Since 2024, Digital Asset Treasuries (DATs) have gradually gained popularity in the crypto market, with more and more companies joining the "crypto treasury" game.

On August 26, the market stirred again. According to The Information, cryptocurrency fund Pantera is planning to raise up to $1.25 billion to transform a publicly listed company into a Solana investment firm. Meanwhile, Galaxy Digital, Multicoin Capital, and Jump Crypto are also negotiating a $1 billion SOL acquisition deal.

Notably, Pantera is not only deeply involved at the capital level but has also pushed its partner Marco Santori onto the board, directly participating in corporate governance. This move signifies that crypto funds are stepping out from behind the scenes to personally shape the strategic direction of DAT companies.

This "treasury competition" surrounding Solana may become the largest concentrated allocation focused on this digital token to date.

In the view of Pantera partner Cosmo Jiang, the rise of "crypto treasury companies" is not a hype but the birth of a new financial organizational structure. Before joining Pantera, he worked on Wall Street in traditional investments, from mergers and acquisitions at Evercore to private equity at Apollo, and then to a long/short hedge fund at Hitchwood, where he was responsible for fundamental research in the retail and internet sectors, covering companies like Walmart, Costco, Facebook, Google, and Spotify.

"You have to admit that those companies that seem the craziest to us are also creating real business value. And this is worth serious study."

Pantera General Partner Cosmo Jiang | Source: Pantera Capital official website

In this two-hour interview, Cosmo systematically outlined the underlying logic of the DAT model, investment selection criteria, exit paths, and the evolution of the industry landscape. He believes that there is still a "window period" for DATs, but the time left for new players is running out.

"You are witnessing the birth of a new industry. And an industry will not be 'born twice.'"

This interview was conducted by BlockBeats in mid-June, and here is the dialogue:

TL;DR

· Why would someone choose to hold a "digital asset treasury company" instead of directly buying spot assets? The only reason is: you believe that the value of this "half a Bitcoin" will be worth more than a full Bitcoin in the future. As long as the market sometimes overestimates certain assets and there is enough volatility, you can activate the ATM (At Market) mechanism and operate the Convertible Debt engine.

· The DAT track is essentially a "quasi-commodity business," which will ultimately form an oligopoly. Because this type of industry competes on cost efficiency—who can produce at a lower cost.

· Compared to Bitcoin, assets like Ethereum and Solana are actually more suitable for running the DAT model. The reason is simple: because BTC itself does not generate yield, DAT companies need to rely on structure to amplify exposure; but smart contract assets like ETH and SOL can participate in staking and join DeFi, possessing inherent "profitability."

· This field will definitely experience consolidation in the next three to five years. Especially among large assets like Bitcoin, Ethereum, and Solana, there may only be two or three DAT companies that truly emerge from each chain.

· We are still in a window period, but the difficulty for new entrants will gradually increase. There will be another three to six months of "new product period," but if we extend the timeline to one or two years, or two to three years, the number of new entrants will decrease.

From Wall Street to Cryptocurrency: Why Do Fundamental Believers Focus on Treasury Companies?

BlockBeats: You didn't start with a crypto-native background; can you tell us how you entered this industry?

Cosmo Jiang: My career began in traditional finance. I graduated from Harvard with a degree in mathematics and then followed a typical New York finance path. I first worked in the mergers and acquisitions team at Evercore, then spent a few years in private equity at Apollo, and then joined Hitchwood Capital, a long/short hedge fund managing billions of dollars. The companies I researched included Walmart, Costco, Facebook, Google, and others.

Cryptocurrency was not my initial focus. It wasn't until 2020 to 2021 that I noticed these companies starting to talk about crypto, from Facebook to Spotify, Universal Music, Nike, and LVMH, all getting involved. As an analyst, if I wanted to be the chief analyst for these companies, I had to quickly learn about the crypto space.

At first, I was just trying to keep up with research needs, but I found that this field was building real business models.

I realized that in the future, there would be a group of companies that would never go public, and their incentives would rely entirely on tokens: the incentives of the team, employees, holders, and users would all be integrated. This innovation excited me greatly.

I originally planned to start my own fund, continuing the traditional stock style. But in New York, there were many such funds, while there were very few people who truly understood financial modeling and could grasp crypto.

So I founded Nova River, and soon after, several large funds, including Pantera, reached out to me.

I ultimately joined Pantera because they had a solid accumulation in venture capital and strong platform capabilities. I merged my capital into theirs and began overseeing investments related to Liquid Markets.

