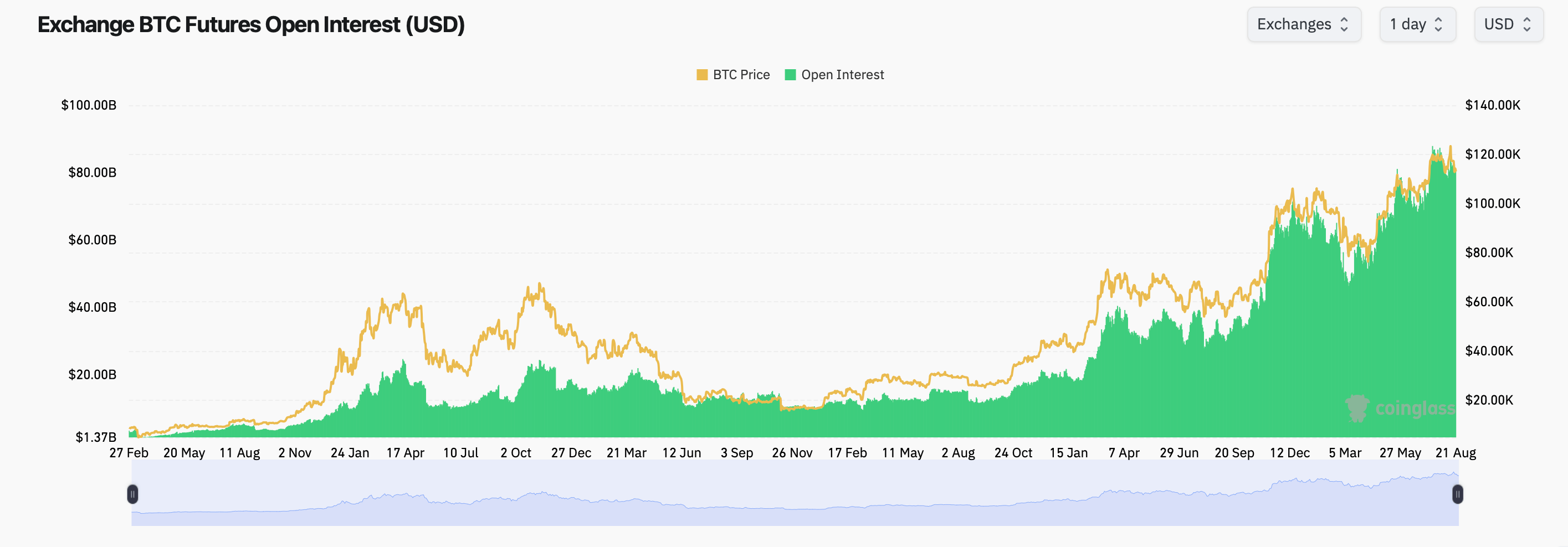

Total bitcoin futures open interest (OI) stood at 711.18K BTC, equal to $80.98 billion, up 0.59% over four hours and 1.05% over 24 hours. The OI-to-24-hour volume ratio across venues was 1.1181.

By exchange, CME led with $16.70 billion in notional OI, a 20.62% share, followed by Binance at $14.44 billion, or 17.82%. Bybit listed $9.29 billion (11.46%), and Gate showed $8.59 billion (10.6%), reflecting a market still centered on a handful of large venues.

Elsewhere, Bitget held $6.04 billion (7.45%). OKX posted $4.18 billion (5.16%) and added 1.08% over four hours and 2.00% over 24 hours. MEXC had $3.27 billion (4.03%), WhiteBIT $2.38 billion (2.94%), Kucoin $714.44 million (0.88%), and BingX $1.26 billion (1.55%).

