Retail investors reject the trading era; what exactly are the big players profiting from?

Hyperliquid's liquidity always brings surprises or shocks.

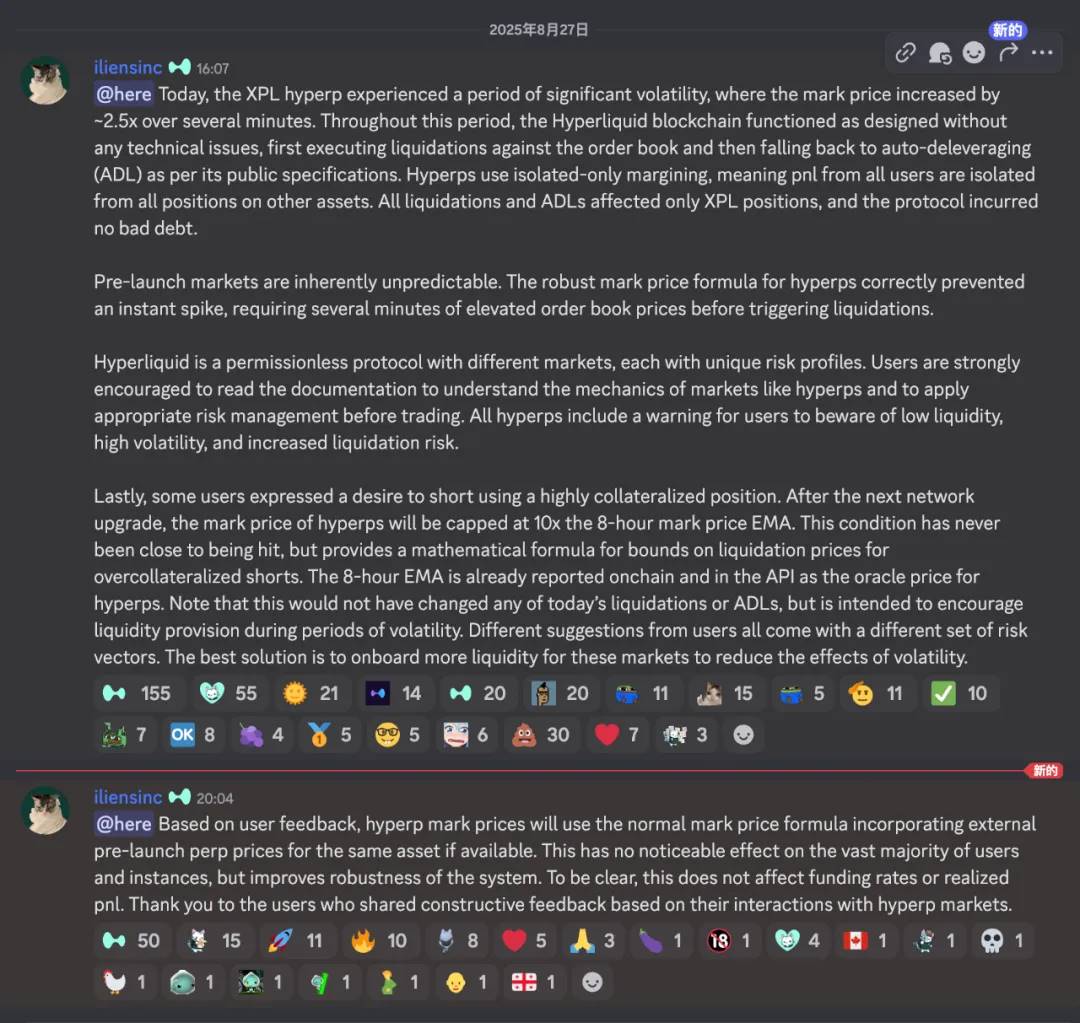

On August 27, just as Hyperliquid's BTC spot trading volume ranked second only to Binance, surpassing Robinhood's trading volume when the news was announced last month, a super whale address related to Sun's actions "attacked" the $XPL pre-contract market, resulting in user losses of tens of millions of dollars.

