Since the U.S. elections, prediction markets have gained popularity due to results that "defy polls." Compared to traditional news, they require participants to bet real money, thus being hailed as a higher quality and more authentic source of information, gradually replacing media and institutional surveys as a new barometer of public opinion. Capital is also rapidly following suit: Polymarket not only secured a multi-million dollar investment from Donald Trump Jr., but he will also join Polymarket's advisory board; meanwhile, Kalshi completed a $185 million Series C funding round led by Paradigm in June, with its valuation soaring to $2 billion, becoming synonymous with institutional trust.

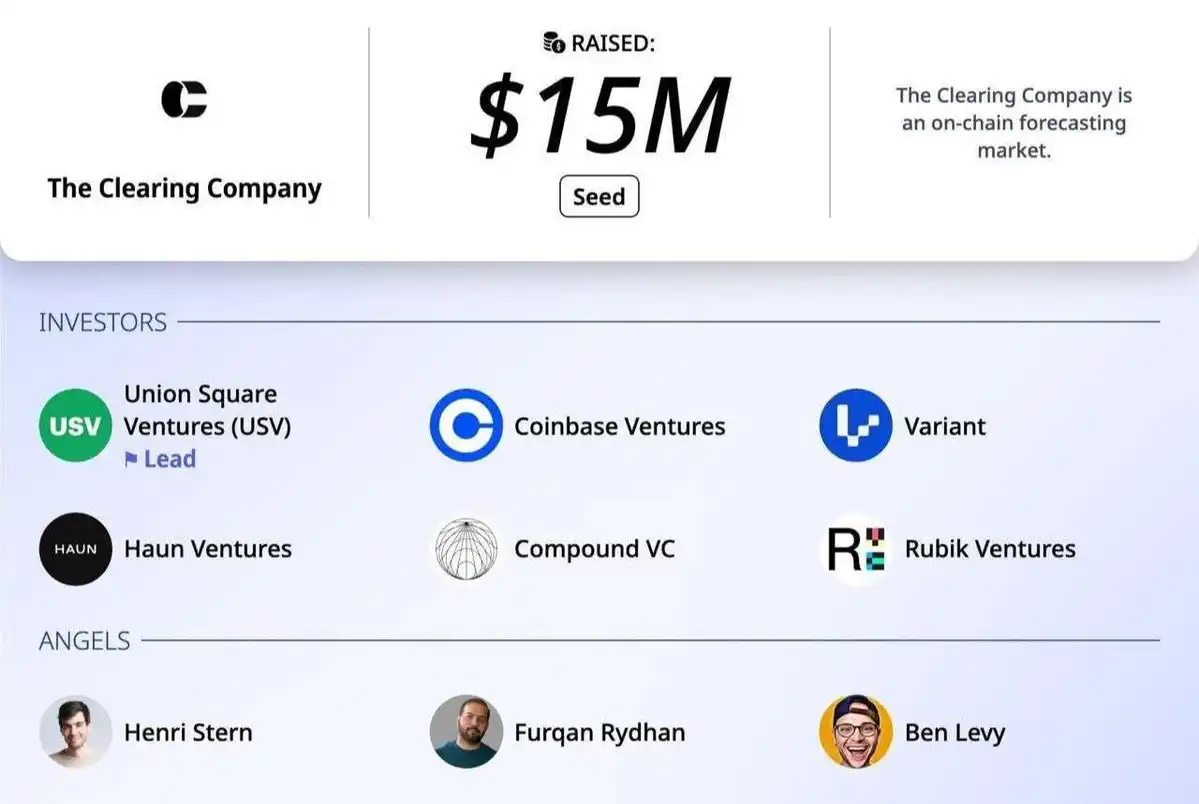

Against this backdrop, on August 27, The Clearing Company announced the completion of a $15 million seed round financing, led by USV, with well-known institutions like Coinbase Ventures participating. More notably, its core team members come from Kalshi and Polymarket—CEO Toni Gemayel previously served as the growth lead for both "rival" platforms. The goal of The Clearing Company is to merge decentralization's openness with the credibility of regulatory compliance, creating a new generation of prediction markets that can be accepted by retail investors while also gaining favor from regulators.

Polymarket vs. Kalshi: Decentralized "Gray Player" vs. Institutional "Gold Standard"

In the prediction market arena, Polymarket and Kalshi represent two completely opposing paths.

