Premiums belong to those who can foresee breakthroughs, hedge against dilution, and view volatility as the only true constant.

Written by: arndxt

Translated by: Luffy, Foresight News

Every cycle has its unique narrative, and currently, the market is struggling through contradictory chapters: Bitcoin's seasonal patterns versus post-halving dynamics, the Federal Reserve's dovish rhetoric versus inflation, and a bond market steepening that may signal easing or recession.

We are in a highly volatile market:

In the short term: September may see Bitcoin experience volatility not seen so far this year. For those willing to downplay seasonal patterns in the post-halving year, a pullback may present a buying opportunity.

In the medium term: The Federal Reserve's policy faces the risk of credibility damage. Rate cuts due to rising inflation will change the investment landscape.

In the long term: The key to the cryptocurrency cycle may not only lie in retail or institutional capital flows but also in the structural health of corporate cryptocurrency treasuries. This is a fragile pillar, and if it breaks, demand will turn into supply.

The core logic for investors is simple: we are entering an environment of narrative volatility, where seasonality, policy, and structural mechanisms point in different directions.

In the eyes of investors, signals are not found in a single data point but in the collisions of these narratives.

Bitcoin's "September Ghost" and Post-Halving Reality

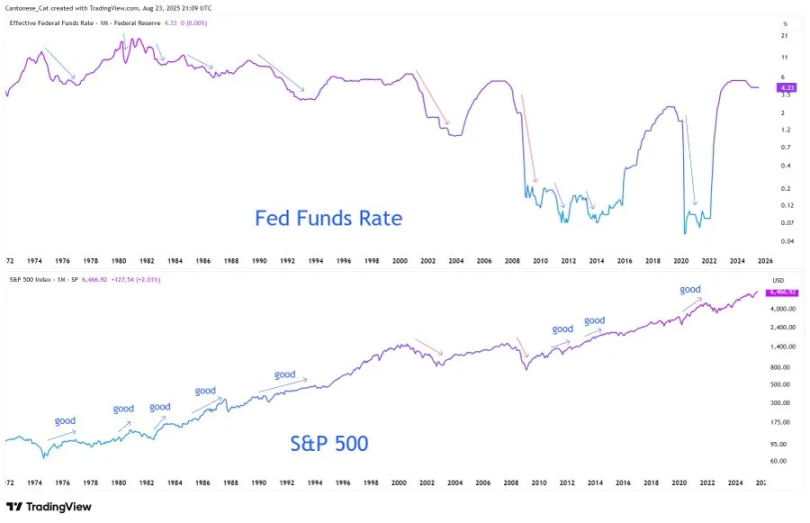

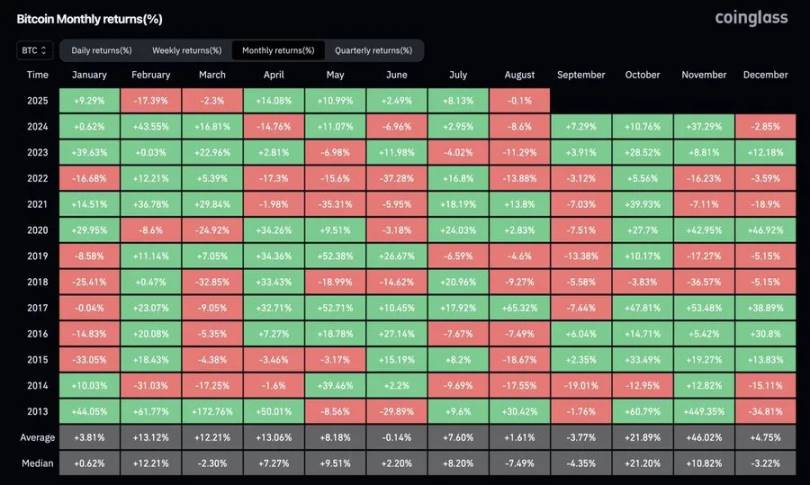

Historically, September has been the worst-performing month for Bitcoin. Charts show that declines caused by the liquidation of long positions have repeatedly occurred. However, this cycle is different: we are in a post-halving year, and historically, the third quarter of such years tends to be bullish.

