Yunfeng Financial Group (0376) joined the ranks of publicly listed firms to adopt an ether treasury strategy, buying 10,000 ETH for $44 million.

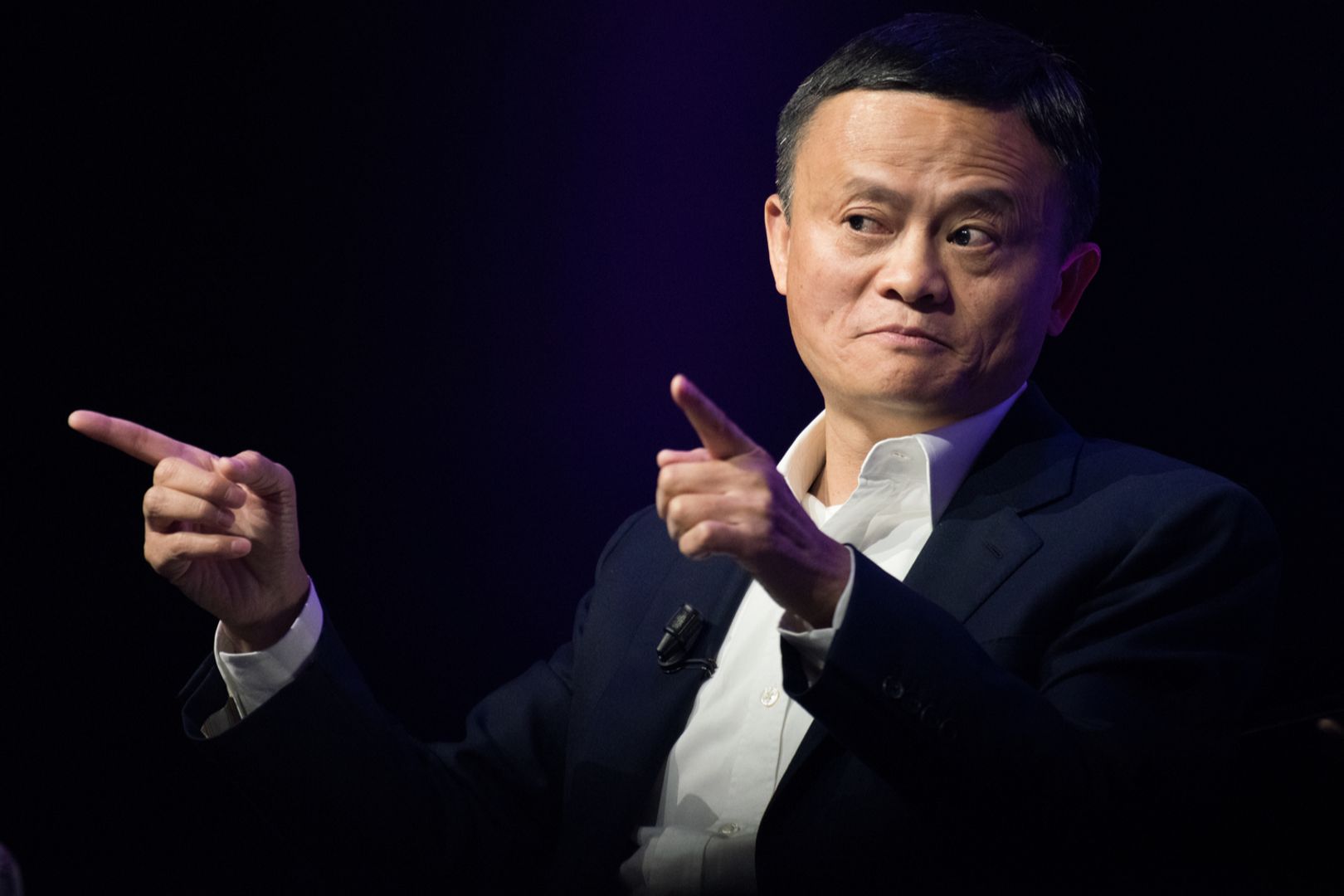

Hong Kong-based Yunfeng Financial, a provider of financial services such as insurance, brokerage and asset management, is majority owned by Shanghai-based private equity firm Yunfeng Capital, which was co-founded in 2010 by Jack Ma, who also co-founded Ant Group and Alibaba.

The ETH purchase, announced on Tuesday, forms part of Yunfeng's expansion into Web3, real-world assets (RWAs), digital currency and artificial intelligence (AI), which it unveiled in July. Yunfeng Financial said the ether will reduce its reliance on traditional currencies and help facilitate its technological plans in Web3.

A number of public including firms sports betting company SharpLink Gaming (SBET) and crypto mining and data center operator Bitmine Immersion Technologies (BMNR) have begun pursuing ether treasury strategies in recent months, buying large quantities of the world's second-largest cryptocurrency to emulate the playbook that Michael Saylor's Strategy (MSTR) made famous with bitcoin (BTC).

Yunfeng Financial's Hong Kong-listed shares closed 9.55% higher at 3.67 Hong Kong dollars (47 U.S. cents) on Tuesday.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。