As we all know, Hong Kong, as one of the world's financial centers, has always been at the forefront of the cryptocurrency asset field. The small shops for buying and exchanging USDT are spread all over Hong Kong, and the threshold for using cryptocurrency assets in Hong Kong is unprecedentedly low. Of course, the development of cryptocurrency assets in Hong Kong is not entirely chaotic; important legislation is gradually being introduced.

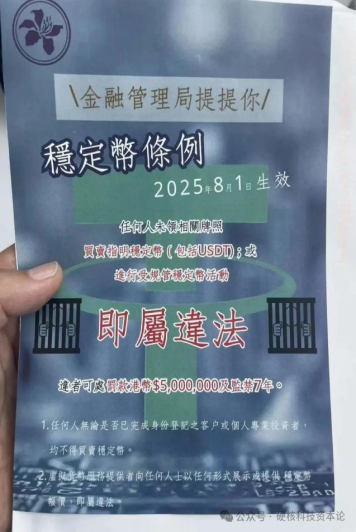

This year, the most influential "Stablecoin Ordinance" in Hong Kong has been published and will take effect on August 1, 2025. This is originally a great thing to further regulate the cryptocurrency asset industry and financial markets. However, the team at Sister Sa has noticed that, with the approaching effective date, a very bizarre flyer incident has occurred in the Hong Kong cryptocurrency asset market, causing widespread panic.

Today, the Sister Sa team will analyze in detail, based on this incident and the response from the Hong Kong Monetary Authority, whether it will still be possible to buy and sell USDT in Hong Kong after the "Stablecoin Ordinance" is officially implemented.

01 August Flyer Incident: A Strange Risk Event

As the saying goes, people scare people, and it can be deadly. In August, various USDT shops, cryptocurrency merchants, and OTC practitioners in Hong Kong experienced a collective scare event. In fact, a certain USDT merchant owner had already left Hong Kong as soon as he received the news…

Here's what happened: In early August 2025, USDT shops in Hong Kong suddenly received a flyer delivered by an unknown source overnight. The gist of it was: The Hong Kong "Stablecoin Ordinance" will take effect on August 1, 2025, and anyone who trades specified stablecoins (including USDT) without the relevant license; or engages in regulated stablecoin activities will be considered illegal, with violators facing a fine of HKD $5,000,000 and imprisonment for 7 years.

Is this news true or false? One opinion: It's half true and half false; the main information conveyed seems to exploit the ambiguities of the legislation to promote misleading information.

However, it must be noted that the "Stablecoin Ordinance" may not be good news for many OTC cryptocurrency merchants in Hong Kong.

02 What Behaviors Does the "Stablecoin Ordinance" Mainly Regulate?

To avoid being misled, partners must be aware of some basic concepts in the "Stablecoin Ordinance" in Hong Kong.

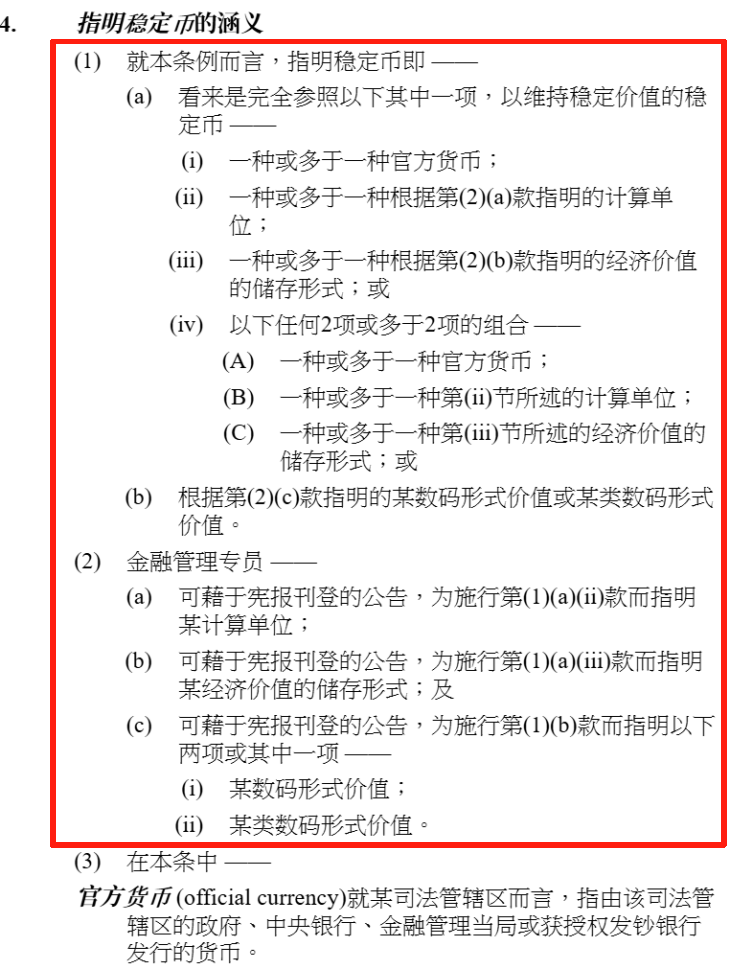

(1) What is a "Specified Stablecoin"?