Unlike mainstream trading markets like BTC/ETH, the trading volume in Hyperliquid's pre-contract market is inherently small, and whales can exploit trading rules without permission, ultimately leading to a tragic outcome.

If it were a CEX like Binance, whales would have been banned manually long ago, and the possibility of order sniping would be minimal. In response, the Hyperliquid team stated on Discord that they deeply understand, will learn from the lessons, and will make improvements, but will not provide compensation for now.

Image caption: HL team's response

Image source: @hyperliquidx

Let’s recall the security incidents and responses that occurred with HL:

- In November 2024, BitMEX founder Arthur Hayes and others accused Hyperliquid of being centralized in its architecture;

- In early 2025, a 50x whale explosion incident in the HLP treasury led the HL team to adjust the leverage of multiple cryptocurrencies afterward;

- On March 26, 2025, facing malicious sniping of $JELLYJELLY, the HL team directly intervened to cut off the network to protect themselves.

- On August 27, 2025, a whale sniped the $XPL pre-contract market, and the official statement indicated that the risk was borne by users.

It can be observed that the HL team adopts completely different measures in response to various security incidents. If it does not involve HL's own treasury or interests, they resort to decentralized governance; if it truly threatens the protocol itself, they directly use super admin privileges.

I do not intend to make a moral judgment on this matter; I can only say that any trading venue with concentrated liquidity will inevitably face the "accident" of whether to protect retail or whale liquidity. From Binance's opaque listing standards to Robinhood's retail battle against Wall Street, this is universally true.

Time and space are a circle; liquidity is the source of gravity.

In 2022, the Perp DEX trend emerged after the collapse of FTX, leaving a void in the perpetual contract market, while Binance faced a reconfiguration of its pricing strategy due to PumpFun's influence.

Hyperliquid is not special; it mimics the strategy of $BNB = Binance main site + BNB Chain, moving all liquidity to a no KYC chain, with Binance's regulatory arbitrage growing rapidly, while HL attracts retail investors with no entry barriers for arbitrage.

Returning to 2022, the crypto world originated from the sudden collapse of FTX. Backpack took away Solana's legitimacy, Polymarket took away political event predictions, and Perp DEX was still enduring the dominance of GMX and dYdX, as well as the encroachment of Bybit and Bitget.

The market experienced a brief void; Binance was under investigation, coinciding with Biden's presidency, where the Democratic president was not fond of cryptocurrencies. Even SBF, who donated tens of millions to Biden, had to face consequences, while Gary was cracking down on the crypto space as SEC chairman, and Jump Trading had to pull back.

In the midst of chaos, opportunities emerged.

With Binance under scrutiny, FTX collapsed, BitMEX aged, and OK/Bybit/Bitget were fighting off-chain, the CEXs at that time did not deny the trend of on-chain migration, but the chosen path was through wallets.

Hyperliquid chose to embrace CLOBs (Central Limit Order Books), using off-chain matching + on-chain settlement, combined with a mechanism inspired by GMX's LP Token, officially launching the Incentive Game.

Image caption: Overview of Perp DEX

Image source: @OAK_Res

However, this mechanism, when placed in 2023-2024, is not even fresh. At a critical moment, Pump Fun broke through Binance's pricing system, and the meme frenzy allowed HL's liquidity to truly attract its first batch of loyal users.

Before Pump Fun, NFTs or meme coins existed, and even in 2021, BNB Chain was the main battlefield. Therefore, the big brother's lack of understanding of memes is purely marketing, but Pump Fun chose an internal and external trading mechanism along with the Solana ecosystem.

• The internal and external trading mechanism provided small amounts of capital with the opportunity for large-scale experimentation;

• The Solana ecosystem maximized the rapid rise and fall characteristics of meme trading.

All of this disrupted the rhythm of VC financing—project assembly—Binance's exit—> empowering the BNB mechanism. The collapse of the overvalued system is a precursor to Binance's liquidity crisis. It can be said that the current BNB is Binance's debt, and Binance Alpha is filled with passive defensive helplessness.

The meme craze was HL's first validation; liquidity was available everywhere. After experimenting with small amounts and small cryptocurrencies, large funds and mainstream coins would follow. In terms of publicity, it was all reverse marketing; first claiming there were big players, so retail investors dared to enter, but in reality, without retail losses, there would never be profits for market makers, whales, and protocols.