Now, I am a general partner at Pantera, responsible for coordinating the company's overall investment strategy while continuing to lead our mixed opportunities in the public market, especially those between the secondary market and private equity—such as the digital asset treasury companies (DATs) we are discussing today.

BlockBeats: Why did you specifically establish a new fund instead of using the existing Liquid Fund to cover these investment opportunities?

Cosmo Jiang: When we first started laying out this strategy, it was actually a non-consensus bet. We received many pitches for similar projects but never fully understood their significance until we encountered Defi Dev Corp (DFDV)—a team trying to replicate the Solana version of MicroStrategy in the U.S.

Their setup was very clear: the team was in the U.S., able to directly access the U.S. capital markets; the treasury's main warehouse was Solana, and we were also very optimistic about Solana's prospects. This combination seemed very attractive at the time.

So we chose to invest in DFDV. It was a very forward-looking project, with almost no other institutions entering the space; we were among the earliest and few willing to make a significant bet. Although it seemed very niche at the time, we were willing to bear the uncertainty and be the first to take the plunge. A few other capital players joined us, but we were the lead investors.

At that time, we even thought this might be the only one; there might just be this single digital asset treasury company in the U.S.

BlockBeats: And then you quickly encountered a second one?

Cosmo Jiang: Yes, far more than that. We later received about 90 pitches and invested in multiple projects. So going back to your earlier question: I had no idea this track would develop so quickly and so large.

Initially, we were using the venture fund and liquid token fund to invest in these projects, providing some anchoring effect. But as the track completely exploded, the concentration limits of the original funds began to show—we had already invested a significant amount, but there were still many excellent entrepreneurs worth supporting.

Thus, establishing a dedicated vehicle became necessary. This way, we could acquire more "ammunition" (dry powder) and no longer be limited by allocation ratios. Our original funds would continue to participate in some projects, but the amounts were basically nearing their limits.

That’s why we launched this dedicated fund to address what we believe is a truly emerging category of companies. As investors, encountering such opportunities in our careers is very rare, and we feel fortunate to be part of it.

DAT's "Dedicated Fund" Treats Public Companies as Early-Stage Ventures

Background: In July 2025, the established crypto investment firm Pantera launched the DAT Fund (Digital Asset Treasuries Fund), focusing on investing in publicly listed companies that use crypto assets as strategic reserves. The core logic of the fund is: through stock premium financing, increase crypto asset holdings, thereby enhancing the number of tokens held per share. Pantera views this model as a new narrative for "gaining crypto exposure in the public market," aiming to connect traditional finance with crypto assets.

Since its inception, the DAT Fund has rapidly deployed capital, investing in multiple projects, including Solana reserve company DFDV and Ethereum reserve company Bitmine, frequently acting as an anchor investor in transactions. As market enthusiasm surged, Pantera also initiated fundraising for a second DAT fund, further increasing its commitment to this emerging track.

Related Reading: "Crypto VCs Bring $2 Trillion Stories to Wall Street"

BlockBeats: In your DAT fund memorandum, you referred to this as a "timely investment opportunity." I want to ask, will this affect the cycle settings and exit plans of the DAT fund itself?

Cosmo Jiang: Yes, I think this type of investment is a form that lies between "venture capital" and "liquid assets."

Our funds all have long-term investment goals— we are long-term believers in this industry, participating from the perspective of long-term investors rather than short-term traders. For example, our venture capital fund is a closed-end fund with a 10-year lifecycle and an 8-year lock-up period, designed specifically for the growth cycle of early-stage projects, with a long holding time.

On the other end, we also have a more "liquid" product—our "liquid token hedge fund," which has quarterly liquidity. We certainly hope that investors will join us with a multi-year perspective so that they can truly benefit from the returns generated by our research and investment processes. However, we also provide a certain level of liquidity.

The DAT (Digital Asset Treasury) fund is positioned right between these two. Since we are helping these companies start from scratch, we will set certain lock-up periods and liquidity restrictions. At the same time, we believe that the success of these projects can actually be assessed in a relatively short time. Therefore, the holding period for this fund will be shorter than that of traditional venture capital funds.

Moreover, since we are investing in "public company stocks," we also hope that investors can hold onto what we consider to be "long-term winners" for the long term. Therefore, in terms of exit strategies, we will also adopt an "in-kind distribution" method, meaning we will directly distribute these stocks to investors, allowing them to choose whether to continue holding them rather than being forced to sell. Through this approach, we can execute a long-term investment strategy while also giving investors greater freedom.