The concept of "Specified Stablecoin" is very important; it is one of the foundations of the entire legislation. Sections 3 and 4 of Part 1 of the "Stablecoin Ordinance" clearly define two basic concepts: one is "stablecoin"; the other is "specified stablecoin."

The concept of "stablecoin" defined in Section 3 is easy to understand; it aligns with the traditional understanding of being pegged to a stable, highly liquid asset, used for (1) payment for goods or services; (2) debt settlement; (3) investment, and other activities of economic value. This provision serves as a broad legal definition and description of "stablecoin."

The concept of "specified stablecoin" defined in Section 4 is a bit more complex; partners can simply understand it as a legally "narrow definition of stablecoin" created by the Hong Kong "Stablecoin Ordinance" to regulate related businesses. The specific text is as follows:

Once partners understand what "regulated stablecoin activities" are, they will know why the Sister Sa team says there is a serious concept-switching behavior by the flyer distributor in the August flyer incident.

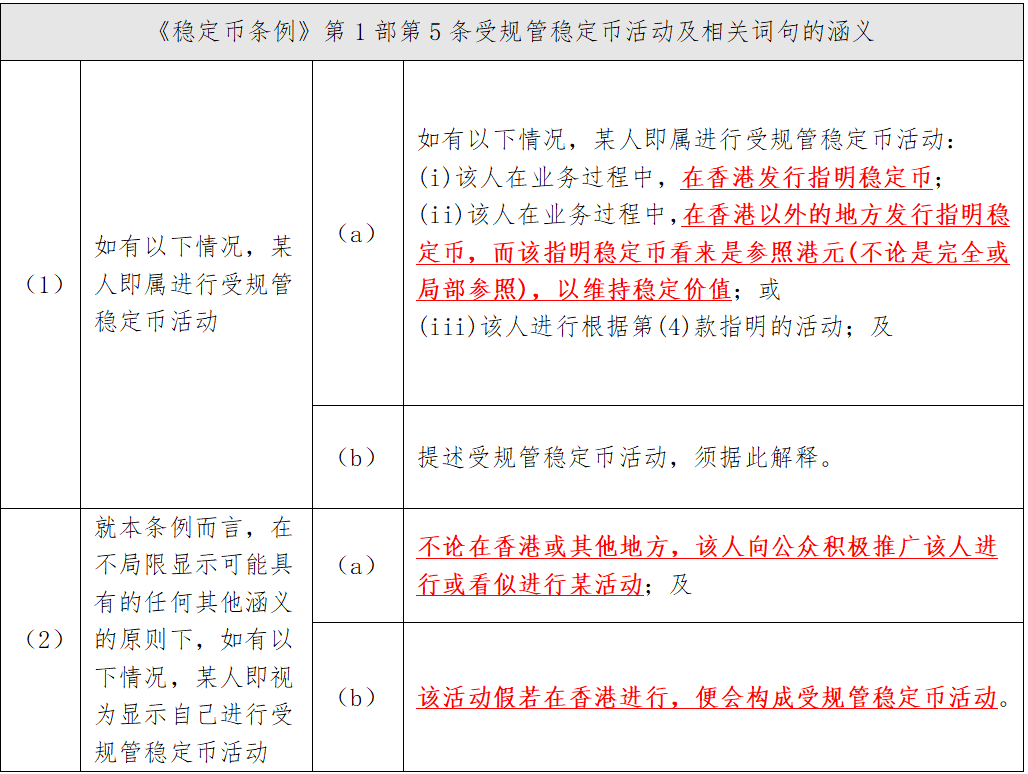

(2) What are "Regulated Stablecoin Activities"?

Once partners understand what "regulated stablecoin activities" are, they will know why the Sister Sa team says there is a serious concept-switching behavior by the flyer distributor in the August flyer incident.

