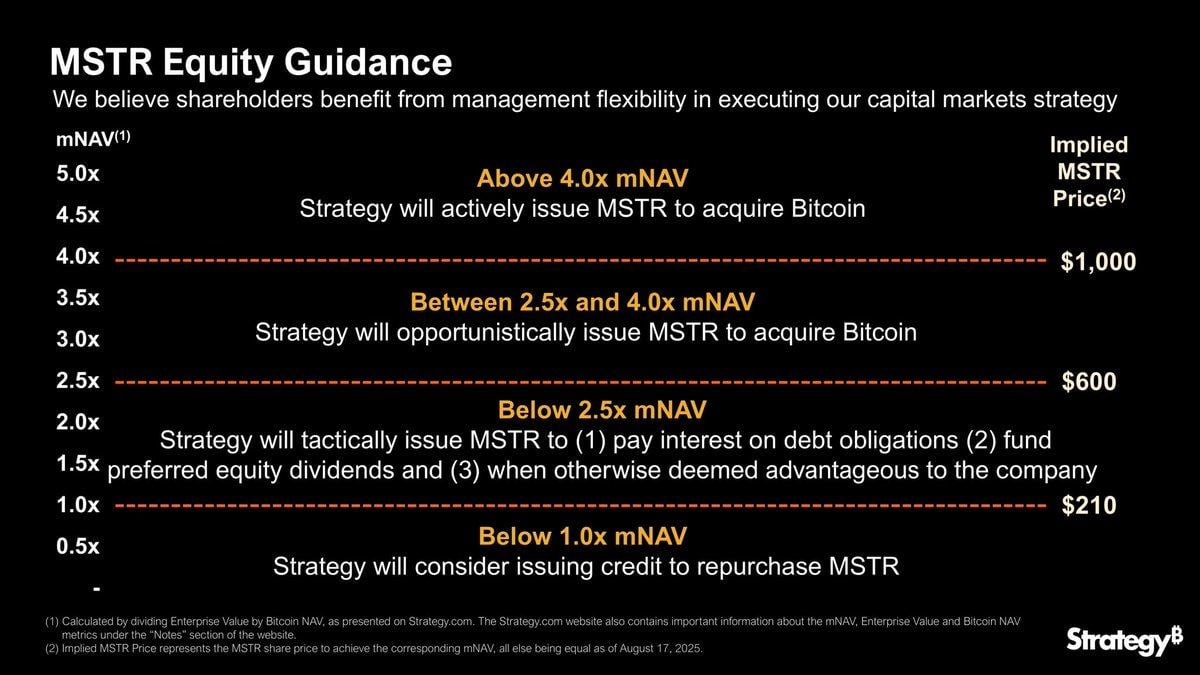

Central to understanding Strategy’s market valuation is the metric mNAV, or multiple of Net Asset Value. mNAV compares the company’s enterprise value to the market value of its bitcoin holdings. Simply put, it measures how much the market is willing to pay for Strategy’s stock relative to the underlying bitcoin it owns. An mNAV of 1 implies the stock trades at parity with its bitcoin (BTC) value. A figure above 1 indicates a premium; below 1, a discount.

Historically, MSTR has traded at a significant premium, often between 2x and 3.4x its bitcoin NAV. This premium is the core of a heated controversy. Critics have argued investors overpay for bitcoin exposure; they could get it cheaper via spot exchange-traded funds (ETFs) or direct ownership. They contend the premium ignores the company’s debt, the dilutive effect of future share sales, and its marginally profitable software division.

Supporters, however, justify the premium by framing Strategy as an active “bitcoin refinery.” They argue the company’s use of financial engineering—like issuing convertible debt and selling shares at high premiums—actively increases the amount of bitcoin per share, creating value that passive bitcoin holdings do not. This strategy, they claim, warrants a higher valuation.

