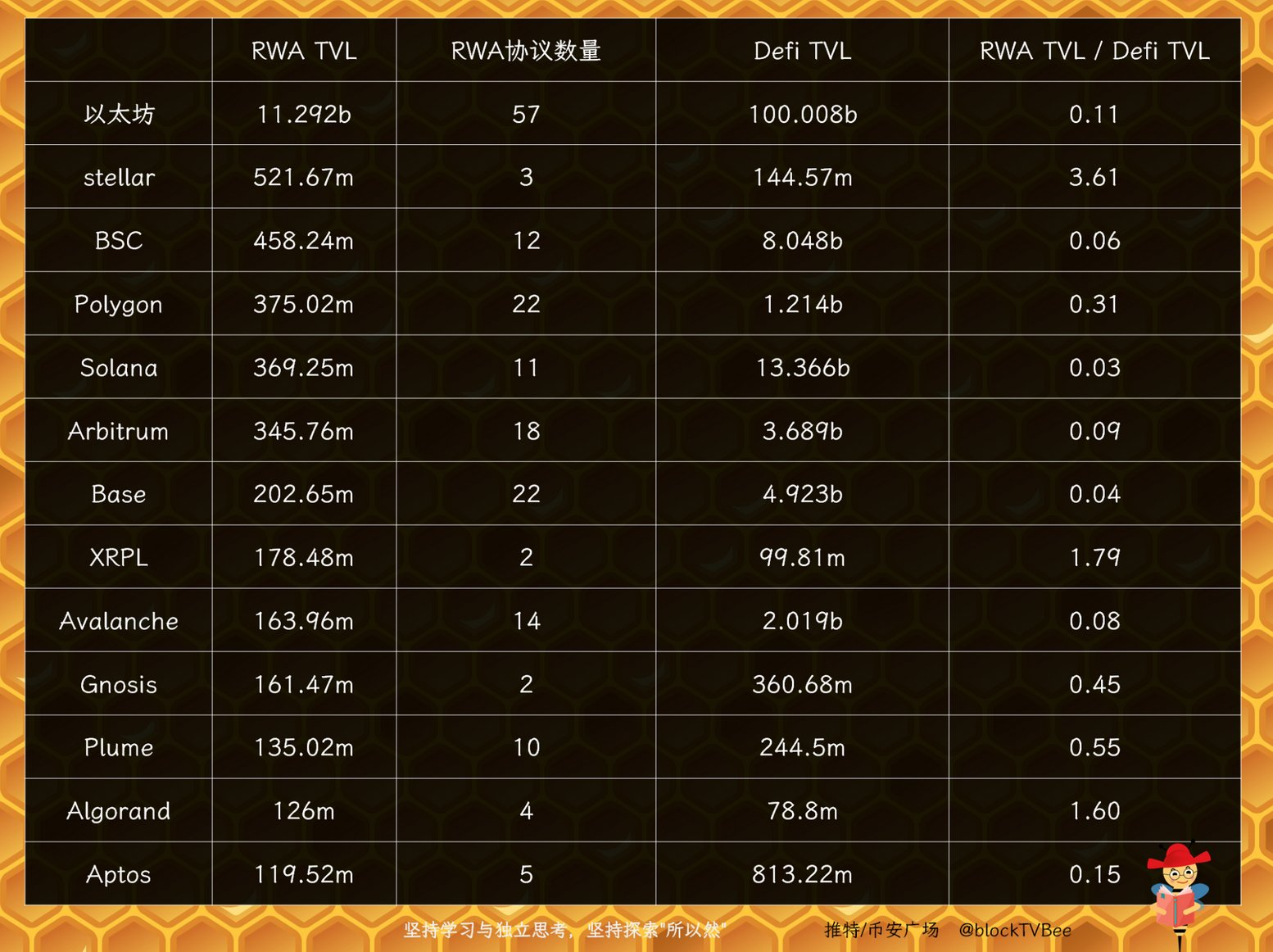

DefiLlama has recently launched RWA TVL data, and Bee Brother has organized the RWA TVL, the number of RWA protocols, and the ratio of RWA TVL to Defi TVL.