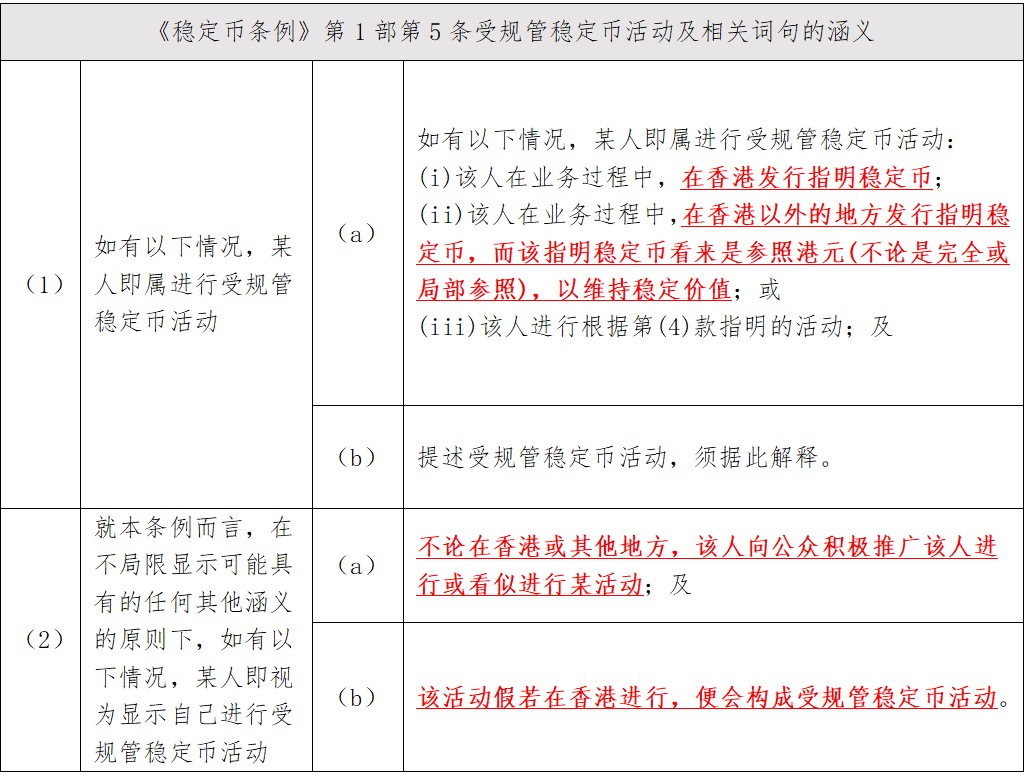

According to Sections 5 (1)-(2) of Part 1 of the "Stablecoin Ordinance," regulated stablecoin activities are:

In summary, the "regulated stablecoin activities" clearly defined in the "Stablecoin Ordinance" are actually unrelated to buying and exchanging USDT; they regulate:

(1) Issuing specified stablecoins in Hong Kong;

(2) Issuing stablecoins outside Hong Kong that are fully or partially pegged to the Hong Kong dollar;

(3) Promoting stablecoin activities to the public in Hong Kong.

The above "regulated stablecoin activities" strictly regulate the issuance of stablecoins, not the OTC exchange of stablecoins.

