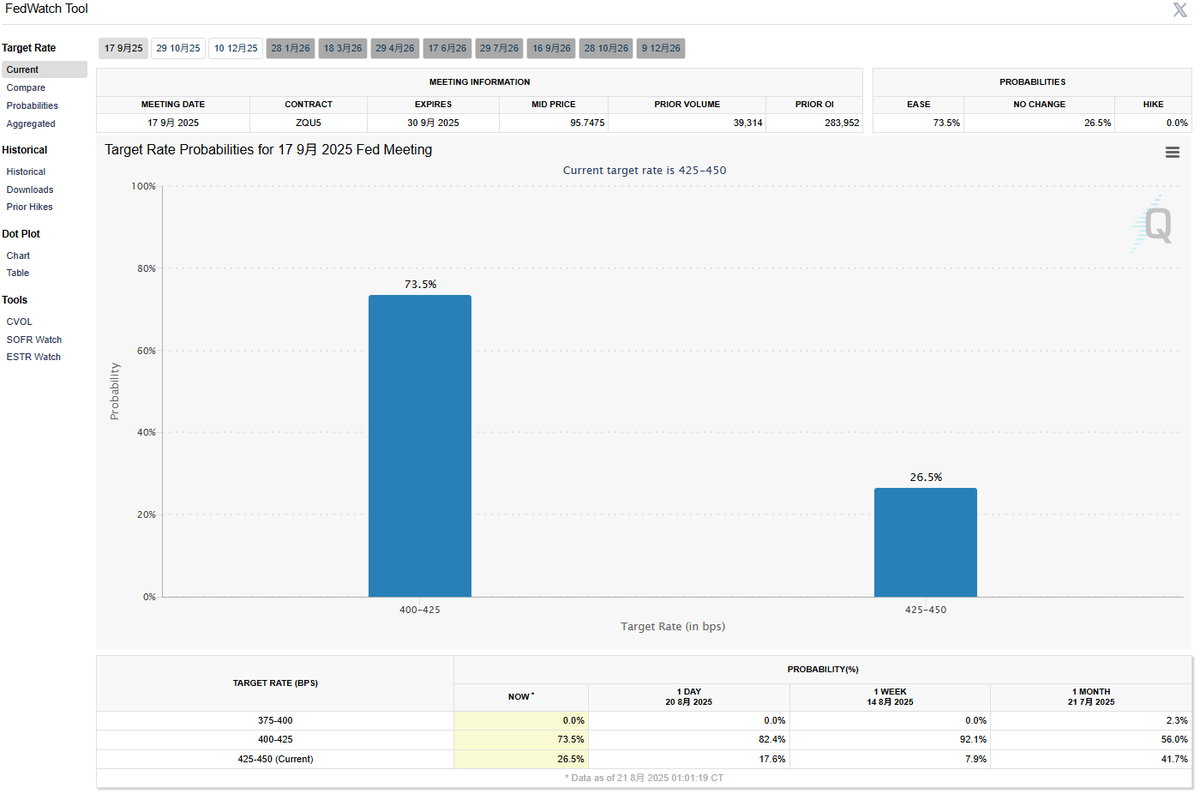

After the Federal Reserve's Harker did not support a rate cut in September, the CME's probability of a September rate cut dropped to 73.5%. The risk market also followed suit and declined. The old man mentioned that Powell's performance at the Jackson Hole annual meeting tomorrow is very likely, but I can imagine Trump holding the Federal Reserve's Cook accountable, as Trump is investigating all the board members who are not cooperating with the rate cuts (voting committee).

Cook's situation is likely a warning to others, so although the expected probability of a September rate cut has decreased, Trump should use some "dirty" tactics to increase his chances of success. If there is no rate cut in September, it should be quite a blow to Trump, who represents the current AI and cryptocurrency sectors in the U.S. stock market, particularly $BTC.

The likelihood of a 50 basis point cut is low, while a 25 basis point cut is still possible. Theoretically, when the market's expectations are contrary to those of the Federal Reserve, the market has not won since 2022. However, this time it is hard to say. If some voting committee members are not so clean, they might either choose to resign (like Kugler) or choose to comply. Of course, those who have no issues, like Powell, will definitely be fearless.

That said, I think it is very likely that Powell will not give a clear statement on whether there will be a rate cut or not at the Jackson Hole annual meeting.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。