Hyperliquid cannot operate with strong liquidity solely based on its own funds; external capital injection is essential. However, the absence of VCs does not conflict with this. By November 2024, Paradigm had already entered the $HYPE system, with @mlmabc estimating a purchase volume of possibly 16 million tokens.

Image caption: Paradigm buys $HYPE

Image source: @matthuang

VCs can directly buy in, which is hard to classify as a traditional investment model. Similarly, market makers may also participate in this way, but logically, they are just like ordinary retail investors in terms of airdrops and purchases.

From a narrative perspective, the issuance and sale of project tokens is a typical game theory crisis. The project party, multiple VCs, and exchanges do not trust each other. Immediate selling after unlocking may result in future losses, but it preserves current gains. Thus, all parties choose to sell immediately, leading to a world where only exchanges and project parties are hurt.

Hyperliquid airdrops $HYPE while retaining project control, trading spot $HYPE primarily on its platform. This dual control stabilizes the initial momentum of the flywheel. By mid-2025, Bybit will list $HYPE spot, likely through direct purchases to increase trading pairs, rather than HL pushing for the listing.

HL is not mysterious; the wealth effect created when Pump Fun launched Hyperliquid was even stronger than Binance's. Today, Binance merely regains a point in this ongoing competition, which will continue for a long time. During the $JELLYJELLY period, both Binance and OK could set aside past grievances to jointly target Hyperliquid.

The marketplace is like a battlefield; the competition is long, but the opportunities are few.

Retail investors trading meme coins, while big players rush to HL.

Retail investors reject the trading era; what exactly are the big players profiting from?

Meme coins are bankrupt, and among Pump Fun, Berachain, and Story Protocol, one can guess which protocol has the highest revenue. Surprisingly, it is Pump Fun, from which retail investors are exiting, while the DeFi-native design of Berachain has become a roadside attraction.

However, retail investors will no longer touch altcoins. The current upward trend is due to the spillover of liquidity from the US stock market. Unfortunately, DAT has already started selling coins, and the strategy (MSTR) of the coin-stock-bond flywheel looks good but is hard to learn. Even ETH's resilience in price increases is far inferior to BTC.

In the era of retail investors rejecting trading, everyone is focused on big players and institutions. Their thinking is quite interesting; they believe that as long as big players act as counterparties to each other, they can earn intermediary fees and transaction fees. This is not just laziness in thinking but an insult to Hyperliquid.

Liquidity is always the most fundamental infrastructure in the crypto industry, and Hyperliquid has succeeded by establishing direct connections with retail investors.

With 500,000 no KYC users, they are all big players and whales. If cryptocurrencies had already replaced the existing financial system, even Trump's $5 million gold card wouldn't sell that many. Similar to USDT, the lack of entry barriers is highly attractive to funds. One could argue that there are many practitioners in the black and gray markets, but this is not a financial miracle that a few people can create.

In this attack incident, the stories shared on Twitter (X) are from real users, and in the low-volume pre-contract market, it proves Hyperliquid's appeal and user base. The only issue is that HL messed up this time, using liquidity to undermine its own governance system.