BlockBeats: The emergence of the DAT (Digital Asset Treasury) trend has really exceeded everyone's expectations, and some people are starting to feel that this might already be a "toppish signal." Do you think it is still a suitable time for investment?

Cosmo Jiang: What I want to say is that the core of my daily work is closely tracking the public market. As someone who has been investing for 15 years, I no longer "obsess" over any fixed beliefs. I now firmly believe that when reality changes, our understanding should also change, and our actions should adjust accordingly.

Returning to your earlier question, I do believe that because these investment targets have liquidity, we are evaluating them every day.

Although my initial intention for investing was to hold these assets for the long term, the reality is that sometimes the management team's execution does not meet expectations, and sometimes industry consolidation happens faster than you think. Once this occurs, we will respond promptly and make decisions that are most beneficial to our LPs. After all, our core goal is to provide LPs with the best risk-adjusted returns.

So regarding market cycles, I do believe there is still a 3 to 6-month opportunity window ahead, with new projects worth participating in. But if this judgment changes, we will face it honestly and quickly adjust our strategy.

Of course, I also believe that ultimately every mainstream token will have two to three winners, and we will hold onto these winners for the long term. But the overall principle is: as facts change, we will adjust to respond to market changes.

BlockBeats: How much has the cost of investing in these companies increased compared to before?

Cosmo Jiang: Overall, the valuation multiples for these DAT (Debt Asset Tokenization) projects generally range from 1.5x to 8x. So the current premiums are still quite high. It is important to note that many projects have very low early circulation, so the initial trading valuations may be high, but once shares are unlocked and truly circulate, there is usually some pullback.

So some projects currently have high premiums, but they face these liquidity restrictions. Therefore, in the future, we may see valuation pullbacks for such projects. However, even after full circulation, many projects still fall within the 1.5x to 8x range, which overall remains a quite healthy premium range, right?

BlockBeats: What is the average amount that Pantera typically invests in these projects?

Cosmo Jiang: The range actually varies quite a bit, but our check sizes generally fall between $5 million and $29 million, which is our typical investment range. Of course, we have indeed invested in some larger projects that are several times this range. But we have never made investments smaller than this. So if we are to participate in a project, it must meet this standard.

BlockBeats: So investing in these DAT projects is not necessarily cheaper than investing in early crypto projects, such as seed rounds or Series A?

Cosmo Jiang: I think these are just different types of investments, and their risk-return structures are very different. For example, when you invest in an early-stage startup, you are essentially buying a small portion of equity at a valuation you estimate.

In these (DAT) companies, what you are buying is more like "Bitcoin in a box." In other words, if you spend $1, you can get a share of Bitcoin worth $1—so the total amount of this investment is not that important because you are almost getting back the corresponding asset at a 1:1 ratio, in a form of "asset share mapping."

BlockBeats: In the past month (June), how many DAT projects has Pantera looked at in total? And how many have you invested in?

Cosmo Jiang: In the past three months, we have looked at nearly 100 projects, very intensively since this trend started.

BlockBeats: Can you elaborate on how the investment process for these DAT companies works?

Cosmo Jiang: Well, I think this process is quite diverse. We try to get involved as early as possible at reasonable times.

Sometimes we actively reach out to foundations or large holders to understand their plans and why this approach might be beneficial for them. Many times, because we have a strong reputation in this field, some foundations will proactively come to us for advice, or some main initiators not relying on foundations will also seek us out. Generally speaking, this process can involve them coming directly to us or them first approaching an investment bank to set up the deal, and then the investment bank comes to us.

Both situations are possible. We try to get involved early and provide as much help as we can because we know we are the team that has seen the most deals of this kind in the market. We take this responsibility very seriously and hope that through our participation, we can help them understand and create what we believe to be the best products.

BlockBeats: So would you say that in these projects, crypto VCs are not the main source of funding, but rather family offices or traditional funds?

Cosmo Jiang: The participant structure is now very diverse. Initially, it was mainly crypto insiders because the projects were still relatively new. But now many projects are quite large, and crypto-native funds do not have that much capital reserve, so we are seeing more and more traditional funds, even some very well-known large blue-chip funds joining in. Although we cannot disclose names, they are indeed doing these transactions, and many hedge funds are also entering.

BlockBeats: For projects like BitMine or SharpLink Gaming, what is the approximate participation threshold? If a crypto VC has only a few million dollars in fund size, can they still participate?

Cosmo Jiang: It depends on the project structure, but we pay close attention to the quality of the investor structure. If a project is looking to raise $500 million, we care a lot about whether that funding comes from long-term investors rather than a group of "quick money" speculators. Now we are more "assertive" in our involvement, directly helping the project side filter out what we consider to be short-term speculative money, retaining only those investors we believe are "true long-term capital." This is what we are doing.

