After months of controversy and waiting, WLFI has finally reached a decisive moment.

On August 26, the Trump family's crypto project WLFI announced the launch of the Lockbox page, allowing holders to move their tokens into it in preparation for the unlocking process. At 8 AM Eastern Time on September 1, WLFI will complete its first release—20% of the initially allocated tokens will officially enter circulation.

For a governance token that was once described in its white paper as "potentially non-tradable forever," this step almost symbolizes a turning point in the project's narrative: from concept and voting to actual realization, WLFI is completing its transformation from a "political symbol" to a "tradable asset."

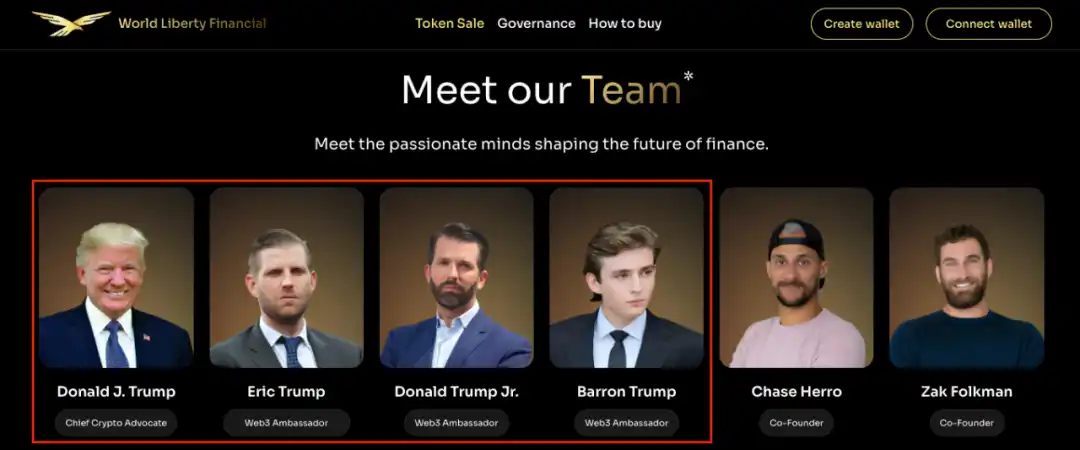

Designers Behind WLFI

World Liberty Financial (WLFI) was established on September 16 last year, guided by real estate mogul Steve Witkoff and his son Zach, with co-founders including crypto KOL Chase Herro and Zak Folkman.

The Trump family also holds a significant position, with Trump listed as the "Chief Cryptocurrency Advocate," while his sons Eric, Donald Jr., and Barron serve as "Web3 Ambassadors."

Additionally, WLFI has three technical leaders:

Rich Teo: Head of stablecoins and payments, previously founded the exchange itBit and the stablecoin company Paxos, currently serving as CEO of Paxos Asia. Rich is also an advisor for the SocialFi project RepubliK.

Corey Caplan: Head of technical strategy, co-founder of the DeFi platform Dolomite, responsible for integrating lending and trading functions.

Bogdan Purnavel: Chief developer, formerly a developer at Dough Finance.