So far in 2025, there has not been a single month with gains exceeding 30% (or even 15%), indicating that volatility has been compressed. In every bull market, explosive rallies tend to cluster. With four months left in the year, the question is not whether volatility will return, but when it will return. Investors conclude that if a pullback occurs in September, it may become the last significant entry window before the inevitable rise in the fourth quarter.

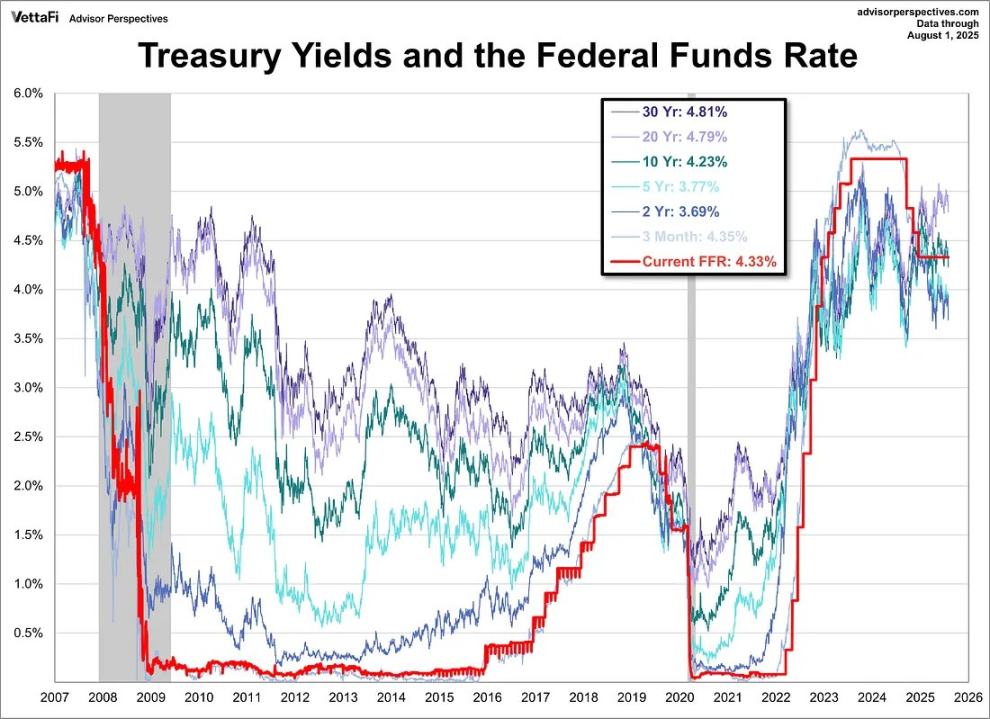

The Federal Reserve's Divided Narrative

Powell's speech at Jackson Hole was widely misinterpreted as a green light for aggressive easing. In reality, his statements were more nuanced: he left the door open for a rate cut in September but emphasized that this does not signal the beginning of an easing cycle.

Regarding the labor market, Powell acknowledged a "strange balance": both labor supply and demand are slowing, leaving the market in a fragile state. The risks are asymmetric; if this balance is disrupted, it could quickly manifest in layoffs.

On inflation, he was candid: tariffs have clearly pushed prices up, and the effects will continue to accumulate. Although Powell referred to this as a "one-time change in price levels," he stressed that the Fed cannot allow inflation expectations to spiral out of control.

The shift in framework is more revealing. The Fed has officially abandoned the "average inflation targeting" from 2020, returning to the "balanced path" model from 2012: no longer tolerating inflation above 2% and no longer focusing solely on the unemployment rate. In other words, even if the market has digested the almost certain rate cut, the Fed is still signaling a stricter interpretation of the 2% inflation target.

The contradiction lies in the fact that the Fed is preparing to cut rates in a stagflation environment, easing amid accelerating core inflation and a weakening labor market. Why? Because structurally, the U.S. debt burden makes it politically and fiscally unsustainable for "high rates to last longer." Powell can talk about credibility, but the system is caught in a vicious cycle: spending, borrowing, printing money, and repeating.