BlockBeats: Do you think small crypto VCs still have opportunities to participate in this track?

Cosmo Jiang: We do have some advantages, such as experience, reputation, information access, and so on. But there will always be deals available, so there are still opportunities. Some projects are indeed broadly seeking funding, but those usually have lower quality—we generally do not participate. However, truly high-quality projects, like BitMine, had already raised $20 million before going public, completed among a small group of mutually trusted funds. The higher the quality of the project, the more closed it is.

DAT, A Financial Experiment in the U.S. Stock Market

BlockBeats: You mentioned earlier that the "Digital Asset Treasury Company" (DAT) model was not initially accepted by everyone. How did you determine that it would be viable?

Cosmo Jiang: I think the core is that we must first recognize the business model of "Digital Asset Treasury Companies" itself. Frankly, I also took some time to overcome my initial biases. It was only after the success of MetaPlanet that I began to seriously study this type of company. At that time, we also saw Sole Strategies in Canada starting to make similar attempts, and I spent a lot of time understanding their underlying logic.

For me, it was quite a challenge because I come from a traditional fundamental value investing background. Think about it, a company like MicroStrategy trading at a long-term price of 2x NAV is simply unacceptable in my past investment logic; it completely contradicts everything I have done before, right?

BlockBeats: But you later changed your view on it?

Cosmo Jiang: Yes, because as an investor, you must continuously challenge your own preconceptions, especially when contrary evidence appears in reality.

The reality is that MicroStrategy has almost consistently maintained a premium trading status over the past five years. Even after the ETF was launched, its advantage was not "terminated"—at that time, the mainstream view was that once the ETF was online, MicroStrategy's valuation premium would collapse.

Moreover, some of its largest shareholders include some long-term value investors I greatly respect, such as Capital Group (the largest mutual fund company in the U.S.) and Norges (the Norwegian sovereign wealth fund). These are all very fundamental-focused long-term funds, definitely not short-term speculators.

So I really forced myself to change my perspective on this matter, and in the end, I realized—wow, this is indeed a "sustainable" financial engine?

BlockBeats: Why?

Cosmo Jiang: From a first principles perspective, there are actually two key points:

First, do you believe that the market can sometimes become overly exuberant, pushing the valuations of certain things above their intrinsic value? My answer is: yes, of course, this can happen.

Second, do you believe that the market can sometimes be volatile? It is precisely this volatility that gives you the opportunity to sell convertible bonds for arbitrage. My answer is: yes, clearly the market is sometimes volatile.

So as long as the market sometimes overestimates certain assets and there is sufficient volatility, you can activate the ATM (At-the-Market) mechanism and operate the convertible debt engine.

From this perspective, premiums can actually be maintained in the long term.

BlockBeats: So what do you think the fundamentals of these "Digital Asset Treasury Companies" really refer to?

Cosmo Jiang: I think the fundamental question is: why would someone choose to hold a "Digital Asset Treasury Company" instead of directly buying the underlying assets?

Take MicroStrategy as an example; its stock price often trades at twice its net asset value (2x NAV). This sounds crazy, right? Why would you spend the same amount of money to buy "half a Bitcoin" instead of directly buying a whole Bitcoin? The only reason is: you believe that the value of this "half a Bitcoin" will be worth more than a whole Bitcoin in the future.

So how do they achieve this? The key lies in increasing the "number of crypto assets per share" (token per share). MicroStrategy raises funds by issuing stock at a premium, issuing convertible debt, and then uses that money to increase its Bitcoin holdings. These tools essentially sell volatility or sell call options on their own stock.

As a result, the company generates income that can be used to increase its Bitcoin holdings, and it does so in a value-accretive manner.

For example:

- Suppose a company can increase the number of Bitcoins per share by 50% each year for two consecutive years.

- If a person initially holds an exposure of "half a Bitcoin," after two years of 50% growth, they would own about 1.1 Bitcoins. Thus, after a few years, their holdings would exceed that of someone who directly bought one Bitcoin.

From this perspective, buying into such companies is a reasonable choice. As long as you believe that these companies have the ability to continuously increase the "number of crypto assets per share," investing in them makes sense.

In 2024, MicroStrategy's Bitcoin per share grew by nearly 75%. So far this year, it has already increased by over 25%. Therefore, in just a year and a half, their Bitcoin per share has more than doubled. So if you bought in 2023 or 2024, your returns are far better than those of investors who directly bought one Bitcoin at that time.