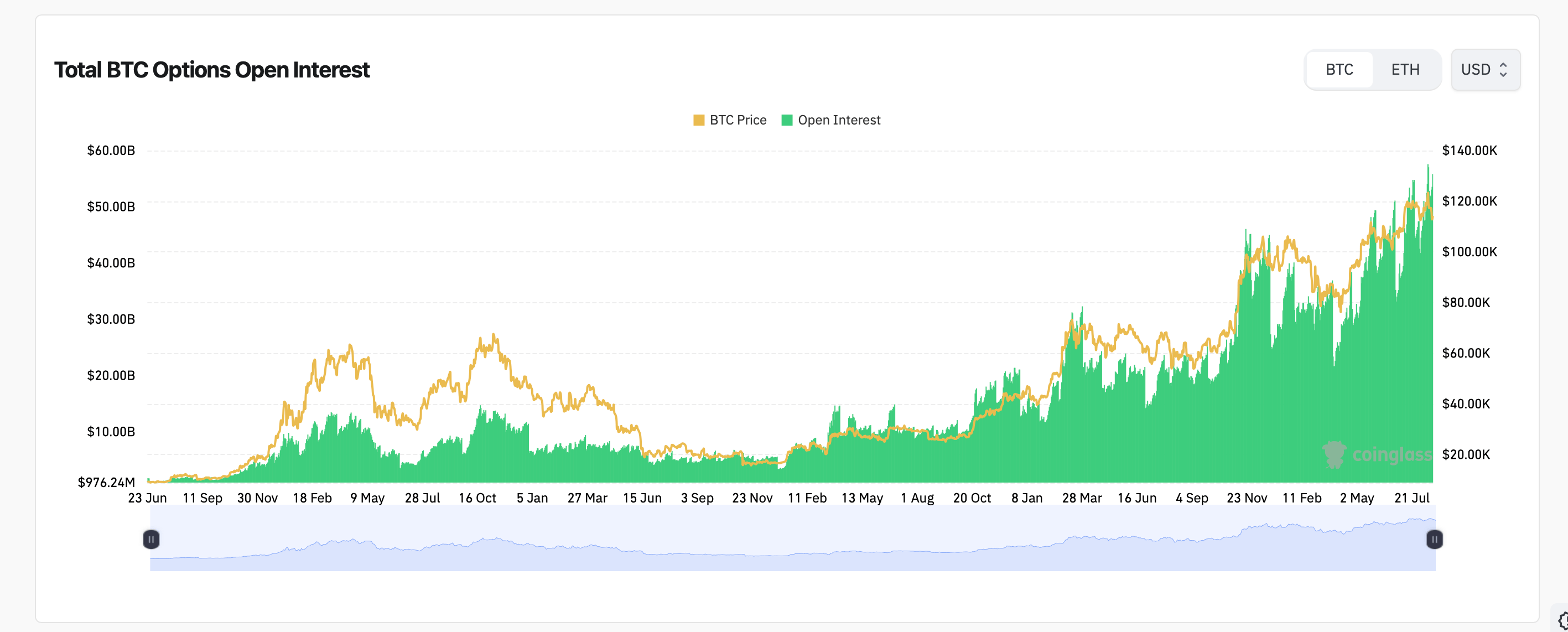

In options, coinglass.com stats show open interest tilted toward calls at 59.05%, or 268,086.55 BTC, versus 40.95% in puts, or 185,910.34 BTC. Trading over the past day leaned modestly the other way, with puts at 52.40% of volume (18,172.81 BTC) and calls at 47.60% (16,505.1 BTC).

Strike activity has been concentrated at higher price levels. On Deribit, the Sept. 26, 2025 $140,000 call held the largest open interest with 10,785.3 BTC. The Dec. 26, 2025 $140,000 call followed with 10,166 BTC, while the Dec. 26, 2025 $200,000 call carried 8,523.4 BTC. On the put side, the most significant position was the Sept. 26, 2025 $95,000 contract with 8,122 BTC of open interest.

Recent trading volume showed strong demand for near-term puts. The Aug. 22, 2025 $112,000 put recorded 1,765.5 BTC in activity, while the $114,000 put cleared 1,578.5 BTC and the Aug. 29, 2025 $120,000 put traded 1,571.9 BTC. Call volume was lighter, led by the Aug. 29, 2025 $115,000 call with 1,173.5 BTC and the $110,000 call with 1,163.8 BTC. The Sept. 26, 2025 $140,000 call also logged 663.7 BTC in trades.

Charts showed options open interest near the top of its multi-year range alongside price. Futures open interest in dollars also tracked toward highs on major venues. Positions remain near cycle highs. All eyes will be on U.S. Federal Reserve Chair Jerome Powell tomorrow when he delivers statements at Jackson Hole.

Liquidations were active but still modest compared to earlier in the week. Over 24 hours, $302.58 million in positions were closed, with $98.48 million in longs and $204.10 million in shorts. The data counted 84,016 affected traders, and the largest single liquidation was a $39.08 million BTC- USDT order on HTX. That’s quite the wipeout.

Shorter windows showed lighter flows: $91.03 million over 12 hours, $39.86 million over four hours, and $14.40 million over one hour. In each span, short liquidations outweighed longs in the latest hour, while the 12-hour tape showed longs ahead.

Overall, derivatives positioning expanded modestly as spot hovered near $113,000, with call-heavy options OI but slightly put-leaning day-over-day flow and futures OI dispersed across CME, Binance, Bybit, and Gate amid mixed changes by venue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。