With the Trump family's crypto project WLFI completing its initial release—20% of the initially allocated tokens officially entering circulation—the market is bound to stir again, and many players are likely gearing up. For those who did not participate in the WLFI token presale, what related projects are worth paying attention to besides speculating on the WLFI token itself in the secondary market?

Rhythm BlockBeats summarizes the WLFI-related conceptual projects for you.

Vaulta (formerly EOS)

On May 14, the original EOS was renamed Vaulta, with the token supporting a 1:1 wear-free exchange and no changes to the token economics. The Trump family's crypto project WLFI purchased $3 million worth of EOS through the BSC ecosystem DEX protocol Pancake, and simultaneously bought $3 million worth of Vaulta (A) through the exSat ecosystem DEX protocol 1DEX.

On July 23, according to official news, WLFI and Vaulta (formerly EOS) reached a strategic cooperation, with WLFI committing to invest $6 million to promote the development of Web3 banking in the United States.

As part of this cooperation, Vaulta's native assets will be included in WLFI's macro strategic reserves, and WLFI's USD1 stablecoin will be directly integrated into Vaulta's Web3 banking infrastructure, aiming to enable users to manage, grow, and protect their wealth with the speed, security, and freedom of decentralized financial systems.

The current market capitalization of Vaulta token $A is approximately $768 million.

Plume

On June 30, the EVM-compatible blockchain Plume Network, designed for real-world assets (RWA), announced a strategic cooperation with the decentralized finance platform WLFI to jointly promote the multi-chain expansion of the USD1 stablecoin. As WLFI's strategic multi-chain partner, Plume will integrate the USD1 stablecoin as the infrastructure of its RWAfi ecosystem, with USD1 becoming the official reserve asset of the native stablecoin pUSD on the Plume chain.

The current market capitalization of Plume token is approximately $235 million.

Lista DAO

On May 7, according to official news, WLFI and Lista DAO reached a strategic cooperation, with USD1 officially landing in the Lista DAO ecosystem, and USD1 has been launched in the ListaDAO treasury.

On May 27, Lista DAO announced the integration of its stablecoin USD1 with the Trump family's crypto project WLFI. This integration will bring more use cases for USD1 on Lista DAO, including: USD1 officially launching CDP innovation, which can be used as collateral to borrow lisUSDLisUSD/USD1 liquidity pool on PancakeSwap; obtaining BNB through USD1 and participating in Binance Launchpool.

The current market capitalization of Lista DAO token $LISTA is approximately $57.19 million.

Blockstreet

The first official USD1 Launchpad, co-founder Matthew Morgan is an advisor to WLFI and also the CIO (Chief Information Officer) of the Nasdaq-listed company ALT5 Sigma, which raised $1.5 billion to launch the WLFI treasury.

The current market capitalization of Blockstreet token $BLOCK is approximately $148 million.

Dolomite

A DeFi service provider for USD1, co-founder Corey Caplan is also the CTO (Chief Technology Officer) of WLFI.

The current market capitalization of Dolomite token $DOLO is approximately $124 million.

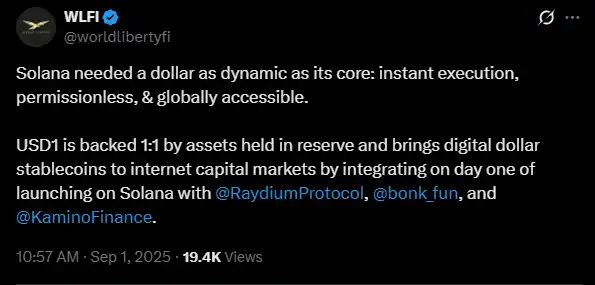

Raydium, BONK, and Kamino

On September 1, WLFI's official Twitter announced that USD1 has launched on Solana, stating, "Solana needs a vibrant dollar like its core: instant execution, permissionless, and globally accessible. USD1 is backed 1:1 by reserve assets and was integrated with Raydium, BONK.fun, and Kamino on the first day of its launch on Solana, bringing the digital dollar stablecoin into the internet capital markets."

BONK.fun's official Twitter announced that it will become WLFI's official USD1 launchpad on Solana.

Currently, Raydium token $RAY has a market capitalization of approximately $900 million, BONK.fun token $BONK has a market capitalization of approximately $1.7 billion, and Kamino token $KMNO has a market capitalization of approximately $152 million.

ONDO Finance

On February 11, the Trump family's crypto project WLFI and Ondo Finance announced a strategic cooperation to promote the adoption of tokenized real-world assets (RWA) and bring traditional finance on-chain.

As part of the cooperation, WLFI is exploring the integration of Ondo's tokenized assets as reserve assets into the WLFI network, including dollar yield tokens (USDY) (for non-U.S. persons outside the U.S. only) and short-term U.S. government bonds (OUSG).

WLFI also plans to integrate Ondo's upcoming USDY, OUSG, and tokenized securities into the WLFI platform to provide its users with lending and margin trading.

The current market capitalization of ONDO token is approximately $2.774 billion.

Ethena

On December 19, 2024, The Block reported that the Trump family's DeFi project World Liberty Financial announced a partnership with Ethena Labs, with both parties seeking a "long-term cooperation," starting with Ethena's yield token sUSDe.

The current market capitalization of Ethena token $ENA is approximately $4.2 billion.

StakeStone

The STO official release plan is to create a more flexible cross-chain yield experience based on STONE and USD1. As an infrastructure focused on full-chain liquidity, StakeStone has integrated over 20 chains and 100 protocols, and its yield token STONE can enhance asset utilization for USD1 users while retaining liquidity.

StakeStone announced on May 9 that it has completed integration with the Trump crypto project WLFI, with its deployer address having received a test transfer of 10,000 USD1 from the official USD1 custody address on May 6.

The current market capitalization of StakeStone token $STO is approximately $18.47 million.

Falcon Finance

Falcon Finance is a synthetic dollar stablecoin protocol launched by DWF Labs.

On May 7, according to Ember monitoring, the Trump crypto project WLFI deposited a total value of $4.51 million worth of AVAX, SEI, and MOVE tokens into Falcon Finance (funds held by Ceffu) as collateral, then minted 2.023 million USDF.

On July 30, the synthetic dollar protocol Falcon Finance received a $10 million strategic investment from the Trump family's crypto project WLFI. Falcon has accepted USD1 as collateral.

Falcon has not yet issued tokens. Currently, the protocol has a points system called "Miles," where users can earn badges by participating in various actions within Falcon Finance and earn points by engaging in a series of activities related to $USDf and $sUSDf.

BUILDon (meme coin)

BUILDon ($B) is a token fairly launched through the Four.meme platform, with its core being the mascot that promotes the BSC construction culture. This is the first meme coin purchased by WLFI. The project team has announced plans to launch a USD1 launchpad.

The current market capitalization of $B is approximately $720 million.

AOL (meme coin)

Dev @cryptogle is an advisor to WLFI and is currently empowering this coin to create a USD1 launchpad America.fun.

The current market capitalization of $AOL is approximately $11 million.

Conclusion

There are still some related tokens not mentioned above. For example, the crypto assets previously purchased by WLFI, such as TRX, LINK, MNT, etc., and the EGL1, Liberty, Tag, and Bank tokens bought with tens of thousands of dollars worth of WLFI in the "USD1 Million Incentive Program" initiated by WLFI and BUILDon. Of course, there is also $TRUMP, the meme coin that first sparked the "Trump craze" last year.

Will WLFI experience a shocking surge in September? If so, will the sentiment and liquidity spread to these WLFI-related conceptual tokens? Let's wait and see.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。