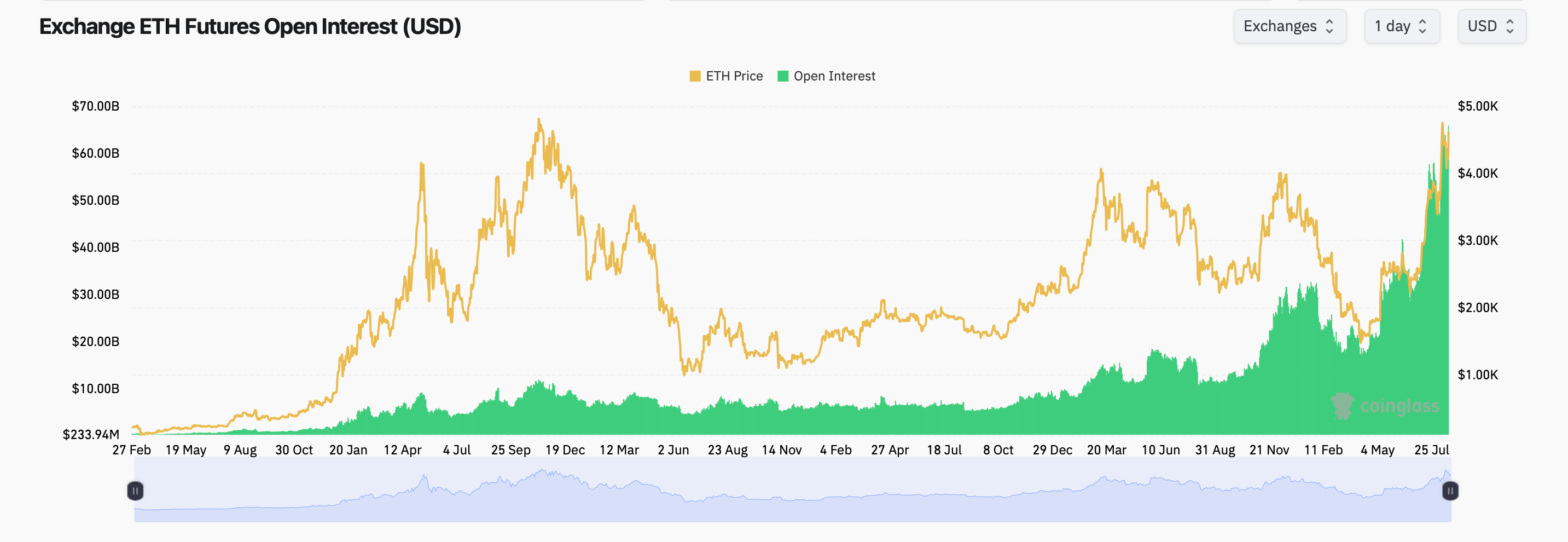

According to Coinglass figures, ethereum futures open interest across exchanges now totals $65.87 billion, representing more than 14.26 million ETH. Binance holds the largest share at $13.33 billion, or 20.24% of the market, followed by CME Group at $8.84 billion and OKX at $4.11 billion. Bybit and Kucoin also posted notable increases, with open interest growth in the double digits on an hourly and daily basis.

Ether‘s options markets are showing similar expansion. Total ETH options open interest has climbed past $21 billion, with calls dominating 65.65% of contracts compared to 34.35% puts. Options traders appear heavily concentrated around December 2025 expiries, with strikes at $4,000, $5,000, and $6,000 drawing the highest levels of activity.

Ethereum futures open interest via coinglass.com on Aug. 22.

The single largest contract is the Deribit ETH-26DEC25-6000-C, with open interest of more than 82,000 ETH. Volume data reinforces the trend. Over the past 24 hours, call contracts made up 52.73% of trading at 297,074 ETH, while puts accounted for 47.27%, or 266,267 ETH. Deribit contracts dominate both open interest and volume, followed by the centralized crypto exchange OKX.

At the same time, liquidations have accelerated across the crypto sector. ETH recorded $246.40 million in liquidations in the past day, leading the market in overall wipeouts. The day’s crypto liquidations totaled $545.12 million across the board, with 134,928 trades wiped out. Short positions bore the larger share, with $284.80 million cleared compared to $260.32 million in longs.

