Written by: J1N, Techub News

On September 1, 2025, as World Liberty Financial (WLFI) launched simultaneously on major exchanges such as Binance, Coinbase, OKX, HTX, Gate, and Bithumb, it quickly sparked market discussions. However, after reaching $0.478 at launch, WLFI's performance was lackluster, and within hours of opening, insiders began to sell off. In less than three hours, the price plummeted from $0.34 to $0.2.

_Source: _Odaily

There were subtle adjustments in the token distribution information before and after WLFI's launch. According to the project's official website and the latest disclosures, the total supply of WLFI is 10 billion tokens, distributed as follows:

Public Sale: Approximately 3.4 billion (34%);

Community Incentives: 3.26 billion (33%);

Founders' Share: 3 billion (30%);

Team and Advisors: 350 million (3.5%).

The shares for founders, team, and advisors are fully locked and do not participate in the initial circulation, with market attention focused on the early presale unlock. The presale price of WLFI was $0.015 and $0.05, and the project innovatively introduced a "Lockbox" mechanism, requiring investors to actively deposit tokens into a contract and sign an unlock agreement, releasing only 20%, while the remaining 80% is released at a pace determined by community governance.

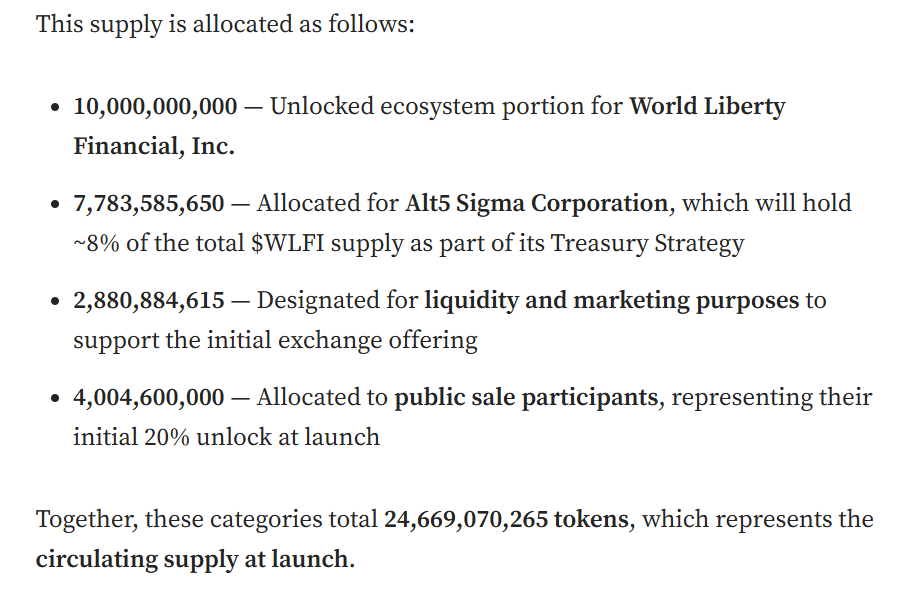

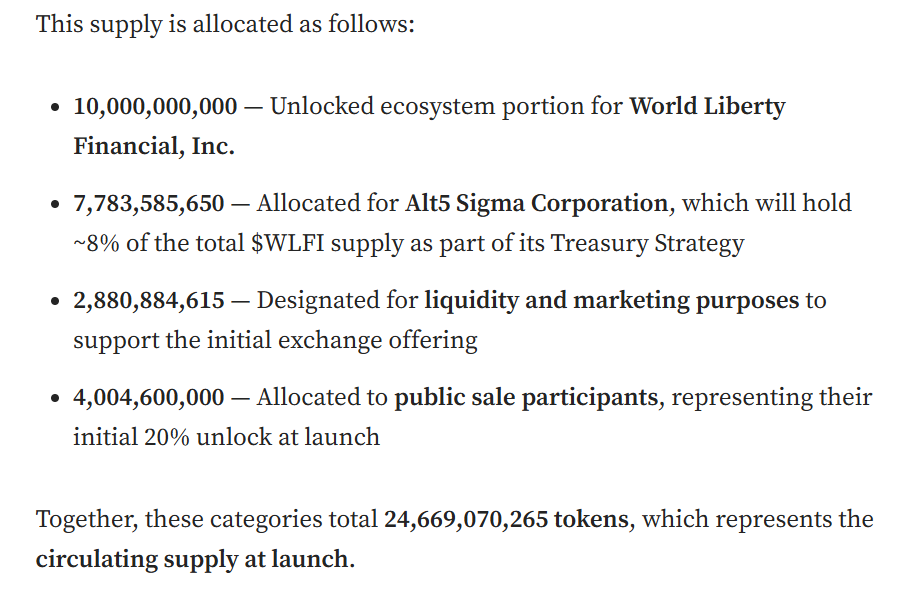

However, on the first day of launch, the official World Liberty Financial blog disclosed another initial circulation plan: approximately 24.67 billion WLFI tokens were in circulation at launch, including 10 billion for the World Liberty Financial, Inc. ecosystem, 7.784 billion for Alt5 Sigma Corporation, 2.881 billion for liquidity and marketing, and 4.005 billion for initial unlock participants in the public sale. This article was quickly taken down, indicating that WLFI has some flexibility in its token distribution and circulation strategy, which quickly drew market criticism.

As the Lockbox unlock mechanism was activated, a large number of users rushed to the on-chain contract to claim tokens, causing the Ethereum network to become congested, and Gas fees soared. Data showed that Gas fees once exceeded 60 gWei, and at certain times even peaked at 130 gWei, with the cost of a single transaction reaching as high as $145. On-chain monitoring platforms indicated that WLFI's smart contract became the busiest contract on the network on its opening day, with the sharp rise in Gas fees directly reflecting the project's popularity.

This situation not only reflects WLFI's strong user interest but also exposes the scalability pressure public chains face when dealing with hot assets. For early investors, the high Gas costs have also inadvertently raised the threshold for token claiming and circulation, indirectly aligning with the project's overall strategy of "low circulation rate control."