The ecosystems with RWA TVL exceeding $100 million are shown in the table below.

╰┈➤ Ethereum is the King of RWA

As the only smart contract public chain that has passed the US ETF, Ethereum rightfully has the highest RWA TVL and the most RWA protocols, with both metrics far exceeding those of other ecosystems. Additionally, the RWA TVL / Defi TVL ratio is also not low.

Ethereum is indeed the king of finance.

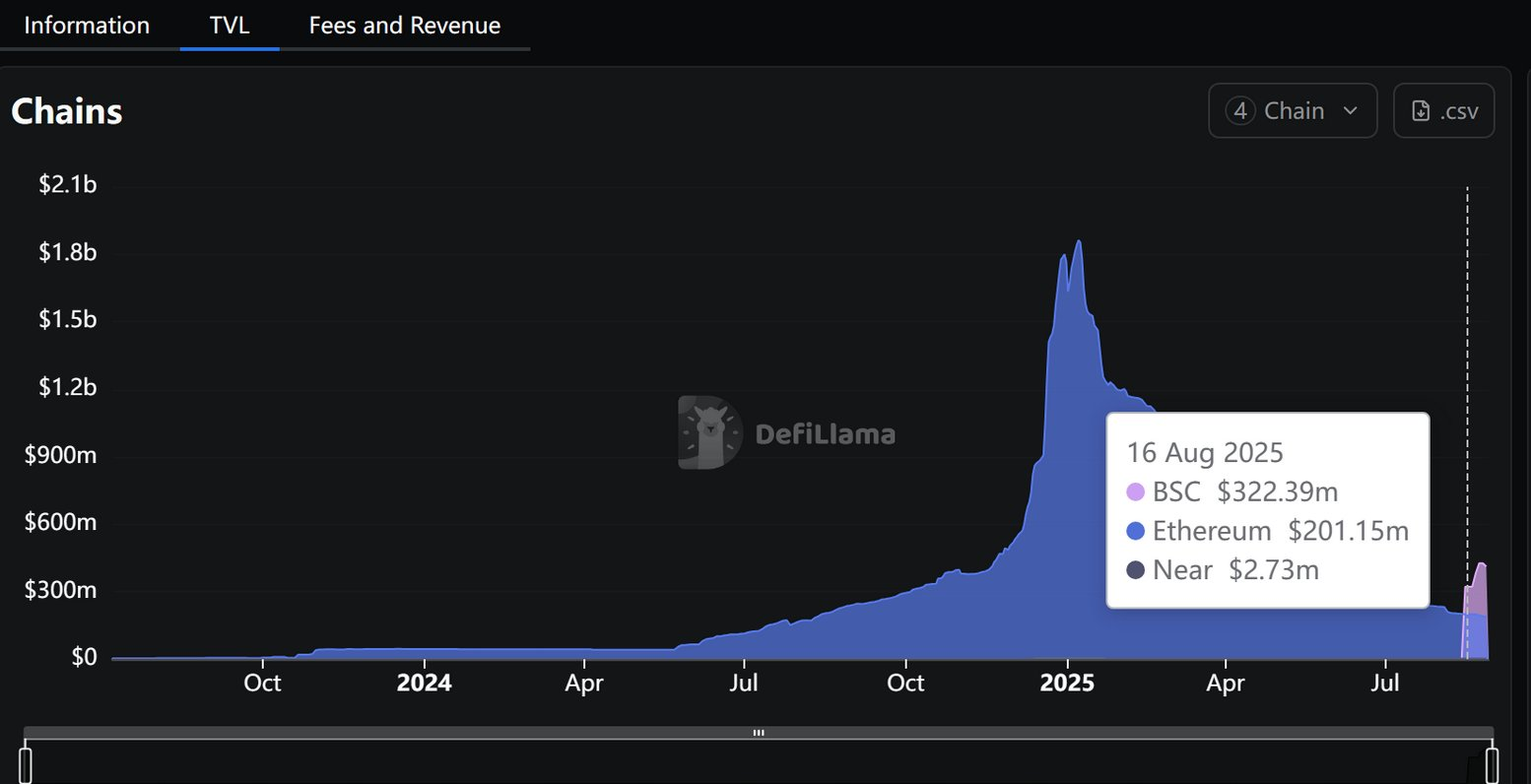

╰┈➤ BSC Chain's RWA Ecosystem is Rising

The RWA TVL on the BSC chain is surprisingly high, even surpassing the ecosystems Solana and Base in the US.

The RWA TVL on the BSC chain has been increasing since May this year, with a significant growth in August.

Among them, the RWA protocol with the highest TVL on the BSC chain is Circle USYC, which is an institutional-grade tokenized money market fund launched by Circle, providing exposure to short-term US Treasury bonds and US Treasury reverse repos. Borrowing institutions can use US Treasury bonds as collateral to borrow from the USYC fund.

Circle USYC is deeply integrated with USDC.

Additionally, it is worth noting that the TVL of Circle USYC was originally primarily based in the Ethereum ecosystem. Since August, it has shifted towards the BSC chain. Currently, Circle USYC's TVL on the BSC chain is about twice that of Ethereum.

Since Circle USYC is an institutional-grade RWA product, its shift to the BSC chain is likely not due to a higher number of retail investors or lower GAS fees on the BSC chain. A possible reason is that the BSC chain offers faster speeds, which can address the urgency of borrowing needs.

Of course, this indicates that Circle is confident in the security of the BSC chain.

As a result, the RWA ecosystem on the BSC chain now includes not only USD1 and WLFI but also the Circle ecosystem.

Finally, the ratio of BSC chain RWA TVL to Defi TVL is not high, reflecting the diversity of the BSC ecosystem.

╰┈➤ Polygon's RWA Ecosystem in Non-US Regions

