The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and refuse any market smoke screens!

Yesterday, after discussing contracts, many friends were indeed very interested. A large number of friends hope that Lao Cui can talk about the specific operations regarding contracts. If you have experience in other markets, I believe you can understand the trading logic in the coin circle. Trading itself is not complicated. Especially in short-term trading, many technical indicators cannot be referenced. You are too obsessed with linear indicators, which is also a necessary path for traders. When Lao Cui first entered the coin circle, I also used so-called technical indicators to enhance my confidence in making entry judgments. Familiar indicators like Japanese candlestick charts, Dow Theory, Elliott Wave Theory, and MACD, among others, I have also undergone systematic learning. However, when facing the market independently, these indicators only harm oneself, especially when facing a highly suspicious market; indicators will only overturn one's own views.

In the coin circle, especially before 2021, during the 519 incident, everyone asked Lao Cui which indicator could provide an early warning. I have always emphasized that the system is the most important in the coin circle. What is a system? Trading is not a competition of who works harder. If observation indicators were useful, then everyone could profit just by staring at the market every day. My current understanding of the coin circle is to see who can wait for the confirmation of their own system. In the future, when reviewing, we can only look at one thing: the number of stop losses. Currently, my trading logic, based on contracts, is that if I have more than 2 stop losses in a day, I will choose to give up trading for that day and wait for opportunities with no positions. It can be said that seizing opportunities is important, but even more important is forcing oneself to calm down. Profitable trades do not prove themselves in trends but realize their understanding within trends. I will not engage in things that exceed my own understanding.

Especially in the coin market, there is never a lack of opportunities. Looking at the entire development history of the coin circle, you can find that long positions are never trapped. Because Bitcoin's historical highs are always being created, the most interesting event was during the 519 incident, which led Bitcoin into a bear market phase. At that time, one user had an average Bitcoin price of 60,000. I remember it vividly. Because it was a historical high, my suggestion was to give up shorting at 50,000, but this friend remained firm in his viewpoint, and now he has already made over half of his profits. In fact, if we calculate it, we should really thank this coin friend, Old A, who clearly knows that a bull market can lie dormant for ten years. At that time, his reasoning was that he could just wait for the next bull market to start. The coin circle has a four-year cycle, which means just waiting another four years (the previous Bitcoin halving effect makes the current four-year cycle not a reference).

To put it bluntly, Lao Cui was not so optimistic about Bitcoin at that time. From my perspective, I felt that the historical high should not be held onto like that. Following the trend is the way to go; shorting from 50,000 to 20,000 can yield profits. Why gamble on an uncertain future? The fact proves that this coin friend’s understanding is higher than mine, and the result is his victory. This is the benefit of system-based trading. This kind of operation can be simply understood as protecting the principal and maintaining a bit of composure in rhythm. Most users lose money in spot trading for two reasons: one is choosing the wrong coin, and the other is a lack of composure. It can be said that if you held the coins from the 519 incident in 2021 until now, you could have doubled or tripled your investment. When you start using weekly and monthly charts to choose trends, utilizing news in conjunction with sufficient composure, you can definitely achieve profits. This applies to contract users as well; while using 100x or even 1000x leverage, you must maintain sufficient margin and always have the ability to convert contracts into spot.

To achieve stable profits, it is not about predicting probabilities. Many coin friends do not have their own system. Even if they profit a hundred times, a single loss can wipe out their capital. When contract users enter the market, they must consider whether they can withstand the current volatility and maintain the discipline of their system. A pyramid cannot be built in a day, nor can it be completed by one person. Victory requires "timing, location, and harmony," all of which are essential. This is also what I mentioned earlier; my successful path in contracts is not replicable. Most users come to me hoping to find the absolute low point. How is that possible? I need to know where a market trend can stabilize, and I wouldn’t discuss so much with everyone; I rely on trading to support myself. More importantly, I hope that everyone finds me for the purpose of communication and learning, to discuss and grow together. My understanding is always my own and cannot be given to you.

Let me elaborate on my system. Those who follow me can intuitively feel it. I mostly stick to my system, and I enter the spot market almost on a yearly basis. Including OKB, which has recently dropped extremely, I will hold such coins for at least half a year to a year. Because I value domestic strength, the current market value is only tens of billions, and the fixed upper limit of 21 million coins means the price will definitely not be lower than BNB. From a value investment perspective, it is very likely to surpass BNB in the end. However, for the sake of short-term market clearing and eliminating retail investors, even if it drops below the entry price of 92, I will only add to my position and not exit. All systems will ultimately be defined by value investment. Value investment may not apply to the domestic market but is applicable to all financial markets. To recognize value, one must firmly establish a system. All investment processes will have ups and downs, but in the long run, there should be no major issues. If you view OKB from a speculative perspective, the current profits are enough for you to exit; it just depends on how you define it.