For investors, the key conclusion is that credibility risk has now become an asset pricing risk. If the 2% target devolves from an "anchor" to a "vision," it will reset the valuations of bonds, stocks, and hard assets. In such an environment, scarce assets (Bitcoin, Ethereum, gold) become reasonable choices to hedge against dilution risk.

Signals from the Steepening Bond Market

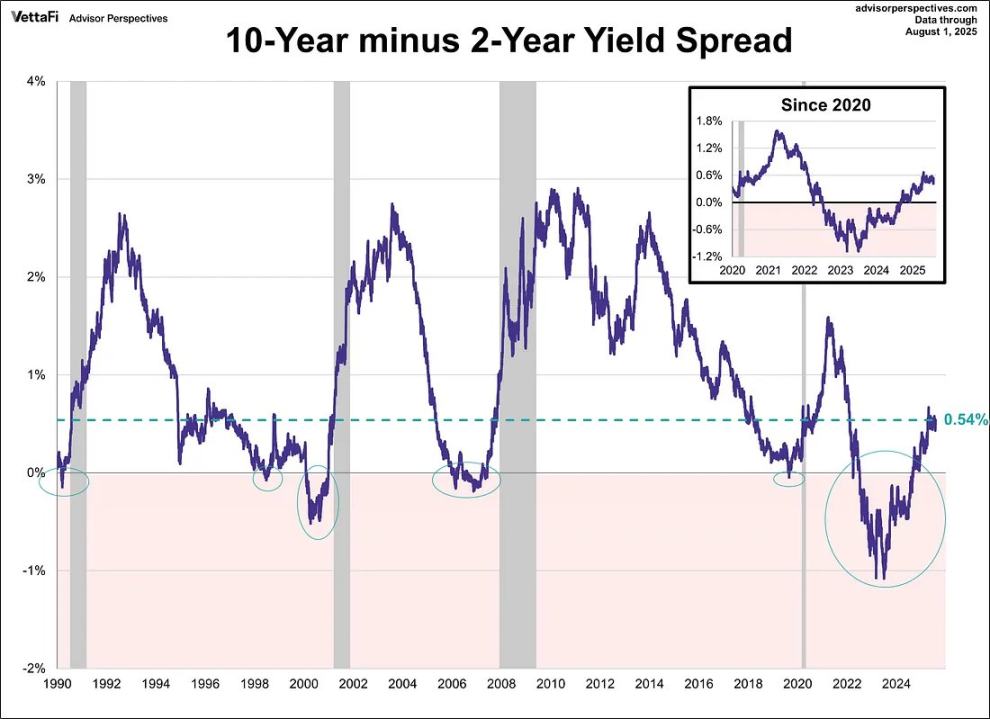

The yield curve has quietly unraveled its inversion: the spread between 10-year and 2-year U.S. Treasury yields has rebounded from one of the deepest inversions in history to +54 basis points. On the surface, this looks like normalization, and the curve appears healthier.

However, history offers a different warning. In 2007, the steepening of the curve after inversion was not a "safe signal" but a precursor to collapse. The key lies in the reason for the curve steepening: if it is due to improved growth expectations, it is bullish; if it is because short-term rates are falling faster than long-term inflation expectations, it signals that recession risks are approaching.

Currently, the curve is steepening for the wrong reasons: the market is translating rate cut expectations into sticky inflation. This is a fragile pattern.