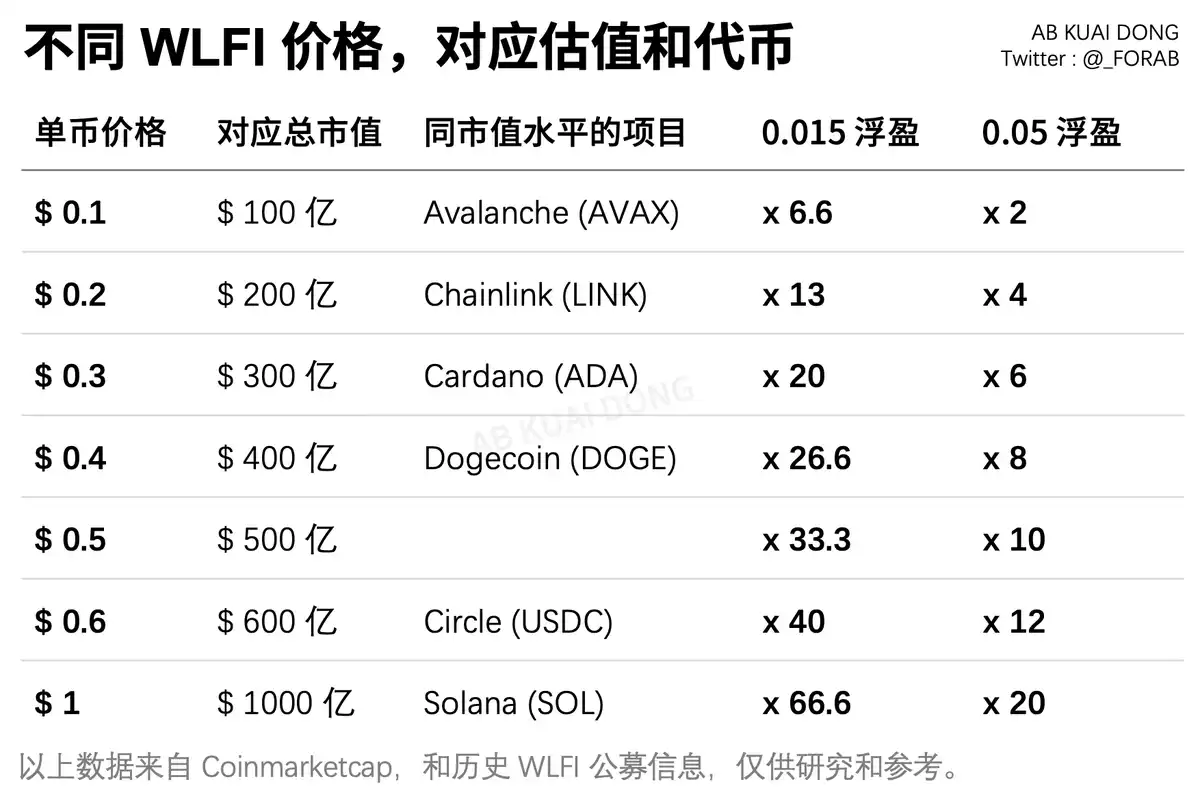

One of the first initiatives of World Liberty Financial is to sell its own tokens, with an ICO starting on October 15, 2024, selling 20 billion $WLFI tokens at a price of $0.015, raising approximately $300 million for the company.

On January 20, 2025, the day of Trump's inauguration, WLFI announced a second token sale, citing "huge demand and strong interest." Another 5 billion tokens were issued at a price of $0.05, a 230% increase from the first sale. The second sale was completed on March 14, nearly two months later, reaching a total target of $250 million.