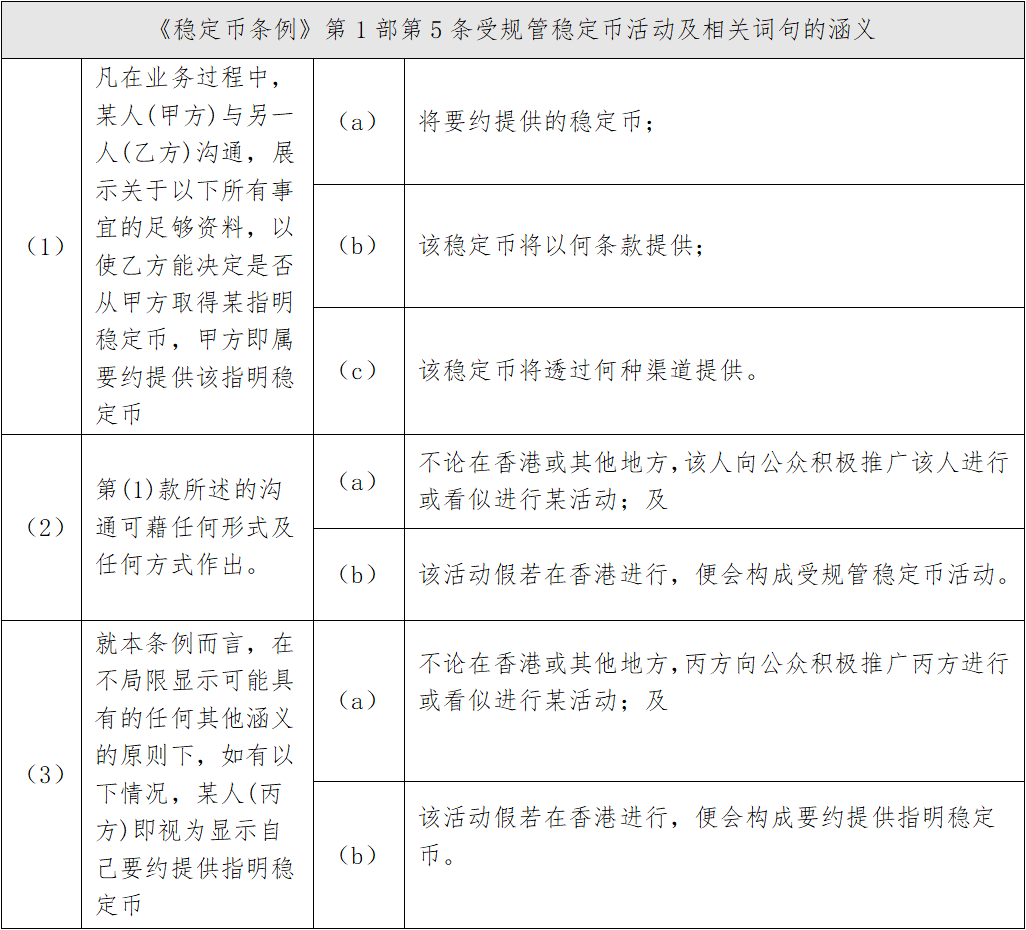

03 Is Cryptocurrency Merchant OTC Considered "Offer Providing"?

The answer is: There is significant controversy, and there are gray areas; the "offer providing" in the "Stablecoin Ordinance" leans more towards "distribution" or "underwriting" behavior.

"Offer providing" (Offer) is actually a professional legal term. Article 471 of the Civil Code states: "Parties to a contract may adopt offers, acceptances, or other methods." Therefore, it is generally understood that an offer is "a party's expression of intent to propose contract terms to the other party with the aim of concluding a contract, hoping the other party will accept." In the legal context of Hong Kong, an offer is also one of the key elements for the formation of a contract.