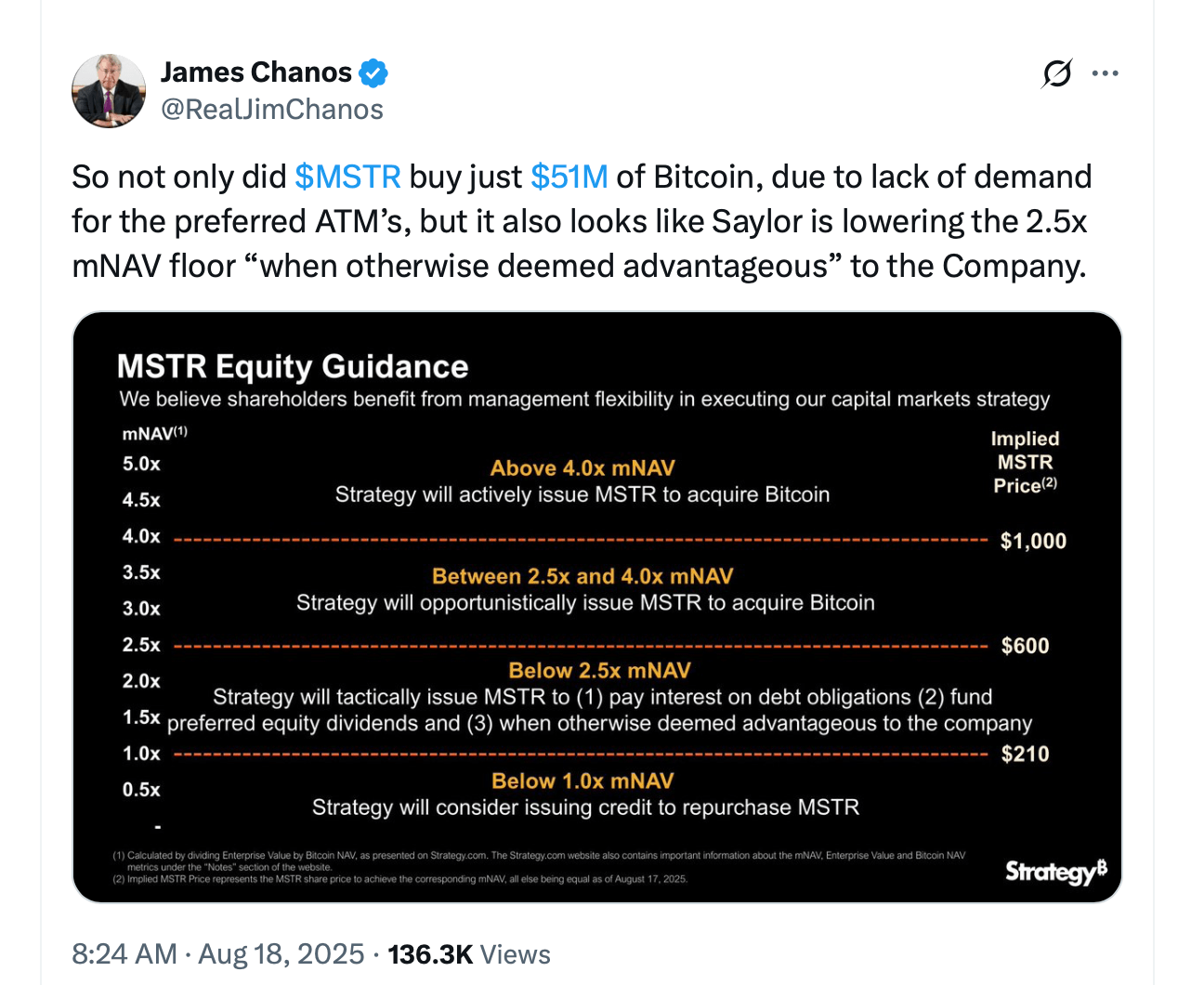

The controversy intensified in recent weeks. During its Q2 2025 earnings call, Strategy committed not to issue new common stock below an mNAV of 2.5x, except for specific obligations. This promise, many believed, was meant to protect shareholders from excessive dilution.

On Aug. 18, 2025, observers insist that the company abruptly abandoned that safeguard. Its new policy allows issuance below 2.5x mNAV “if management deems it advantageous.” The announcement sparked immediate outrage from investors who viewed the move as a bait-and-switch that significantly increases dilution risk, especially with mNAV recently reported near 1.68x.

This policy shift is not occurring in a vacuum. A class-action lawsuit filed this year alleges the company made misleading statements about its bitcoin strategy and financials. At the end of last year, critics like investment analyst Michael Lebowitz have accused Strategy of “preying on investors” by using bullish bitcoin rhetoric to inflate its stock volatility and enable cheaper fundraising.

Market dynamics further complicate the picture. mNAV tends to expand in bull markets, sometimes allowing Strategy to raise large sums— nearly $25 billion via stock sales in the past year—to buy more bitcoin. However, in bear markets, the premium can collapse, potentially pushing mNAV below 1 and magnifying losses for shareholders.

The company’s capital structure adds another layer of risk. Strategy continues to issue preferred shares with dividend obligations, complicating its financial picture and increasing fixed costs irrespective of bitcoin’s price performance.

Ultimately, the mNAV controversy highlights a fundamental tension between two investment philosophies: direct bitcoin ownership versus a leveraged corporate bet on its future. While Strategy’s model has generated spectacular returns during rallies, its recent policy change underscores the heightened risks of dilution and volatility that come with the premium. For investors, understanding mNAV is now essential to navigating the high-stakes world of corporate bitcoin adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。