Thus, this model has been practically validated.

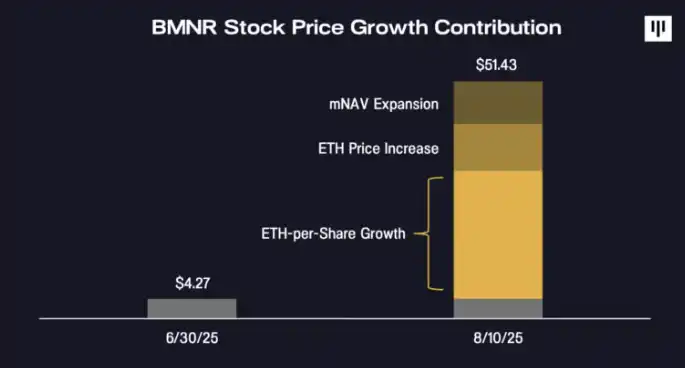

Three main drivers of BMNR stock price increase | Source: Pantera official website

BlockBeats: So how do these companies achieve this? What tools do they use to continuously increase their Bitcoin exposure per share?

Cosmo Jiang: I think this can be viewed from two levels.

First, it is about enhancing awareness and user adoption.

Many people think that the stories of the crypto industry are already well-known, but that is not the case. I have talked to friends at Tiger, Coatue, Viking, and Lone Pine, who are now fund partners, but crypto is not their daily focus. For them, it is still a new field.

So, companies like MicroStrategy or these Digital Asset Treasury Companies (DATs) first need to tell the story of crypto assets to the traditional financial world, breaking into the mainstream market that has not yet truly understood crypto.

And this market is huge. There are currently tens of millions of active users in crypto, while traditional financial users may be 100 times that number. This awareness gap is the opportunity for DATs.

Therefore, "enhancing awareness" is a very key strategy. Whether someone can clearly articulate this story—both the underlying token story and the story of the company itself—is one of the key factors for success. This is the first point: increasing awareness.

BlockBeats: What about the second level?

Cosmo Jiang: The second point is the overall marketing capability among retail investors. I believe that in the early stages, it is not just about impressing retail investors in the crypto circle, but rather about engaging "Main Street retail" investors early on, which is crucial for the long-term success of these companies.

To unlock financial leverage tools, such as convertible debt and preferred stock, the company's market capitalization must first be elevated, generally reaching a level of $1 to $2 billion.

However, there won't be many institutions willing to buy in early; the real key is to tell the story to a broader audience of ordinary investors, making them willing to come in. Therefore, "building trust and belief" is a critical part of this process, which also includes promoting awareness among institutions.

The ultimate goal of all this is to achieve "valuation premiums" in the market—thus monetizing the stock and achieving growth in a more valuable way. Once you reach the $1 to $2 billion market cap range, you can start issuing convertible debt and preferred stock, truly opening another door to institutional capital.

So, all these steps are prerequisites that you must "believe will be realized" for the entire model to work. Ultimately, it all comes down to "marketing."

BlockBeats: Once a company gains market trust, how does it further expand its asset exposure?

Cosmo Jiang: This leads us to the second phase—using various financial tools to further enhance the Bitcoin or other token exposure per share. Specifically, it involves converting the market awareness you established earlier into financing capabilities, such as through ATMs, issuing convertible debt, and continuing to raise funds, then using that money to buy more crypto assets.

BlockBeats: Does this also mean that different types of underlying assets support this model differently?

Cosmo Jiang: Yes, we have recently observed an interesting phenomenon: compared to Bitcoin, assets like Ethereum and Solana are actually more suitable for running the DAT model. The reason is simple: because BTC itself does not generate yield, DAT companies need to rely on structure to amplify exposure; but smart contract assets like ETH and SOL can participate in staking and join DeFi, possessing inherent "profitability."

In other words, even without financial engineering, they can increase the token per share through on-chain yields, interest rate products, and other means.

BlockBeats: Is this why the market is willing to give these DAT companies valuation premiums?

Cosmo Jiang: You can understand it this way. When you think about why an asset can achieve a valuation premium, the core actually lies in whether it is a structure that can continuously generate income. DAT companies are such structures; they resemble financial service companies or banks.

The essence of a bank is a pool of capital that generates income through lending and other means. DAT companies operate similarly. They are a pool of capital used to create income. Therefore, as long as this income is sustainable and stable, they should enjoy a valuation above their book value, just like banks.

Why Ethereum?