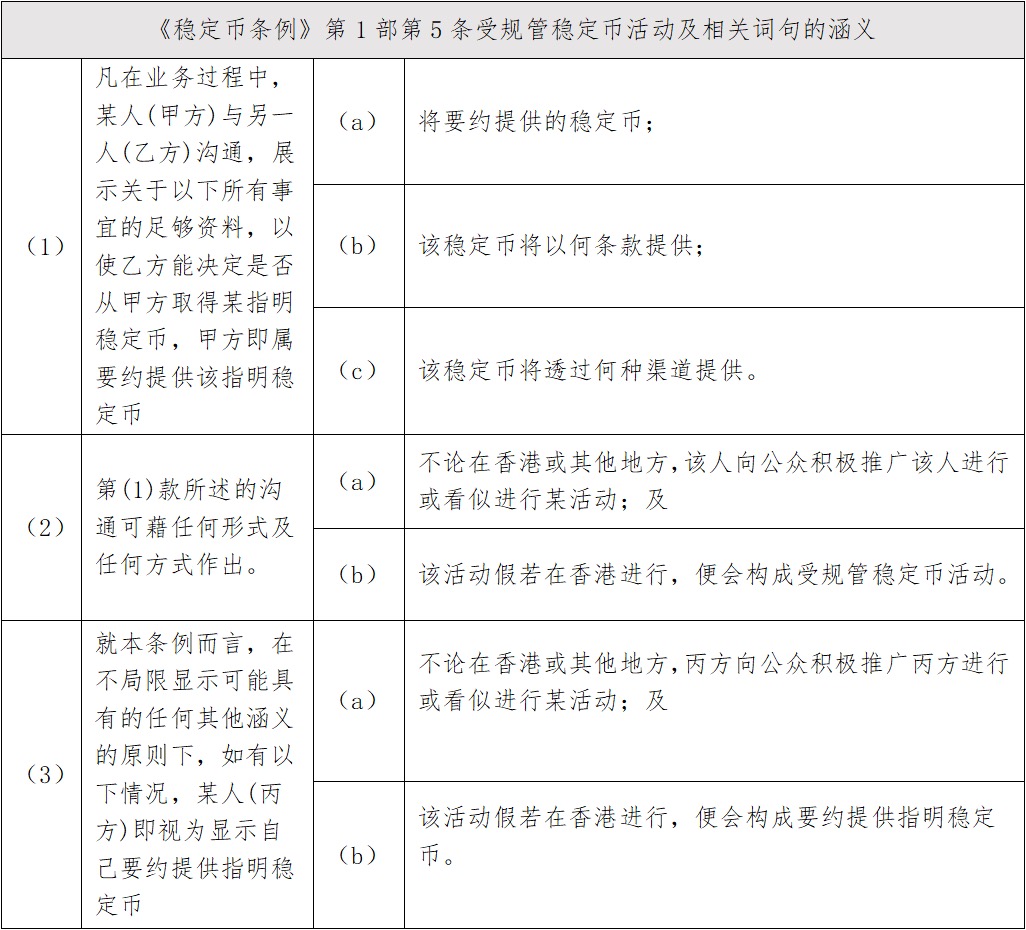

Section 6 of Part 1 of the "Stablecoin Ordinance" clearly states: "Offer providing" refers to specified stablecoins as follows:

According to the provisions of the "Stablecoin Ordinance," if the OTC activities of cryptocurrency merchants and other entities constitute "offer providing," then such activities fall within the regulatory scope of the "Stablecoin Ordinance." According to Section 9 of Part 2, only "permitted offerors" can engage in "offer providing" for "specified stablecoins."

Currently, there are only five types of "permitted offerors":

(1) Licensed holders of stablecoins;

(2) Corporations licensed under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615) to provide virtual asset services (as defined in Section 53ZR of the Anti-Money Laundering Ordinance);

(3) Individuals licensed under the Payment Systems and Stored Value Facilities Ordinance (Cap. 584);

(4) Licensed corporations under the Securities and Futures Ordinance (Cap. 571) for regulated activities of Class 1 (as defined in Schedule 1 of the Securities Ordinance);

(5) Recognized institutions.

In light of the legislative purpose of the "Stablecoin Ordinance," the Sister Sa team believes that the "offer providing" referred to in the legislation exists in a gray area. If "offer providing" is understood according to general legal concepts, then transfer activities between individuals could also fall under regulatory scope, which would significantly broaden the enforcement scope and unnecessarily increase the review obligations and regulatory difficulties for licensed platforms.

Therefore, the Sister Sa team believes that the "offer providing" in the "Stablecoin Ordinance" leans more towards a "distribution" or "underwriting" behavior.

This can be partially seen from the provisions in Section 3.4.2 of the December 2024 draft of the "Stablecoin Ordinance": "…… If a third-party entity offers specified stablecoins in Hong Kong, the licensed person must ensure that the third-party entity is a permitted offeror… Additionally, the licensed person must ensure that the third-party arrangements comply with the relevant laws and regulations of the respective jurisdictions. Specifically, such arrangements should not involve distributing specified stablecoins issued by the licensed person in jurisdictions where trading specified stablecoins is prohibited."

However, the Sister Sa team must also point out that the "offer providing" in the "Stablecoin Ordinance" is a general concept, and the legislation itself does not restrict this concept. Therefore, theoretically, cryptocurrency merchants that do not meet the "permitted offeror" status but still engage in OTC activities (operational activities) are within the criminal liability range in Hong Kong, specifically:

(a) Upon conviction through summary proceedings—can be fined $500,000 and imprisoned for 2 years; if it is a continuing offense, an additional fine of $10,000 for each day of the offense duration may be imposed; or

(b) Upon conviction through indictment—can be fined $5,000,000 and imprisoned for 7 years; if it is a continuing offense, an additional fine of $100,000 for each day of the offense duration may be imposed.

Partners must be extremely cautious.

04 In Conclusion

In summary, if strictly following the definition of "permitted offeror" in the legislation, the entities that can currently clearly engage in this business are: (1) VASP license holders; (2) Hong Kong payment license holders; (3) Class 1 license holders.

Currently, the Sister Sa team has not heard of any cryptocurrency merchants being penalized for providing USDT, USDC, and other stablecoin exchange services. However, to be honest, this should not be taken as a guarantee that there will be no future crackdowns on the OTC activities of cryptocurrency merchants, as regulatory authorities can indeed impose penalties according to the law. In other words, Hong Kong is no longer a paradise for the free exchange of USDT; to avoid being bitten by the "teeth" of criminal law, the Sister Sa team advises partners to plan ahead: get licensed or leave.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。