At the same time, market sentiment rapidly fermented on the day of WLFI's launch, with several instances of smart money. Lookonchain revealed that a whale investor, who registered the domain "trumpisthebest.eth," purchased 23.14 million WLFI tokens for $347,000 and is currently sitting on a profit of over $8 million.

_Source: _@ai9684xtpa_

WLFI's ability to stand out in the 2025 market environment is largely attributed to its combination of political and capital narratives. From the project's inception, it has been endorsed by the Trump family, with Eric Trump and Zach Witkoff joining the ALT5 Sigma board, giving the brand a strong political label. The core strategy of the project is the on-chain transformation of traditional finance: first, leveraging political traffic to achieve branding effects and create natural topics; second, replicating MicroStrategy's strategy through the concept of a "cryptocurrency treasury," incorporating the balance sheets of publicly listed companies into the token support system; third, simultaneously laying out stablecoin USD1 and RWA assetization tracks, attempting to create institutional-level settlement tools to compete with USDC and PYUSD; fourth, linking ALT5 stock prices with token prices to promote a strong correlation between traditional capital markets and on-chain markets. This narrative framework positions WLFI not just as a token issuance but as an institutional innovation experiment across financial systems.

However, I believe this experiment also hides significant risks. The uncertainty of the political cycle means that if policies or public opinion reverse, the token's market value will be directly impacted; while a low circulation rate may help control the market, it also intensifies capital concentration, significantly increasing the risk of price manipulation; the decentralization of DAO governance is more of a facade, with actual control still firmly held by WLFI company; if it can operate within the compliance framework in the U.S., it will become an important example of institutional participation in on-chain finance, but regulatory scrutiny remains a sword hanging over WLFI.

In the short term, WLFI's low circulation rate strategy undoubtedly amplifies speculative space, and the crazy performance in the futures market is the best proof. However, from an industry perspective, this is not just a wave of speculation but also a litmus test for the institutionalization of the crypto industry: the combination of political narratives and off-chain capital forces regulators, institutions, and retail investors to face a brand new economic model together.

In the future, whether WLFI can deliver on its stablecoin and RWA ecosystem layout will determine whether its value can traverse bull and bear cycles. For investors, it is particularly important to continuously monitor WLFI's on-chain contract (0xda5e1988097297dcdc1f90d4dfe7909e847cbef6) and community governance dynamics. The fervor in the derivatives market is just the beginning; this path attempting to connect Wall Street with the crypto world is destined to be filled with controversy and challenges.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。