BlockBeats: Returning to Bitmine, which was originally a Bitcoin mining company but has now transformed into an Ethereum treasury company. This seems like a very clever market entry strategy, and as you mentioned earlier about the importance of "marketing," is this one of the main reasons you and Tommy chose Bitmine to be the ETH treasury company?

Cosmo Jiang: I believe that when we pursue such transactions, there are many factors to consider comprehensively. First, you are usually working with an existing management team, so choosing the right partner is crucial. In a public company, the continuity of the team is very important.

Therefore, we believe that finding a team that is already highly aligned with the vision is very important. Especially, the other party must already understand the importance of building a digital asset treasury company, which we value highly. Bitmine happens to meet these criteria.

I think their willingness to shift from Bitcoin to Ethereum and their open attitude is also very key. While not every company would do this, their flexibility is very valuable to us.

So these are all important factors we consider. By bringing in Tom Lee and his reputation, we significantly accelerated this process. His influence has propelled the company's development.

Tom Lee being interviewed

BlockBeats: Defi Dev Corp is the first non-Bitcoin crypto treasury company in the U.S. Why did the Solana treasury company appear first, but now Ethereum treasury companies seem to be outperforming?

Cosmo Jiang: I think this kind of thing only makes "logical sense" in hindsight. The reality is that the world is full of randomness, and often it is some incidental events that become catalysts for the market.

One reason we initially supported Defi Dev Corp is that it was the first well-prepared and clearly structured financing proposal we saw at the time. Of course, we are strong supporters and investors in Solana, which undoubtedly helped, and we had already invested. We have always been optimistic about Solana, but that does not mean we have any bias against Ethereum.

In fact, Ethereum itself has also been one of our important investment targets for a long time. It was just that at that time, the DFDV team appeared first, and they clearly stated their intention to focus on Solana because, at that time, Solana was undoubtedly stronger in the market and had more momentum. So we first supported DFDV.

You mentioned correctly—back in April and May of this year, the Ethereum ecosystem was somewhat quiet and sluggish. So very few people had the confidence to launch Ethereum-related projects at that time.

Until later—I really admire Joe Lubin and the ConsenSys team for proactively asking, "Why can't we do it?" I completely agree: why can't it be them? So we collaborated to help them finalize who would be the investment bank and who would be the advisors, among other things.

We have actually been quite deeply involved in the entire process. Because we felt at the time: since there is already a Solana treasury company, it is time to have an Ethereum treasury company as well. This is not about favoring one over the other. The market's response has clearly leaned towards Ethereum. In the eyes of mainstream users and traditional financial institutions, Ethereum is indeed much more well-known than Solana.

Moreover, the news of Circle going public has greatly accelerated the entire pace. Because in most people's minds, the correlation between Ethereum and stablecoins is far stronger than that of Solana. The success of Circle in the public market is also seen as a clear signal, which is the real reason why the Ethereum treasury trend started faster and more vigorously than Solana.

The subsequent explosion followed suit.

BlockBeats: But you also mentioned in previous interviews that institutions and LPs actually have more interest in Solana than in Ethereum.

Cosmo Jiang: I think that's true; the market itself is very dynamic, and the recent "stablecoin moment" has indeed shifted the entire discussion about the "top ten assets" rapidly. So indeed, one or two years ago, the most questions we received from institutional investors were basically about Solana.

But if we look at the current situation, the reality is—even in the stock market, most participants are actually individuals, not institutions. Moreover, the majority of wealth is actually held by individuals.

Among the mainstream public, Ethereum's recognition is undoubtedly much higher than Solana's. So I believe this is why we are now seeing Ethereum treasury companies achieving greater success in the public market.

If we take a broader view, this is actually a very important moment for the U.S. stock market regarding "crypto asset exposure." Therefore, any company associated with "crypto assets" has performed very well recently. These "Digital Asset Treasury Companies" are just one component of that.

Look at companies like Coinbase and Robinhood; their stock prices have surged this year largely because they have exposure to crypto assets. If you look at Circle's IPO, or Etoro's IPO, and even the success of many other IPOs this year, it is essentially because they have crypto-related asset exposure.

I believe a significant catalyst was Coinbase being included in the S&P 500 index.

I think many people do not truly realize how important this is—its impact has been greatly underestimated. Because the S&P 500 is the benchmark index for all fund managers globally, and before Coinbase was included, there were no crypto-related components in that index. But after it was included, all financial professionals around the world had to consider crypto for the first time in their careers.

This means that almost everyone, all professional investors, must start to consider whether they are overexposed, underexposed, or equally weighted in crypto assets. And this question was only "legitimized" because Coinbase joined the S&P 500 in April of this year.