Although the gap in RAW TVL among Polygon, Solana, and Arbitrum is small, Polygon has the highest number of RWA protocols, which is twice that of Solana. Moreover, its RWA TVL / Defi TVL ratio is high.

It is well known that Polygon is not a US project.

Among Polygon's RWA protocols, the one with the highest TVL is Spiko, which is a tokenized money market fund regulated by the French Financial Markets Authority, investing in US Treasury bills / Eurozone Treasury bills.

Additionally, Arbitrum has a relatively high number of RWA protocols, and as a widely recognized ecosystem in the Defi space, its RWA ecosystem may have growth potential.

╰┈➤ Attention to the RWA Ecosystems of Avalanche, Plume, and Aptos

Although the RWA TVL of these three ecosystems is less than $200 million, all three projects are US-based.

Avalanche has 14 RWA protocols,

Plume is positioned as an RWAFi ecosystem,

Aptos is the Move language ecosystem with the highest RWA TVL, and its RWA TVL / Defi TVL ratio is relatively high.

╰┈➤ Stellar, XRPL, and Algorand May Have Some Degree of Centralization

These three projects share the characteristic of having a very high RWA TVL / Defi TVL ratio, exceeding 1, and having a low number of RWA protocols, not exceeding 4.

Especially Stellar and XRPL, which may exhibit a certain degree of centralization.

╰┈➤ Final Thoughts

Ethereum is the king of RWA and finance, more suitable for institutional and large-scale participation.

The RWA on the BSC chain is rising, with Circle and USD1 actively integrating into the BSC ecosystem, indicating a harmonious relationship between Binance, BSC, and US institutions. The development of RWA makes the BSC chain the most diversified ecosystem. The BSC chain, which integrates diverse ecosystems such as RWA, MEME, Defi, and AI, is suitable for participation from institutions, large investors, and retail investors alike.

The RWA ecosystem of Polygon in non-US regions, as well as the RWA ecosystems of Arbitrum, Avalanche, Plume, and Aptos, are also worth continuous attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。