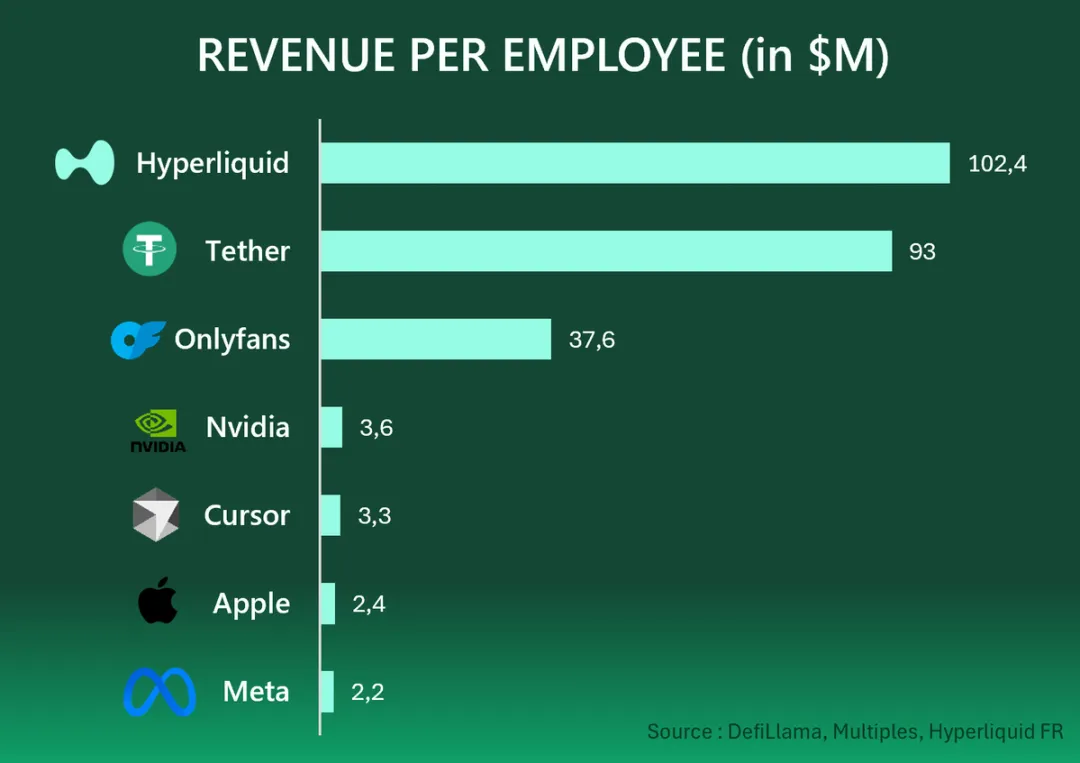

11 individuals generated $1.167 billion in annual revenue, with an average benefit of $106 million per person, followed by Tether with an average of $93 million, and then OnlyFans with $37.6 million. The scale effect of the internet, combined with humanity's most primitive desires, has created an incredibly brilliant underground and on-chain world between the unique industries of Asia, Africa, and the First World.

Image caption: Web2&3 enterprise average benefits

Image source: @HyperliquidFR

If you think Hyperliquid is just whales trading against each other, does that mean Tether is just big players swapping? Or that OnlyFans is just big shots diving in?

In the era of retail investors rejecting trading in altcoins and memes, the high leverage of BTC and ETH is one of the few "opportunities" with deadly allure for everyone. Of course, being short-squeezed is also a fatal loss.

People cannot deviate from their successful paths.

Binance will only continue to optimize around the logic of listing coins until it overfits and falls into a dead cycle;

CEXs will only focus on increasing liquidity rebates until they break through their meager profit margins;

CLOB DEXs will only learn to become Binance, and after issuing tokens, they will become imitations of GMX.

Unique pigs are rare; many people are willing to provide asset management services for big players. If today one still assumes that the largest liquidity is in CEXs, it can only be said that they are not suited to participate in the upcoming crypto market.

Retail investors have entered a permissionless free market, big players have seized liquidity exit opportunities, Paradigm has profited from the rise and holdings of $HYPE, and retail investors have gained opportunities to bet small against large, provided they do not touch small-cap assets.

Everyone prices their own destiny, and then All in Crypto becomes the eternal main theme.

Conclusion

Human intervention is a traditional feature of Hyperliquid, and the entire Perp DEX race is heavily colored by human governance.

It is not that HL's airdrops and profit distribution are in place, nor that Jeff's technical architecture is superior, but rather that after the collapse of FTX and the regulatory scrutiny of Binance during the market void, Hyperliquid's competitors are actually limited. Timing is always the best entry point to break existing structures.

FTX collapse—-> Binance being regulated and tied up + Binance management immersed in listing coin thinking—-> PumpFun breaking through Binance's listing mechanism and pricing logic—-> Perp DEX becoming a vast blank market space—-> Bybit is a beneficiary of existing thinking + Hyperliquid building the $HYPE flywheel.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。