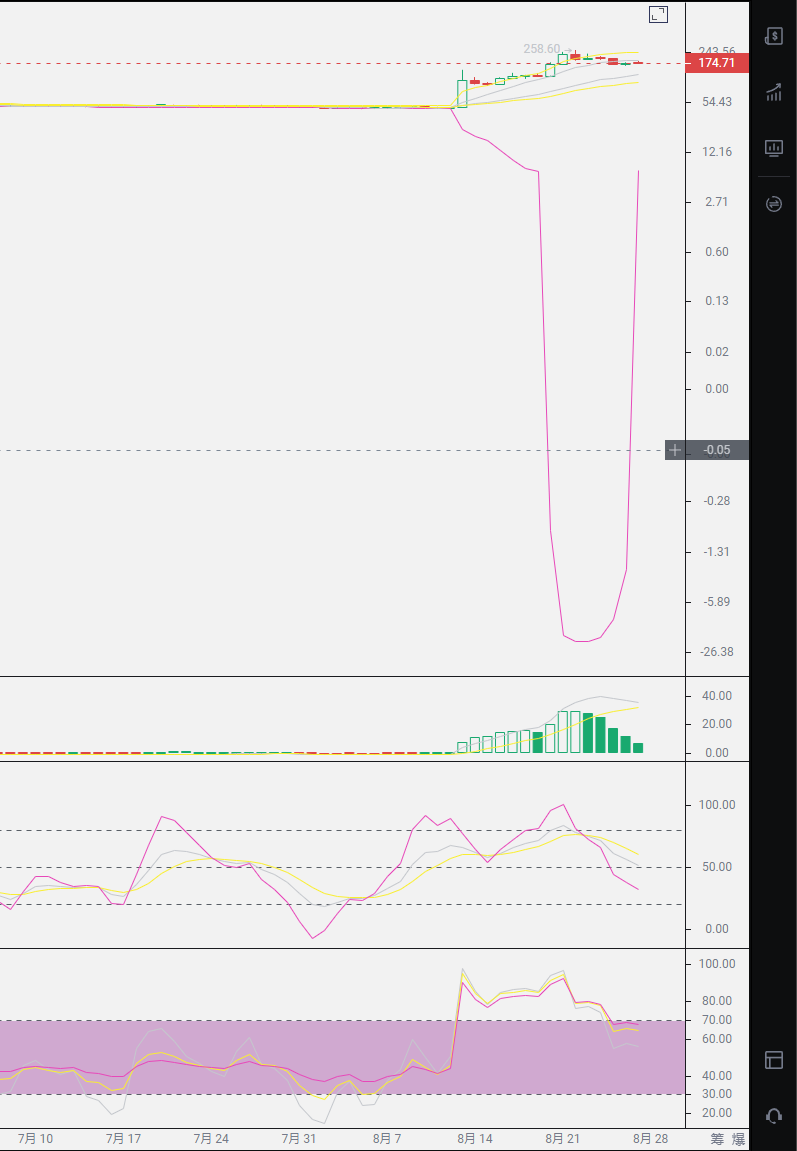

In summary, my system cannot form a complete closed loop, and mine is no exception. Even in the current mainstream capitalism, there are still imperfect corners. Therefore, you can seek your own trading system; you do not have to profit by standing on the same perspective as me. Everyone has different characteristics, and the methods to respond to market trends will also differ. So for spot users, do not seek immediate profits. The coins I recommend to everyone have strong potential, especially the short-term trend of SOL, which has almost single-handedly countered the bearish impact. The future market can be said to be limitless. The last bull market did not see SOL rise much, but the next bull market will likely break out first. It is not too late to enter now. For contract users, just look for daily low points to enter. The current long positions will not trap you; leaving a stop-loss space of 10,000 for Bitcoin and around 200 for Ethereum can ensure you do not incur losses. After the interest rate cuts, it will be your harvest season. Remember not to chase shorts; chasing shorts is going against the market trend. If you have any misunderstandings, please try not to leave messages. Many platforms have assistants handling private messages. Those who have a way can directly ask me.

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess. A master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only seeking short-term gains, and ends up frequently trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。