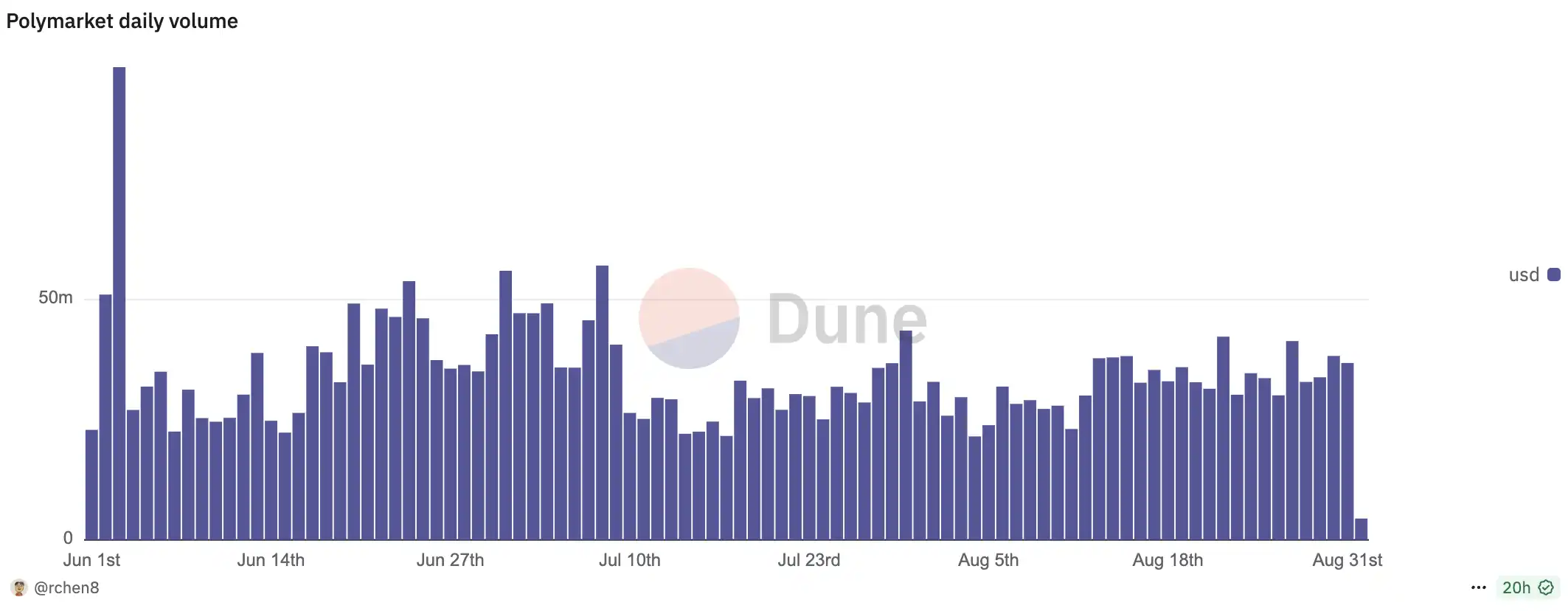

Polymarket is the most striking contradiction in the prediction market: it is both the industry leader and the "gray player" facing the deepest compliance dilemmas. In terms of scale and popularity, it is undoubtedly a phenomenal platform in the industry. The platform's TVL has reached $140 million, surpassing the total of the top ten platforms in the sector; during the 2024 U.S. elections, Polymarket's cumulative trading volume reached $3 billion, with betting amounts exceeding $4 billion, far outpacing Kalshi. Even in daily trading data, it remains at the top: over the past three months, Polymarket's average daily trading volume was about $40 million, while Kalshi only had $20 million. Although the gap has narrowed, Polymarket's leading position remains solid. With its highly open architecture and global expansion pace (such as in markets like Singapore and the UAE), Polymarket has formed a significant lead in user scale and market depth.

However, its biggest shortcoming is the shadow of regulation. As early as 2022, Polymarket was sued by the CFTC for offering unregistered over-the-counter binary options, paying a $1.4 million fine and "promising" to exit the U.S. market. However, on-chain data shows that about 25% of its traffic still comes from U.S. users, making it common to bypass restrictions. After the 2024 elections, troubles escalated further, with the U.S. Department of Justice and FBI directly investigating, even raiding the home of founder Shayne Coplan, suspecting him of manipulating market results and guiding U.S. users to bet. Even after acquiring the derivatives exchange QCEX, which holds a CFTC license, and attempting to return to the U.S. market in compliance, it still faces regulatory friction at the state level (such as in Nevada and New Jersey). Additionally, while the DAO governance model ensures democracy, it can lead to institutional instability, causing widespread concerns among institutional investors.