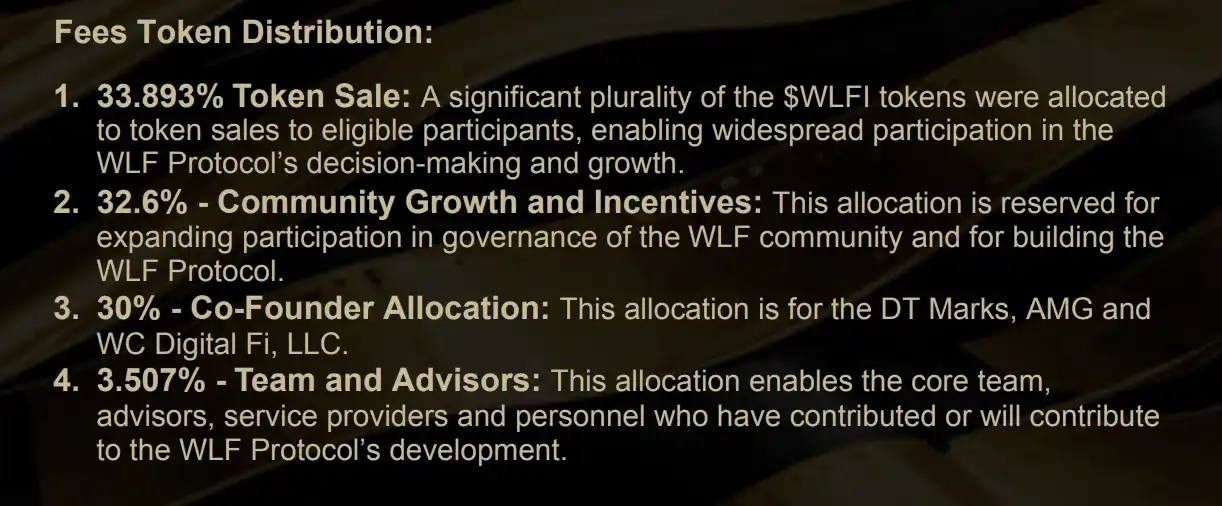

According to WLFI's "Golden Book," WLFI tokens will grant holders voting rights on important matters affecting the protocol (such as upgrades). In the expected token distribution, 33.893% will come from token sales, 32.6% will be used for incentives and community development, 30% will be allocated to "initial supporters," and "core team and advisors" will account for 3.5%.

The project white paper also states, "The issuance of $WLFI tokens raises funds to purchase mainstream project tokens with growth potential, and $WLFI token holders share in the returns from the appreciation of the asset portfolio." The project white paper clearly indicates that the $WLFI purchased by users is solely a governance token, with $550 million already belonging to the project team.

However, the Trump family's multiple crypto ventures seem to "indicate" that WLFI will not merely serve as a non-transferable token for "identity verification." Now, with the opening of the Lockbox function, the token issuance logic of WLFI has officially entered the "realization phase," and the previously sold 55 billion tokens will be gradually released under the community governance framework.

What is the Valuation of WLFI Tokens?

On August 23, WLFI announced initial unlocking rules, stating that only the token shares of early presale users will be unlocked at the initial opening of WLFI. Specifically, 20% of the WLFI purchased at the $0.015 and $0.05 rounds will be unlocked, while the unlocking plan for the remaining 80% will still be decided by the community through governance voting. The token shares of founders, team members, advisors, and partners remain locked and will not be included in the initial unlocking.

The market generally views the launch of WLFI's circulation as a potential "price revaluation" moment. The initial 20% unlocking serves as a test of funding interest and may become a crucial turning point for WLFI's market capitalization to reach higher ranges.

If we base it on the first round of financing valuing WLFI at $1.5 billion (corresponding to $0.015 per token) and the second round valuing it at $5 billion ($0.05 per token), the current over-the-counter price of $0.24 implies that WLFI's valuation has increased more than 16 times over the past 8 months.

In horizontal comparison, the market generally sees WLFI as a heavyweight project benchmarked against the TRUMP token. The latter surged to an $80 billion market cap shortly after its launch, while WLFI's current preliminary market cap forecast is close to $30 billion, indicating significant market expectations.

Which Big Players Have Bought In?

According to a joint disclosure by Accountable.US and Bloomberg, among the top 50 addresses of WLFI, at least 14 users hold tokens through trading platforms restricted by the U.S., collectively holding over 6.7 billion WLFI tokens (valued at approximately $335 million), with the most notable holder being Justin Sun.

In November 2024, Justin Sun's TRON DAO became the largest independent investor in World Liberty Financial (WLFI), subscribing to as much as 3 billion WLFI tokens for $30 million. According to insiders, the transaction price was far below the market-expected issuance price of $0.015, with the actual transaction price being $0.01, meaning Sun entered at a significant discount. This price not only earned him early investment returns but also established his core position in the WLFI project.