This is a key driving factor behind why everyone suddenly started paying attention to this sector.

A Brief Window of Opportunity

BlockBeats: We noticed that your first investment was in BitMine. Previously, Pantera had already invested in another Ethereum treasury company, SharpLink, and it seems these two are direct competitors. Why invest in BitMine? What is the reasoning behind this?

Cosmo Jiang: We do believe that there is a competitive relationship between these two companies. But ultimately, this is one of the reasons we are optimistic about this sector. My judgment is that this field will definitely undergo consolidation in the next three to five years. Especially among large assets like Bitcoin, Ethereum, and Solana, there may ultimately be only two or three DAT companies that truly emerge.

BlockBeats: Why?

Cosmo Jiang: Because this sector essentially belongs to a "quasi-commodity business." Its biggest "moat" is capital, but capital is not really a moat. Typically, the development trend in such industries is that they usually do not form monopolies but will form an oligopoly, as these industries compete on cost efficiency—who can produce at a lower cost.

So I believe there will be a consolidation process in the future, and ultimately only two or three real winners will remain.

BlockBeats: So you think it is not yet a winner-takes-all situation?

Cosmo Jiang: Not at all; we are currently at the starting point of this "big explosion," at the early stage of a new type of company being born.

Who will ultimately win is still completely unknown. Because there are too many excellent and interesting teams and many talented people pursuing this direction, and the paths are all different. So at this initial stage, what we are doing is to place early bets on those teams we believe have high quality and high potential, who may become one of the "two or three" in the future.

BlockBeats: What about the "survival rate"? For example, out of ten DAT companies, how many will survive?

Cosmo Jiang: I believe that those projects with large market capitalizations are more likely to survive. Let's return to the core question—if a company wants to succeed in the DAT (Digital Asset Treasury) field, the key is: scalability.

You need to achieve a circulating market value of at least one billion, or even two billion dollars, to truly have basic sustainability. Moreover, once you reach this scale, you must continue to generate market attention and heat. Because only in this way will your "flywheel effect" not stop.

But the reality is that the number of tokens that can support a billion-dollar public company is extremely limited. If you casually look at CoinMarketCap, there are only about 15 tokens with a circulating market value exceeding 5 billion dollars. If your token's market value is below this standard, it will be very difficult to create a billion-dollar public company, although it cannot be said to be impossible, but it is indeed very hard.

Especially for long-tail assets, it may be that not even one survives. We judge that the DAT companies that can truly survive will ultimately concentrate on major assets like Bitcoin, Ethereum, and Solana, with perhaps only two or three on each chain.

In my past professional experience, whether in the commodity industry or other less transparent industries, there will ultimately form a pattern of "two or three leaders + a little long tail."

I believe the future of the DAT sector will likely develop according to this logic. In the past three months, I have looked at 90 to 100 projects, but it is impossible for 100 to survive. The portion we actually invest in is just a tiny part of that, because we want to set the bar high enough to only invest in the projects most likely to become future winners. This is probably the overall trend for this sector's future.

BlockBeats: You and Tom Lee have both mentioned that during market downturns, there will be a trend of "consolidation" that will prompt more mergers and acquisitions among DAT companies. But it seems you do not completely agree with this "merger route." Do you not support this approach?

Cosmo Jiang: Let me clarify; we actually completely agree with Tom's statement. This is a thought that I and many of our digital asset treasury company teams have discussed repeatedly, or rather, it is a question I have been thinking about. Because I come from a traditional finance background, I am very clear about which financial tools can be operated. So I feel that mergers and acquisitions make a lot of sense in this field.

What I really want to say is that if a company's stock price is below its net asset value (1x NAV), I believe such a company will make the right choice: either buy back stock or seek to be acquired. Rather than just maintaining a position below net asset value, collecting management salaries while thinking about some "empire expansion," right?

So as long as it falls below net asset valuation, I expect these companies to become "willing sellers." Of course, how this develops in practice remains to be seen, but that is my judgment.

Therefore, I do believe that once we enter a downturn, as I mentioned earlier, this is a relatively "homogeneous" sector, and only scale can win. So those small companies that cannot grow or achieve economies of scale will likely perform poorly in their stock prices once the market corrects.

At such times, larger, more mature companies that can maintain premium trading will find it very value-accretive to acquire other companies at 1x or below 1x net asset value. This is much more cost-effective than directly buying assets in the public market, right?

So I think this is very reasonable, and I fully expect this to happen.

