“I’ve always said that I really believe in the next several years, bitcoin hits a million dollars. There’s no question bitcoin hits a million dollars.” Those were Eric Trump’s words during a fireside chat on Friday at the 2025 Hong Kong Bitcoin Asia conference. Trump is a strategic advisor to Japanese bitcoin treasury firm Metaplanet. And just as the cryptocurrency dipped below $109K on Labor Day, Metaplanet snapped up 1,009 BTC, bringing the firm’s total bitcoin holdings to 20,000 BTC.

(Institutional investors are following the time-tested strategy of buying low, which has been helping reduce bitcoin’s volatility / Metaplanet on X)

Bitcoin ( BTC) appears to no longer go through the wild rallies and crashes that characterized much of its history. Many attribute this recent reduction in volatility to the deluge of institutional investors like Metaplanet, who don’t sell at the slightest hint of a price decline. If anything, they do the opposite; they buy the dip.

And so while bitcoin was mostly flat over 24 hours on Monday, down 2-3% for the week, only retail investors seem to be melancholic. The Metaplanets of the world and the rest of the so-called “smart money,” are not only buying the dip this weekend, they are also raising billions to buy even more of the cryptocurrency down the road.

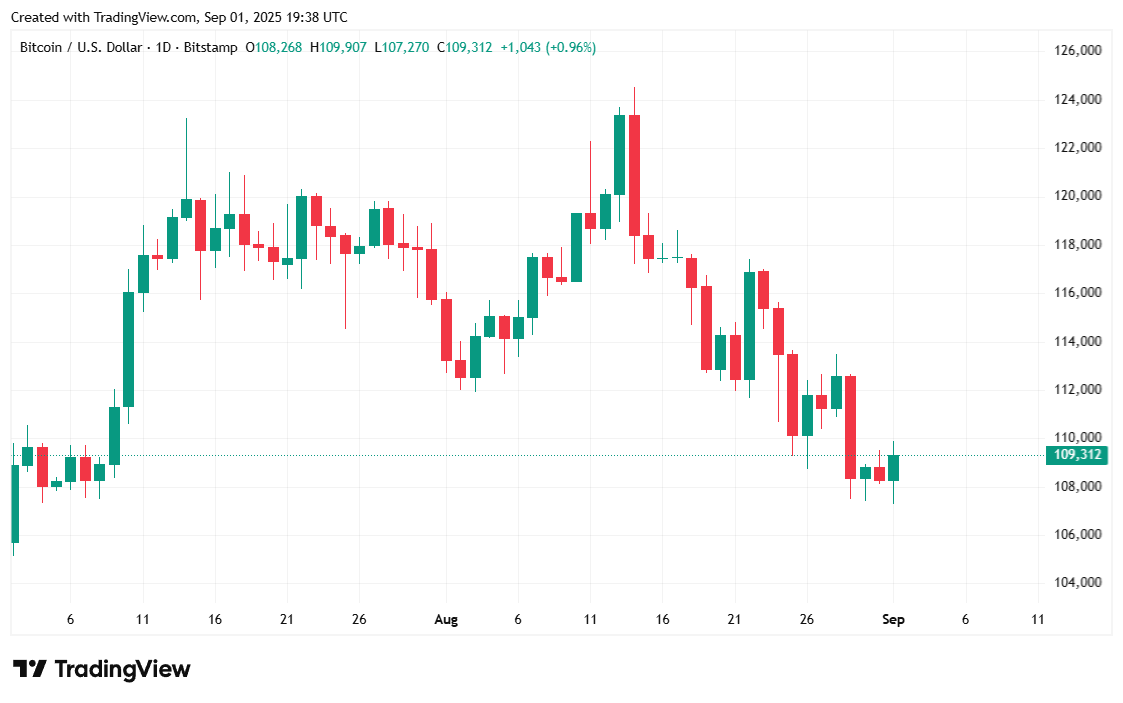

Bitcoin was trading at $109,236.39 at the time of writing, according to Coinmarketcap, up slightly by 0.24% for the day, but still down 2.02% for the week. The cryptocurrency’s price has moved between $107,271.18 and $109,890.58 over the past 24 hours.

( Bitcoin price / Trading View)

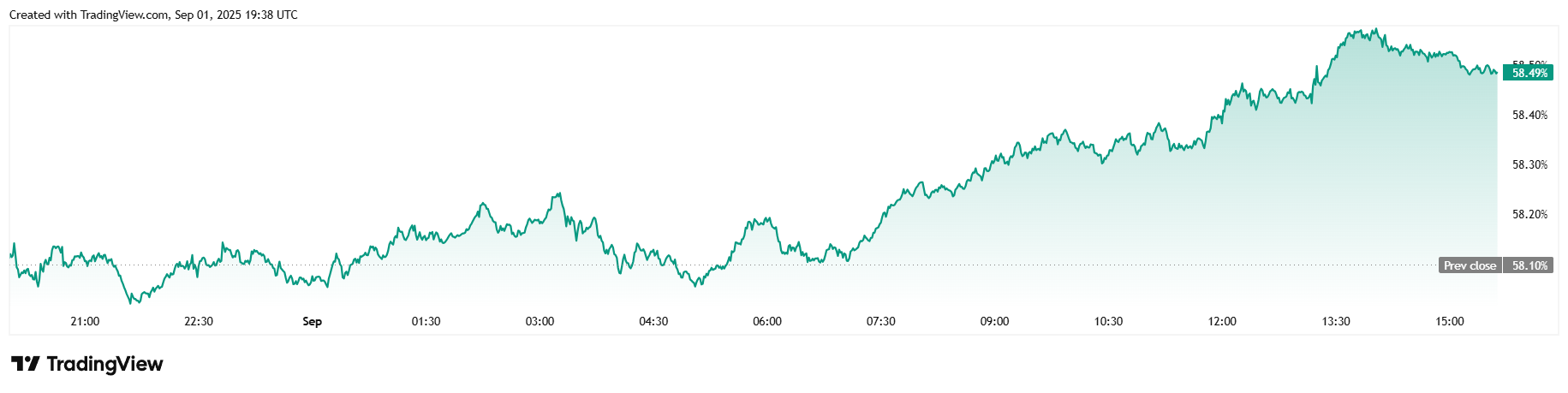

Trading volume was up 32.94% at $62.28 billion, despite the Labor Day holiday. Market capitalization was also slightly up by 0.21% at $2.17 trillion. Bitcoin dominance rose 0.67% to reach 58.49% at the time of reporting, according to data from Coinmarketcap.

( BTC dominance / Trading View)

Total bitcoin futures open interest was mostly flat at $80.33 billion over 24 hours, a small 0.39% increase. Bitcoin liquidations on Coinglass came to a total of $58.95 million for the day. That sum comprises $36.20 million in long liquidations and a smaller $22.75 million in shorts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。