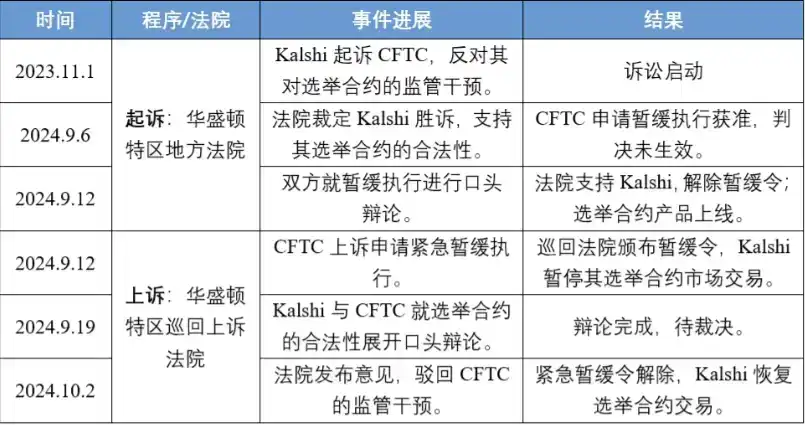

In stark contrast is Kalshi. It chose a completely different path—directly breaking through regulatory barriers. In 2023, Kalshi was targeted by the CFTC for launching election contracts. In just a few months, it went from "self-certification" to being "suspected of illegal gambling," facing continuous denials. However, it did not stop there but chose to engage in a protracted legal battle with regulators. Ultimately, in October 2024, it won a ruling from the Washington D.C. Circuit Court, becoming the first prediction market in the U.S. to gain legal status for election contracts. This victory not only provided Kalshi with a compliance "ticket" but also earned it the trust of institutions and mainstream opinion in the U.S. domestic market.

With this breakthrough, Kalshi became a CFTC-approved prediction platform and partnered with Nasdaq for market monitoring, ensuring transparency and compliance in trading. Its operational model leans towards centralization: all contract creation and rule adjustments are decided by the core team. This model sacrifices some flexibility of decentralization but provides reassurance to institutional investors. The platform uses the U.S. dollar as its primary trading currency, lowering the entry barrier for traditional investors and further solidifying its "gold standard" position on Wall Street.

However, this highly compliant and centralized path also presents Kalshi with another challenge: how to attract crypto-native users while maintaining stability. To this end, it recently appointed crypto KOL John Wang as "Head of Crypto," attempting to bridge the gap with the Web3 community. Whether this attempt will succeed remains to be seen. In a sense, Kalshi represents the "institutional faction," with compliance and institutional trust as its core advantages, but it still lags behind Polymarket in flexible innovation and decentralized community building.

The Clearing Company: A Hybrid Between Compliance and Decentralization

If Polymarket represents the ultimate attempt at decentralization and Kalshi represents the "gold standard" of the institutional faction, then The Clearing Company has found a "hybrid path" between the two.

This company was co-founded by core members who previously worked at Polymarket and Kalshi, making them well aware of the strengths and pain points of both. Therefore, its core strategy is "compliance-by-design"—not patching loopholes after the fact, but embedding compliance requirements from the protocol architecture level. As users create prediction markets on-chain without permission, smart contracts automatically run KYC/AML processes, ensuring that all fund flows are auditable and comply with anti-money laundering regulations. While ensuring transparency, it also leaves room for regulatory interfaces. For example, in terms of result verification, Polymarket relies on UMA's Optimistic Oracle to verify prediction results, while The Clearing Company directly binds the oracle to the compliance framework, incorporating result verification into audit and regulatory interfaces, thus reducing friction costs for institutional entry. Compared to Polymarket's approach of "doing first and negotiating with regulators later," The Clearing Company proactively mitigates legal risks from the outset; and unlike Kalshi's high centralization, it retains the openness and user innovation space of on-chain systems.

In terms of liquidity mechanisms, The Clearing Company also chooses a middle path. It does not adopt a purely order book model nor a completely AMM approach, but introduces algorithmic market-making to enhance liquidity. This method allows institutional investors to enter more easily while maintaining the liquidity flexibility required by decentralized markets. In other words, it considers the compliance market's need for stability while preserving the flexibility of the crypto-native ecosystem.

More critically, it was born at a time of institutional turning point. In 2025, the U.S. passed the CLARITY Act, categorizing cryptocurrencies as commodities, laying the legal foundation for the legalization of prediction markets; simultaneously, the GENIUS Act provided a clear payment and settlement framework for stablecoins, allowing The Clearing Company to settle directly with compliant stablecoins. This "institutional dividend," combined with its own design, enables it to attract institutional capital, lower retail entry barriers, and provide standardized templates for market creation.

This is the true value of The Clearing Company: it meets institutional compliance demands without sacrificing the openness of decentralization. For prediction markets, this may be the "hybrid solution" needed for the next phase of expansion—finding a balance between compliance and innovation, thus driving the entire industry into a new development cycle.

Summary

The prediction market arena is entering a heated stage. In addition to established players like Polymarket and Kalshi, new entrants are emerging at a rapid pace. Novig, after completing an $18 million Series A funding round, has branded itself as "America's first sports prediction market," circumventing gambling regulations through a lottery system to capture the sports market; FanDuel has teamed up with the Chicago Mercantile Exchange (CME) to make a strong entry, bringing about a crossover between traditional finance and prediction markets; while on-chain projects like Flipr and Hedgemony are also emerging, with the former embedding prediction trading directly into X (Twitter) timelines, attempting to create "socialized predictions," and the latter using AI-driven algorithms to focus on global news and political sentiment, carving out a differentiated path.

With more capital, compliance dividends, and innovative models being injected, prediction markets stand at a turning point: they must win regulatory trust in competition while firmly capturing the mindset of crypto-native users and continuously expanding into mainstream markets. The next round of competition may determine who can truly cross the boundary of "niche products" and grow into a new infrastructure for the global financial market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。