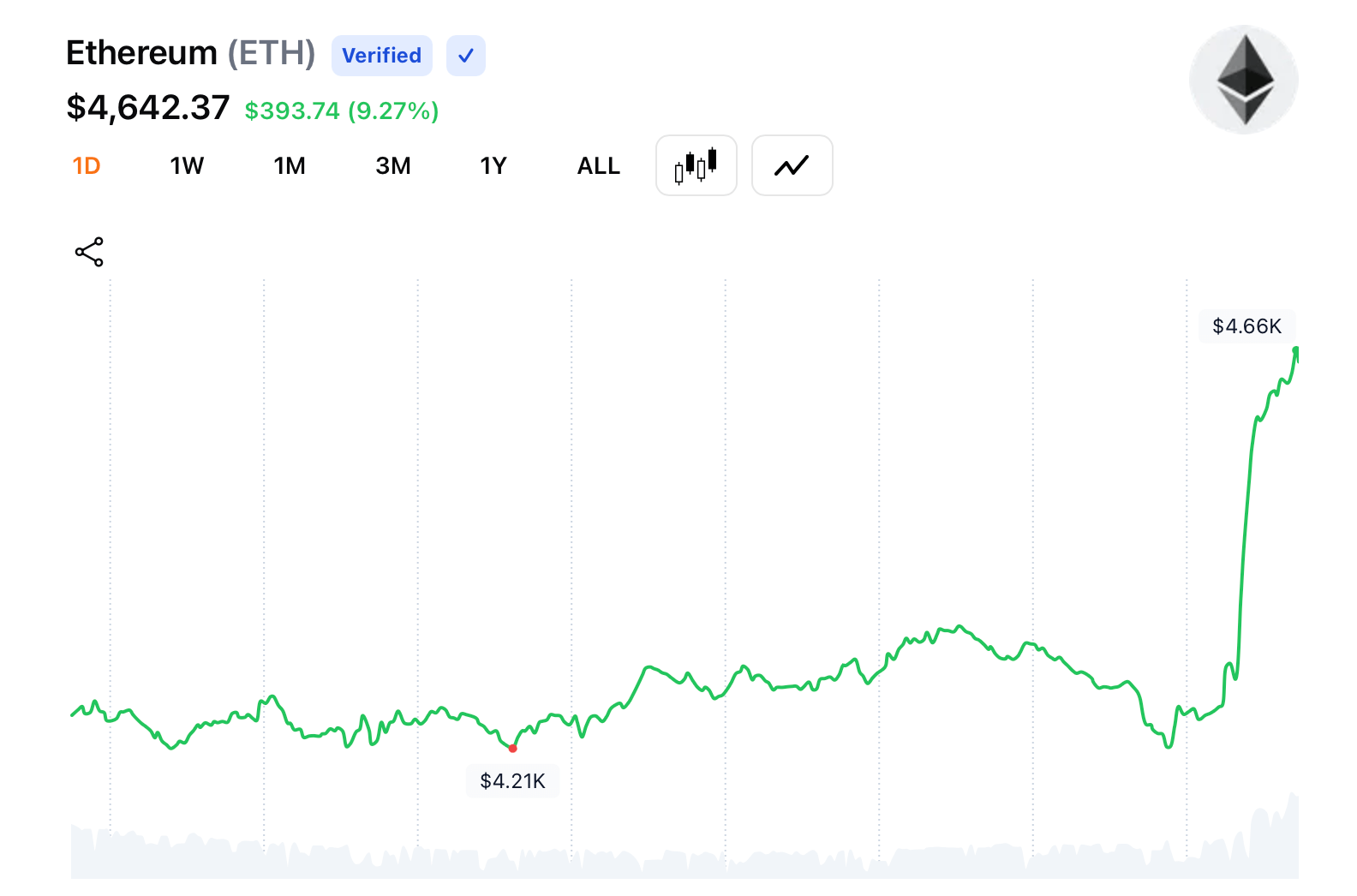

Bitcoin followed with $100.15 million in liquidations, while solana ( SOL), XRP, and dogecoin (DOGE) saw between $12 million and $29 million each. The largest single liquidation order occurred on OKX’s ETH- USDT swap, valued at $10 million. Data show short positions absorbed the heaviest losses today, suggesting traders were caught off guard by ETH’s move above the $4,600 level following Jerome Powell’s Jackson Hole speech.

With derivatives open interest climbing rapidly across both futures and options, Ethereum remains at the center of speculative activity. The dominance of calls over puts, coupled with high exposure at major strike prices into late 2025, indicates markets are preparing for further volatility as ETH holds firm above $4,600.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。