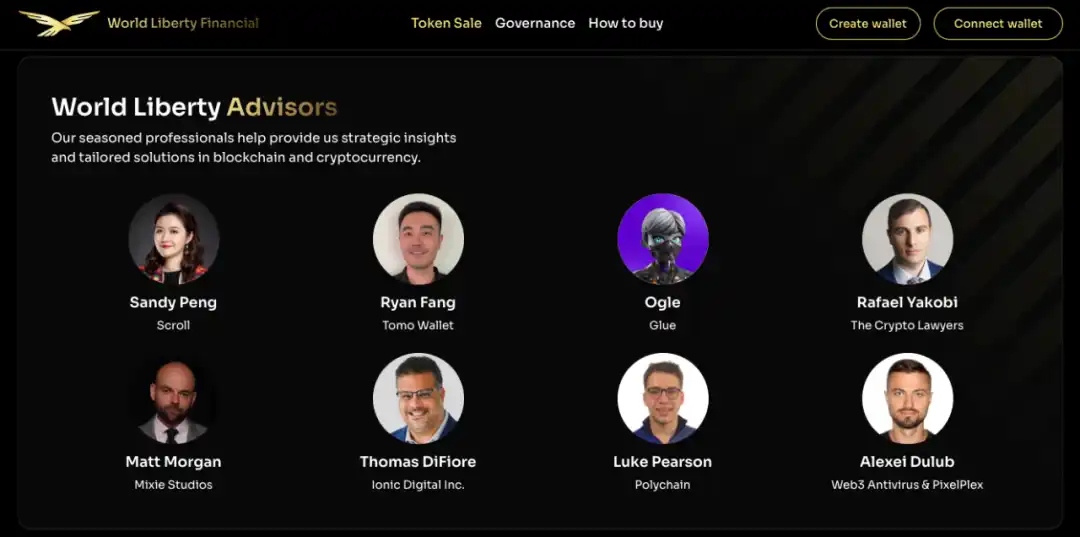

Subsequently, WLFI officially announced on November 27, 2024, that Justin Sun would join the project as an advisor; however, no introduction of Justin was found on the WLFI official website.

Aqua1 Fund

Recently, a fund has pushed Justin Sun out of the top position. On June 26, the Web3 native fund Aqua 1 announced a strategic purchase of $100 million worth of the Trump family's crypto project World Liberty Financial governance token WLFI, aiming to participate in the governance of the decentralized financial platform and accelerate the construction of the blockchain financial ecosystem. According to on-chain information, Aqua1 Fund holds 800 million WLFI tokens.

Additionally, Aqua 1 plans to establish Aqua Fund in the Middle East and co-incubate the RWA tokenization platform BlockRock with WLFI.

DWF Labs

In April 2025, Abu Dhabi-based crypto investment and market-making firm DWF Labs announced that it had invested $25 million in tokens issued by the Trump family-controlled crypto project World Liberty Financial (WLFI).

Mike Dudas

Mike Dudas, founder of 6th Man Ventures and The Block, purchased over $145,000 worth of WLFI tokens on the eve of Trump's inauguration on January 20, 2025, amounting to approximately 970,000 WLFI tokens.

Troy Murray

Troy Murray, a member of BarnBridge DAO, purchased approximately 666,000 WLFI tokens.

Sigil Fund (alias Fiskantes)

This Gibraltar-based fund, whose chief investment officer goes by the alias "Fiskantes," spent 40 Ethereum (approximately $130,000) to purchase WLFI tokens, estimated to be around 400,000 WLFI based on the issuance price.

From a "non-tradable" governance token to the asset circulation of Lockbox unlocking; from "presidential ambassadors" to on-chain holdings; from stablecoin financing tools to international investment matching platforms, WLFI presents an unusual narrative—political and capital forces are converging through cryptocurrency. The initial unlocking on September 1 will mark the starting point for WLFI's entry into real market competition and a critical moment to test whether the "political-financial-crypto" triple narrative can be realized.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。