Structural Issues in Cryptocurrency

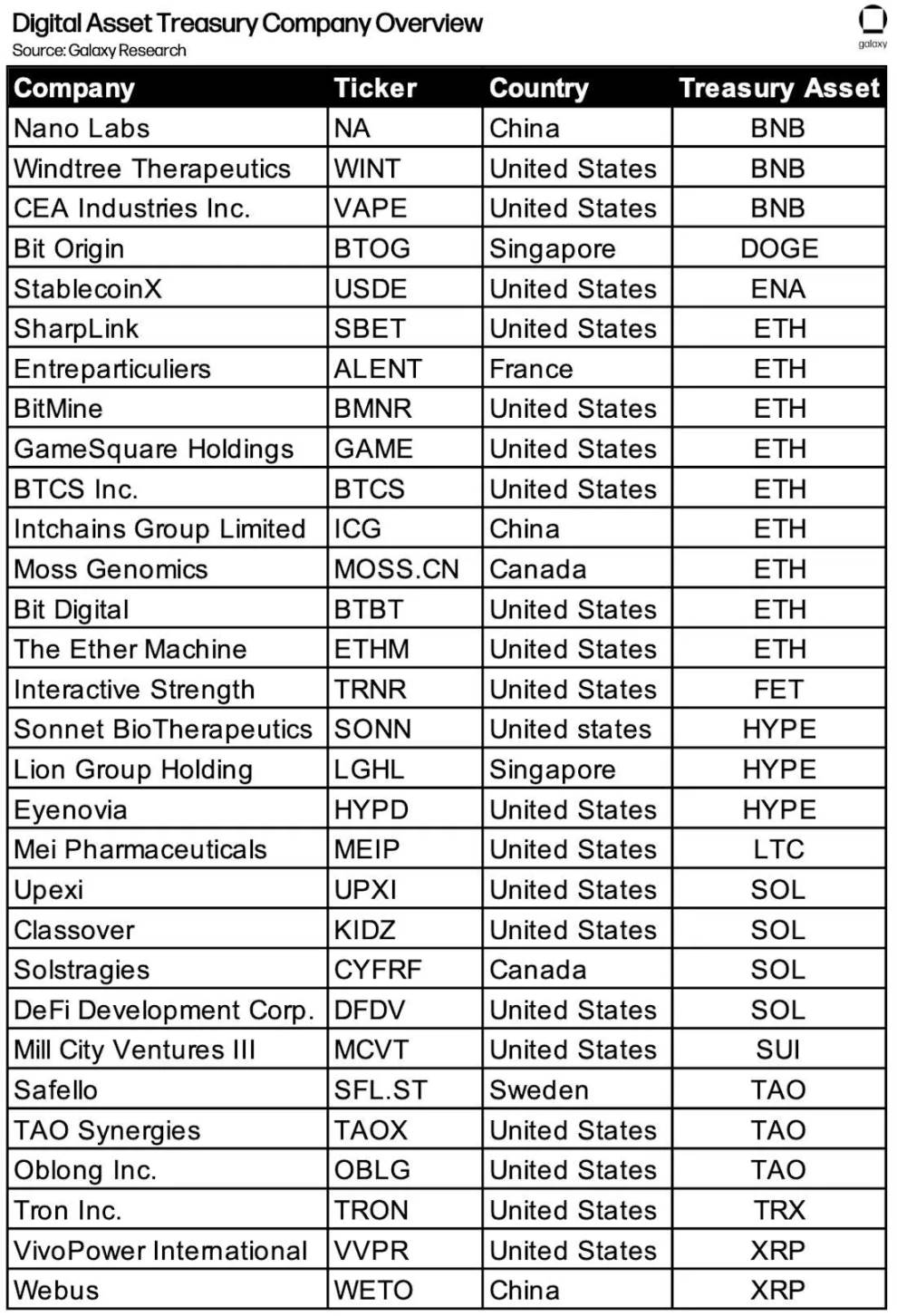

In this macro context, cryptocurrencies face their own survival test. "Corporate treasury accumulation" (MSTR, Metaplanet, companies holding ETH, etc.) has been a core demand pillar. However, as net asset premiums compress, the danger is that these entities may turn to discounts, becoming forced sellers.

Cycles do not end because narratives fade but because the mechanisms driving demand reverse. 2017 was about ICOs, 2021 was about DeFi/NFT leverage, and 2025 may be about cryptocurrency treasuries reaching the limits of balance sheet arbitrage.

Overall, the core narrative of this cycle is "disharmony": the market is being pulled in opposite directions by seasonality, policy, and structural mechanisms.

The collision between Bitcoin's September pullback and the inevitable rise post-halving;

The Federal Reserve's cautious rhetoric, yet being forced to cut rates in a stagflation backdrop;

The steepening of the bond market seeming to ease, yet revealing fragility;

The cryptocurrency's own fuel—treasury accumulation—facing the risk of turning into liquidation.

For investors, the logic is simple: we are in an era of narrative collisions, and premiums belong to those who can foresee breakthroughs, hedge against dilution, and view volatility as the only true constant.

Opportunities do not lie in choosing a single narrative but in recognizing that volatility itself is an asset.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。