BlockBeats: So what kind of DAT companies can survive?

Cosmo Jiang: Yes, ultimately, it all comes down to "execution capability."

You see, the U.S. equity capital market is very deep and broad, right? So as long as the company is of high quality, there is a large volume of transactions in the market to support it. Therefore, if many crypto treasury companies (DATs) can achieve very high trading volumes, I would not be surprised at all, as you just mentioned, this is crucial for enhancing valuation premiums and increasing financing capabilities.

Of course, this also comes with volatility—but it is clear that the core still lies in execution capability. This is why you see significant differences in trading volumes between different DAT companies. Ultimately, it comes down to their execution ability—whether in terms of market promotion or capital operations.

BlockBeats: During the due diligence phase, what key points does Pantera evaluate to assess a team's investability?

Cosmo Jiang: We mainly look at several core dimensions:

First, what kind of token is the underlying asset? Do we really have a deep understanding and confidence in it?

The reason we place bets on these projects is not to treat them as short-term trades, but to make real long-term investments.

Therefore, we will only act if the underlying token of a crypto treasury company (DAT) is something we genuinely believe in. We will spend a lot of effort researching these tokens, which is also the core of our work.

Second, is the project's opportunity or arbitrage space clear? Is there a specific tax arbitrage opportunity?

For example, MetaPlanet has a very clear tax arbitrage logic in the Japanese market. So, is there a certain "entry arbitrage" opportunity in the U.S., such as projects like Hyperliquid, where U.S. investors cannot repurchase, creating arbitrage possibilities?

So we will ask ourselves: does this project have some interesting mechanism that gives it uniqueness and thus creates excess demand?

Third, what is the competitive landscape of this project in the market?

We have a very large comps table that lists all currently issued crypto treasury companies, including their tokens, issuance methods, market capitalizations, etc.

Therefore, we have a very clear understanding of the competitive landscape of the entire market. So, where does this new team stand in this framework? What differentiated message do they intend to convey to the market?

Of course, the management team itself is also crucial.

Do they have enough credibility and communication skills to convey this narrative convincingly?

Especially in financial structure design, it is not only about having the relevant capabilities; more importantly, do you really know how to execute it? Do you have a complete and actionable execution plan?

Many teams that come to us say, "We want to raise $200 million." I would ask, "Great, what comes next? What is your second step?" They often respond, "We haven't thought that far yet."

This is completely unacceptable to us. Because getting these projects up and running is not just about the first round of financing; the first round is usually easy. The key is whether you can complete the second, third rounds of financing.

So, we hope that the other party has already planned their second, third, and fourth steps.

Additionally, the design of the trading structure is very critical, including how they plan to go public, liquidity arrangements, and pricing mechanisms.

BlockBeats: What you provide to the team is not just funding; it is more like systematic guidance.

Cosmo Jiang: You could say that. We are fortunate that many teams come to seek our advice. We are often the first point of contact for them.

Therefore, I try to share all the experiences I have accumulated during this time with them: because I have seen too many teams rise and fall, I know which steps are correct and which advisors are reliable, thus truly helping them get started and stabilize.

BlockBeats: You also mentioned that this industry is still in its early stages, and consolidation has not yet begun. When do you think we will enter the consolidation phase? Is there a rough timeline, say within the next two to three years?

Cosmo Jiang: You know, if we go back to April of this year, when we did the DFDV (Defi Dev Corp) deal, I thought, "One deal is enough." Then after doing the second deal, I thought, "Two deals are enough." But now it seems this has evolved into a larger trend.

This precisely illustrates the depth of the U.S. capital markets and the enormous demand for exposure to crypto assets—this is what I want to emphasize today.

I consider myself someone who "lives in the secondary market," basically judging the situation on a daily basis. I am very aware that the public market always has "window periods": sometimes opportunities are open, sometimes they are closed, and you must be ready to adapt at any time. Currently, this window is very "open," and I believe it can last for at least a few more months.

However, I think starting a new digital asset treasury company will become increasingly difficult—especially when you are the 100th or 110th company. So from now on, this will only get harder. However, there are indeed some promising teams emerging, and we judge that there will be a "new product period" of three to six months ahead, during which some good new projects will appear. What comes after that? We will wait and see.

Perhaps three months or six months from now, I will still say, "There are still three to six months of window period." Just like I said three months ago (laughs). So let's take it step by step. But if we extend the timeline to one or two years, or two to three years, I believe the number of new entrants will decrease.

Because this is a very rare window period, and you are witnessing the birth of a new industry. An industry will not be "born twice."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。